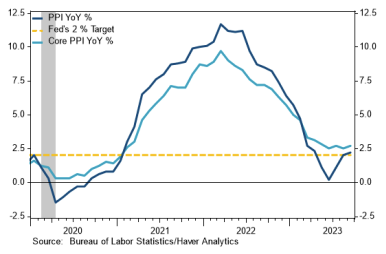

Inflation Still a Concern

September PPI rose 0.5%, more than the 0.3% gain expected and following a 0.7% increase the month prior. Year-over-year, producer prices rose 2.2% in September, up from the 2.0% gain in August and marking the largest increase in five months, ticking back higher.

Source: Stifel as of 10.11.2023

Source: Stifel as of 10.11.2023

A stronger-than-expected rise in producer prices suggests the Fed’s battle against high inflation will continue. We continue to face an upside risk from energy and food costs as a result of market imbalance and more recently, international conflict, now is not the time for the Fed to lose its resolve and back away from further policy firming, let alone consider removing the existing level of restriction.

While higher rates may assist the Fed in achieving the goal of price stability, market conditions remain uncertain and unstable, maintaining the need for monetary policy to tame price pressures.

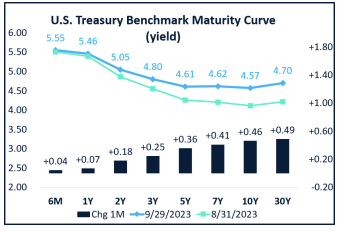

Large Move Up in Rates in Q3

Over the past month, interest rates have risen drastically. The rise has been multifaceted: expectations for fewer rate cuts in 2024 than previously expected, stronger domestic growth, higher energy prices, and an upside surprise in US Treasury issuance (larger fiscal deficits).

Source: BondBloxx as of 09.29.2023

Source: BondBloxx as of 09.29.2023

Bonds appear to be testing the “this time is different” hypothesis. The bear-steepening (curve steepening due to long-end rising) alongside rising term premia tells the story of a market that is rushing to price in a transition to a higher interest rate environment.

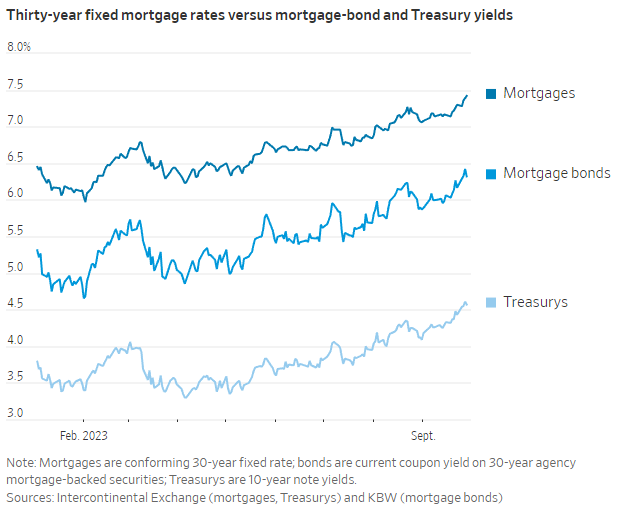

Mortgage Spreads are Historically Wide

Mortgage-backed Securities (MBS) are the second largest bond asset class after USTs. There are roughly $7 trillion in 30-year Fannie Mae, Ginnie Mae, and Freddie Mac mortgage bonds outstanding. The agency mortgages are implicitly guaranteed by the US Govt (i.e., they have no credit risk). Agency-backed mortgage bond spreads are currently wide when compared to Treasury bonds.

Source: ICE as of 10.09.2023

Source: ICE as of 10.09.2023

As a reminder, a mortgage-backed security holds a big pool of residential mortgages that are collateralizing the bond. Mortgage bonds are best explained as a covered call strategy for bonds. Mortgages have negative convexity, given that they can be “called away” early depending on what interest rates do.

Because of this uncertainty, they offer a higher yield versus comparable duration Treasuries. We will have more out on this with our income portfolio update, but we thought the spread discrepancy was worth highlighting.

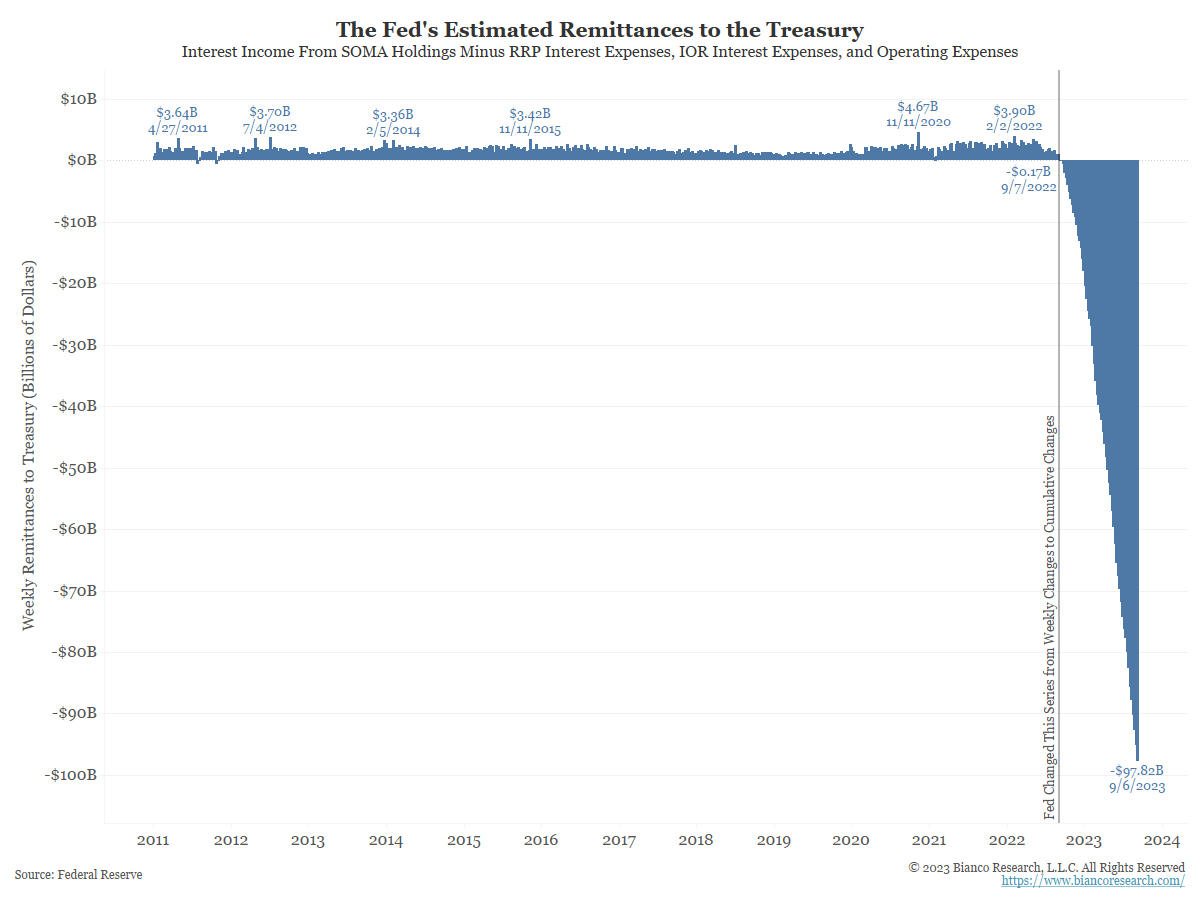

Fed’s Losses Digging a Deeper Hole

The Fed has been experiencing losses due to the combination of its large holdings of Treasuries and mortgages, given the sharp increase in rates and rise in their interest expenses from IOR and RRP.

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

In addition, the interest income they receive from their SOMA portfolio has remained relatively constant (bonds bought when rates were low). Simply put, they have been operating at a loss since September 2022.

The chart above is a bit confusing due to the way the Fed changed its weekly data once losses began piling up. Prior to September 7, 2022, the bars show weekly estimated remittances that the Fed would hand over to the Treasury. In essence, these were weekly profits.

When rates were low and their SOMA portfolio posted profits, they were able to hand over an estimated $1 billion to $4 billion per week to the Treasury.

Once the Fed was no longer running at a profit, they changed their accounting to show the cumulative losses rather than continuing with weekly losses. As the chart above shows, they are now an estimated $98 billion in the hole.

Higher Real Rates Will Slow Growth But It Works Slowly

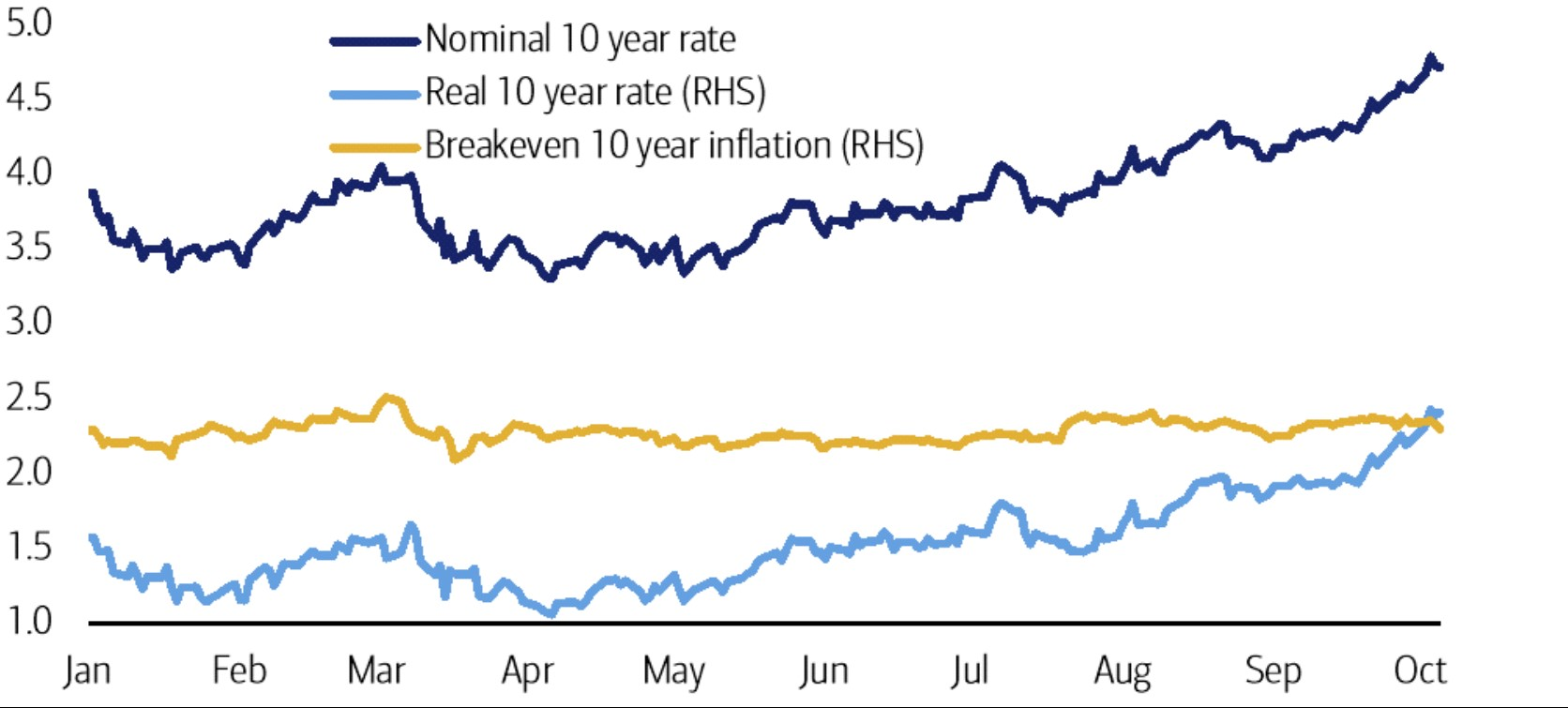

Real interest rates continue to rise as the Fed maintains a firm monetary policy stance and inflation slowly grinds lower. What has been interesting to us through the recent rise in interest rates has been the contribution of what is driving returns higher.

Source: Morgan Stanley as of 10.09.2023

Source: Morgan Stanley as of 10.09.2023

The US 10-year inflation breakeven rate has contributed only 10bps to the 135bp increase in nominal yields over the last five months which has been dwarfed by the 125bp jump in real yields to ~2.5%. Higher real rates should continue to slow the economy although it will take time for them to work their way through the real economy.

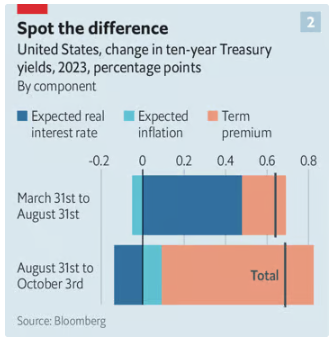

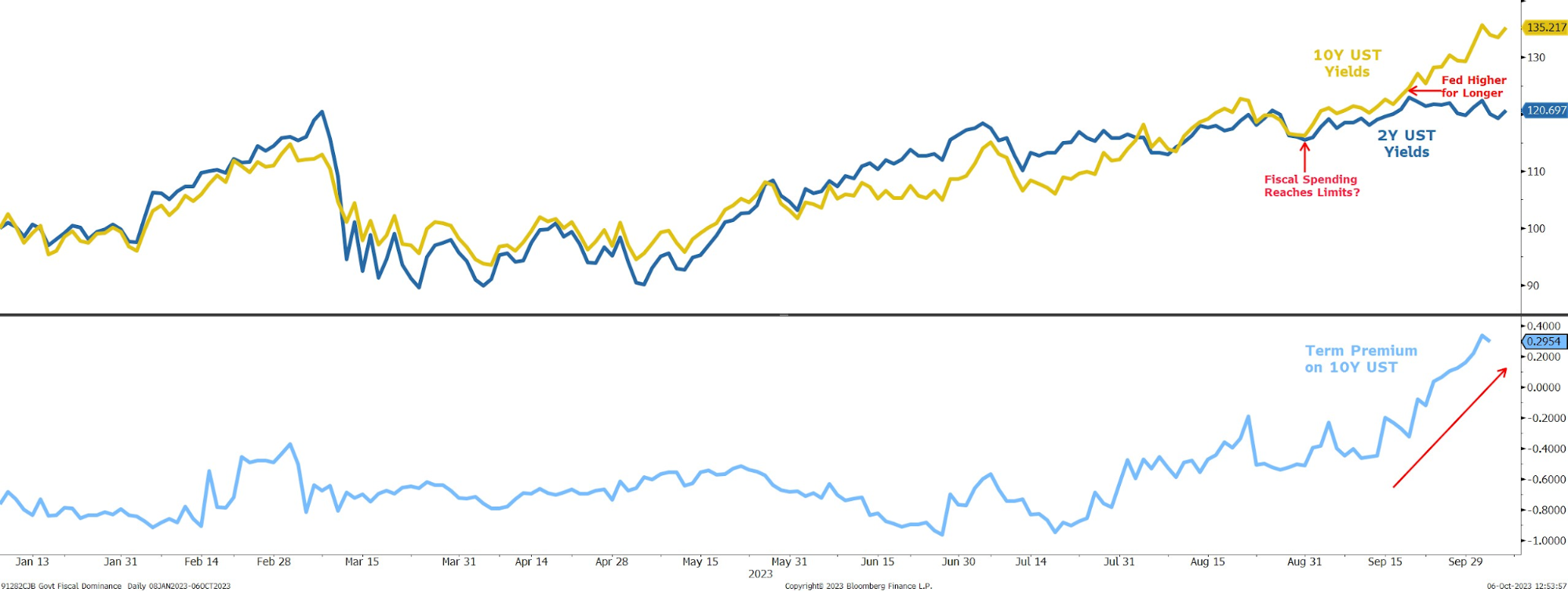

Term Premium is Rising

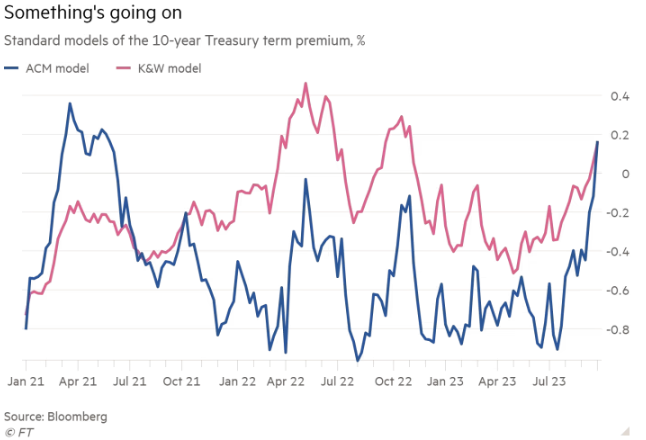

A Treasury bond’s term premium is the difference in yield an investor requires to invest in a long duration bond vs rolling over a short duration many times (i.e., buy a 10-year Treasury vs rolling a 1-year Treasury over 10 times). It is simply the compensation for the interest rate risk embedded in longer-dated bonds.

Source: Economist as of 10.09.2023

Source: Economist as of 10.09.2023

The term premium is unobservable and is mostly a guesstimate followed by economic models. Two of the more popular models indicate that the premium is up a lot recently.

Source: FT as of 10.09.2023

Source: FT as of 10.09.2023

We’d note that this is the first time since 2017 that both models have shown a positive premium. We’d point to some of the issues above as to the reason for a wider term premium (stronger economic growth, question of a higher neutral rate, as well as inflation and growth uncertainty) but I think the other piece of the puzzle is the uptick in Treasury issuance. We will dive in on that a bit more below.

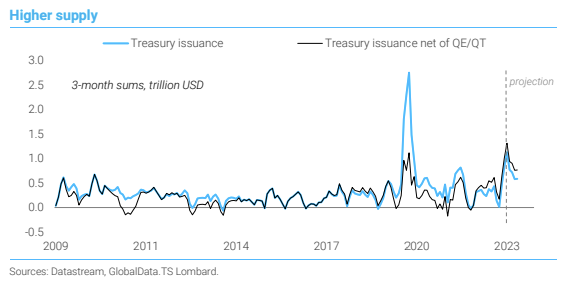

Higher Treasury Supply is Requiring Higher Yields to Incentivize Buyers

We believe the government spending (fiscal policy) is also adding to the inflationary pressure and counterbalancing some of the Fed’s tightening regime. U.S. budget deficits are widening, as are forecasts for the next 12-24 months.

Source: TS Lombard as of 10.09.2023

Source: TS Lombard as of 10.09.2023

In March, the budget deficit forecasts for 2024 and 2025 were approximately 5% of GDP; now, they’re at 6% of GDP (keep in mind this is occurring at near full employment). As a quick history reminder, the U.S. ran budget deficits of greater than 5% of GDP in 1982, 1992, and 2009.

In each instance, the unemployment rate was above 7% – significantly higher than the current 3.8%. We think wider deficits (i.e., more supply) are a key reason as to why long-term Treasury yields are rising.

Additional food for thought: Each percentage point increase in rates costs the government nearly $3 trillion over the next ten years and as much as $30 trillion over three decades in additional interest expense.

Reckless US Spending Coming Home to Roost?

With the US Treasury in the process of issuing close to $2T in new supply in the second half of the year, the bond market has taken notice and demanded a higher rate of return to fund that issuance.

Source: Morgan Stanley as of 10.09.2023

Source: Morgan Stanley as of 10.09.2023

While front-end interest rates have been generally stable over the past several months on the expectation the Fed is close to ending its rate hikes, the longer end of the Treasury market continues to trade poorly with 10-year yields hovering near 5%.

With inflation expectations relatively stable and economic growth showing limited signs of reaccelerating, it appears this move in yields is, in part, related to the question as to whether the US government pushed the limit of its ability to spend without proper long-term fiscal discipline and funding in place.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-12.