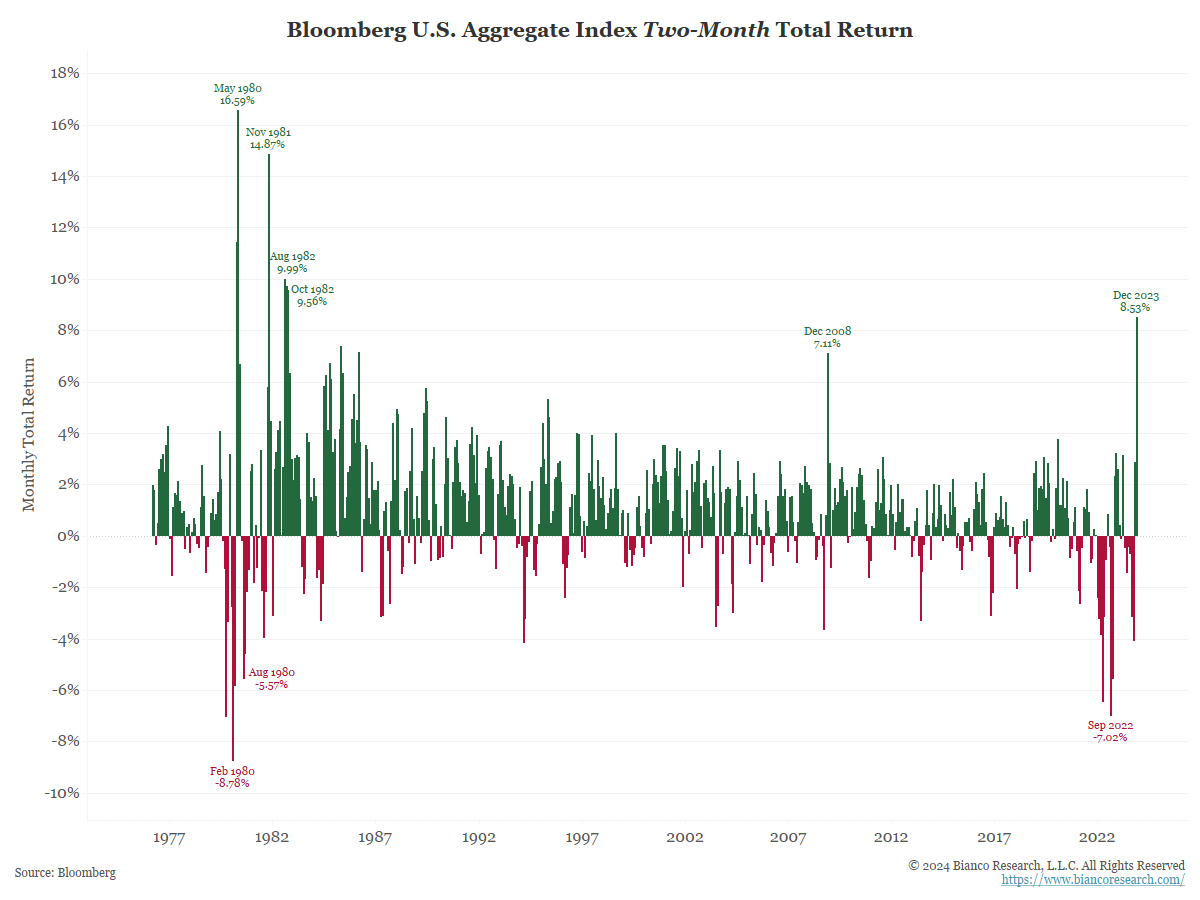

Biggest Two-Month Rally in 40 Years

Optimistic inflation data, and a Fed in the driver’s seat, have investors pricing in ~6 rate cuts in 2024.

Source: Bianco as of 12.31.2023

Source: Bianco as of 12.31.2023

While 6 cuts sound optimistic, based on history it’s not outlandish. Typically, when the Fed cuts it’s not in a linear fashion. Cuts are almost always reactionary to economic weakness.

Likely, if the Fed achieves a soft landing, we see reason for 3-4 cuts in 2024 as inflation comes down to target and growth remains sufficient (this is basically what the Fed’s DOT plot is forecasting). On the other hand, if the economy falters, it’s not unreasonable to expect 8-10 cuts.

The main point is that in order to get large cuts, we believe we’ll need to see the economy really stumble.

Inflation Expectations Remain Stable

While survey data can have its problems, we’d imagine the Fed has been pleased with their ability to anchor inflation expectations, specifically regarding longer-term expectations. Looking at the graphic below, current inflation expectations closely line up with what we saw the last couple decades which featured ~ 2% inflation.

Source: UBS/Univ of Michigan as of 01.02.2024

Source: UBS/Univ of Michigan as of 01.02.2024

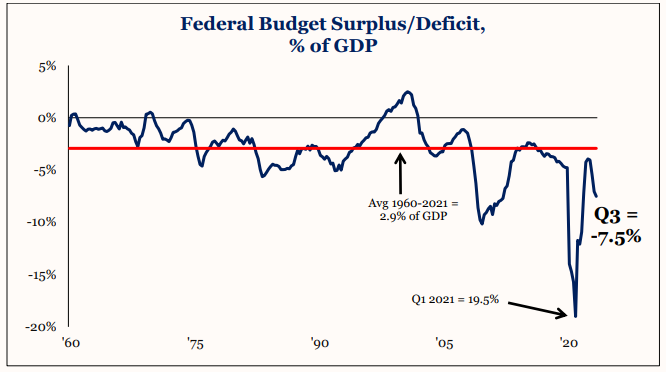

Budget Deficits are Running at Recession / Wartime Levels

One feature of the economic resilience in 2023 was related to the strong fiscal impulse. Currently, the Federal Deficit is running at -7.5% of GDP as of Q3 2023. In the last 50 years, we’ve experienced an average budget deficit of ~2.9% of GDP.

Source: Strategas as of 12.31.2023

Source: Strategas as of 12.31.2023

I don’t think anyone expected the magnitude of fiscal response we experienced during 2023. Although in hindsight, it’s not that surprising. One fun fact is the incumbent president has never been re-elected when a recession has occurred going into the election cycle. This isn’t a political comment; both parties have used the fiscal lever to get the economy going into their re-election campaigns.

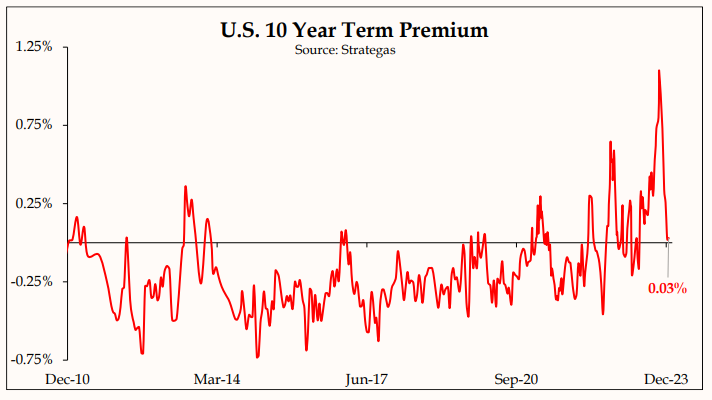

Term Premiums Have Collapsed

Term premiums got considerable attention back in September/ October as interest rates were tearing higher.

Source: Strategas as of 12.31.2023

Source: Strategas as of 12.31.2023

As a reminder, term premium is simply the additional spread lenders require for longer-duration bonds over what is available at the front end of the curve. They could also be referred to as the “Price of Time”. Term premiums can move around considerably and be quite volatile (as seen in the last couple of months).

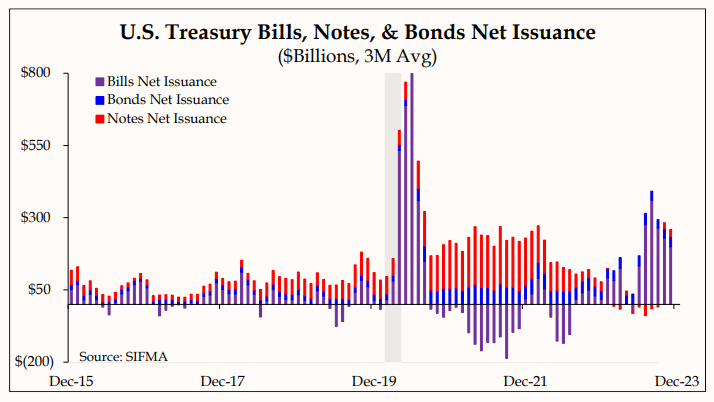

Another impact on term premiums has been the Treasury’s preference for issuing short-term debt. Given elevated front-end yields and the demand from money market funds, short-term bonds have been gobbled up by the market.

Source: Strategas as of 12.31.2023

Source: Strategas as of 12.31.2023

We do think at some point the Treasury will have to go back to issuing a more normalized ratio of Bill / Bonds / Notes, which should generally create pressure on longer-term buyers, further impacting term premiums.

Remember, the longer the Fed continues to prefer borrowing in the front end of the curve, the more interest rate sensitive they become; they basically make our debt burden have a floating rate.

Reminder on Correlations

When stocks and bonds are positively correlated, investors lose some of the benefit of holding bonds in their portfolios, as bonds are typically the risk dampener of a portfolio (remember, bonds can’t grow).

When the “hedge” isn’t there for investors, you tend to see investors require extra compensation in the spread. We think this could continue to be a relevant topic looking ahead, and caution investors from getting too giddy following the November and December rally in long-term bond yields.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-12.