The July CPI came out to be another soft report and points to further moderation in inflation. Headline CPI increased by 0.2% MoM (0.167% unrounded), which resulted in the YoY rate increasing two-tenths to 3.2% as base effects were less favorable than last month.

For core inflation, the print came in at 0.16% MoM (0.2% rounded) increase, which results in the YoY rate declining by a tenth to 4.7%, it’s lowest level since October 2021. Summary of the most recent CPI results vs. expectations:

Shelter inflation continues to soften gradually but likely takes a while to realize the full extent of its decline due to catch up effects. Energy strength didn’t show up in the way we expected so we think headline CPI will be firmer next month. Looking into the back half, tight oil supply and wide ‘crack’ spreads point to significant gasoline price inflation later this year, further amplifying near-term risks to headline inflation.

Source: Stifel as of 08.10.2023

Source: Stifel as of 08.10.2023

The Fed (and market) will be pleased to see only a modest rise in prices for the second straight month. The bottom line is 3-month and 6-month annualized rates for core inflation still stand at 3.1% and 4.1%. Headed in the right direction yet still well above the 2% target. In addition, the base effect will no longer provide an easy path to lower inflation as it has for most of the past year. It’s too soon to declare victory that the Fed has tamed inflation without sending the economy into a recession.

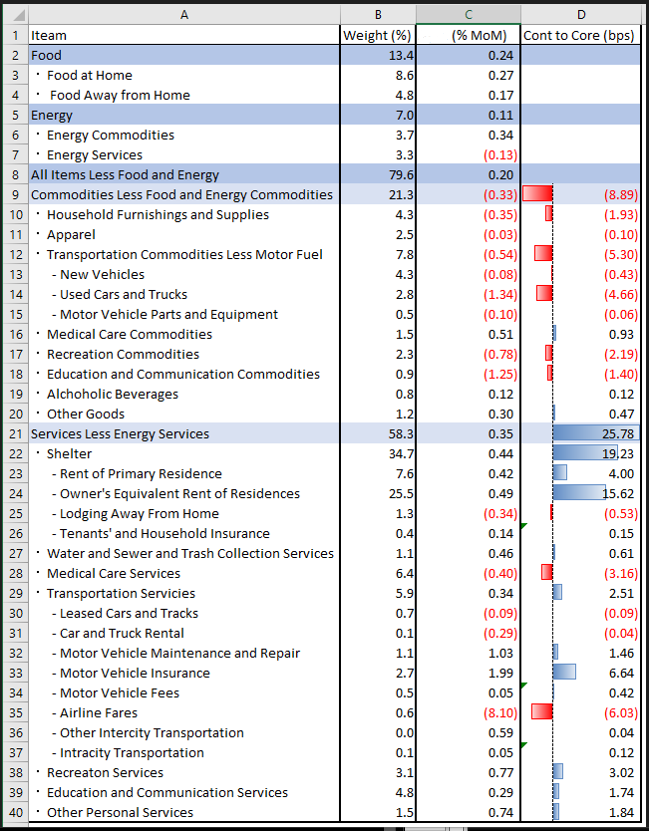

Component Details

Source: Citadel as of 08.10.2023

Source: Citadel as of 08.10.2023

Notables

- OER ticked up to 0.49% which was a surprise

- Used cars were only down 1.3% so not as consensus expectations

- Airfares were down big, -8%

- Insurance at 2%

- Food at home rebounded to 1.1% after falling -0.7% previous

Final Thoughts

As the chart above shows, food, energy, and goods’ contributions to headline CPI are already back to their historical norms. Those categories have contributed to the decline in inflation for about as much as they can. In addition, gas prices have risen significantly so far in August, and we can expect that category will work against further declines.

The bottom line is that any meaningful decline from here in inflation will need to come from services ex-energy, which are still contributing more than their historical norm to headline inflation. Breaking down the main component of services ex-energy inflation, the overwhelming majority boils down to shelter prices. Until housing prices come down considerably, inflation likely will remain elevated.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2308-12.