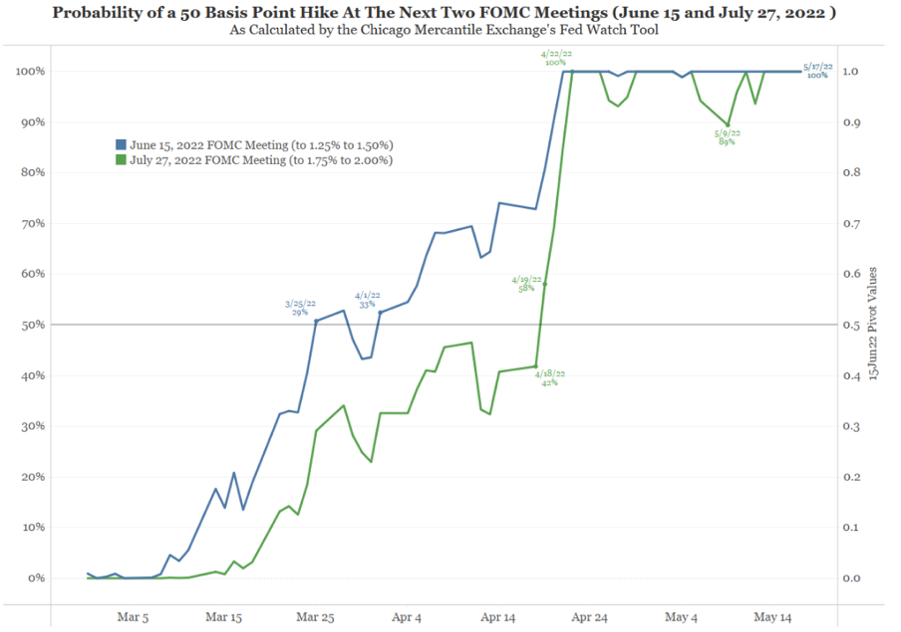

* Fed Expected to Hike 50bps at Next Two Meetings. As you can see below, the odds on both are at 100%. Given the persistence of inflation, the Fed has been put into defensive mode (i.e., forcefully tightening policy) even into a growth slowdown.

Source: Bianco Research. As of 5/18/22.

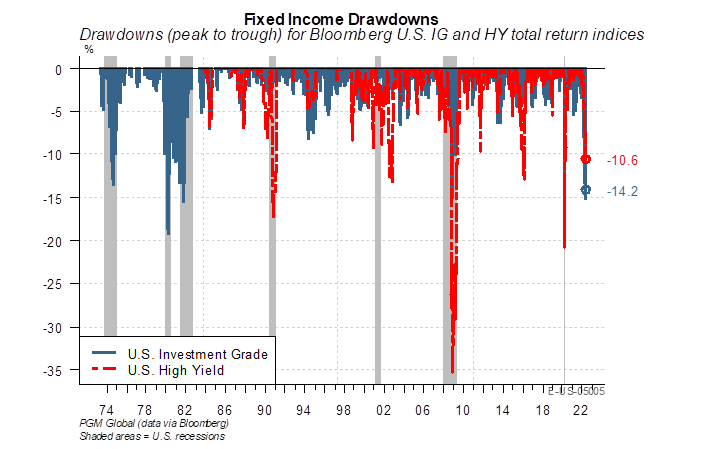

* Bond Carnage Has Been Painful: The rise in U.S. rates from their all-time lows has created a significant drawdown in U.S. fixed income portfolios. So far, most of the downside has been a function of duration risk. Add on Fed QT officially starting in three weeks, and the High Yield credit markets have already started to feel some pain (more below). The difference this time around is that the Fed has only just started tightening and still has a lot of ground to make up regarding its dual mandate.

Source: Pavilion Global. As of 5/12/22

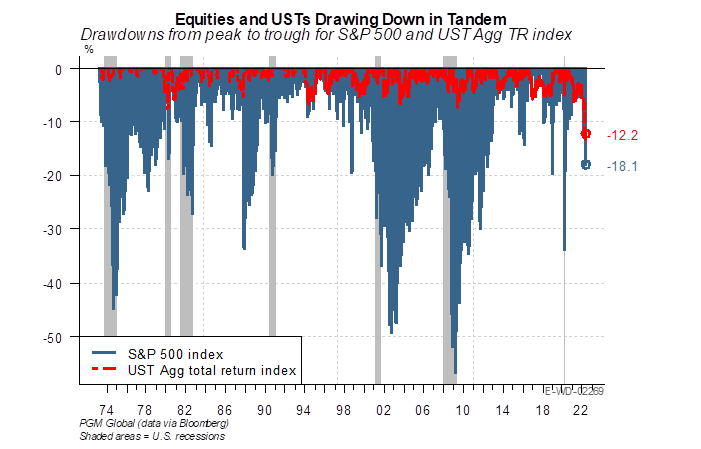

* Treasury Bonds Have Been No Safe Haven: U.S. Treasury bonds have not provided the safety investors typically rely on to insulate portfolios either. The drawdown in U.S. Treasury portfolios is unprecedented in modern finance, especially in tandem with the drawdown in the S&P 500. Modern Portfolio Theory (MPT) has been challenged… at least for now.

Source: Pavilion Global. As of 5/12/22

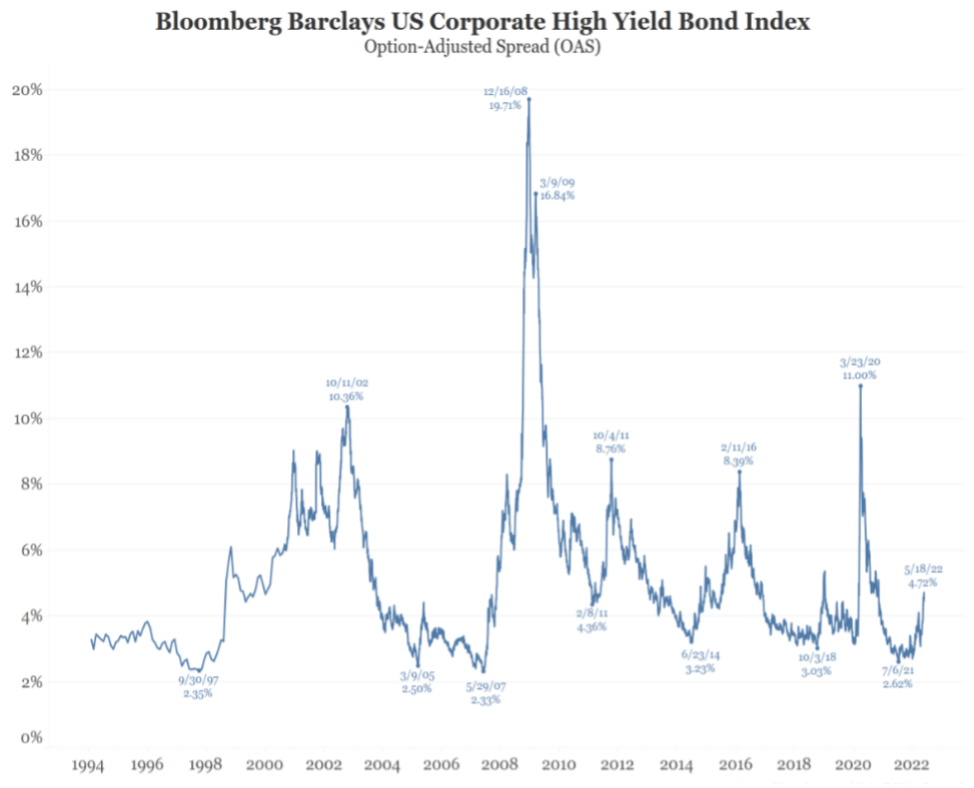

* High Yield Bonds Spreads are widening: Spreads on high yield bonds have started to widen as we get closer to the QT regime and some of the froth of the markets recede. While spreads have widened to ~450bps (from the mid 200s back last summer) over U.S. Treasury bonds, we still are nowhere close to spread levels seen during an outright panic. So, while the recent widening appears “large”, when zooming out, spreads are nowhere near their peaks in 2020, 2016, 2011, 2008, or 2002.

Source: Bianco Research. As of 5/19/22

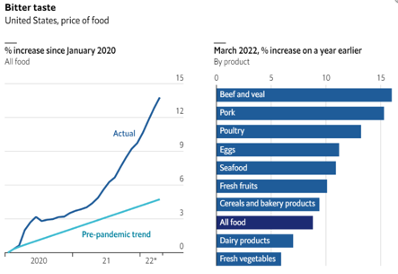

*Inflation Continues to be Problematic for the Fed… specifically the “Stickier” Components like Food & Shelter: The price of meat has risen faster than any other food. Beef prices have increased by over 15% YoY. In comparison Dairy Products and fresh vegetables are up by a less painful mid-single digit %. Why are food prices higher? Transport/ energy prices and labor issues are a big factor. As fuel prices continue to hit new highs on top of shortages across the labor supply chain, more pressure could be ahead.

Source: US Bureau of Labour Statistics. 4/1/22

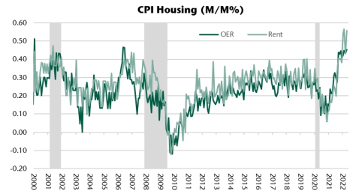

*Shelter Prices are Rising, too: Housing inflation continues to be hot as well, with no sign of easing in rent pressures. OER (Owners’ Equivalent Rent) rose by 0.45% MoM and rents of primary residents rose by 0.56% – both at the high end of the recent range.

Source: Jefferies/Haver. As of 5/12/222

*When Will Inflation Slow?!

Inflation will continue to slow YoY simply given the easy comps over the rest of the year. In addition, we expect core goods inflation to ease further given the buildup of retail inventories, and flattening demand, particularly for nondurable goods (see Walmart/Target earnings). However, given the continued tightness in the labor market – which is likely to get worse before it gets better – it’s hard to see what will slow service inflation. Piling that on top shelter inflation, the Fed is in between a rock and a hard place.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2205-19.