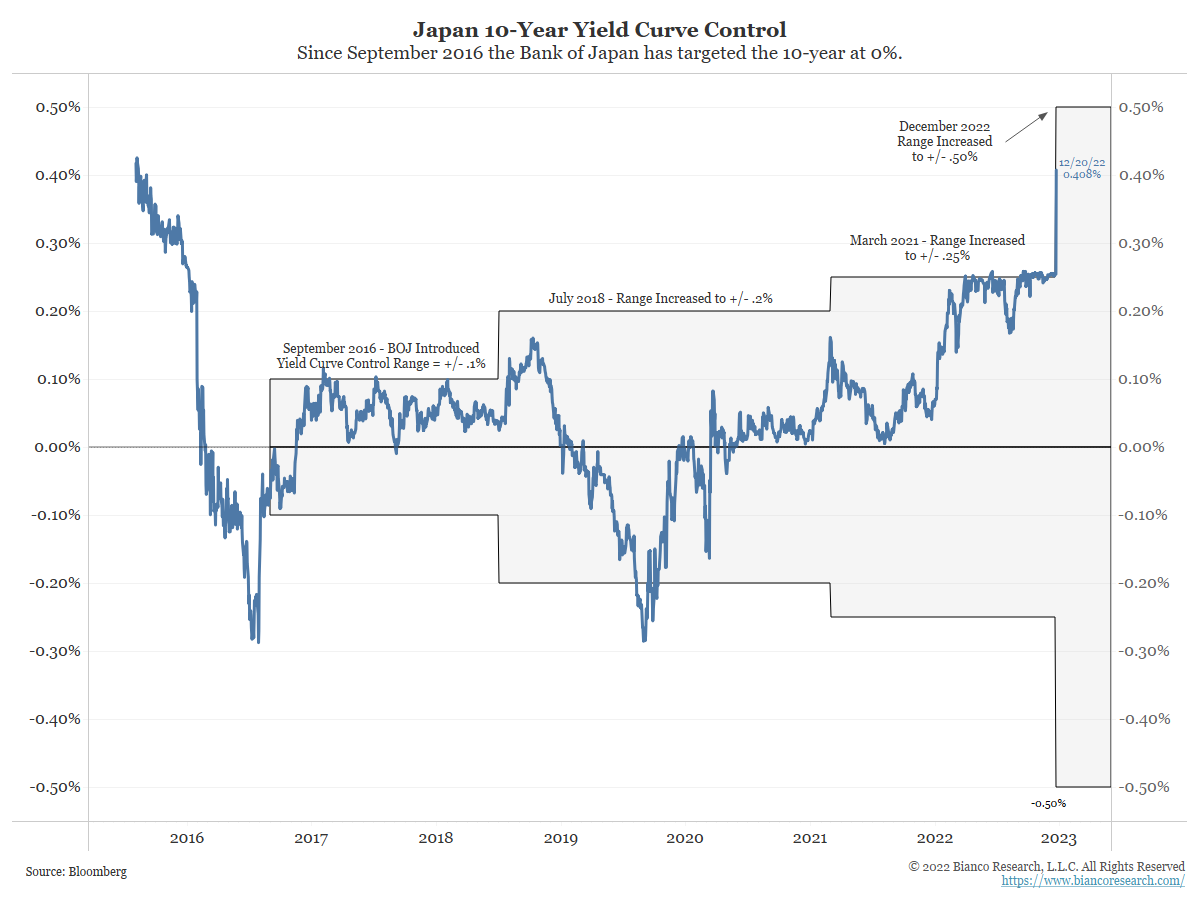

Bank of Japan (BOJ) Finally Flinched

BOJ made a decision to double the trading band of the 10-year Japanese government bond. We believe the move is justified. It may mark the start of a gradual shift away from the strict bond yield controls emblematic of Japan’s status as the last big economy sticking to ultra low rates.

Tuesday’s move is too little, too late. It comes six years after the BOJ adopted negative interest rates. It is the boldest step BOJ Governor Haruhiko Kuroda has taken, after enduring after years of criticism — and only when he has one foot out of the door. Even after spiking, the yen remains at a two-decade low to the dollar.

Source: Bianco. As of 12/20/22.

Source: Bianco. As of 12/20/22.

The BOJ’s move was what they called a “technical adjustment” due to financial stability issues, but we believe the real reason this move was necessary is that inflation is running way ahead of their target and forcing yields higher.

Now that Japan has joined the inflation fight, it makes the idea of a “pivot” by other central banks less likely. Inflation may have peaked, but getting it back to countries’ 2% target is going to be difficult, even in Japan.

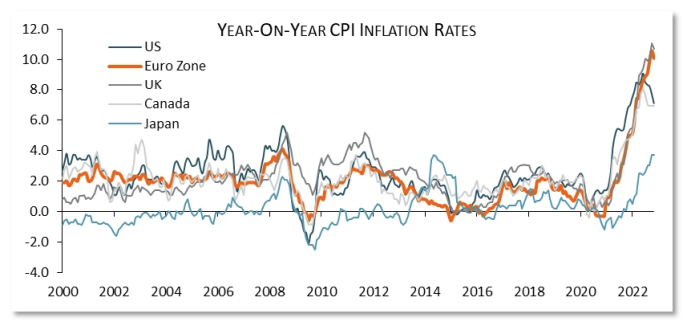

Europe Has a Big Problem

Inflation in the Eurozone is still at 10%, and the European Central Bank (ECB) is an inflation-only mandated central bank (i.e., unlike the Fed, it has no direct employment mandate). Therefore, it’s not surprising that the ECB is communicating the need for ongoing rate hikes “at a steady pace” and to a “significantly” higher level.

In fact in real terms, given where short-run inflation expectations are today, ECB policy is easier today than it was before rate hikes started. Most likely, the ECB will hike more than the 75-100 bps additional tightening that the market is pricing in.

Source: Piper. As of 12/20/22.

Source: Piper. As of 12/20/22.

The key sentence in the ECB statement last week was the following: “the Governing Council judges that interest rates will still have to rise significantly at a steady pace to reach levels that are sufficiently restrictive to ensure a timely return of inflation to the 2% medium-term target.” The qualifier “significantly” tells us that the peak rate is still far off; the phrase “at a steady pace” suggests more consecutive 50-bp hikes. Continued tightening should continue to be a tailwind for the Euro.

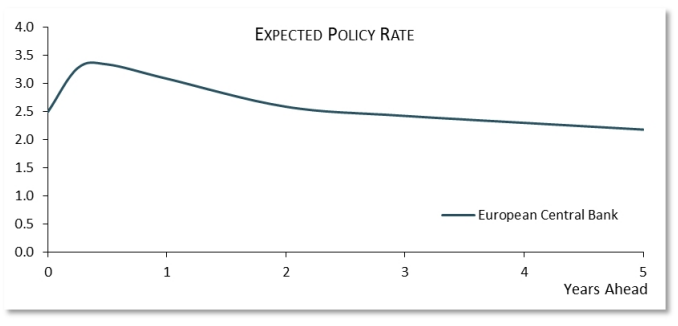

Will the Sub 3.5% Terminal Rate Be Enough for the ECB Given 10% Inflation?

The chart below shows, as of today, the market expects the ECB to hike less than 100 bps more from current levels — we think that is not going to be enough. The verbiage about more hikes “at a steady pace”, to a “significantly” higher level, suggests that the peak rate will be higher than the market expects and that the ECB will pause after the Fed does.

The market also expects prompt rate cuts after the peak is reached. That is also something that the ECB is unlikely to do. We need to remember again that the ECB is a single-mandate central bank focused only on inflation; given how high inflation is, the ECB will want to be really sure that inflation has been defeated before cutting rates, and that will take time.

Source: Piper. As of 12/20/22

Source: Piper. As of 12/20/22

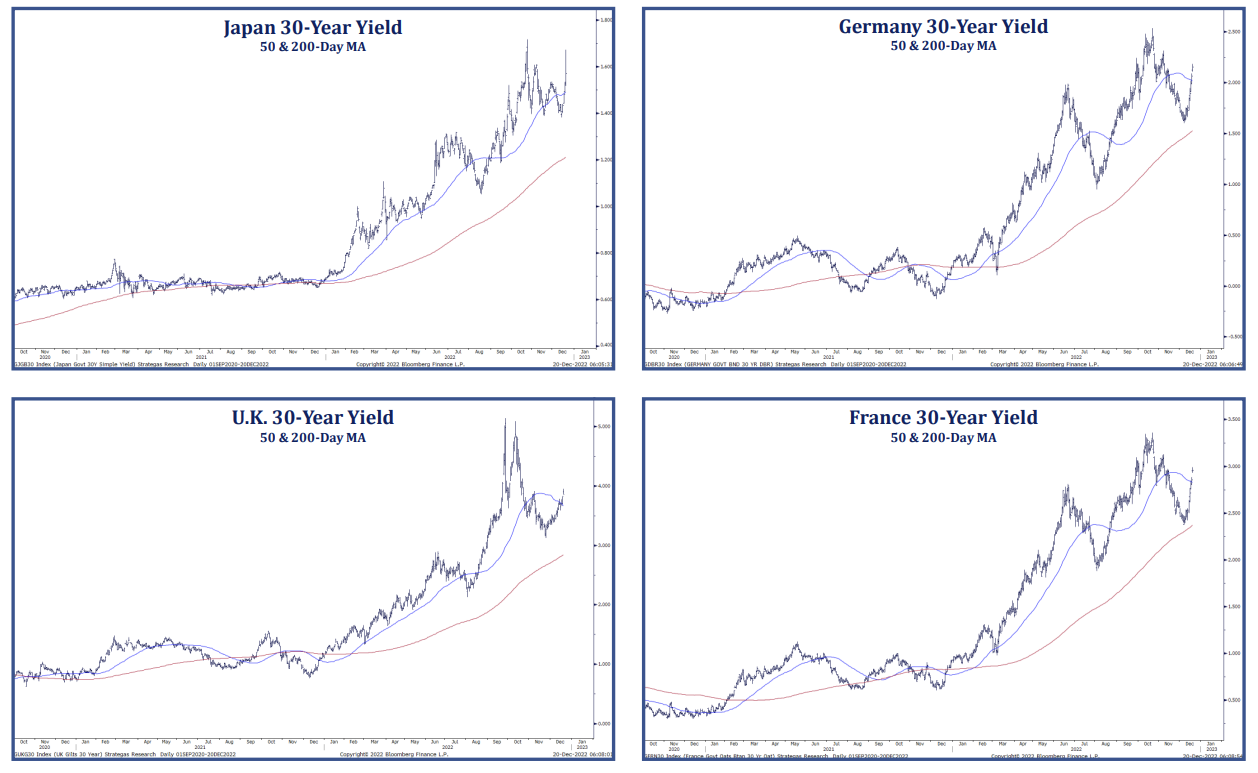

Yields Ex- US Continue to Drive Higher

Rates globally continue to push higher following central bank rate hikes. The actions by the BOJ (raising the cap on their Yield Curve Control) serve to raise the floor on U.S. yields for the short / medium term. Again, this validates our opinion that we are nowhere close to the elusive Fed Pivot.

Source: Strategas. As of 12/20/22.

Source: Strategas. As of 12/20/22.

Happy Holidays & Happy New Year! Thank you for the trust and support and we look forward to another year (hopefully with a more friendly market)!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Foreign securities are more volatile, harder to price and less liquid than U.S.securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries

The content and/or when a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-25.