Productivity is the Way Out

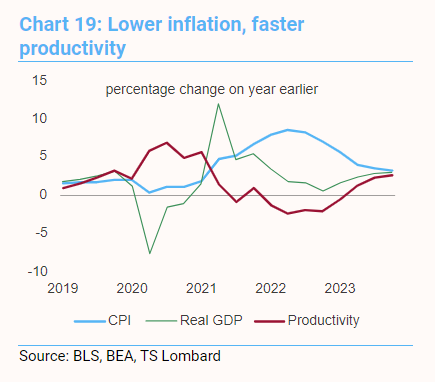

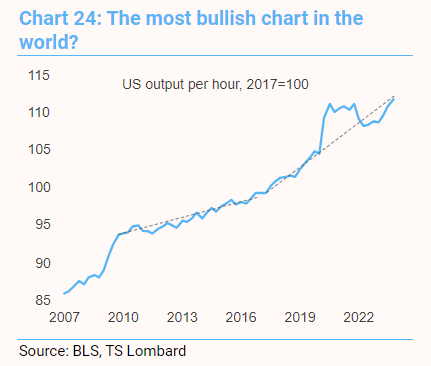

Productivity plays a crucial role in influencing both inflation and economic growth. A key to stopping a second wave of inflation is likely productivity (output per hour) picking up. Instead of having too much money chasing too few goods we want to see more goods & services as a result of higher productivity.

Source: TS Lombard as of 02.23.2024

Source: TS Lombard as of 02.23.2024

There are promising advances developing currently (tech, AI, health treatments) but time will tell how quickly these innovations can feed their way into the economy and spur productivity. A key ingredient to see a soft landing in the economy will be significant improvements in productivity. These improvements can help ease inflation problems as companies become more efficient and increase the overall output of goods and services into the economy.

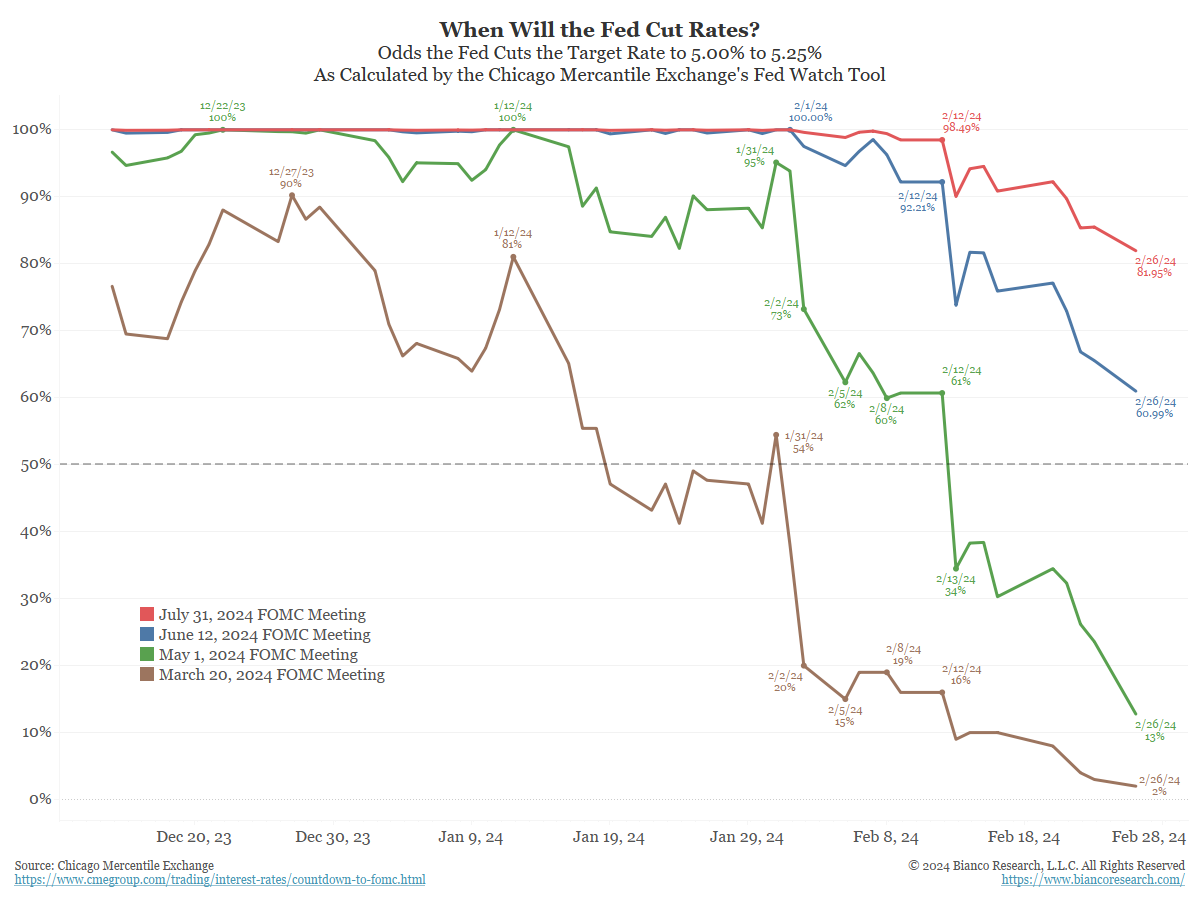

What is the Market Pricing Now?

The next FOMC meeting is on March 20. The market is pricing just a 3% probability of a cut (brown line above). This was nearly 90% at the beginning of the year. The odds of the first cut taking place at the May 1 FOMC meeting are down to 24% (green). Right before the January payrolls report these odds were 95%.

Source: Bianco as of 02.27.2024

Source: Bianco as of 02.27.2024

The odds of the first cut taking place at the June 12 FOMC are 65.54% (blue), so a cut is still priced in. Note that these odds were 100% the day before the January payrolls. The odds of the first cut taking place at the July 31 FOMC meeting are holding strong at 85% (red). But note this was 98% the day before the January CPI report.

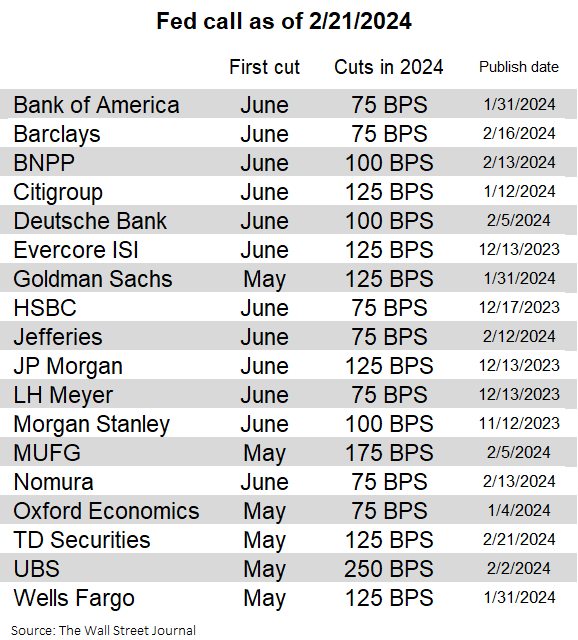

Street Expectations for Rate Cuts

As you’d expect, a mixed bag of expectations from the Street on rate cut expectations for 2024. There are a few outliers that expect far more aggressive cuts than what the Fed is communicating.

Data as of 02.26.2024

Data as of 02.26.2024

We do find it interesting that no one has called for fewer cuts than the Fed’s December SEP projection of 75bps. It is ironic that through the entire hiking cycle, everyone undershot the number of hikes that transpired. If we continue to see the resilient economic and inflation data continue, it will be interesting to see how these cut expectations deviate.

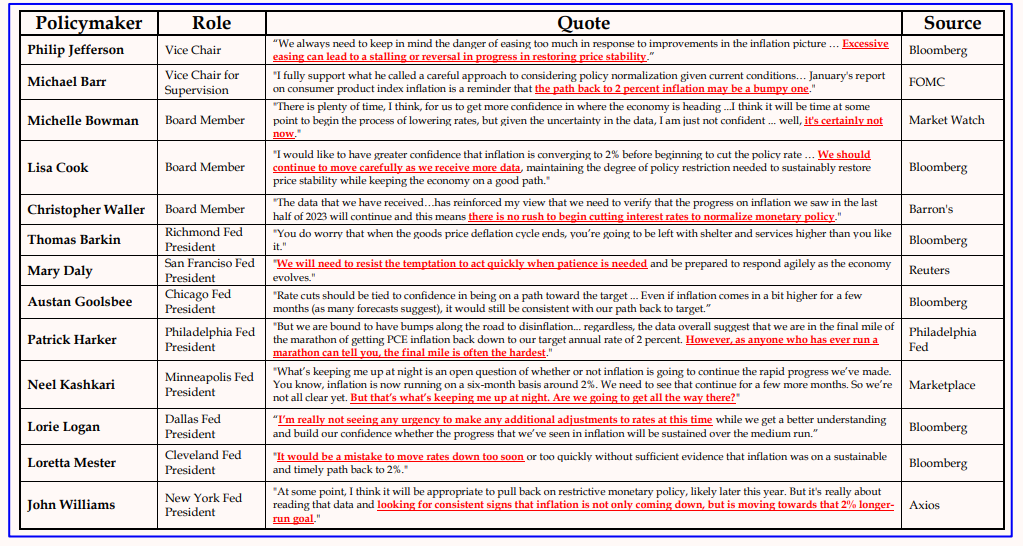

FOMC Public Pronouncements

The recent action regarding short-term interest rate expectations has confused investors for sure. The Fed governors have united (for now at least) around a slow and methodical pace of lowering their target policy rate. As such, market expectations for rate cuts are now pricing inline with Fed communication from their recent DOT plot at 3 rate cuts in 2024 (75bps in total).

Source: Strategas as of 02.26.2024

Source: Strategas as of 02.26.2024

On January 12, rates markets were pricing in 7 cuts in 2024. They’re now pricing in ~3 cuts, as resilient economic/ inflation data as well as Fed commentary has stifled the quick/ aggressive rate cuts that were previously expected. A common theme from the Fed communication (above) is to “proceed carefully, have patience, lack of urgency, and no rush”. These aren’t the words you’d expect spoken right before a massive rate-cutting regime.

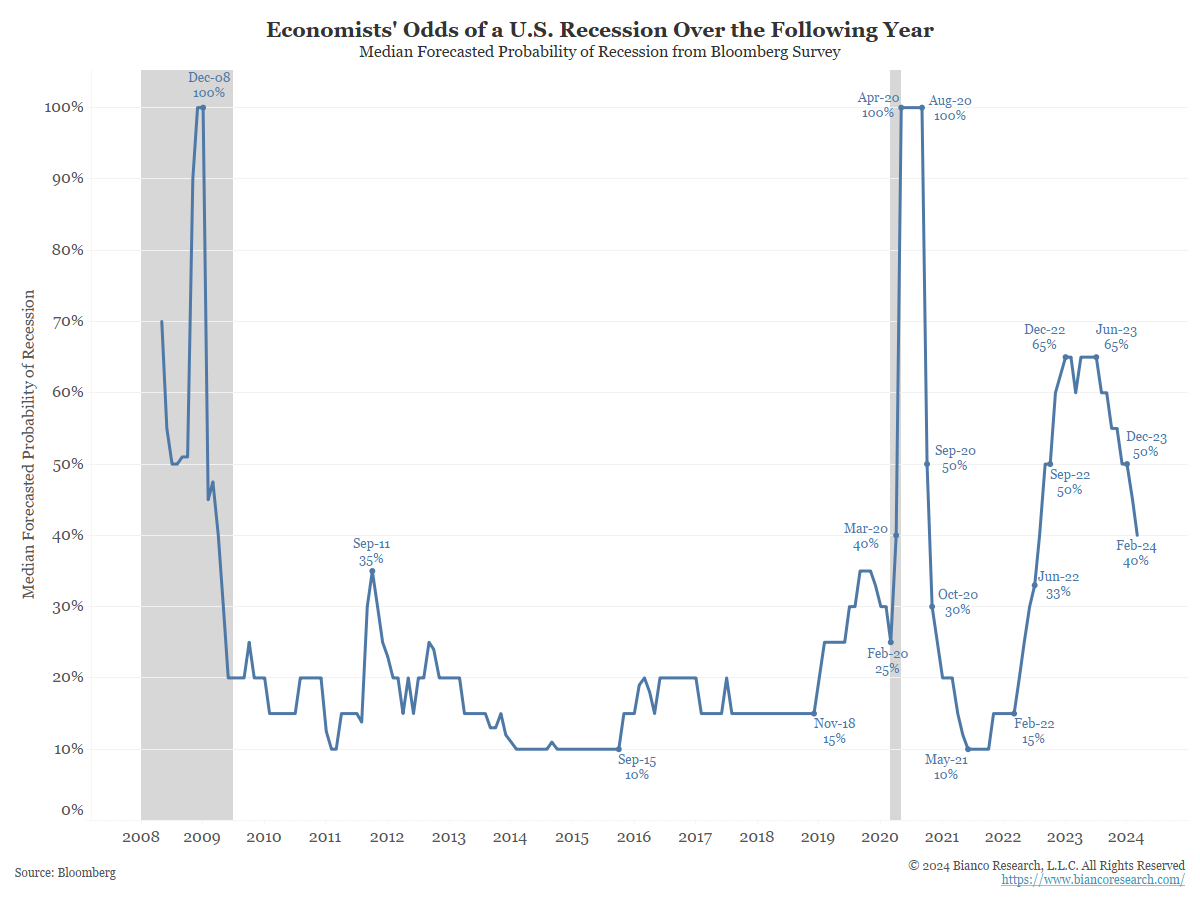

Odds of a Recession Declining

This chart shows economists placed a 65% probability of recession in the U.S. as recently as June 2023. With the economy continuing to surprise to the upside, those odds have fallen to 40%.

Source: Bianco as of 02.26.2024

Source: Bianco as of 02.26.2024

Since 1980, the US economy has had expansions in 7 of 10 years. So, in any randomly chosen year, the probability of a recession is 10% to 15%. This explains why economists put the odds of a recession around these levels during normal times.

We’ll mirror our comments from our last Bond Update: No real surprise here as the tape drives the consensus. In a recent Bloomberg survey, economist odds of a U.S. recession have plummeted on the back of resilient data and strong risk market performance. While we certainly aren’t out of the weeds, it is interesting to see what a few strong months of equity performance will do to forecasts!

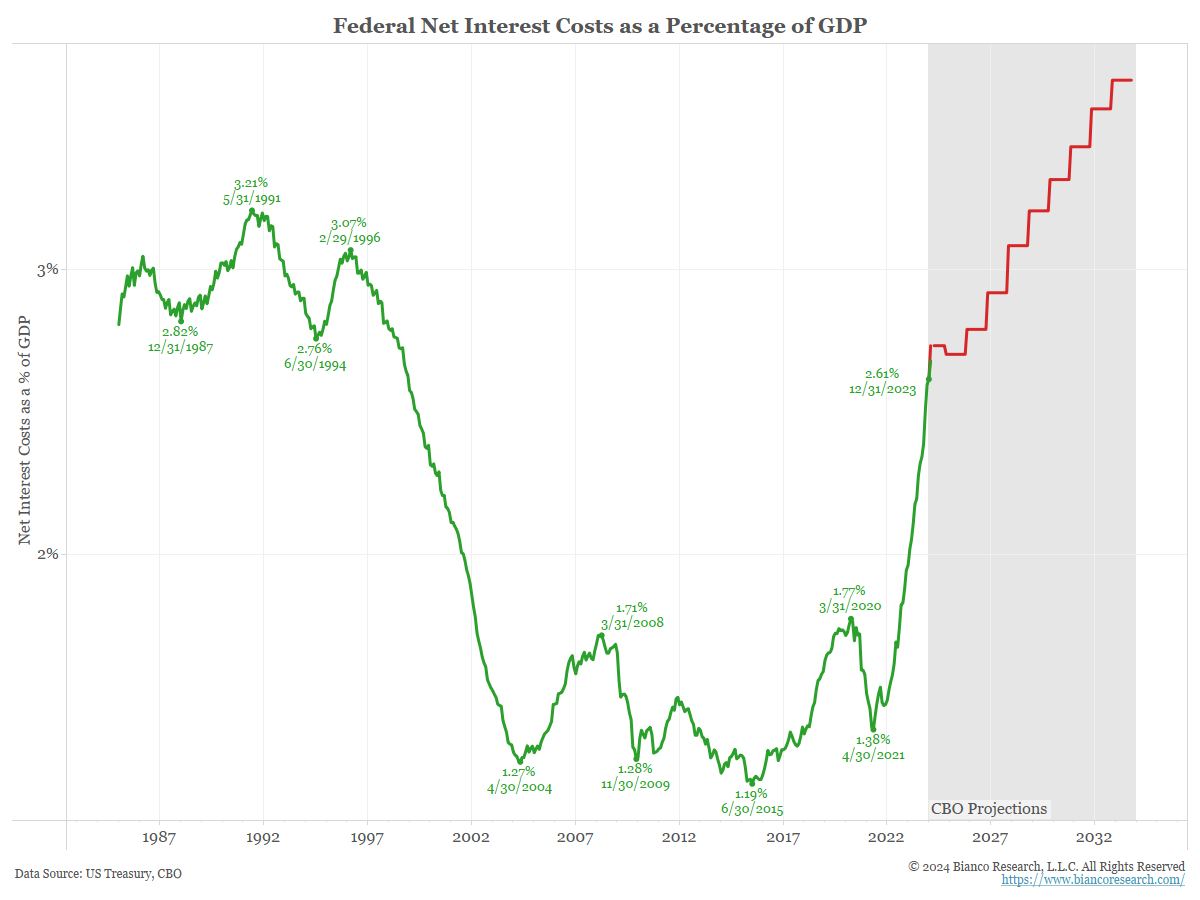

Government Debt Cost Is Rising

If the Fed holds rates at current levels, interest expense will keep climbing as older bonds continue to mature and get refinanced into currently high rates.

Source: Bianco as of 02.14.2024

Source: Bianco as of 02.14.2024

This will keep feeding into larger fiscal deficits, which are stimulatory for certain sectors, and the U.S. economy will begin approaching all-time highs in terms of interest expense as a share of GDP.

The federal government’s absolute interest expense is currently over $1 trillion per year and climbing, and if the current level of public debt (>$34 trillion) gets refinanced to an average of 5% rates over time, it would be >$1.7 trillion in annual interest expense or >6% of current GDP.

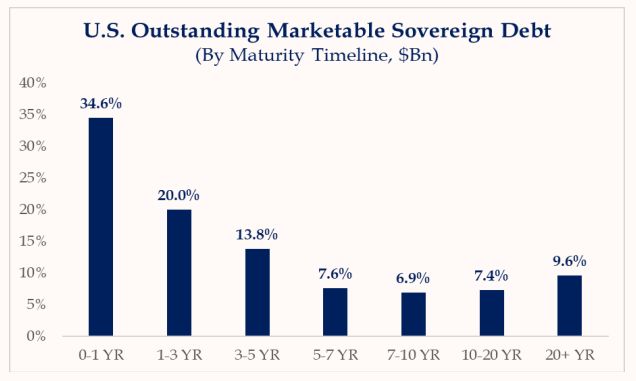

U.S. Debt Maturity Schedule

Nearly 70% of U.S. debt will roll over in the next 5 years. Per the comments above, if rates stay elevated, a huge chunk of the debt will be refinanced into much higher interest rates.

Source: Strategas as of 02.26.2024

Source: Strategas as of 02.26.2024

The fears of fiscal dominance might sound “doomy” but given the backdrop don’t seem unwarranted. Buyer beware on the long end of the curve!

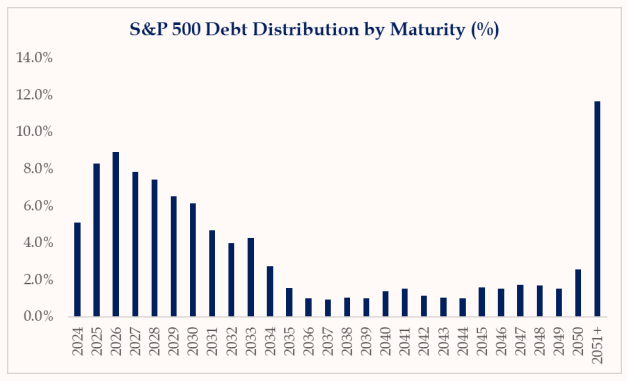

S&P 500 Index Debt Maturity Schedule

Contrary to the positioning of the U.S. government, the debt profile of the companies inside the S&P 500 is quite different.

Source: Bianco as of 02.14.2024

Source: Bianco as of 02.14.2024

While there are some short-term maturities to navigate, many large corporate borrowers used the record low rates of 2020 & 2021 to drastically extend the duration of their debt, making them far less rate-sensitive to rising rates than you’d expect. We’ve seen a similar dynamic in the mortgage market as well on the consumer side. This could be taken as a reason to remain bullish on stocks.

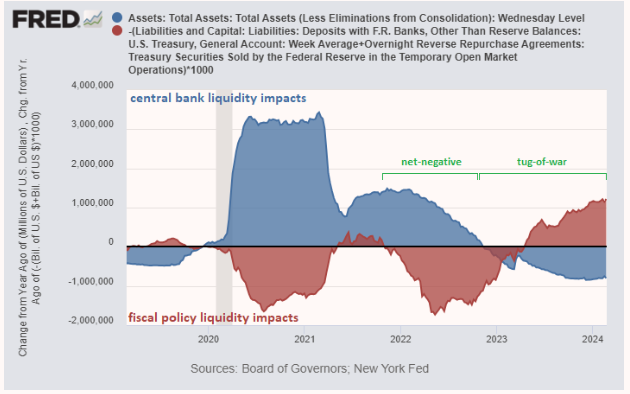

Tug of War for Monetary & Fiscal Policy

Fiscal policy is simply the size of the Federal deficit. As the Fed began its rate hiking campaign in 2022, it began to tighten monetary policy.

Monetary policy is simply the combination of the level of short-term interest rates, the size of the Central Bank’s balance sheet, plus other special facilities put in place by the government (i.e., BTFP facility from last March).

It will come as no surprise to regular readers that fiscal policy has been loose post-GFC. Fiscal policy was further amplified by the Trump tax cuts in 2017 and then screamed higher during the pandemic.

Source: FRED/ Lyn Alden as of 02.26.2024

Source: FRED/ Lyn Alden as of 02.26.2024

As the Fed has tightened monetary policy by increasing their policy rate and shrinking their balance sheet, fiscal policy has remained loose. The two have played off of each other in a way that, to this point, has kept the near-term economy in OK shape.

Government spending has been a key driver to help keep the economy as resilient as it’s been. The real question is whether we can see the Treasury continue to pull the fiscal lever given the long-term impact of the United States’ degrading financial position. Both expansive fiscal policy and a higher interest expense due to the higher interest rates have a cost…it just might take to figure out how big that cost is!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-18.