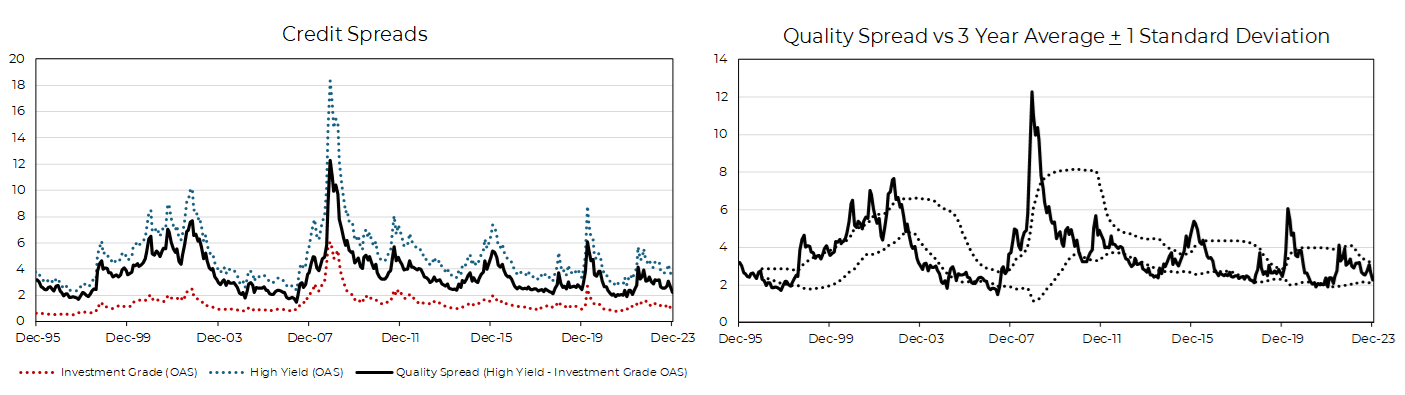

In a previous post, we outlined how shorter-duration bonds may now present an intriguing opportunity, as they now offer a yield surpassing forecasted inflation, a welcome shift from a decade of near-zero rates. In this post, we’ll outline another reality: while rates have risen, corporate bond yields relative to Treasuries have neared historic lows. These credit spreads gauge private sector health and directly impact corporate bond returns.

Low spreads, though potentially appealing in the short term given their reflection of strong underlying fundamentals, may hold cautionary signals for longer-term investors, emphasizing the need for thoughtful, adaptable strategies aligning with clients’ goals. Understanding the relationship between starting spread and future return offers crucial market insights for asset allocation decisions.

The Cyclicality of Credit

Advisors are often forced to consider the fundamental question: tactical allocation or strategic? Tight spreads may signal enthusiastic yet risky long-term valuations OR robust economic growth with minimal short-term default risk, depending on whom you ask.

We’ll delve into credit risk, specifically what we’ll refer to as Quality Spread, defined as the difference in spread between high-yield and investment-grade bonds. We’ll examine its impact on investment and high-yield returns across the following starting spread phases:

- Tight (more than one standard deviation below average)

- Normal (within a one standard deviation band)

- Wide (more than one standard deviation above average)

These insights can guide investors who are willing to make short-term tactical moves, as well as those looking to make longer-term strategic allocation decisions in anticipation of future risk appetite and opportunity.

Spreads are Approaching Decade Lows

Source: Bloomberg / Aptus; Quality Spread = the difference in between high yield and investment grade spread

Source: Bloomberg / Aptus; Quality Spread = the difference in between high yield and investment grade spread

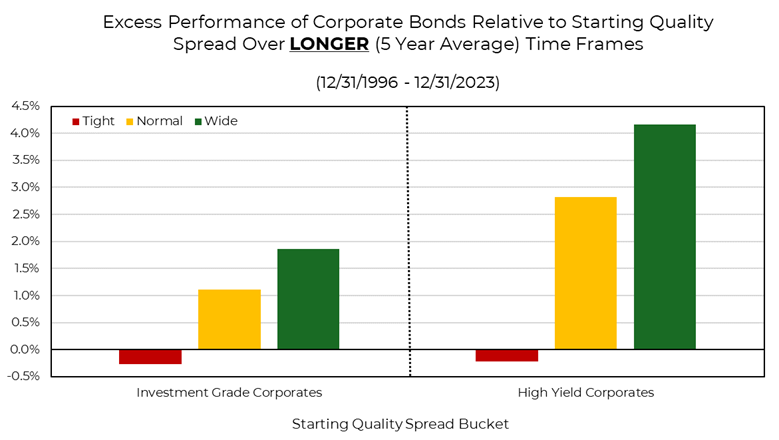

Credit Spreads vs. Long-Term Returns

Scrutinizing different starting points of Quality Spread classified by tight, normal, or wide levels reveals divergent historical five-year relative performance of both investment grade and high-yield bonds. Perhaps not unexpectedly, lower starting spreads correlate with diminished excess return potential. Notably, both investment grade and high-yield bonds produced subdued returns compared to Treasuries when the quality spread dipped significantly below average.

Source: Aptus via YCharts

Source: Aptus via YCharts

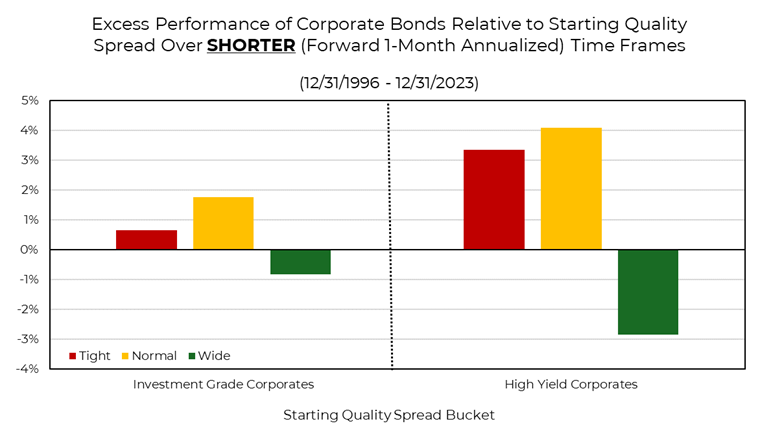

Credit Spreads vs. Short-Term Returns

In contrast to longer-term trends, shorter timeframes revealed a (perhaps surprising) inverse relationship. Tight and normal spreads translated to higher relative returns than Treasuries over the shorter one-month forward horizon, while wider spreads led to poor relative short-term performance. This underlines potential justified risk compensation, especially given prevailing fundamental factors.

Source: Aptus via YCharts

Summary and Implications

The tactical versus strategic conundrum echoes through the analysis of credit cycles. Advisors weighing frequent execution against a more deliberate, forward-looking approach grapple with these market nuances.

This analysis underscores the need for alignment of one’s investment time frame, and the signals in which they are used to make allocation decisions. The possibility of divergent outcomes offers both openings and hurdles for investors to navigate.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-31.