Consumer prices came in hotter than expected to start the year. This delivers another painful blow to market expectations for quick and aggressive Fed rate cuts.

January CPI

MoM

-

- Headline: +0.3% (Exp: +0.2%)

- Core: +0.4% (Exp: +0.3%)

YoY

-

- Headline: +3.1% (Exp: +2.9%)

- Core: +3.9% (Exp: +3.7%)

Source: Stifel as of 02.13.2024

Source: Stifel as of 02.13.2024

Officials have acknowledged that rate cuts will likely be appropriate at some point this year, but have consistently pushed back on the aggressive market expectations. The narrative has been that officials want additional evidence to confirm that improving inflation over the previous six reports will continue and that inflation is on a sustainable path to 2%. However, Tuesday’s CPI inflation report was anything but such evidence.

Bottom line: Consumer prices reaccelerated at the start of the year, reinforcing the Fed’s need for further patience, as the pathway for inflation remains uncertain. Down from earlier peak levels, the lack of continued downward momentum may keep policymakers from believing that inflation will retreat to 2% – at least yet.

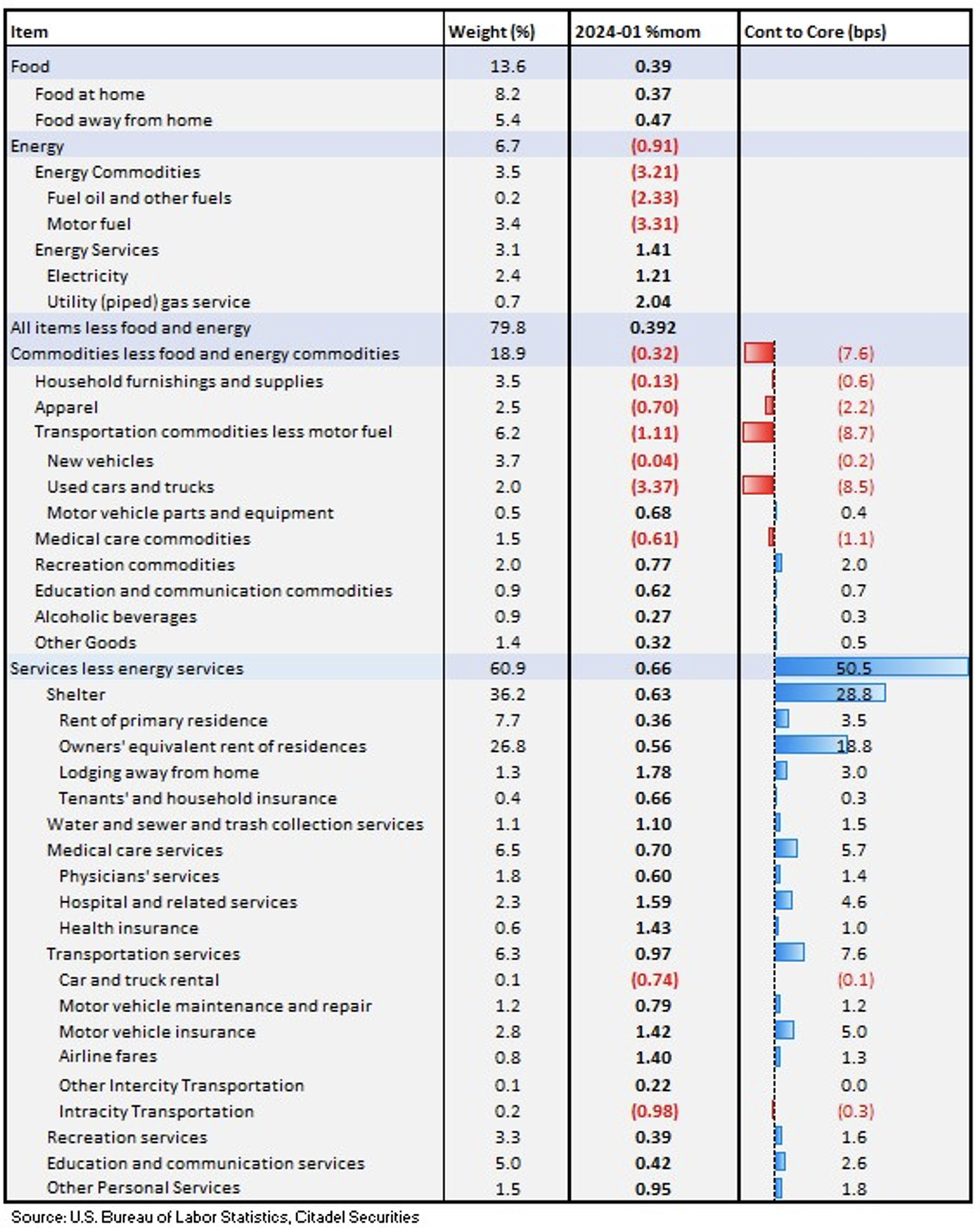

CPI Component Breakdown

Source: Citadel as of 02.14.2024

Source: Citadel as of 02.14.2024

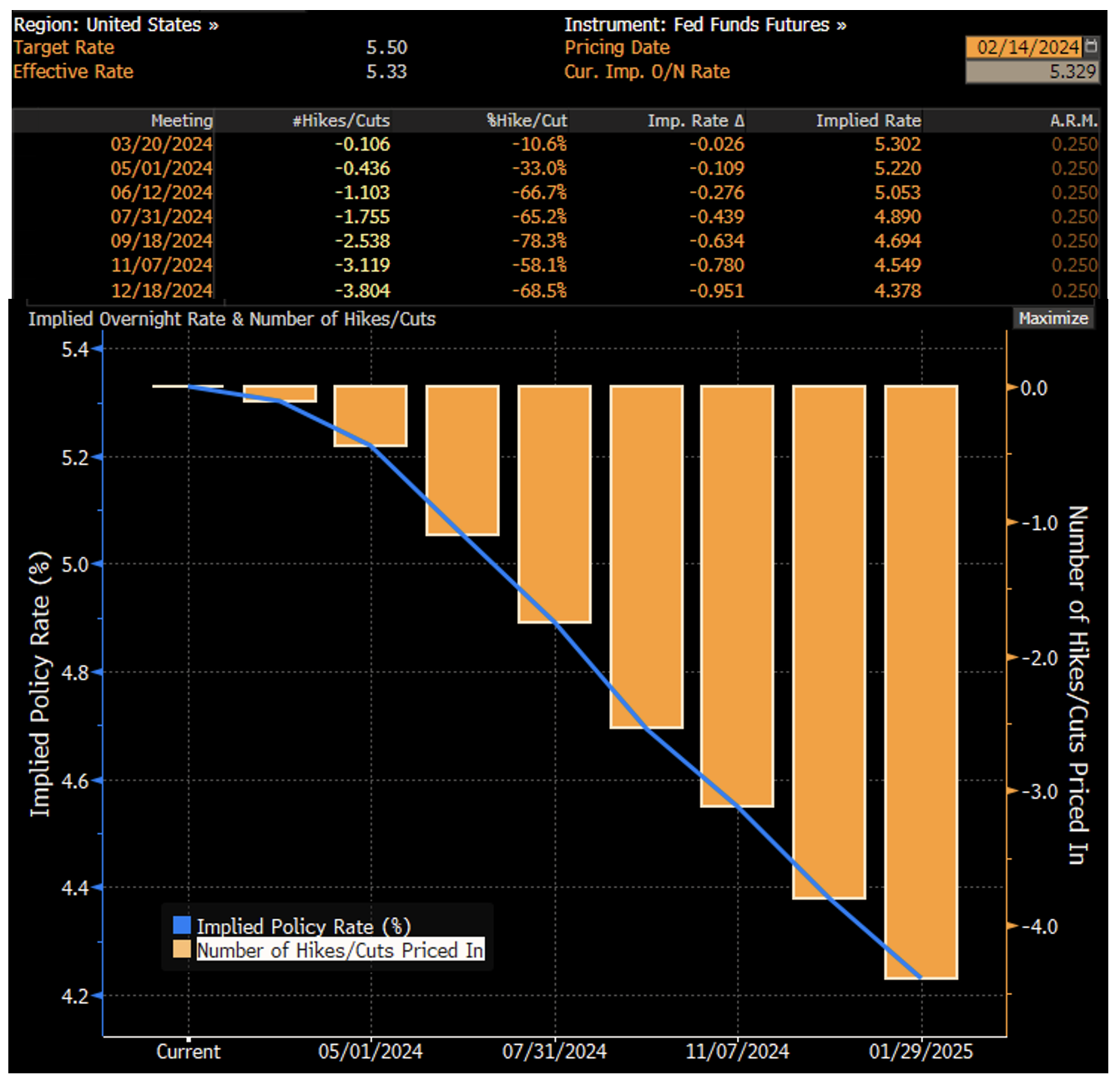

What is the Market Pricing Now?

On January 12, traders were pricing in almost seven rate cuts for the year, the largest number of cuts priced in during this cycle. After CPI’s release, traders became even more pessimistic about rate cuts. In fact, they are now close to matching the Fed’s thinking (~3 cuts in 2024 per their latest DOT Plot).

Source: Bloomberg as of 02.14.2024

Source: Bloomberg as of 02.14.2024

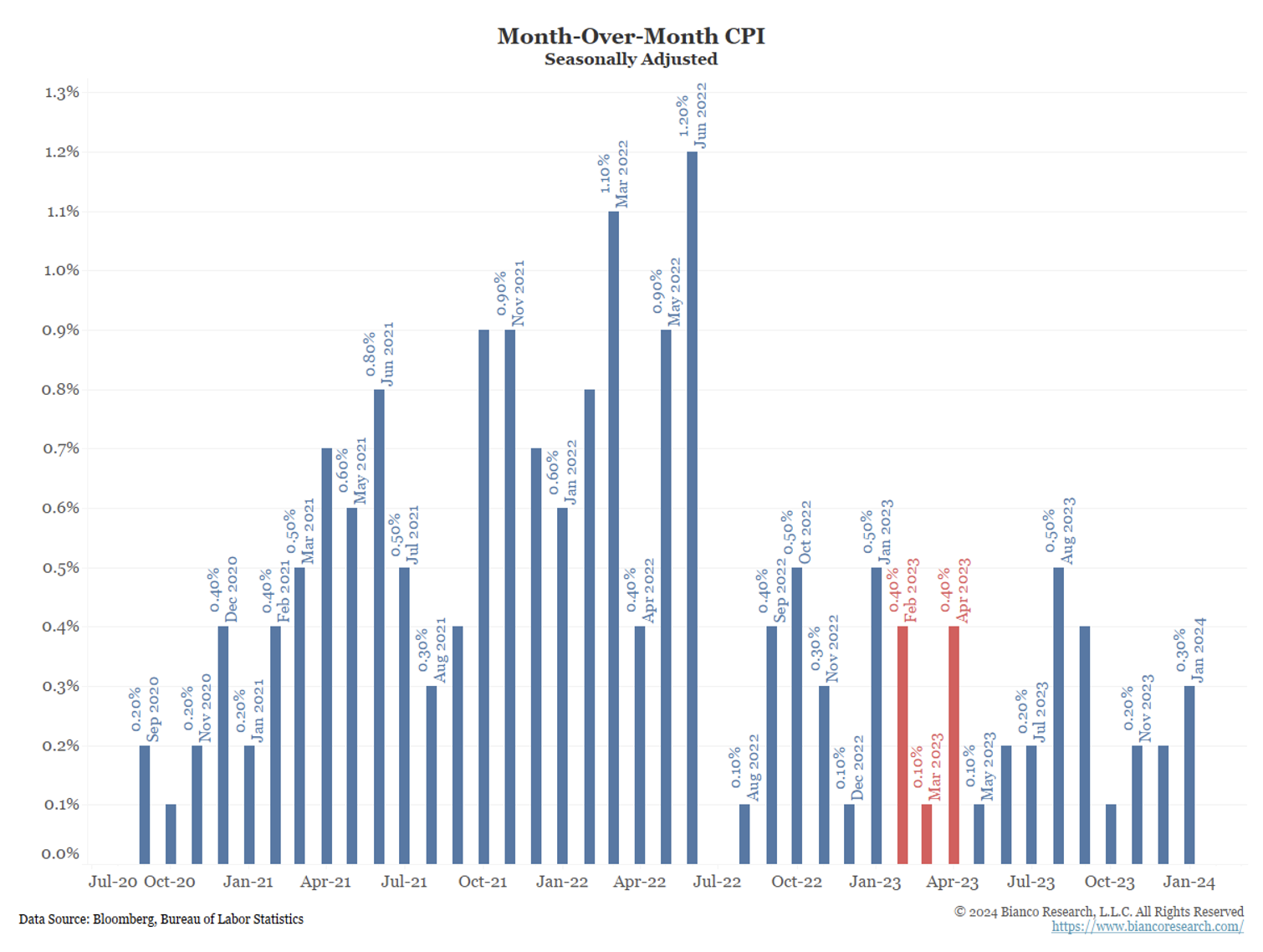

Month-Over-Month Inflation Comps

In the next few months (red bars), headline CPI will be replacing 0.4% (February), 0.1% (March), and 0.4% (April).

Source: Bianco as of 02.13.2024

Source: Bianco as of 02.13.2024

As of now, the Cleveland Fed’s CPI Nowcast puts February’s month-over-month headline CPI growth at 0.37%. This would be enough to keep year-over-year CPI above 3%. Additionally, a period of lower month-over-month numbers between March and July 2023 will roll off the year-over-year calculation in the next seven months, making further declines more difficult.

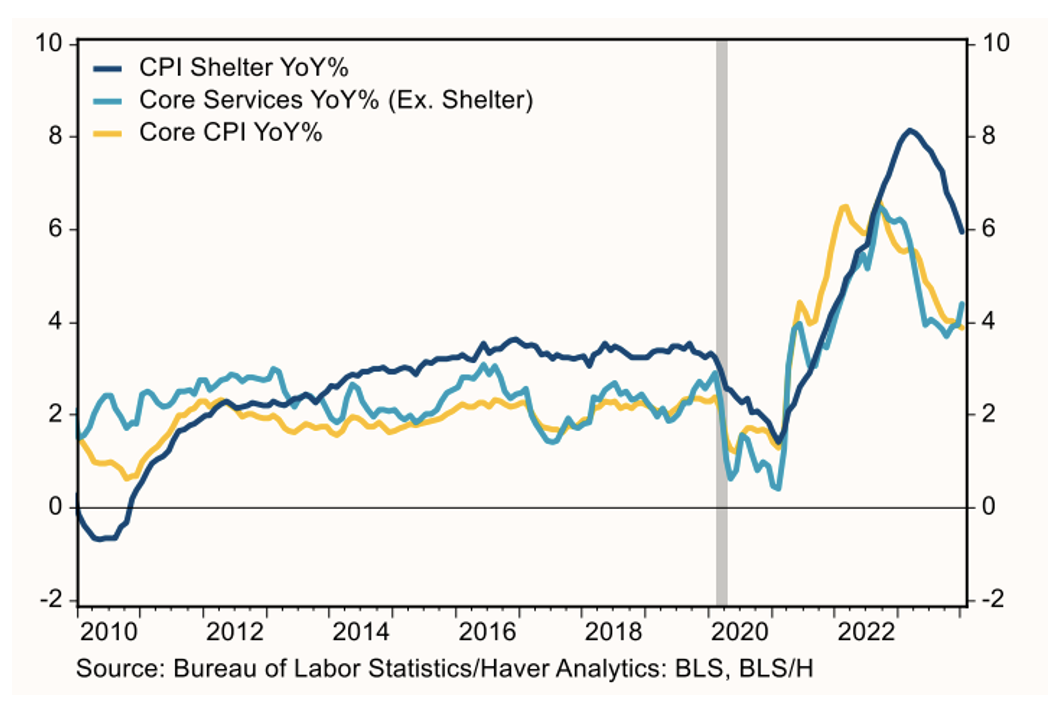

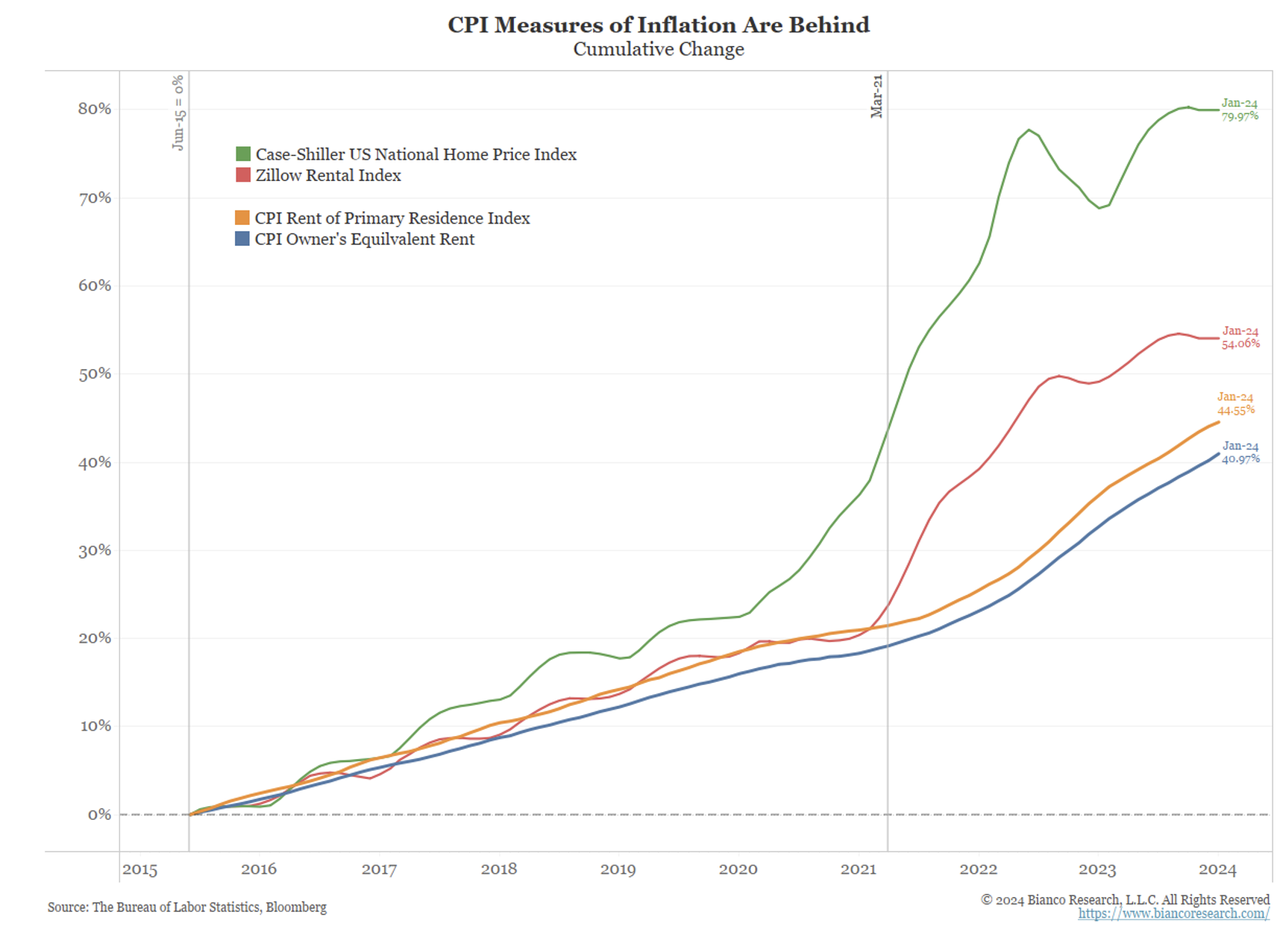

We’ve said this before and we’ll say it again: Ultimately a sustainable decrease in inflation requires shelter prices to revert to pre-pandemic levels.

Shelter Inflation: Thorn in the Fed’s Side

The chart below shows the cumulative gains starting in 2015 of the Case-Shiller US National Home Price Index and the Zillow Rental Index, vs. the two measures of Shelter CPI (OER & RPR).

Source: Bianco as of 02.14.2024

Source: Bianco as of 02.14.2024

We believe the cumulative chart is a better metric for measuring expectations. OER and RPR have significantly understated the cumulative rise in housing inflation since early 2021. We think it’s likely that OER and RPR have to “catch up” to the market measures by staying “sticky” as the gap to Zillow and/or Case-Shiller closes.

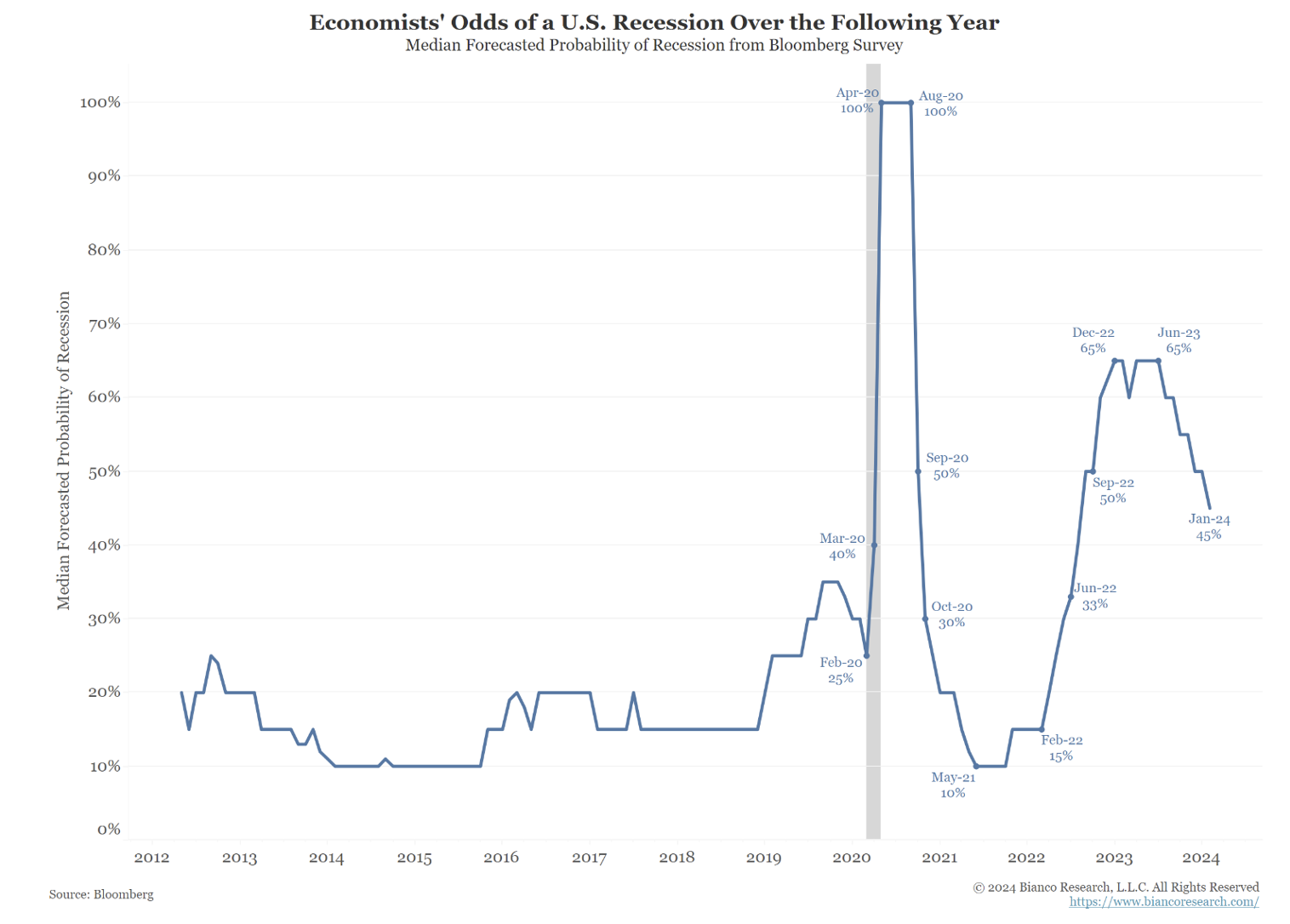

Odds of a Recession Declining

No real surprise here as the tape drives the consensus.

Source: Bianco as of 02.14.2024

Source: Bianco as of 02.14.2024

In a recent Bloomberg Survey, The Economist’s odds of a U.S. Recession have plummeted on the back of resilient data and strong risk market performance. While we certainly aren’t out of the woods, it is interesting to see what a few strong months of equity performance will do to forecasts!

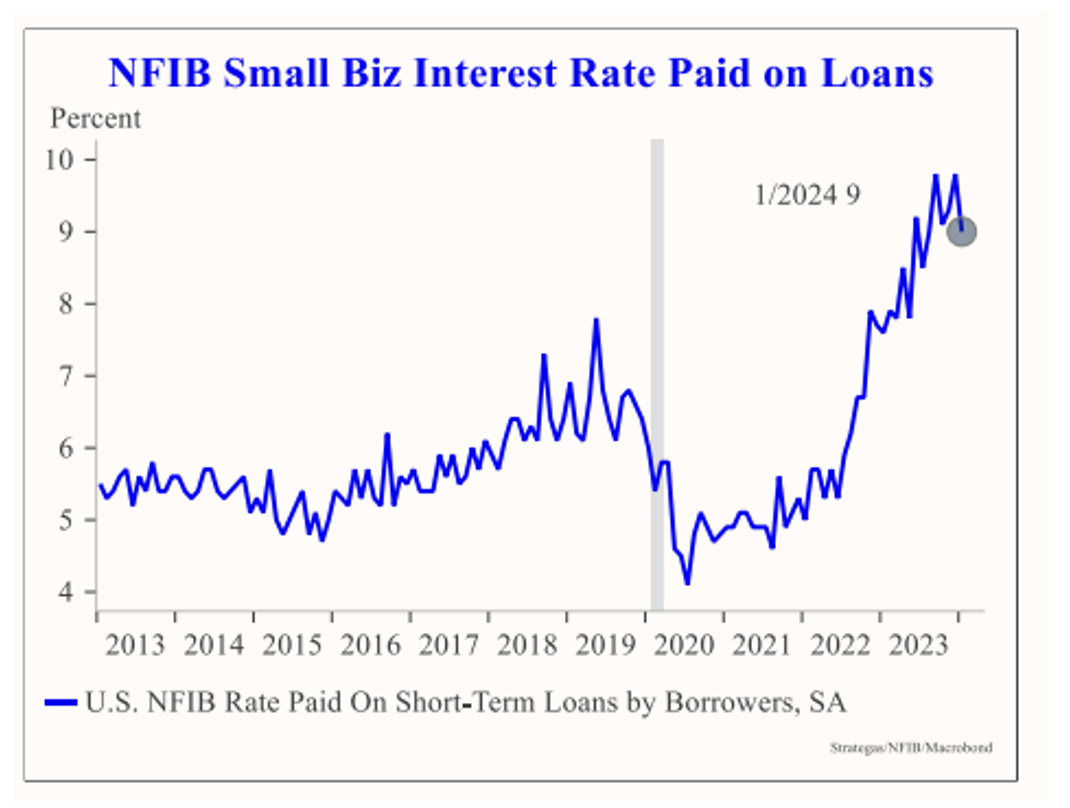

Cost of Money for Small Business is Elevated

Money is now costing small businesses ~9%. That funding is always more expensive than Wall Street funding, and companies are also now forced to adapt to a new rate environment. Time will tell how long it can last.

Source: Strategas as of 01.31.2024

Source: Strategas as of 01.31.2024

Given the disruption to rapid disinflation following yesterday’s CPI report, we are likely to see policy rate cuts on hold for now. While policy rates have different levels of impact on each segment of the economy, we do think policy is restrictive at the small business level. If overdone, there could be negative consequences on the economy.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2402-14.