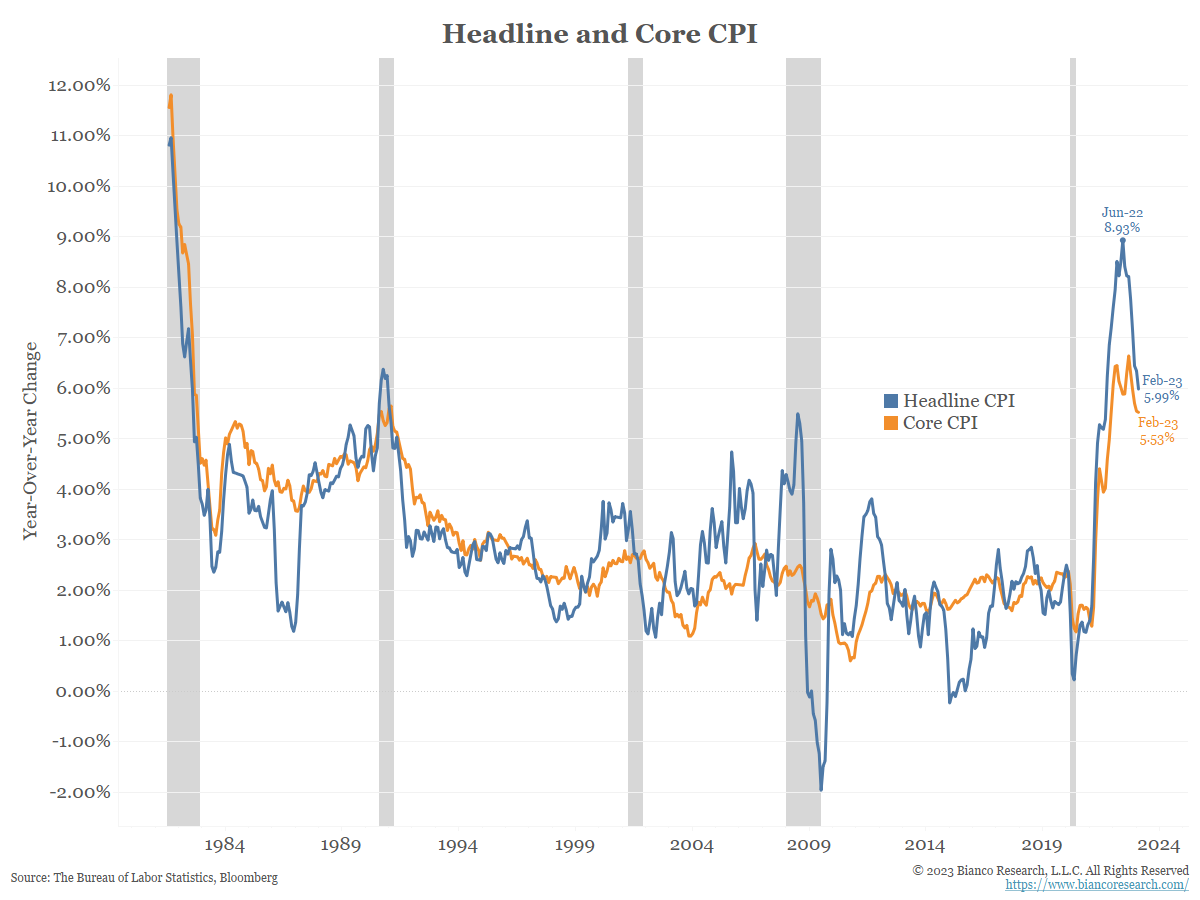

Consumer prices rose in February by the most in 5 months, although the move was roughly in line with expectations. Headline CPI number moved lower to 6.0% YoY as the February 0.4% print replaced last year’s 0.7% print.

Source: Bianco. As of 3/14/23.

Source: Bianco. As of 3/14/23.

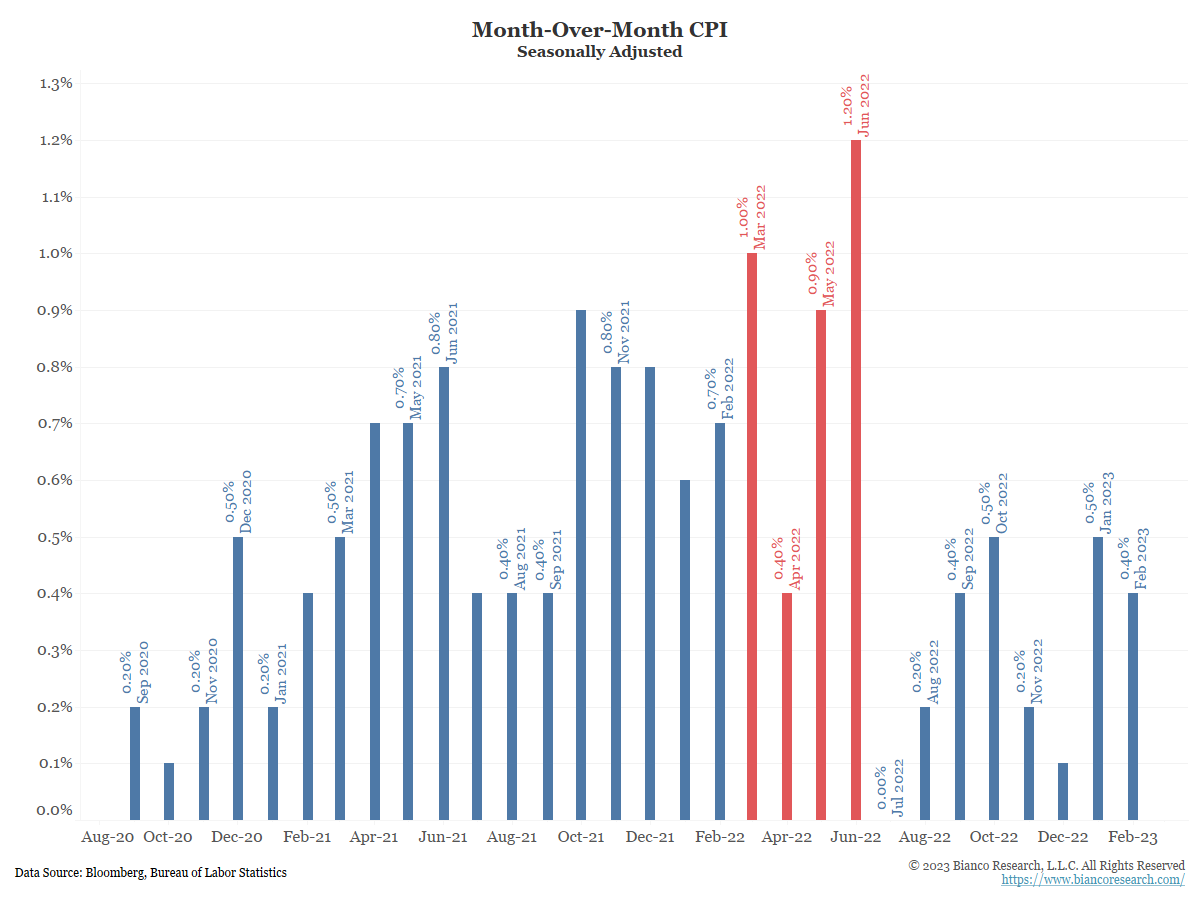

Next month will be critical for lower YoY inflation as a large March print (1.00% MoM in ’22) followed by a string of elevated prints due to Ukraine/Russia conflict roll-off (see next graphic for a visual).

Source: Bianco. As of 3/14/23.

Source: Bianco. As of 3/14/23.

Between March 2022 and June 2022 (red), the month-over-month change in CPI was much higher than in the 2020 period. This means the current monthly numbers will have a much higher bar to surpass if inflation is going to remain elevated. This changes dramatically come July where MoM changes from July – December of 2022 were much lower.

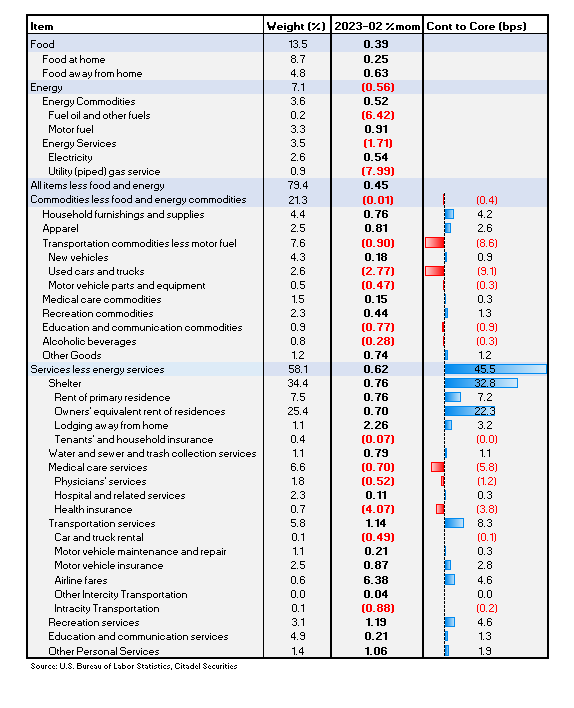

CPI Report Details

CPI m/m: +0.4% (vs +0.4% exp)

CPI y/y: +6.0% (vs +6.0% exp)

Core m/m: +0.5% (vs +0.4% exp)

Core y/y: +5.5% (vs +5.5% exp)

Differences between Core and headline CPI m/m were driven by Food +0.4% vs Energy -0.6%.

Notable Subgroups:

Rent – Primary Residence m/m: +0.8% vs +0.7% prior

Owners’ Equivalent Rent m/m: +0.7% vs +0.7% prior

New Vehicles m/m: +0.2% vs +0.2% prior

Used Vehicles m/m: -2.8% vs -1.9% prior

Source: Citadel Securities. As of 3/14/23.

Source: Citadel Securities. As of 3/14/23.

Overall, the report was a slightly hotter report than expected but nothing shocking. Shelter continues to lead the contribution, rising 0.8% vs 0.7% expected (MoM). Still not seeing the disinflation from market rents following through yet. Shelter continues to dominate the report. To show the impact of shelter, over the last 3 months core inflation ex-shelter is annualizing 2.1% and headline ex-shelter is annualizing at 1.6%.

Conclusion

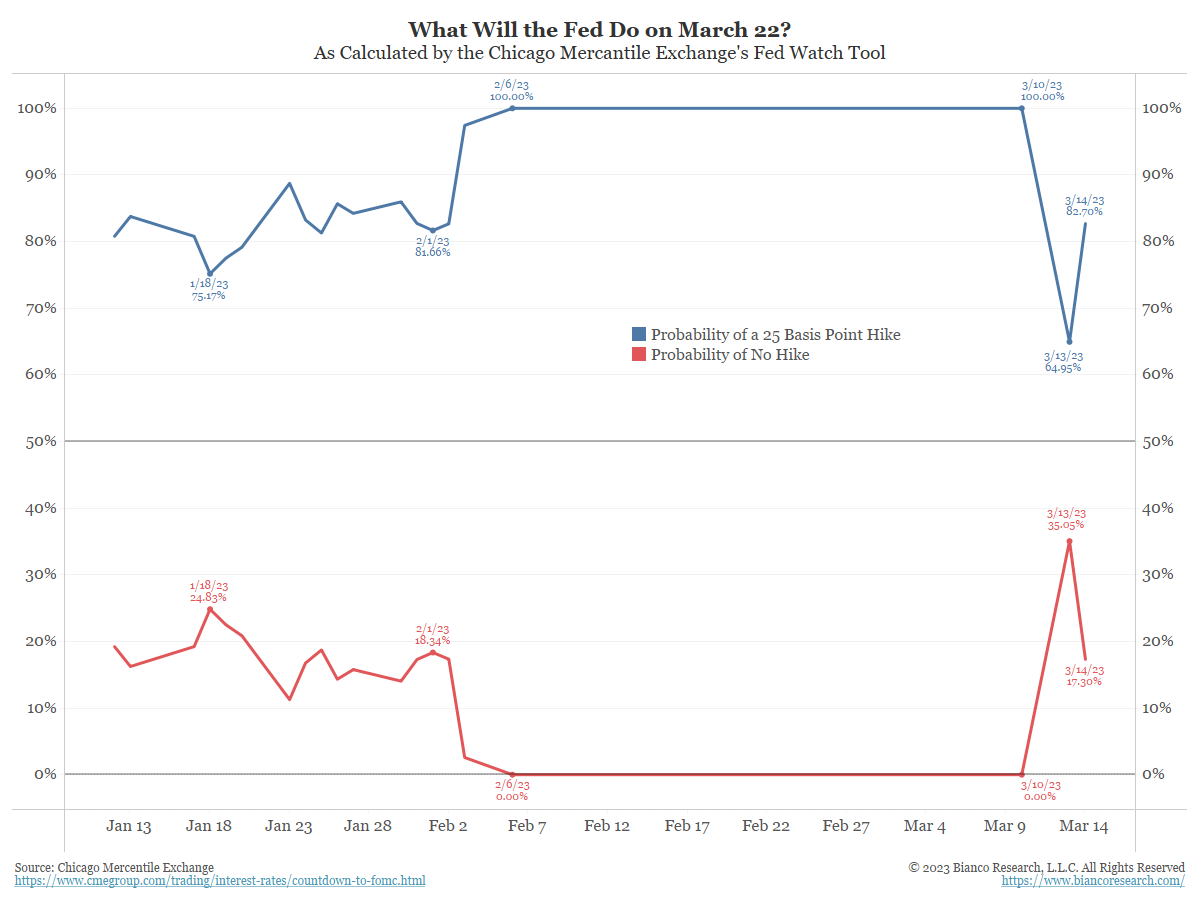

The Fed has historically cut interest rates following every major negative financial event over the past 40 years but today it doesn’t have the same flexibility due to high inflation. Fiscal policy is now also facing restraints. Of course, fiscal policy can pull the lever in a full-blown emergency, but the politics of bailouts, the rising deficit, and the inflation concerns make any type of fiscal assistance limited in our calculus, especially moving into the 2024 election cycle.

Source: Bianco. As of 3/14/23.

Source: Bianco. As of 3/14/23.

Bottom line, we believe the Fed will want to be like the Bank of England (BoE) was last fall as they utilize their balance sheet to put out an “isolated” fire while continuing to keep on with the inflation fight. The Fed still has a job to do and we’re not prepared to say we’ve reached peak in rates, or that we’ve won the battle versus inflation. The Fed has tools to shore up the banking system (demonstrated the last couple days), and it is still top priority to them to keep inflation expectations anchored at FOMC next week. While the move in rate expectations yesterday was eye-opening, we expect the Fed to keep on the hiking train with 25bps next week.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers. The Core CPI measures the changes in the price of goods and services, excluding food and energy.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-18.