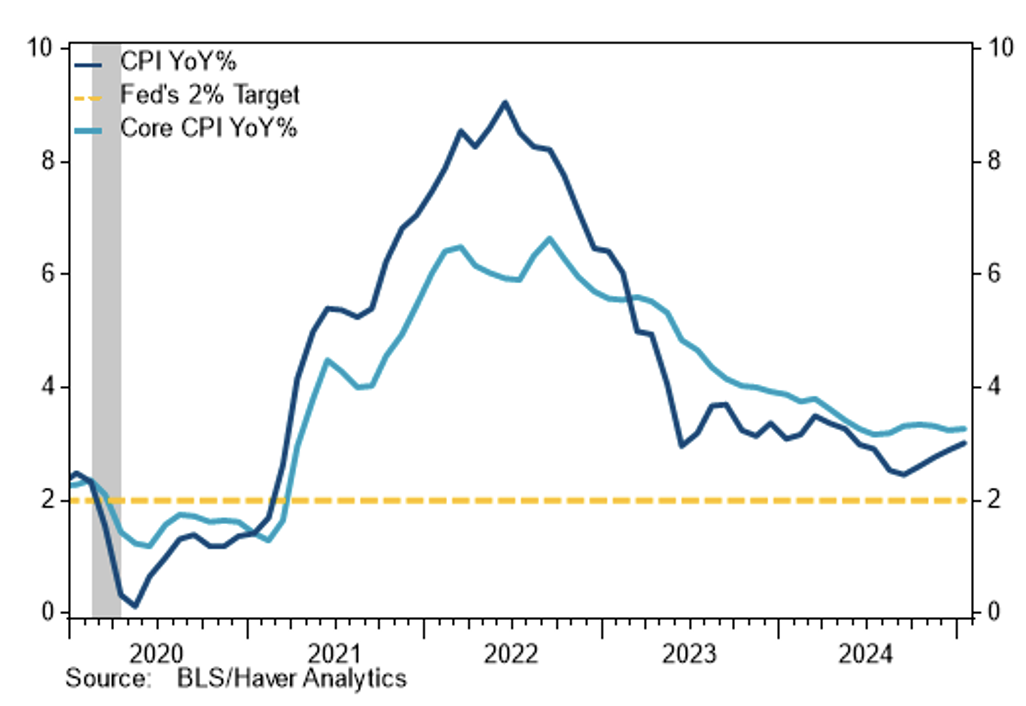

CPI rose 0.5% in January, above the 0.3% gain expected and an uptick from a 0.4% increase in December. Year-over-year, prices rose 3.0%, a tenth of a percentage point higher than expected and the fourth consecutive month of acceleration.

Source: Stifel as of 02.12.2025

Source: Stifel as of 02.12.2025

At 3.0%, this marks the largest annual increase in seven months. Food prices rose 0.4% and energy prices jumped 1.1% in January following a 2.4% gain in December.

Treasury yields moved higher across the board however the long end is rising more, steepening the yield curve. Stock’s initial reaction to the print is negative as the 10-year Treasury is firmly through the 4.5% level that’s proven a difficult level for risk assets.

Excluding food and energy costs, core CPI rose 0.4% in January, a tenth of a percentage point higher than expected and the largest gain in ten months. Year-over-year, core CPI increased 3.3%, two-tenths of a percentage point higher than expected and an uptick from the 3.2% annual gain in December.

Beyond the Headlines

In the details of the report, transportation prices rose 1.4%, due to a 2.2% gain in used cars and truck prices, and a 1.2% gain in airline fares. New car prices were unchanged. Shelter prices rose 0.4% with a 0.3% gain in the OER in January, matching the rise in the month prior.

On a positive note, the shelter index increased 4.4% over the last year, which is the smallest annual increase since January 2022. Commodity prices increased 0.6% in January, and medical care prices rose 0.1%. Apparel prices fell 1.4% to start the year. Shelter inflation and transportation services made up the bulk of the gains in the print.

Given the tweaks to seasonals and weights affecting this print, the outliers aren’t shocking and not totally abnormal for January, which tends to have some funkiness. Supercore, which strips out housing, came in at 0.8% which is the highest level since Jan 2024 (and before that April 2022).

Perhaps some of this strength can be explained by the fires and weather, and in used car prices and lodging. But probably not enough to explain away such a beat. The 2-cut median dot for 2025 are likely at risk for next month’s updated Summary of Economic Projections (SEP), with 3M and 6M trailing core moving up and away from the inflation target. We continue to see inflation expectations (longer run) as key to how the Fed calibrates the next signaling steps.

Bottom Line

The Fed shouldn’t be cutting or at least in a rush to cut. While there is seasonality in the data, the argument of looking to favorable data in the back half of 2025 to make the case for disinflation is becoming more difficult. It appears core PCE is stuck between 2.5% and 3%. Given the strong labor market and continued price pressures, we believe it points to a higher neutral rate.

In addition, unknown tariff, tax, and government spending policy combined with concerning inflation means the Fed is likely to be firmly on hold, and markets will be squarely focused on what the White House does in 2025.

Treasury yields are higher across the board however the long end is rising more, steepening the yield curve. Stock’s initial reaction to the print is negative as the 10-year Treasury is firmly through the 4.5% level that’s proven a difficult level for risk assets.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-13.