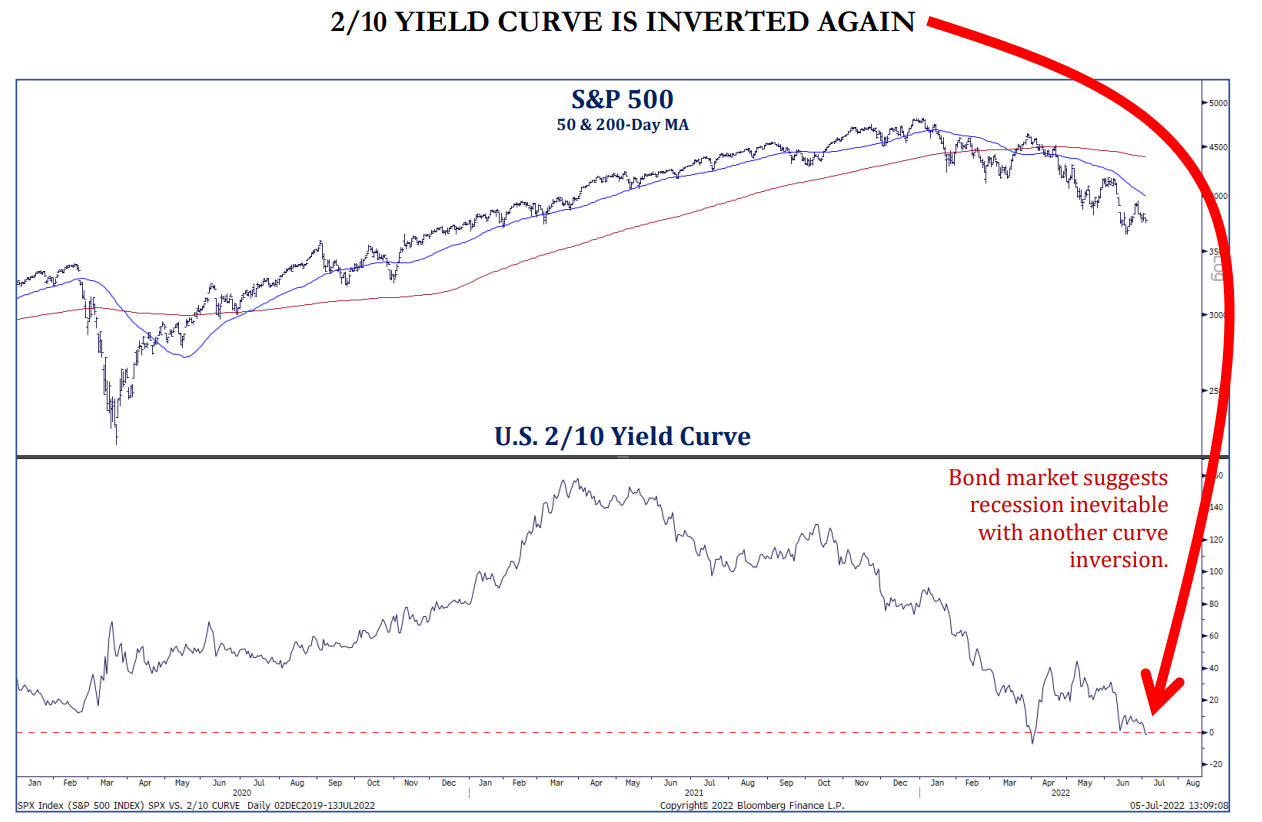

The Yield Curve Inverted… Again

The yield curve has inverted temporarily several times this year, but it’s only been for a day or two and then bounced back to a more normal shape (front end lower than the long end). As the Fed continues to hike rates (raising rates at the front end of the curve) while the backend of the curve (much less controlled by the Fed) becomes more entrenched with recession fears (lower future growth & inflation) we could see a more legitimate, longer lasting inversion which would drive room for concern. Point being is up until now, the inversions while newsworthy, aren’t flashing a red signal… yet.

Source: Strategas. As of 7.7.22

Source: Strategas. As of 7.7.22

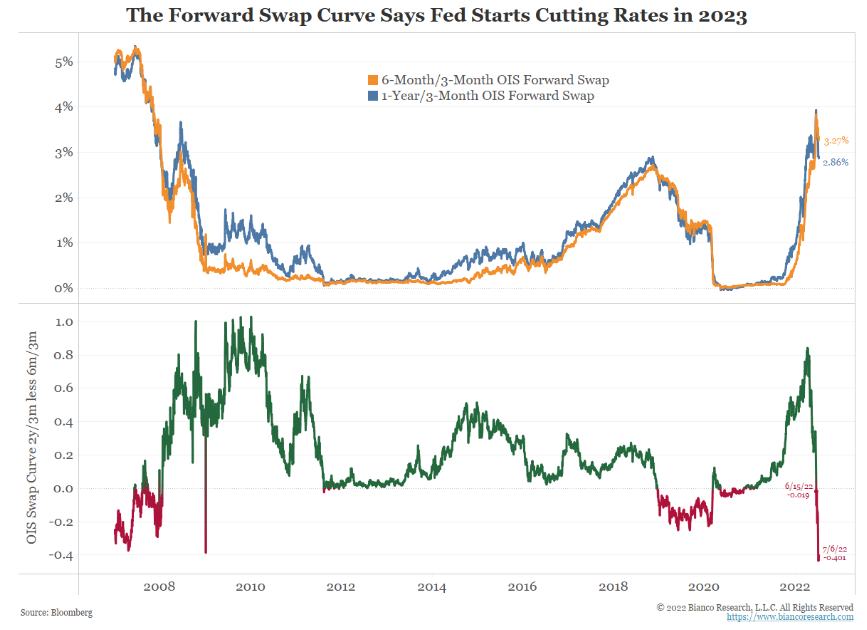

Forward Curves Tell Us What is Priced in and What is Expected. But They Do Not Tell Us What May Actually Happen

The orange line shows where the swaps market is pricing the 3-month rate in six months, now at 3.27%. The blue line is where the swaps market is pricing the 3-month rate in one year, now at 2.86%.

The bottom panel shows the difference between these two rates inverted on June 15, the day of the Fed hike, and is now at -40 basis points. To interpret this, the market sees rates reaching 3.27% by year-end, followed by roughly two rate cuts of 25 basis points by mid-2023. The problem with forward curves is it’s lack of ability to predict the future. For example, back in September of 2021 (9 months ago), the curve priced in no hikes until middle of ’22 and a terminal rate of 0.82% out in ’24. In January of 2022, the market expected the Fed to execute two 25 bps hikes by now (6 have happened) and a terminal rate of 1.5% in ’24. And lastly, back in March of this year (day after the first 25bps rate hike), the market priced in a 1% mid – year Fed fund rate and a 2.5% terminal rate in ’24.

Now the forward curve seems to be saying that either inflation is going to recede rapidly in the coming months or the Fed will abandon its aggressive hawkish stance and respond to a weakening economy/possible recession.

Source. Bianco Research. As of 7/6/22.

Source. Bianco Research. As of 7/6/22.

Source: Strategas. As of 7/7/22.

Source: Strategas. As of 7/7/22.

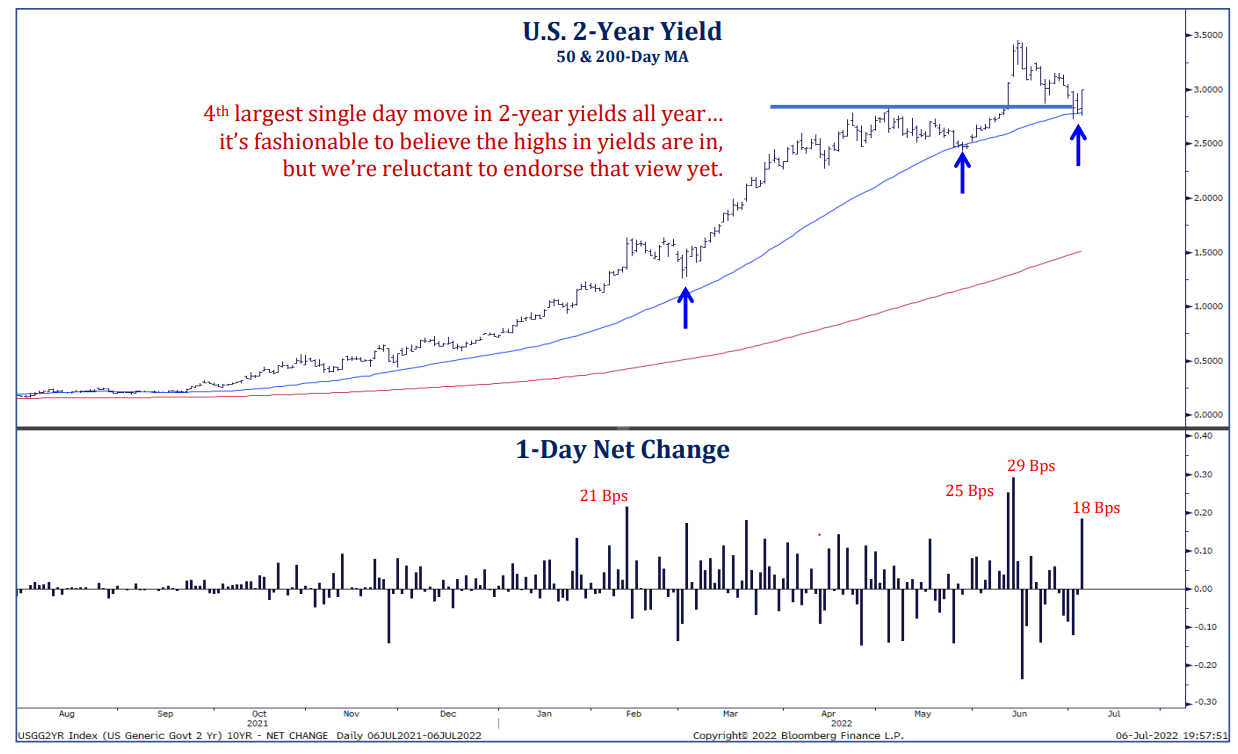

Two Year Yields are VOLATILE

In 2022 alone we’ve seen some significant moves within the yield of the 2-year Treasury. As the market attempts to dissect the future direction of Fed (i.e., how aggressive will they be before halting the hiking program), the bond market is experiencing eye popping moves in both directions. It is of our opinion that while at this point in a S&P 500 drawdown the Fed is typically cutting rates, this time is quite different.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-8.