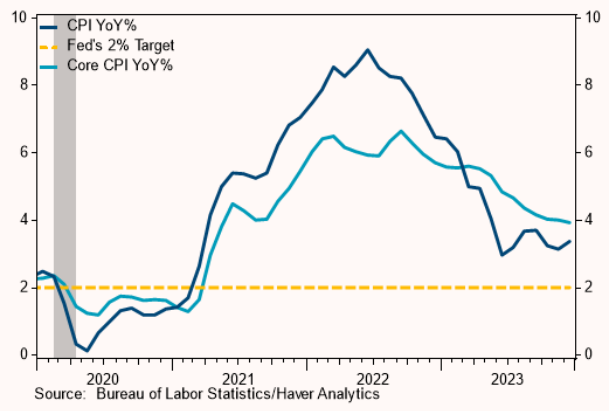

The U.S. Headline CPI for December rose +0.3% m/m (3.4% y/y) and the core CPI (ex: food & energy) was +0.3% m/m (3.9% y/y).

Source: BLS/Stifel as of 01.11.2024

Source: BLS/Stifel as of 01.11.2024

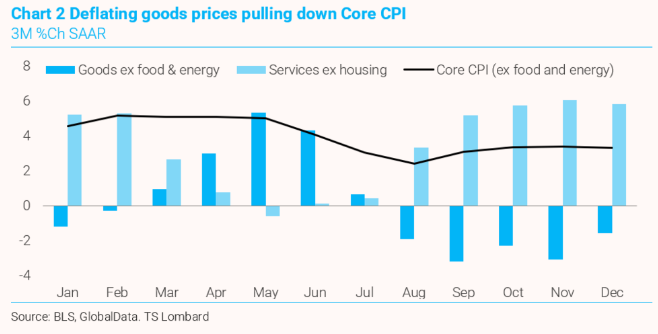

Inflation came in slightly above expectations in December. Core inflation is being aided by deflating goods prices while service inflation remains well above 4%.

Source: TS Lombard as of 01.11.2024

Source: TS Lombard as of 01.11.2024

On the Core Inflation side, the December increase was only the 2nd above-30bp core CPI increase in the past 7 months. Up until May, core CPI increases had been above 30bp for 20 months in a row. Improvement…but there is still work to do.

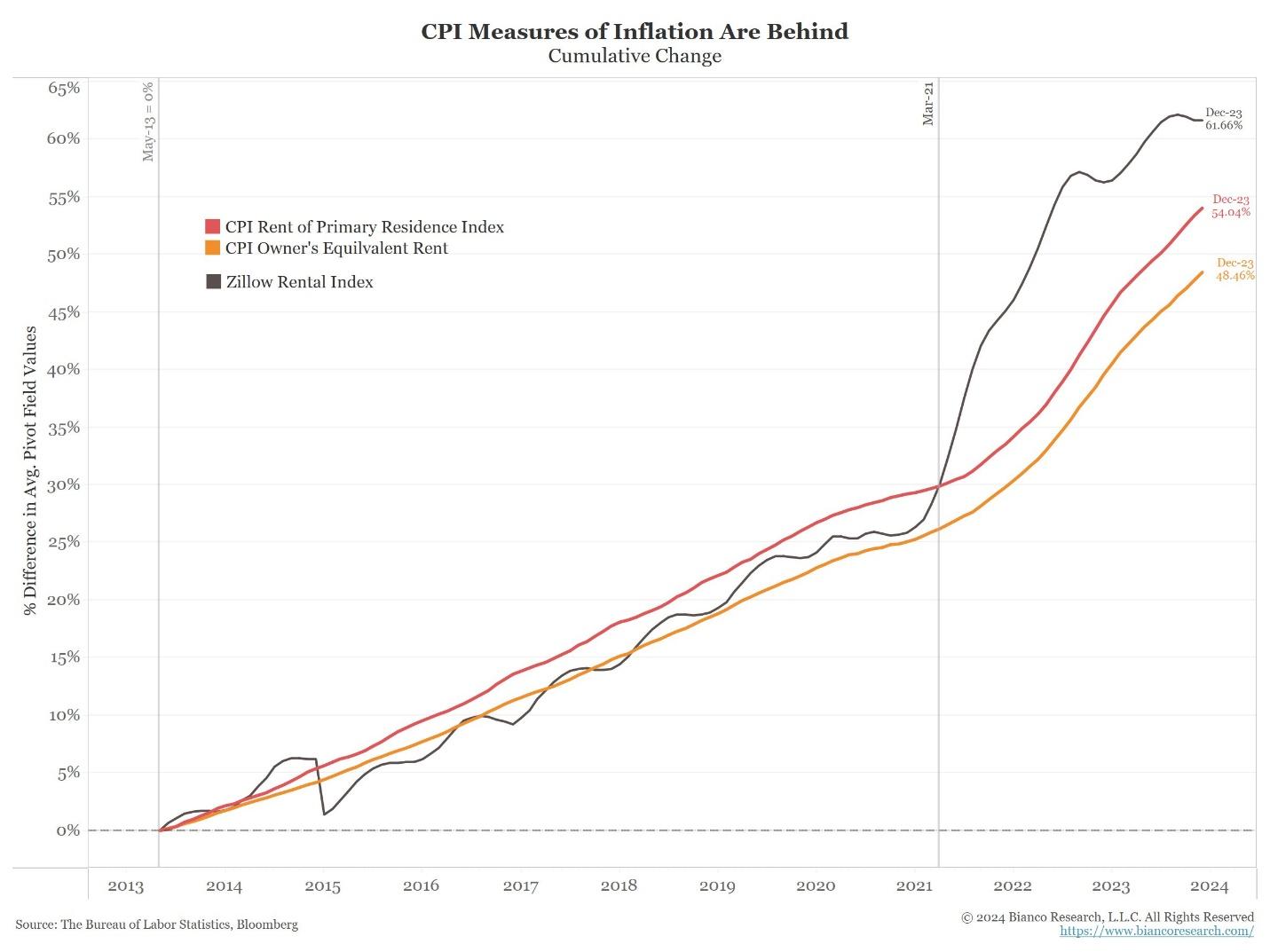

Shelter Inflation: Still Elevated

Shelter prices make up roughly a third of the overall CPI index. Shelter continues to keep inflation elevated, contributing to more than half of the advance.

Source: Bianco Research as of 01.11.2024

Source: Bianco Research as of 01.11.2024

Ultimately, the easy part of the fight against inflation is now over and we’ll need to see shelter prices continue to lower if the Fed hopes to hit its 2% target. Looking at the data, we think we will have to wait until March, or perhaps into Q2, before OER (Owners Equivalent Rent) sees notable improvements.

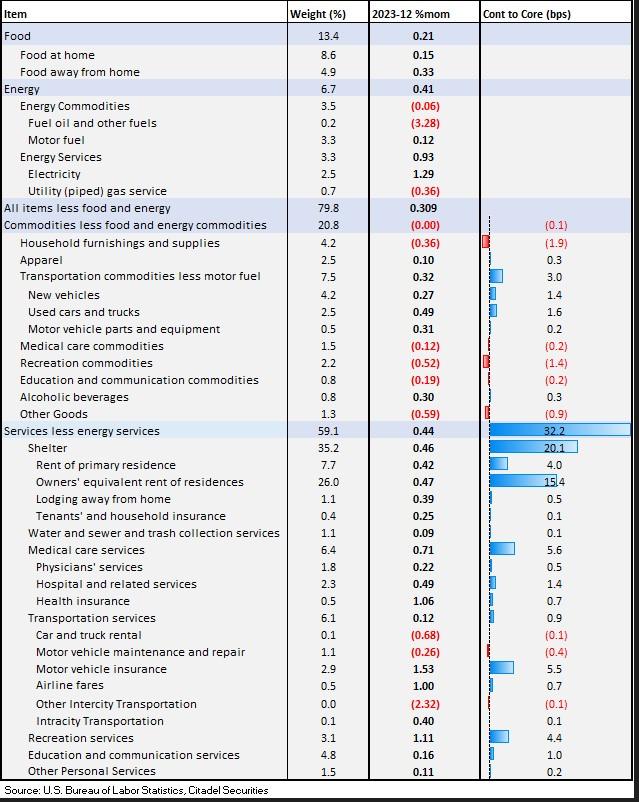

Report Details

Airline fares increased by 1.0% in the final month of 2023, the largest monthly gain since August, medical care prices increased by 0.6%, and shelter prices gained 0.5%, due to a 0.5% rise in the OER. In addition, recreation prices rose 0.4%, transportation prices increased 0.2%, commodities prices gained 0.1%, as did education and communication prices in December. On the other hand, other goods and services costs fell 0.2% in December.

Source: BLS/ Citadel as of 01.11.2024

Source: BLS/ Citadel as of 01.11.2024

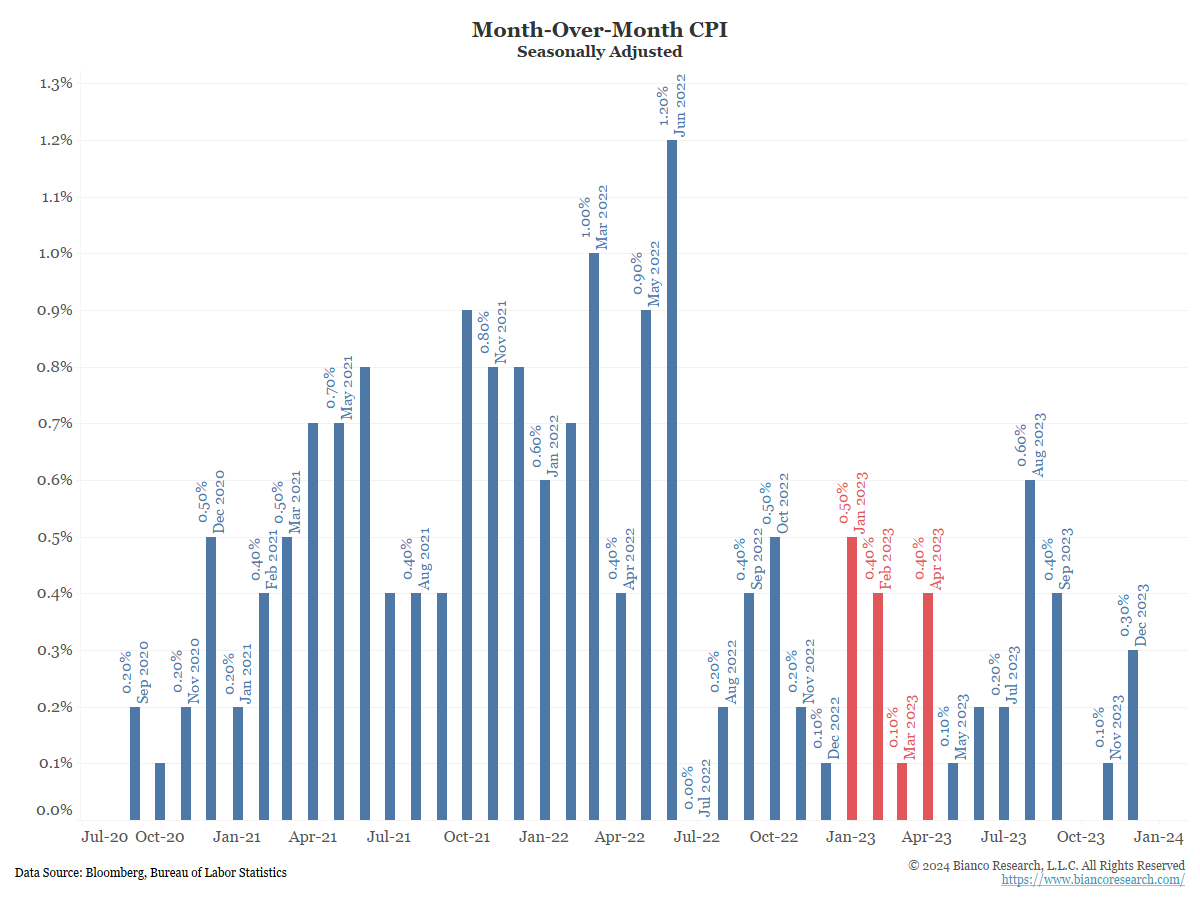

Month-Over-Month Comps Looking Ahead

Looking ahead, over the next four months, CPI will be replacing 0.5%, 0.4%, .01%, and 0.4% month-over-month growth rates from a year ago (red).

Source: Bianco Research as of 01.11.2024

Source: Bianco Research as of 01.11.2024

This should continue to allow inflation to creep lower in the next couple of months which should bring comfort to the Fed.

Conclusion

While today’s inflation report reinforces the decision of the Fed to pause rate hikes as inflation has reversed from peak levels, it’s still too early to make policy adjustments given the uncertainty and nominally high level of prices.

Simply put, price pressures still remain elevated above the Fed’s 2% target with recent memory of prior head fakes (August-September) and risks to the upside. Amid international uncertainty, the latest disinflationary trend is not yet convincing that price pressures will continue to retreat in as orderly and timely of a manner as the market anticipates.

We expect the Fed to maintain their restrictive policy for the remainder of Q1 given core CPI is still hovering around 4%. Rate cuts (while much less aggressive than what the market is pricing in) are more probably a back half of the year item if more definitive data gives comfort to the Fed that they can avert a “Stop and Go” scenario.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-24.