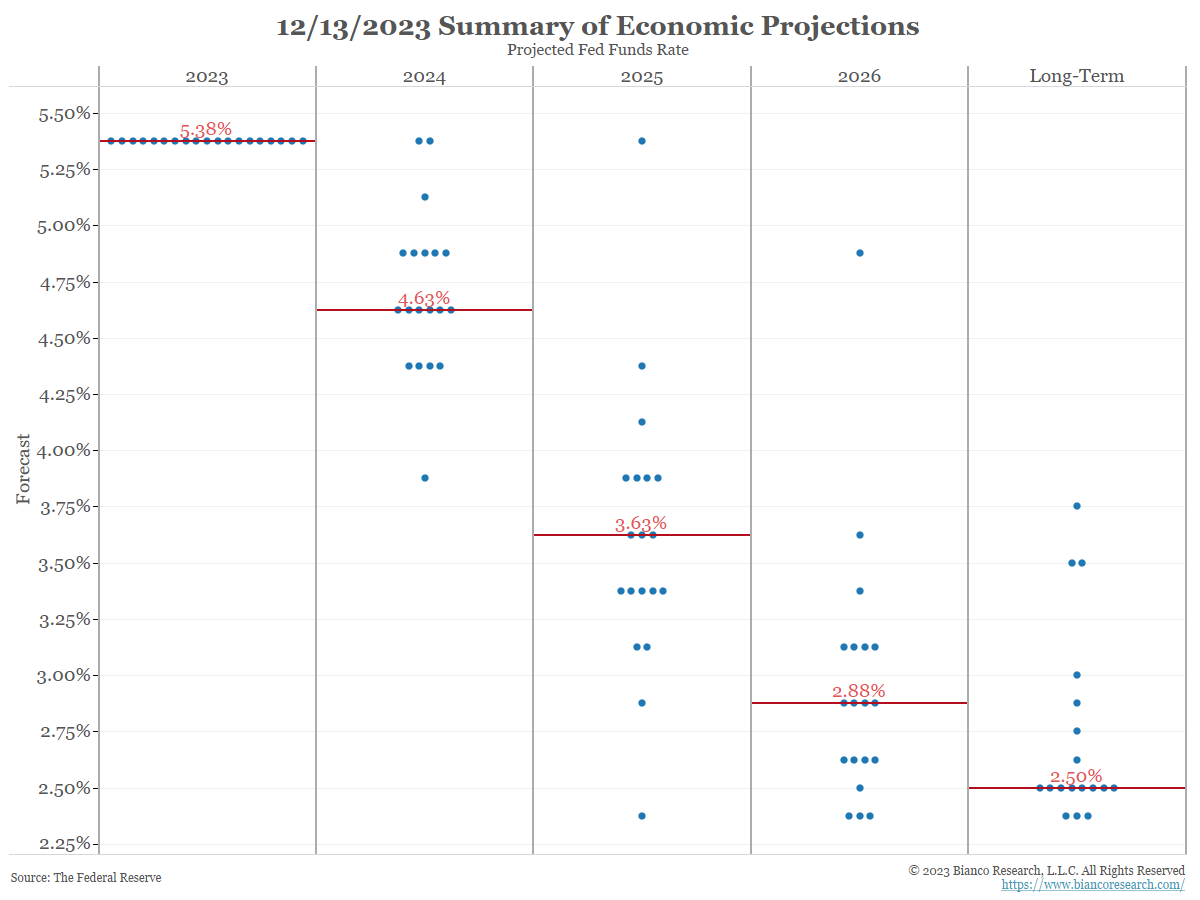

As expected, the Fed left its target rate unchanged at 5.25% – 5.50%, matching market consensus. The updated rate forecast, or dot plot, doesn’t have another rate hike penciled in next year.

Source: Bianco/Fed as of 12.14.2023

Source: Bianco/Fed as of 12.14.2023

In addition, expectations for 2024 rate cuts were increased from 50bps to 75bps. The forecasted 2024 year-end Funds rate is now at 4.625%, well below September’s 5.125% estimate. This more dovish take on 2024 rates has the Treasury market rallying across the curve.

Notables from the FOMC Minutes and Powell’s Presser

- Powell said policy was now “well into restrictive territory” which differs from his “merely restrictive” stance back in November

- The Committee removed their comment from the November statement that said: “Reducing inflation is likely to require a period of below-potential growth and some softening of labor market conditions.”

- Powell states explicitly that the Fed would need to start cutting rates “way before” inflation reached its 2% target, and even that failing to do so could lead to an overshoot and slow activity too much.

- Powell admitted that the FOMC had discussed when they should start cutting rates. This comment caught markets off guard.

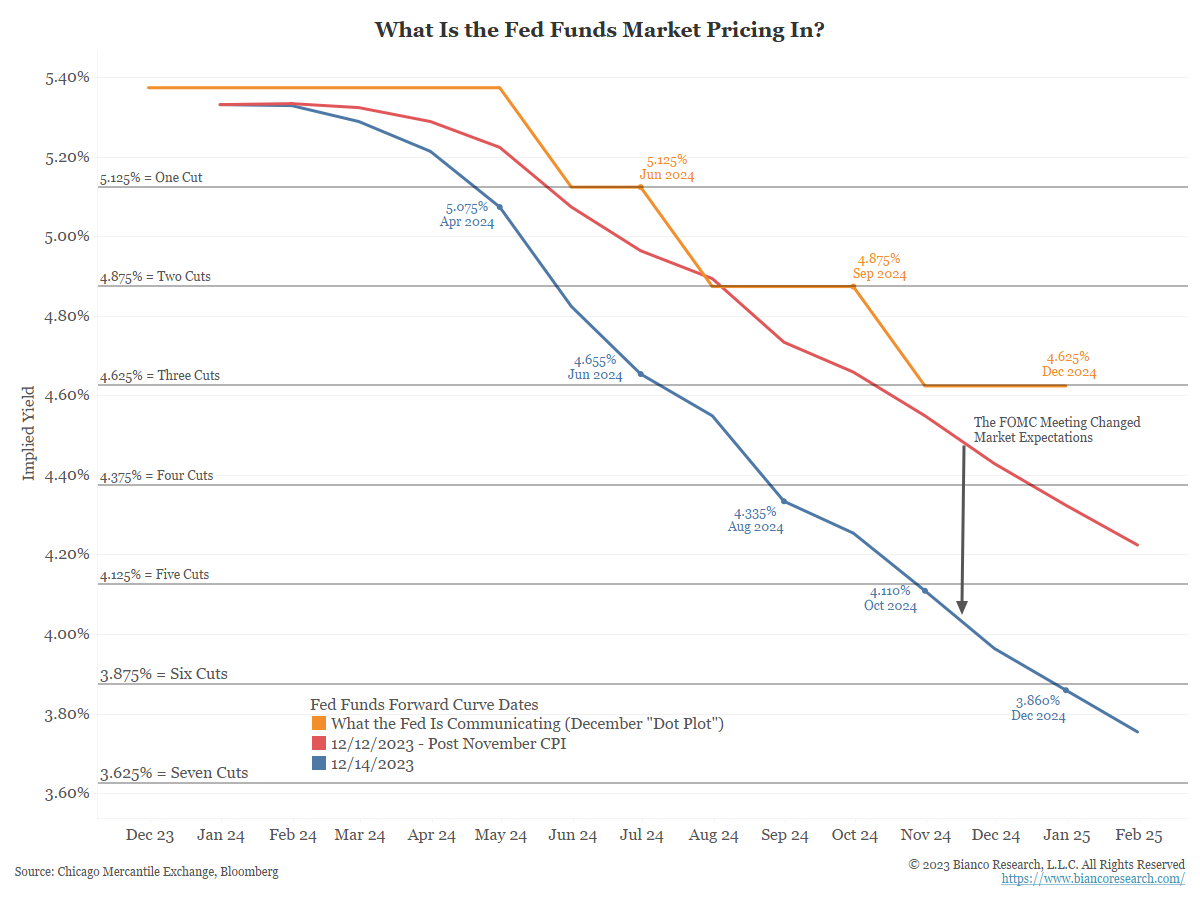

Market Expects Faster Easing of Fed Policy

Futures pricing prior to the announcement had the first rate cut fully priced in for the May meeting, and more than 100bps in cuts during 2024. After the updated information, the market now has the first cut priced in for the March meeting and a total of 130bps in cuts during 2024 with the funds rate at 4.00%.

Source: Bianco/CME as of 12.14.2023

Source: Bianco/CME as of 12.14.2023

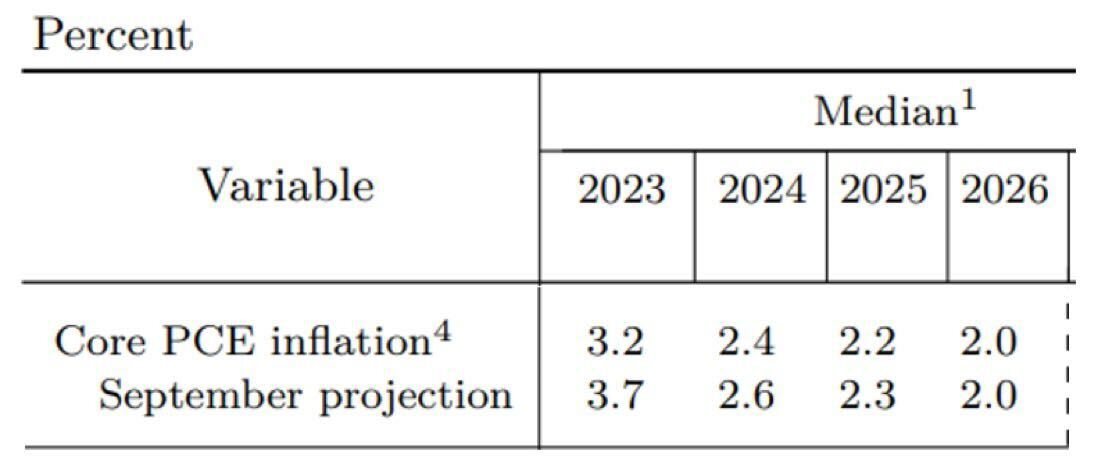

Update to Inflation Forecasts

The Fed reduced their 2023 core PCE forecast to 3.2% from 3.7% in September. It sat at 3.5% as of October, with market expectations at 3.4% for November. They lowered the 2024 forecast from 2.6% to 2.4% while reducing the 2025 forecast to 2.2% from 2.3%. This reflects the marginally better inflation data since the September meeting, with continued improvement expected in 2024.

Source: Fed as of 12.14.2023

Source: Fed as of 12.14.2023

Labor Market Expectations

The Fed’s new forecast is for the unemployment rate to tick up from 3.7% to 3.8% at year-end, which is in line with the September year-end forecast. Then, unemployment is forecast to climb to 4.1% in 2024 and 2025, also in line with the September forecast.

The minimal increase in the unemployment rate forecasts is a recognition of the labor market’s resilience this year, with continued optimism expected for 2024.

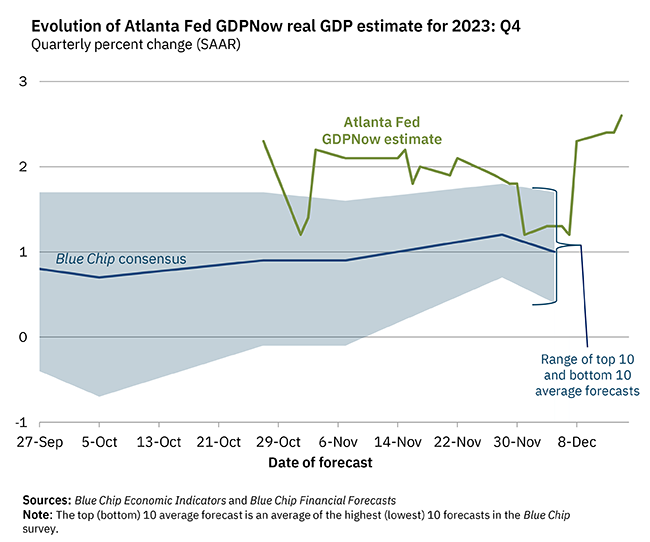

GDP Expectations

The Fed now has GDP at 2.6% for 2023 vs. 2.1% in the September forecast. The pace is expected to slow to 1.4% in 2024 and 1.8% in 2025, both are virtually unchanged from the September forecast. The 2024 and 2025 GDP projections continue to reflect the Fed’s belief in a soft-landing scenario.

When the Fed first started projecting this outcome it was seen by many as wishful thinking, but as the year progressed market belief in a soft landing has increased as economic results have surprised to the upside. Especially now that the Fed is done with rate hikes.

We’d note (below) the Atlanta Fed GDPNow Real GDP Estimate for Q4 of 2023 has ticked higher to 2.6% over the last month as financial conditions have eased. A reacceleration could be problematic given the market’s rosy outlook for rate cuts.

Source: Fed as of 12.14.2023

Source: Fed as of 12.14.2023

Conclusion

Overall, the Fed delivered on the expected pause. With no rate hike in the forecast, the market reacted positively to the expectation of 75bps in rate cuts by 2024, despite the hawkish tone of previous meetings. We don’t think this meeting represents a full pivot to easing mode, but it does signal the Fed is likely done with rate hikes and thus it becomes only a matter of the incoming data to determine when rate cuts will commence.

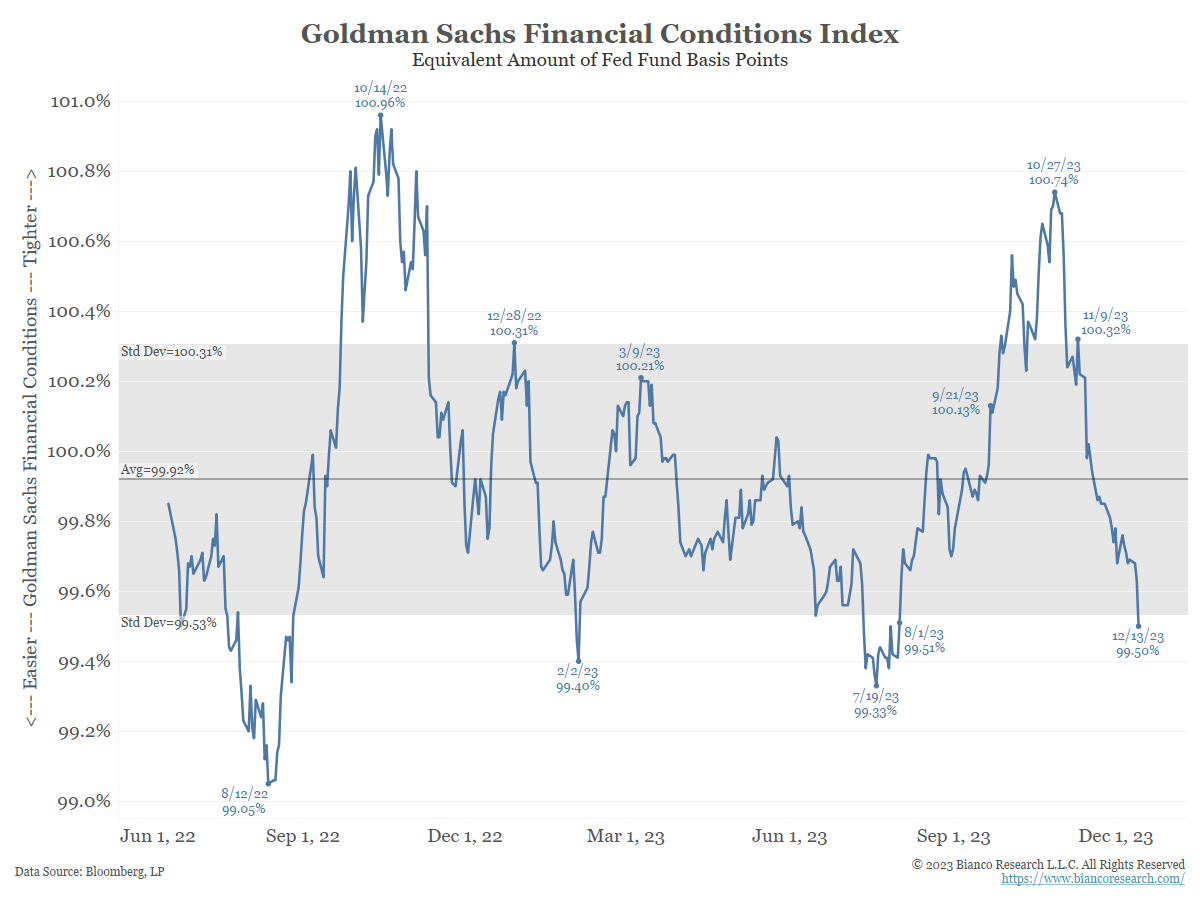

Bonus Chart

Financial conditions have eased significantly since the highs in late October. We must remind readers that Powell used that tightening in financial conditions as part of the Fed’s recipe for finishing the “final mile” of the inflation battle. We’d caution Mr. Powell not to get too far along in the winning celebrations until the job is officially done.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2312-20.