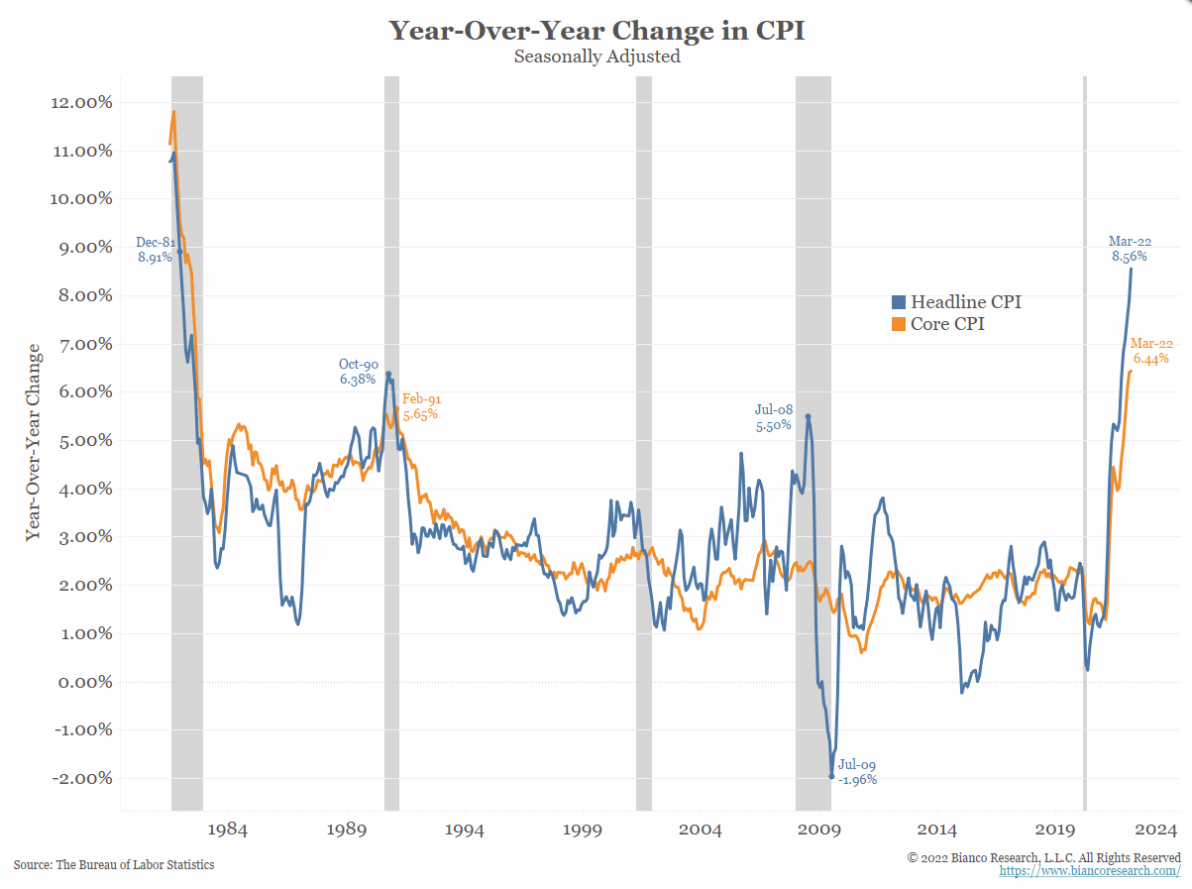

U.S. consumer prices rose in March by the most since late 1981. The consumer price index increased 8.5% (2.2% of the headline number can be attributed to energy) from a year earlier following a 7.9% annual gain in February. The month over month inflation gauge rose 1.2%, its biggest gain since 2005. Gasoline costs drove approximately half of the monthly increase. While energy prices were a large contributor, the “sticky” components of CPI continue to contribute a growing amount to the headline number.

Source: Bianco Research. As of 4/12/22.

Source: Bianco Research. As of 4/12/22.

On a positive note, core inflation came in at just 0.3% MoM/ 6.5% YoY which was the smallest increase since September, led by a decline in used car prices. Both core numbers came in below consensus (MoM/YoY).

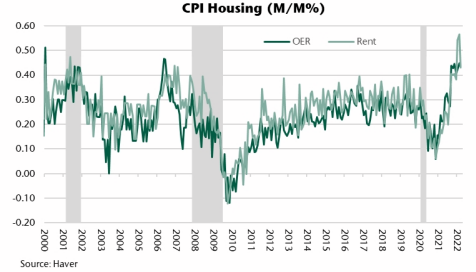

Sticky Components Like Shelter Remain Firm

Compared to the volatile energy component of CPI, housing prices(i.e., owner-equivalent rents) are far more stable (although lagging), and they continue to remain firm. The 6- month annualized Owners Equivalent Yield (OER) has risen 5.3% while Rent of Primary Residence (RPR) 6- month annualized changed sits at 5.59%, the highest level since 1986. Rental inflation did slow from 0.6% to 0.4% MoM and OER was unchanged, potentially a hint that the worst is over?

Source: Haver. As of 4/12/22.

Source: Haver. As of 4/12/22.

Small Businesses Continue to Raise Prices

Before the CPI release, we got the NFIB Small Business Optimism Survey, where 72% of participants said they were raising prices, a second consecutive all-time high. It’s hard to see inflation pressures coming to a complete halt while companies are rising prices at this type of pace. Inflation was also reported as a key business concern.

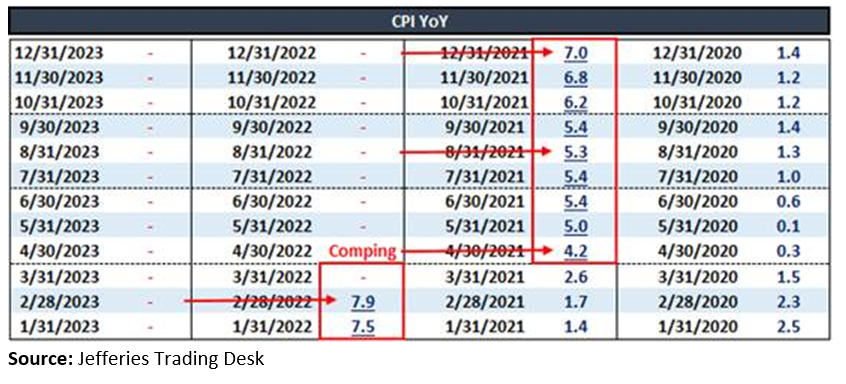

Difficult Comps

Base effects will be kicking in starting next month (i.e., the big price increases from a year ago would require even larger ones to sustain the current 6-8% readings…highly unlikely). Core CPI MoM was 0.9% in April 2021, 0.7% in May 2021, and 0.8% in June 2021. In the next three months, those very high prints from last year will roll off the YoY window, so if today’s somewhat promising results continue, we should see a decent decline in core YoY numbers. This is encouraging from a Fed policy perspective.

Source: Jefferies. As of 4/01/22.

Source: Jefferies. As of 4/01/22.

However, in saying that, we believe that there isn’t enough evidence showing that inflation is headed back to 2% – the Fed’s long-term stability target.

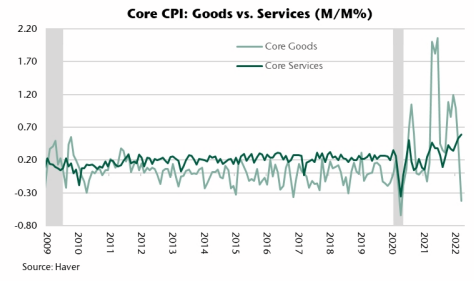

Goods to Services Handoff Continues

As of 4/01/22. Source: Haver

As of 4/12/22. Piper Sandler Macro.

We believe that the Omicron wave delayed the recovery in the services economy, which still sits about $420bn below the pre-pandemic trend. As the economy continues to normalize, we expect the shift from the goods economy (used cars, laptops, phones, etc.) to the services economy (airlines, hotels, restaurants, etc.) to continue.

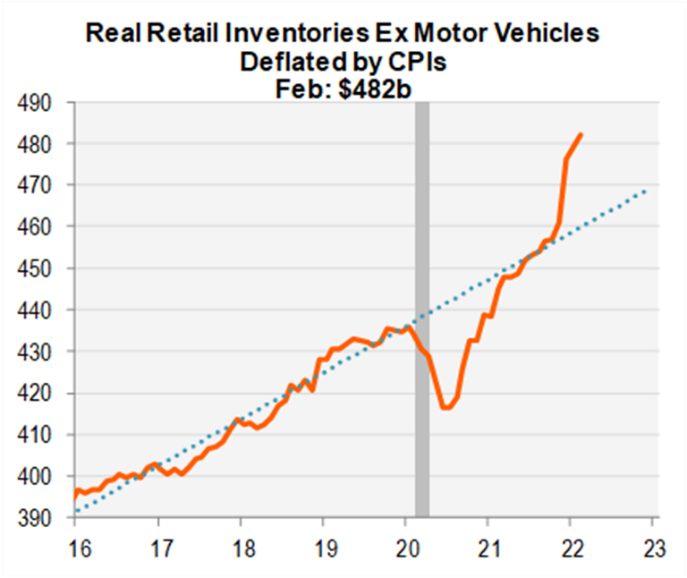

The buildup of retail inventories has undoubtedly helped dampen goods inflation. Over the last 12+ months, an overstimulated consumer – in addition to supply chain issues – has created a goods mania drastically pressuring pricing of goods…it finally looks to be ending. The new lockdowns in China do create some upside risk for these categories in the coming months if we get more supply shortages.

Aptus Take – Is This an Inflation Peak?!

While the path of future inflation is somewhat in the Fed’s hands as they begin to tighten rates and initiate QT (Quantitative Tightening) as an attempt to stunt rising price pressures and demand, we put together a hypothetical situation to evaluate where inflation might sit at the end of 2022. While this is hypothetical, the assumptions are relatively basic.

The Cleveland Fed puts out a MoM Nowcast CPI number which had March at 1.1% and has April at 0.37% (both Month over Month, “MoM”). This does indicate that inflation should recede. The Nowcast projections only go out to April but if we plug in 0.1% CPI growth each month for the remainder of 2022 (average monthly growth in CPI over the last decade leading up to the pandemic) we’d get a YoY CPI number just over 4%. If CPI grows at 0.2% per month, it’d increase the YoY CPI number to ~5%.

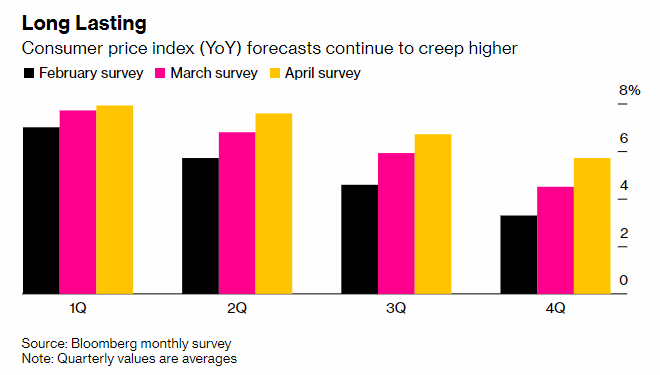

The Bloomberg survey of Economists (median forecast of 72 economists) shows the CPI will average 5.7% in the final 3 months of the year, up from 4.5% estimated a month ago.

Source: Bloomberg LP. As of 4/01/22

Source: Bloomberg LP. As of 4/01/22

While inflation is likely to have peaked or is peaking relatively soon (this month or next), broad consensus is now that inflation will be both higher and longer-lasting than originally imagined. In response, we’ve seen a sharp change in tune from even the most dovish Fed members on the need to expeditiously raise interest rates and remove accommodative policy to lower inflation. Yeah, we’re referring to you, Ms. Brainard.

Bottom Line

There is no denying, the Fed’s stance on inflation has shifted to be incredibly hawkish over the last few months. As inflation has continued to rise, the Fed has begun to take a stance of “something must be done now”. This was shown in statements during their recent minutes where they referred to aggressive QT (balance sheet reduction to the tune of $60bn Treasury securities and $35bn for Agency MBS per month). The participants also said they might even consider asset sales of Agency MBS. The balance sheet reduction is in addition to hiking the Fed Funds Rate to the neutral rate “in quick order”.

The most important question remains yet to be answered… will the Fed make a policy mistake (to correct the policy mistake of waiting so long to remove accommodation) as they begin to attempt to rein in inflation? Remember, inflation was already running at multi-decade highs even before the commodity supply shock from the Russia-Ukraine conflict, which looks to have no end in sight. Will the Fed be able to pull off a soft landing given the challenging macro environment—or will they end up triggering a recession?

Bottom line, the CPI report was encouraging but the Fed is a long way away from claiming victory and must remain in inflation-fighting mode. It will take more than one report to quell investor fears about the potential fallout inflation could have on the economy in the months and quarters ahead.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The hypothetical performance is shown for informational purposes only. Neither past actual nor hypothetical performance guarantees future results.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2204-15.