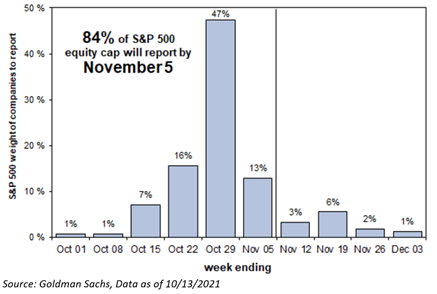

It’s the most wonderful time of the year – Q3 2021 earnings kick off week. We believe that it’s a make-or-break quarter with all eyes on margins and supply chains and for the first time in a while, we won’t just be focusing on management commentary. This is basically the first quarter since before the crisis, where tangible results will help paint a Bob Ross photo of the current environment for companies, specifically surrounding the effects on cost input pricing and supply chain woes. Given this we believe that we could see some extreme volatility amongst different names, whereas previously given everything surrounding COVID, most companies had received a “free pass” on earnings misses – that should not be the case this quarter.

On an individual stock level, the three main things that we will be focusing on this quarter is:

- Is inflation still helpful to EPS at the index level? Or are supply chain shortages at the point of reversing the EPS recovery trend?

- Are investors going to react to supply chain misses the same way they react to demand weaknesses? Or will the “extending the cycle” narrative win out?

- Is Q3 2021 the “peak supply chain stress” or will the market start pricing in that this will last longer…

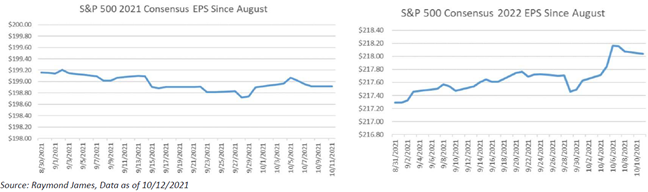

Overall, we will continue to be watching EPS revisions at the index level for 2021. The market has continued to see GDP expectations come down, given supply chain woes, yet index EPS expectations haven’t budged. This leads us to the conclusion that either analysts or management teams have been shy about lowering estimates or pre-releasing estimates, or earnings are in better shape than the market fears despite historic supply chain headwinds.

Moving in 2022, EPS expectations have continued to rise – at the beginning of the year, the S&P 500 earnings were slated for $195, now they sit closer to $220. The interesting part about this is how the market is viewing the 2022 landscape in light of supply chain issues – basically as if it will not be a problem (and not to mention the potential effects of taxes). Is supply chain a short-term issue that will improve in 2022 (helping earnings)? Is it something more permanent that could impact EPS growth for a few years? These are the two potential narrative outcomes of earnings season – we’ll find out shortly!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The views contained herein should not be taken as financial advice or a recommendation to buy or sell any security. Links included direct to third-party sites not affiliated with the Adviser. These links are for informational use only and should not be considered investment advice or an offer to sell any product. Any forecasts, figures, or opinions or investment techniques and strategies described are intended for informational purposes only. They are based on certain assumptions and current market conditions, and although accurate at the time of writing, are subject to change without prior notice. This material does not constitute a general or personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors and should not be relied upon to evaluate the merits of investing in any security. Investors should ensure that they obtain all current available information before making any investment. Investors should also make an independent assessment of the relevant legal, regulatory, tax, credit, and accounting considerations and determine, together with their own professional advisers if investing is suitable to their personal financial goals.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2110-15.