September CPI

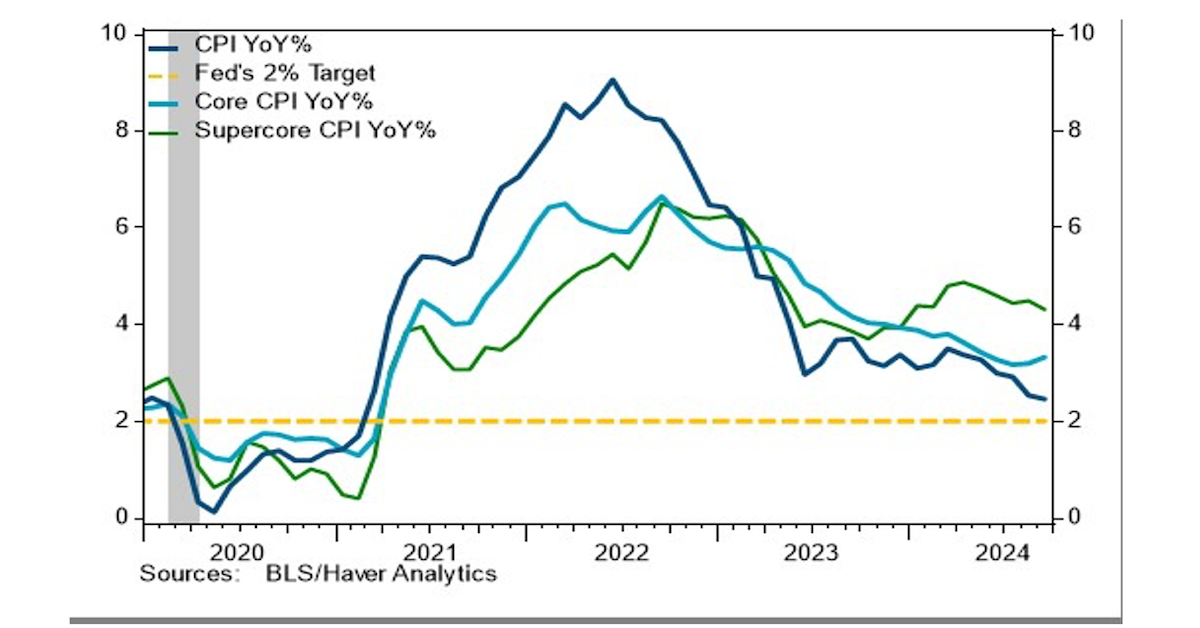

Year-over-year, consumer prices rose 2.4%, a tenth of a percentage point more than expected but down from the 2.5% annual increase in August. 2.4% is the smallest annual gain since February 2021. Food prices rose 0.4%, while energy prices dropped 1.9% in September which was the second consecutive month of decline.

Month Over Month

CPI 0.2%, Expected 0.1%

CPI Core 0.3%, Expected 0.2%

Year Over Year

CPI 2.4%, Expected 2.3%

CPI Core 3.3%, Expected 3.2%

Source: Stifel as of 10.10.2024

Source: Stifel as of 10.10.2024

Excluding food and energy costs, the core CPI rose 0.3% in September, a tenth of a percentage point more than expected, matching a similar gain in August. Year-over-year, the core CPI increased 3.3%, also a tenth of a percentage point more than expected and the largest annual gain in three months. Only 43% of the CPI basket is running above 2.5% annualized.

Details

Transportation prices fell 0.2%, despite a 0.2% gain in new vehicle prices and a 0.3% rise in used cars and trucks prices. Airline fares jumped 3.2%, following a 3.9% gain the month prior. Meanwhile, shelter prices rose 0.2% with a 0.3% gain in the OER, which was down from the 0.5% rise in August. Medical care prices rose 0.4%. On the weaker side of the report, education and communication prices were flat (0.0%), while recreation prices decreased 0.4%, and commodities prices slipped 0.2% in September.

Supercore Inflation – defined as core services excluding housing – rose 0.4% in September following a 0.3% rise the month prior. Over the past 12 months, the supercore has increased 4.3%, down from the 4.5% annual increase in August and the smallest annual gain in seven months. Keep in mind this is more than double the current inflation target of 2%.

Supercore inflation was closely watched by the Fed as inflation was exploding higher given it was less sensitive goods (impacted by COVID demand and supply chain issues) and housing. We’d argue you shouldn’t pay attention to the metric when favorable and ignore when unfavorable. Supercore shows service inflation is still problematic.

Bottom Line

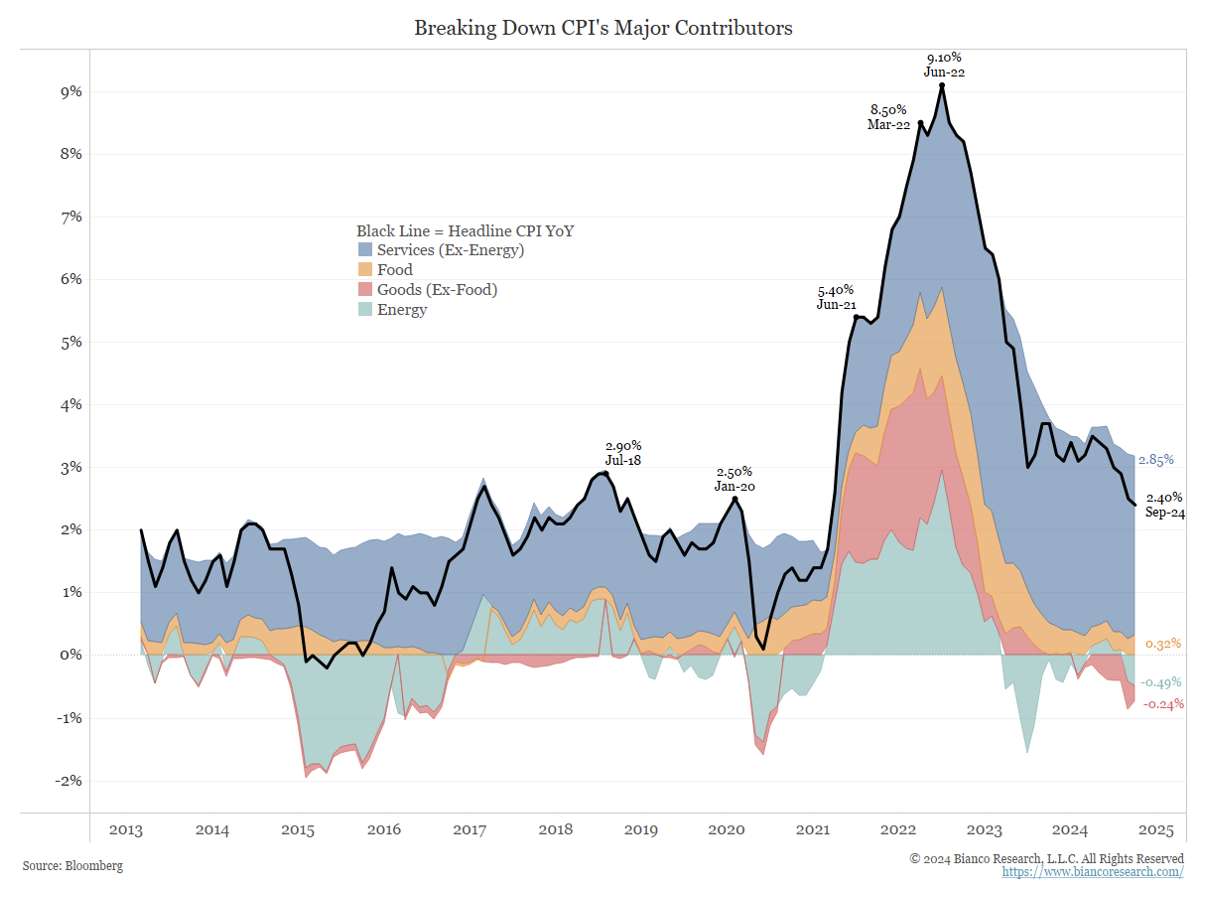

This chart shows that the contributions of food, energy, and goods to headline CPI are already back to historical norms. We have likely squeezed those categories for about as much as we can.

Any meaningful declines from here need to come from services ex-energy (blue), which still are contributing much more than their historical norm to headline inflation. Given recent data showing reasonable resilience and inflation data still stickier than we’d hoped, we’d look for the Fed to be very methodical and data-driven regarding future rate cuts.

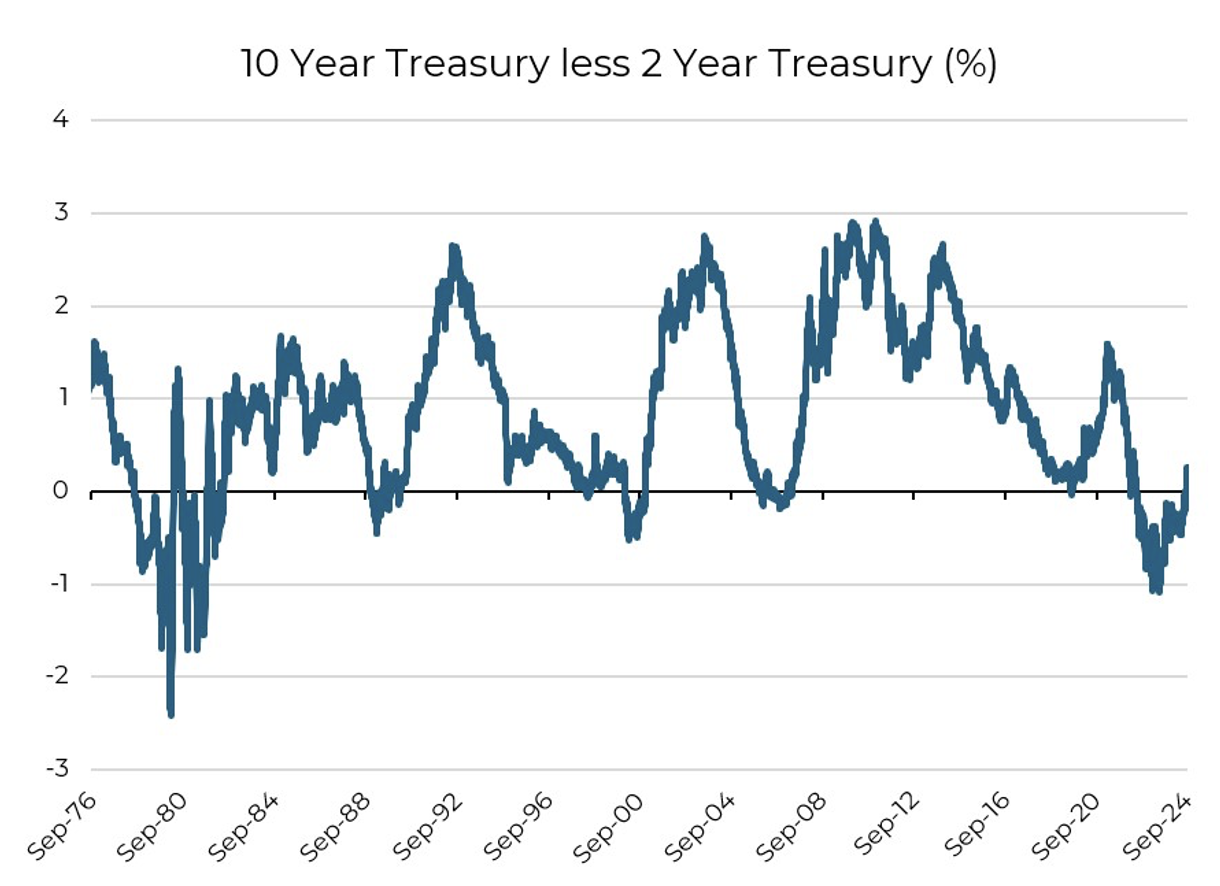

The Long End is Moving Higher as Curve Steepens

Markets priced in a large decline in interest rates across the yield curve as we approached the first rate cut. History tells us this is common where the bulk of rate declines are priced in before the first cut in anticipation. As we’d hinted might happen, the long end of the curve (10yr) has risen about 40bps since the rate cut.

Source: Aptus as of 10.08.2024

Source: Aptus as of 10.08.2024

Why? The supersized 50bps cut increased the chances of a soft landing and probably helped improve the growth outlook looking ahead. This plus many others we’ve highlighted in the past ( term premium, supply, higher neutral rate, less correlation impact from bonds) should continue to pressure interest rates on the longer end of the curve to remain higher.

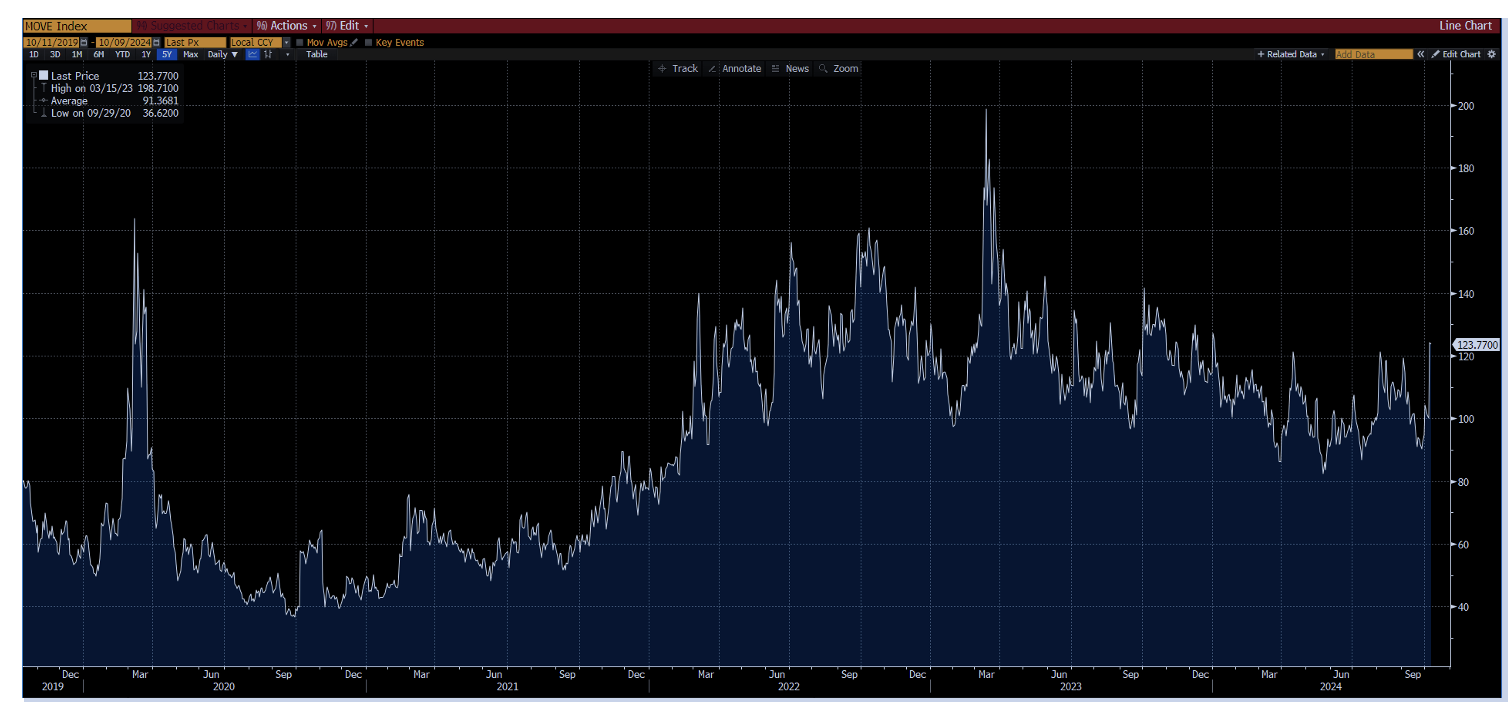

MOVE Index Remains Elevated

The MOVE Index is what the VIX Index is to stocks for US Treasury bonds. It’s a useful tool to measure stress and volatility within the bond market. As interest rates were rising, the MOVE index found the 100 area to be a floor.

Source: Bianco Research as of 09.22.2024

Source: Bianco Research as of 09.22.2024

Given the upcoming election and heightened volatility for the path of rates, rate vol has popped. Rate vol is something that will spook the Fed as it challenges its third (unspoken) mandate of financial stability. If rates keep rising, we expect the Fed to be on high alert.

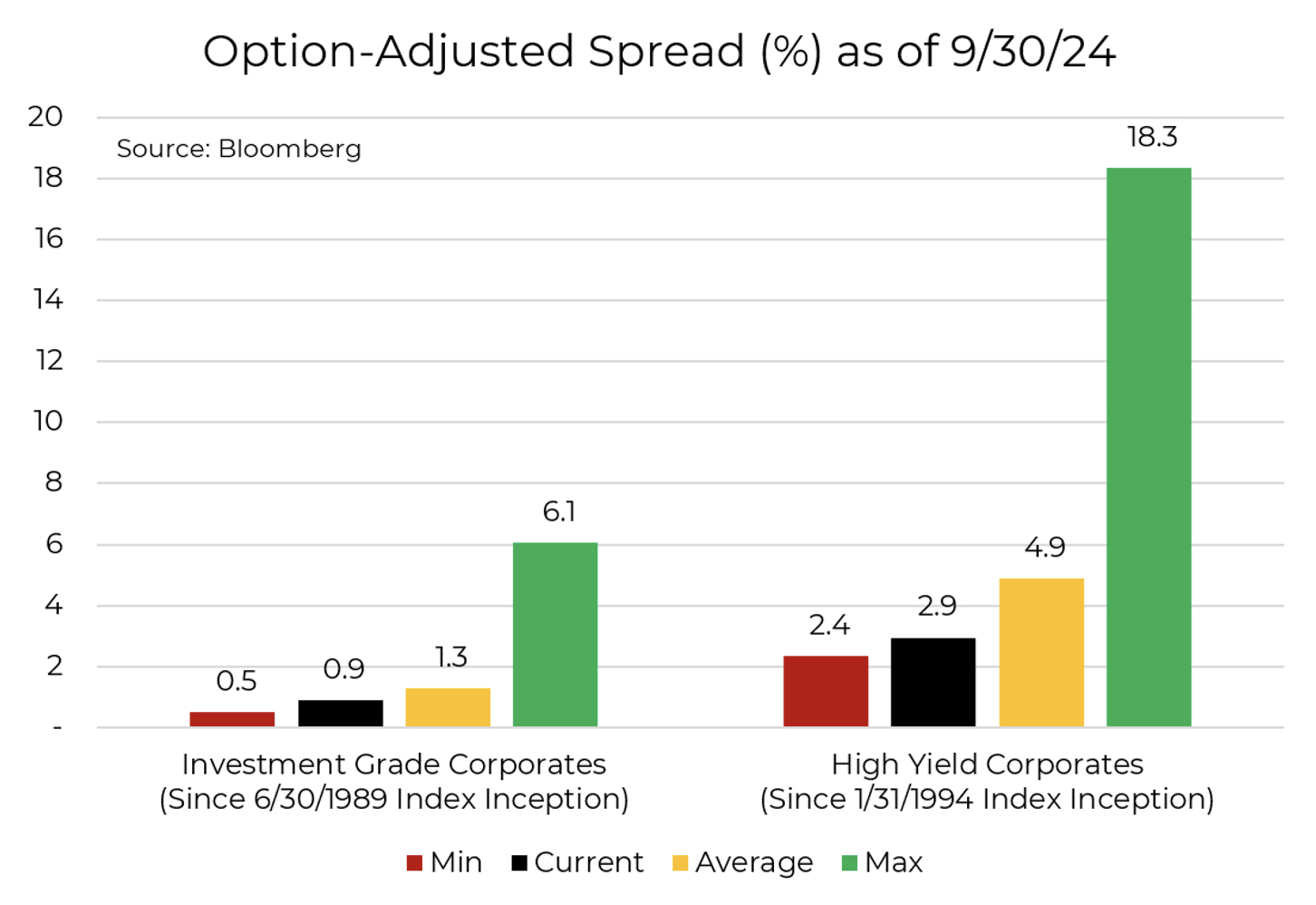

Credit Spreads are Tight

When looking for indicators of market stress, one of the first things we look at is credit spreads. The accessibility of credit drives much of the economy and helps determine the underlying health of businesses and their ability to access capital at reasonable levels. Currently, the spread of both IG and HY bonds over the risk-free rate (i.e., Treasury Yield) is hovering near the lower end of the range, well below the “average”.

Source: Aptus as of 10.10.2024

Source: Aptus as of 10.10.2024

The graphic above shows the min, current, average, and max spread of IG Corporates (1989 inception) and High Yield Corporates (1994 inception). The black bar chart displays the current spread for each, which are notably lower than the average (especially HY). When looking at the price of credit, it appears the soft landing is inevitable.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-20.