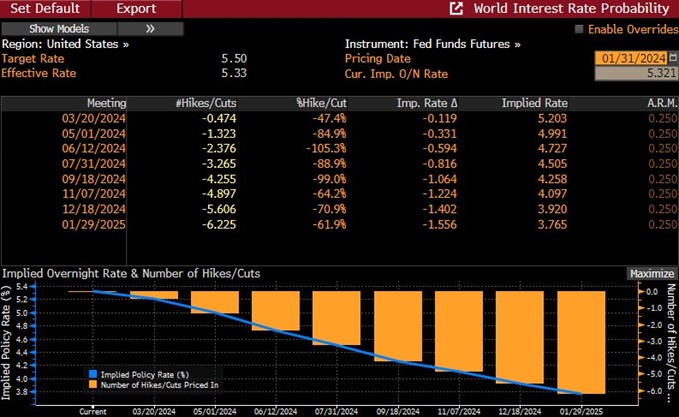

The Fed left the benchmark rate unchanged at 5.25%-5.5%, as was expected. This is the fourth meeting in a row of no action. They did back away from their prior bias to further tightening as inflation has fallen notably over the past year. However, it is still above their target.

Source: Bloomberg. As of 1/31/24.

Powell noted that the Fed’s goals on employment and inflation are moving into a better balance. The committee voiced their preference for more proof of inflation moving sustainably towards 2% before ensuing cuts, taking the odds for a March cut down (March rate cut odds dip below 40% chance). Growth is still solid, “expanding at a solid pace”, and the labor market is still strong.

We’ve had 6 months of good inflation data. But need more good data & time to confirm and give them confidence inflation is coming down sustainably to 2%. Powell did reiterate that most members of the committee see cuts happening this year (dots say 3 cuts), although likely these are pushed to later in the year to allow the Fed more time for inflation data to continue to show improvement.

There were no changes to QT pace, with no mention of a change to their current $60bn Treasury/$35bn MBS balance sheet rolloff. We do expect future color later in the year as it’s likely the pace will slow.

In summary, the Fed delivered an as-expected pause, with a recognition of the improvement in inflation moving closer to the 2% target. They remain data dependent as to when to begin rate cuts. With two additional CPI and employment reports before the March meeting, along with another PCE inflation print, it’s not surprising that Powell didn’t pre-commit to a rate cut today, but with six-month core PCE averaging 1.8% annualized the “confidence in getting to 2%” rationale for holding off on rate cuts will be put to the test in the next couple months.

Data as of 1/31/24.

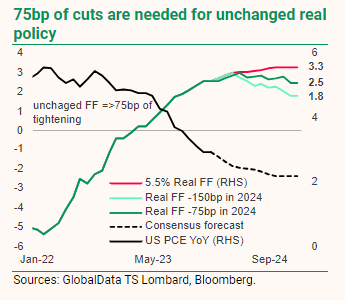

Bottom line…cuts are coming, and it really doesn’t matter if it’s March, May, or June as a starting point. If the data starts to weaken, they’ll cut earlier and if the data remains decent, they’ll delay a bit. Ultimately, real rates are restrictive and likely to continue to remain restrictive (or even get more restrictive) as inflation moves lower. This should open the door for rate cuts.

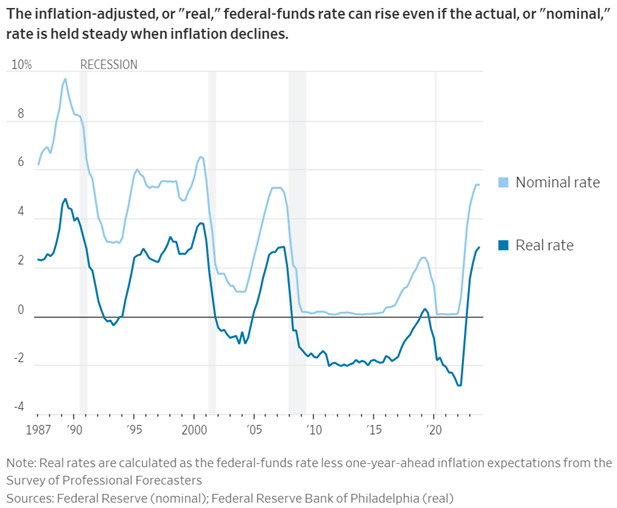

Nominal vs. Real Rates

We continue to monitor the effects of holding nominal rates at current levels as inflation declines This lifts real rates and creates a slowing impact on the economy. How this relationship plays out will be pivotal to how the economy reacts in the future.

Source: WSJ. As of 1/17/24.

That said, cutting too much too soon risks re-acceleration and a reversal of inflation progress. Ultimately we believe the Fed will be more willing to accept a longer timeline to get to 2% to avoid recession. We see future cuts as being more aimed to correct an increasingly restrictive stance, and not in place to ease policy.

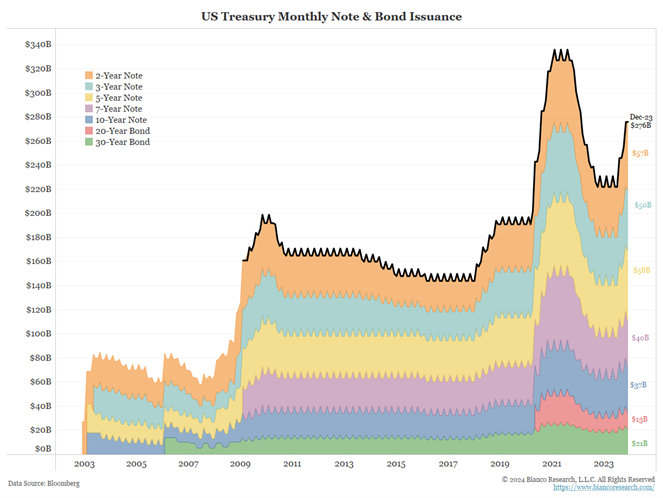

Treasury Issuance Update

Earlier this week, the Treasury released its initial borrowing plans for the first six months of the calendar year.

Source: Bianco. As of 1/13/24.

Wall Street was expecting somewhere around $795 billion in borrowing in the first calendar quarter of the year, but the Treasury announced $760 billion in borrowing needs, slightly lower than expected. Ultimately, this isn’t surprising given the elevated net worth of households, robust equity performance in 2023, and the approaching tax season.

The Treasury leaned into bill issuance for the back half of Q4 ’23, which helped alleviate some of the pressure on long-term yields (less supply for the market to absorb). We will continue to monitor how this plays out but for now, it appears minimal changes as far as how the Treasury finances the debt load. Markets are prepared to gobble up short-term T-bills.

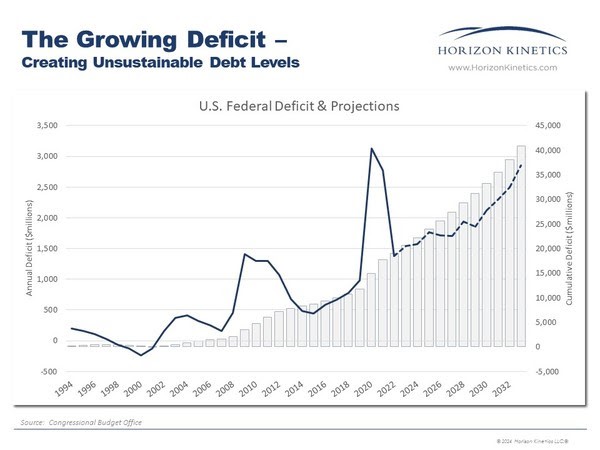

Deficits and Cost of Debt Rising

We’ve seen the annual deficit levels retreat from the highs reached during the COVID-19 pandemic, however, the cumulative deficit continues to mount. The Congressional Budget Office forecasts growing annual deficits for the next decade, meaning a higher debt burden for the United States.

Source: Horizon Kinetics. As of 1/31/2024.

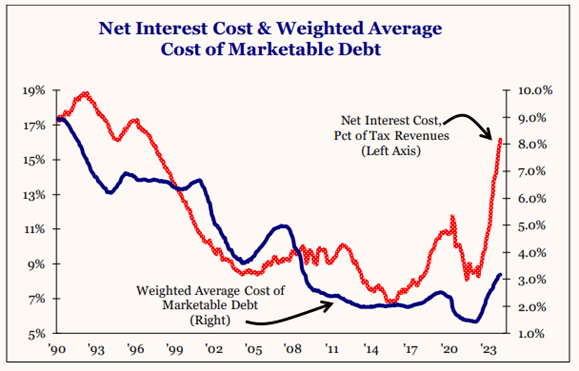

Taking that a step further, interest costs as a percentage of tax revenues are on the rise and the weighted average cost of the debt is rising. While not an immediate issue, it begs the question of who is going to buy all the debt to finance massive deficits, and at what interest rate level.

Source: Strategas. As of 1/31/2024.

Disclosures:

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2401-38.