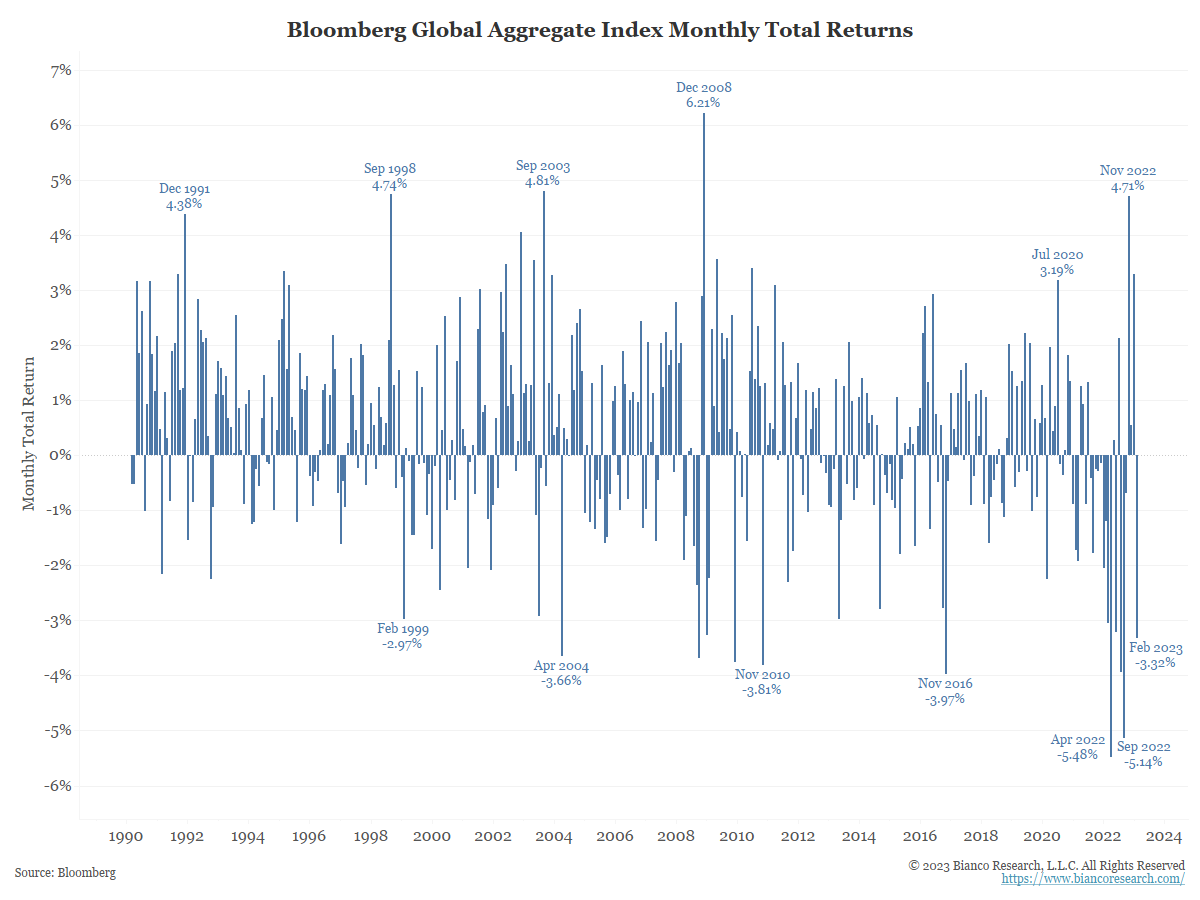

While bonds got off to a fast start this year, February’s returns were almost the mirror image from a total return standpoint. As the chart shows, Bloomberg’s Global Aggregate Index returned -3.32% last month. With data going back to March 1990, this ranks as the ninth worst monthly total return. The Barclays Aggregate (AGG) lost 2.59% in February, which ranks as the 15th worst monthly total return since 1976. Rate volatility appears here to stay… a point we’ve been repeating.

Source: Bianco. As of 2/28/2023

Finally Higher for Longer?

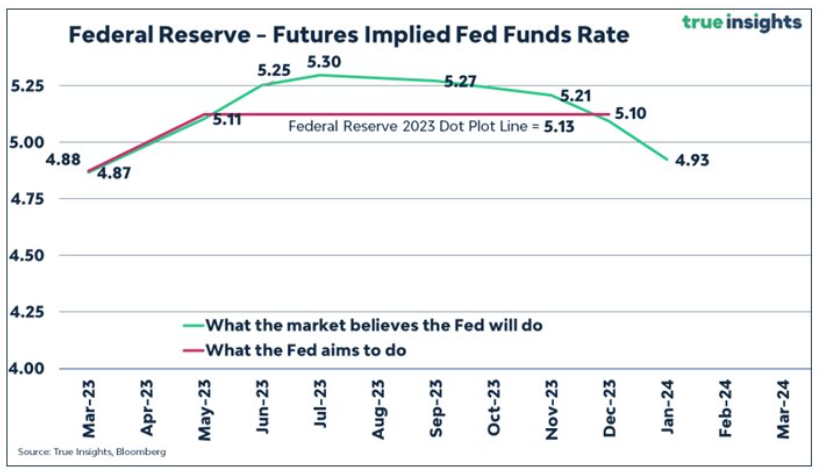

Markets have finally begun to price a higher terminal rate while also removing cut expectations from the back end of 2023. The Fed continues to be more resilient than Wall Street expected.

Source: True Insights. As of 2/28/2023.

Simply put, if you had said 12 months ago that central banks would raise interest rates by 500bps or more – the fastest and broadest monetary tightening in history – most investors would have expected a calamity, either in financial markets or in the broader economy.

Yet, despite several (small) wobbles, the pain these actions have caused has – so far – fallen short of all the hype. The bottom line is the global economy still looks resilient, and asset prices have not yet collapsed, which is contrary to what many would have thought (including us). More tightening ahead considering the economic data remains this firm.

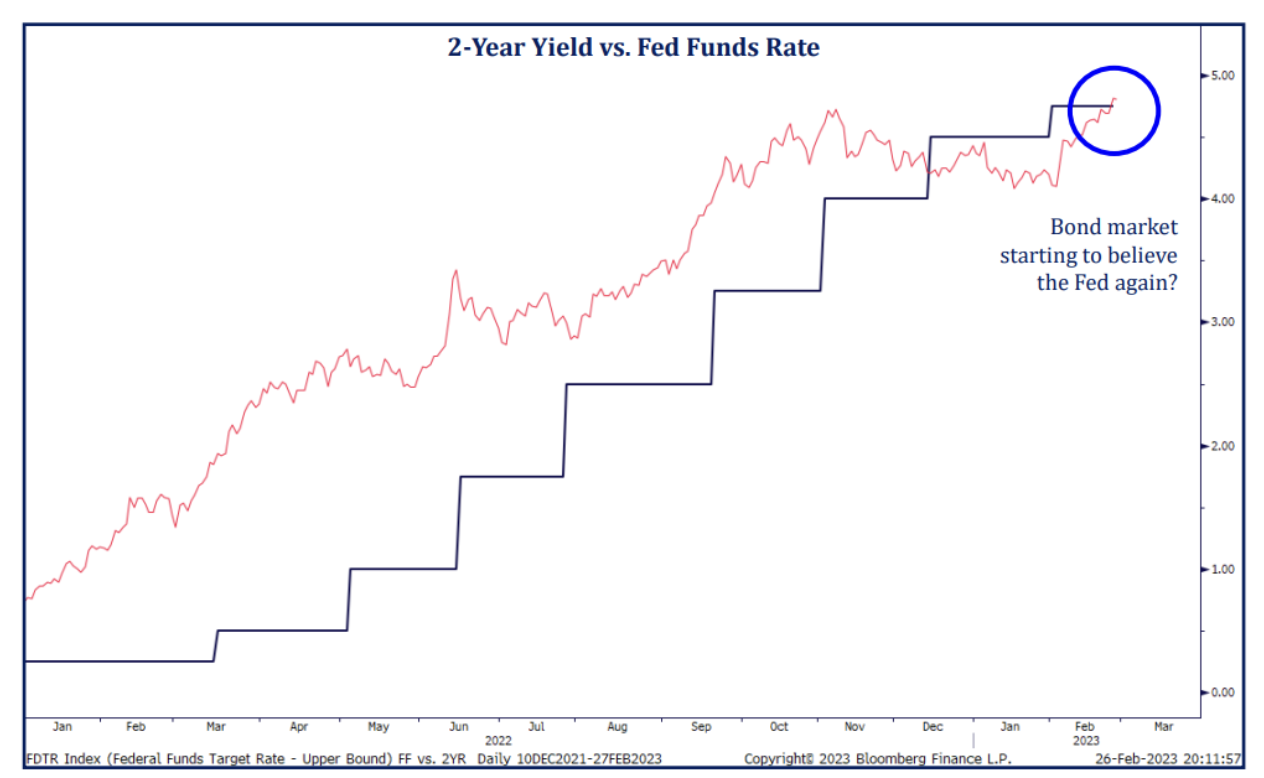

The 2-Year Treasury Yield is the markets interpretation of future short term rates (i.e. the direction of Fed policy). When the market is expecting more hikes in the future, the 2-year Treasury should be greater than the Fed Funds rate and when the market is expecting future Fed cuts, the rate lower. As long as the market expects the Fed to have more work to do, the 2-year yield is likely to continue rising. Historically the 2-Year Treasury has always ended with a yield > the terminal rate. We don’t expect this time to be any different.

Source: Strategas. As of 02/27/2023.

No Cuts in 2023

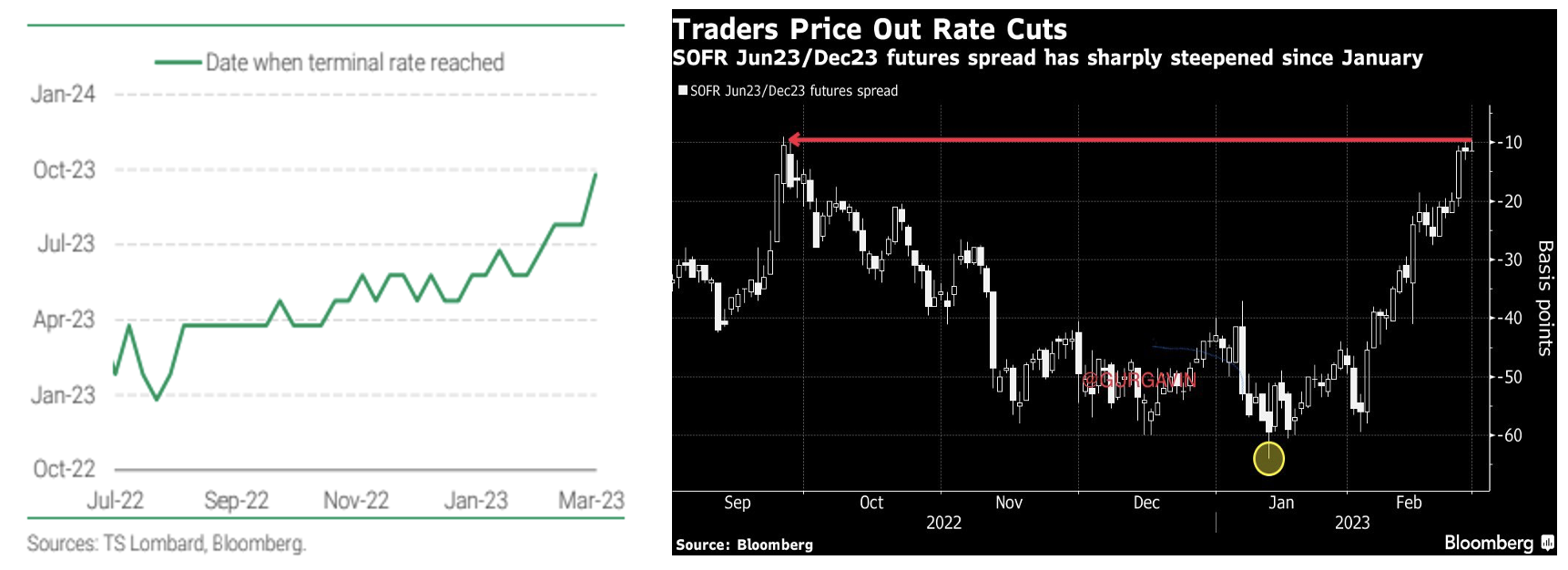

The market has pushed out the time it will take the Fed to get to the terminal rate, while also lowering the amount of easing expected after the terminal rate is reached. The expectations have been reduced from about 2% to less than 1.5%. In other words, investors expect policy to be tighter for longer. Expecting a higher and longer terminal rate looks to be turning into the right call.

Source: TS Lombard. As of 2/28/2023 (L). Bloomberg. As of 2/28/23 (R ).

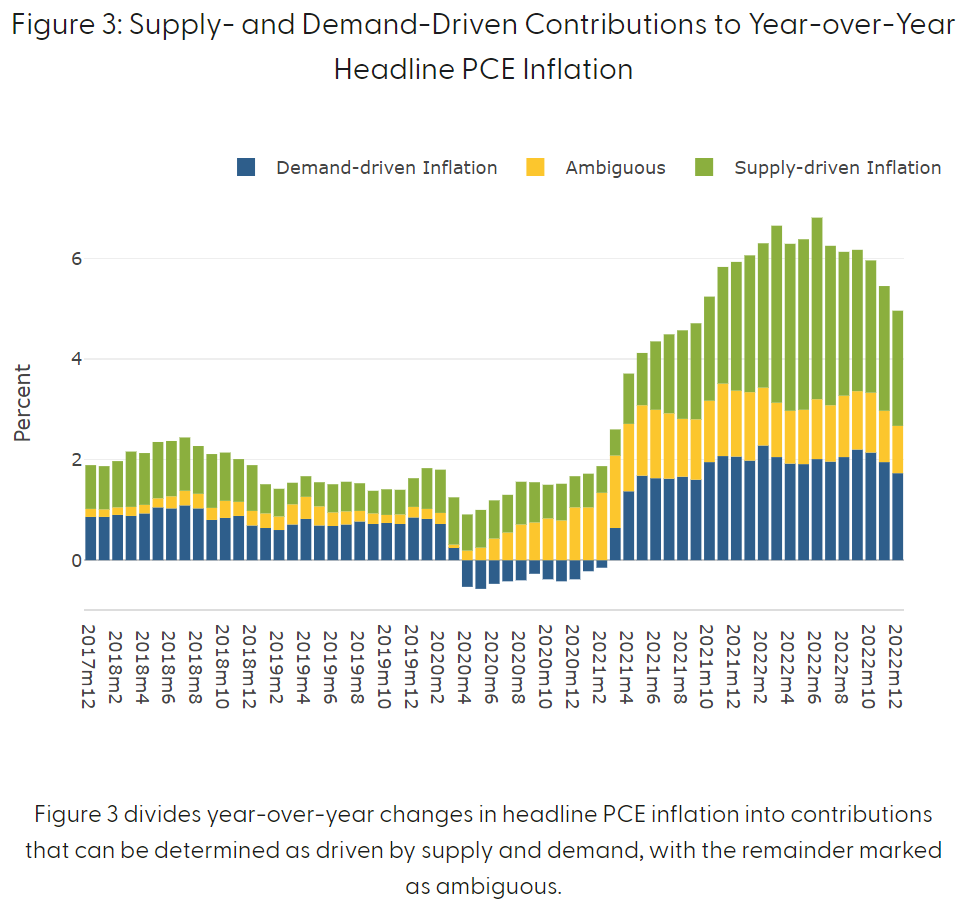

Lowering Demand in a Supply Driven World

The Fed raises interest rates to slow down demand, but as we know they can’t push up supply. Adam Shapiro, an economist at the San Francisco Fed, estimates that about 40 per cent of inflation is supply-driven, 40 per cent is demand-driven, and the other 20 per cent is ambiguous (graphic above). Given that reality, the Fed alone cannot get inflation back to their 2 per cent target. The Fed is playing its role by raising rate which is contributing to the slowing of growth but at the same time, demand management is not an efficient way to deal with supply-driven inflation.

Source: Financial Times. As of 2/23/23.

Given that reality, the Fed alone cannot get inflation back to their 2 per cent target. The Fed is playing its role by raising rate which is contributing to the slowing of growth but at the same time, demand management is not an efficient way to deal with supply-driven inflation.

Breakevens Flying Higher

Investors are anticipating more persistent inflation, shown by US breakevens rising sharply the past month and a half. Over the last six weeks, 2-year breakeven rates are up roughly +120 basis points (while 1-year breakevens up nearly +180bps since January 10th) despite the continued indifference from oil. It’s an odd divergence, as market-based near-term inflation expectations and crude are generally tied at the hip.

Source: Bloomberg. As of 02/27/2023.

Remember, breakevens are calculated by subtracting the real yield from the yield of the closest nominal Treasury maturity. The result is the implied inflation rate for the term of the stated maturity.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-2.