As expected, the Fed kept its Funds rate range unchanged at a 5.25% – 5.50% level. Powell’s comments were less hawkish than feared, but there was disappointment expressed regarding the inflation news thus far in 2024.

The Fed subtly walked back its last statement regarding the improving inflation situation.

From: “The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance”.

To: “Employment and inflation goals have moved toward better balance over the past year.”

This is a slight retreat from the earlier past-tense language and positive tone, perhaps slightly hawkish.

Quantitative Tightening (QT) Plans

The Fed laid out details on beginning the tapering process (starting next month) for Quantitative Tightening (QT). They will reduce the amount of Treasury run-off from $60 billion per month to $25 billion, slightly below the market’s expectation of $30 billion. The MBS run-off will remain at $35 billion if prepayments deliver, and any excess run-off over that cap will be reinvested into Treasuries.

The lower cap will allow more Fed purchases which should be supportive of the intermediate part of the yield curve. Who’s going to buy all the bonds? Well, looks like the Fed for starters!

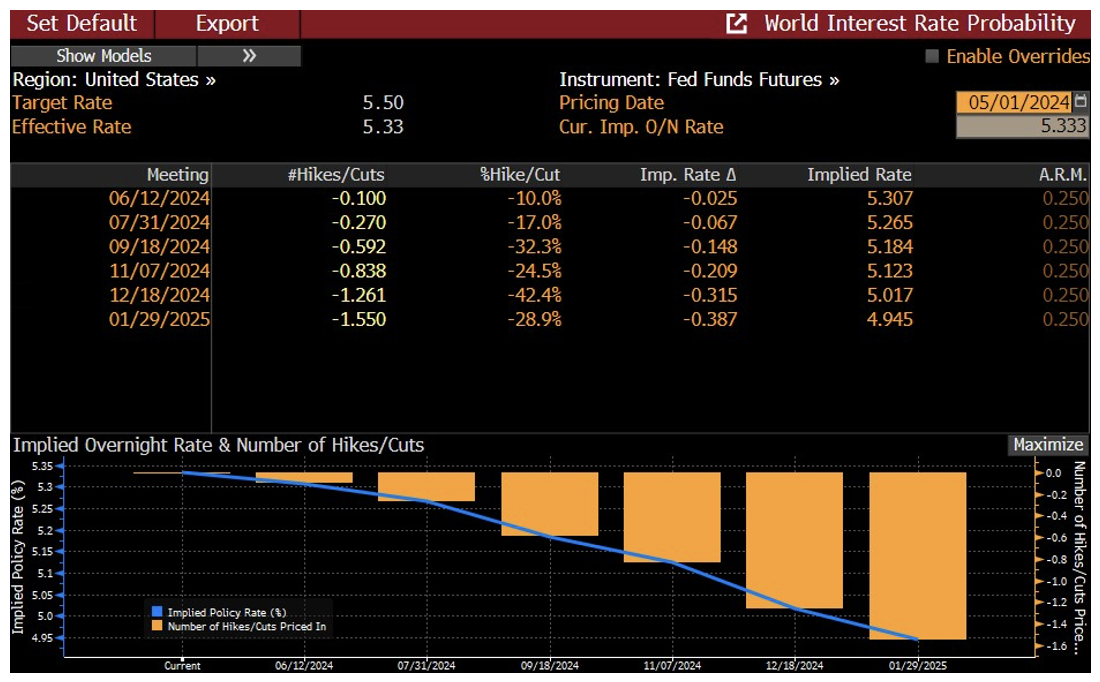

Futures pricing before the announcement had the first full 25bps rate cut at the December meeting, with the 2025 year-end rate at 4.50%, implying three rate cuts next year. It’s remarkable to consider that coming into the year, futures were projecting more than six cuts, and now we’re hanging on by a thread to a single end-of-year cut with only three more projected next year (see table below).

Source: Bloomberg as of 05.01.2024

Source: Bloomberg as of 05.01.2024

Market Reaction

With the fears of a hawkish tone relieved, and QT tapering next month, Treasuries rallied following the presser. The S&P rallied initially but gave back the runup, reversing and finishing red on the day.

In summary, the Fed delivered an as-expected meeting, recognizing the lack of improvement in inflation this year, which will keep the first rate cut on ice until much later in the year. While a rate hike wasn’t ruled out, Powell called it “unlikely”. In my mind, this comment increases the bar for further hikes drastically.

Closing Thoughts

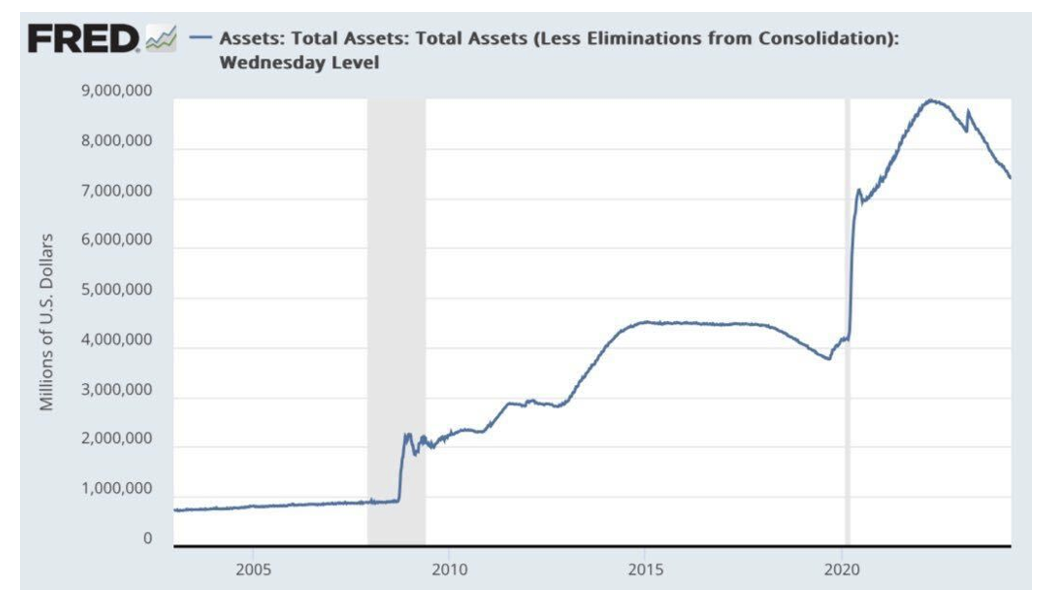

We continue to be surprised at the overall dovishness of the Fed. They persist in “trusting” that inflation will slow despite a recent lack of progress and, arguably, an uptick higher. Even with reaccelerating inflation, the Fed is going to taper its QT program more than expected. Keep in mind that the balance sheet remains substantially higher than it was pre-pandemic (~80% higher). QT was a good run!

Source: FRED as of 05.01.2024

Source: FRED as of 05.01.2024

I believe that Powell’s comment, “There are paths to cutting and there are paths to not cutting, it is really going to depend on the data”, relays that the Fed is hoping to cut.

All in all, in my opinion, the Fed’s communication shows they would prefer to take a stance of not damaging the economy even if inflation is stuck at higher levels than they’d prefer. My non-consensus view is that the Fed has taken a stance to not move the inflation target in name but by action and tolerate it at higher levels for longer — so far, they are getting away with it!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-4.