As expected, the Federal Reserve opted to raise rates 75bps, taking the target range to 3.00% to 3.25%, with a total of 300bps in policy adjustments since March…the fastest rise over a seven-month span in four decades. Coming into today, the debate was between 75bps and 100 bps; Powell said in the end the committee went with 75 bps because the inflation report before the last one was more benign, and the Fed never wants to make decisions based on “one data point.”

We find that explanation a bit funny because the outlier is not the last inflation report but rather the previous benign one. While the Fed “only” hiked 75bps, they did up the peak rate by 25 bps which is what seems to be driving markets lower. Anyhow, we took some detailed notes + comments…initial statement below:

“The Committee is highly attentive to inflation risks. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 3 to 3-1/4 percent and anticipates that ongoing increases in the target range will be appropriate.”

– September 21 FOMC Statement

September Meeting Notes

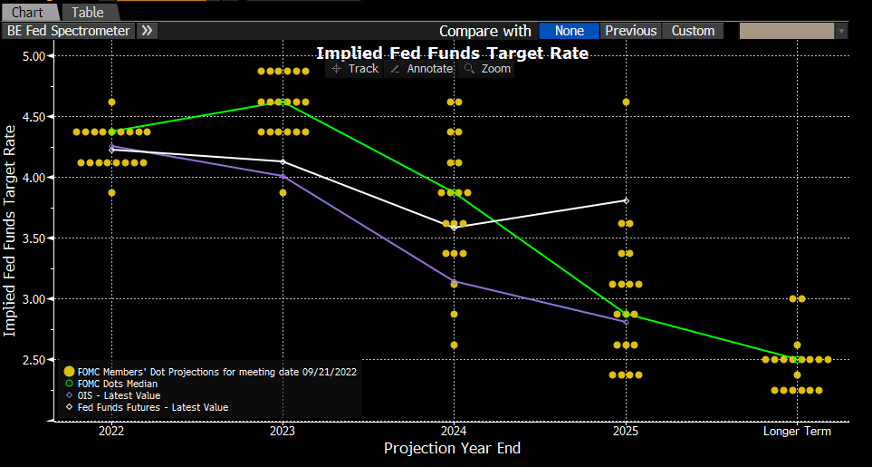

- The Fed raised the overnight Fed Funds target rate by 75bps to 3.00% – 3.25%, matching the market consensus. But the forecast for future Fed Funds rates was more hawkish than market expectations, and that put pressure on both front-end Treasuries and equities. The long end of the curve did rally on the news, furthering the yield curve inversion (at 52bps it’s the largest inversion since 1981).

- The updated Fed Funds “dot plot” now shows the median rate reaching 4.25% – 4.50% by year-end, and peaking at 4.50% – 4.75% in 2023. Six participants, however, have it peaking at 4.75% – 5.00% in 2023. As mentioned, these higher rate projections vs. market expectations pressured front-end Treasury yields and equities.

Source: Bloomberg LP. As of 9/21/22

Source: Bloomberg LP. As of 9/21/22

- Rate cuts are projected to begin in 2024 with the median rate at 3.75% – 4.00% by year-end, but there is a wide range within the FOMC with a high of 4.50% – 4.75% and a low of 2.50% – 2.75%. There was some speculation the Fed would not start rate cuts until 2025 but they kept to the 2024 timeframe (as stated back in June). Futures pricing prior to the announcement had the median terminal rate of 4.50% with rate cuts beginning in the second half of 2023. The longer-run Fed Funds neutral rate was kept at 2.50%. There was chatter that this neutral rate may get nudged higher given the stickiness of inflation, but Fed officials weren’t ready to go there at this meeting.

- While the Fed is frustrated with the persistent inflation pressure, in June they had projected inflation would quickly move lower. That is no longer the case. For Core PCE, they now see it ending 2022 at 4.5% from its current 4.8%, and down to 3.1% in 2023, and then to 2.3% in 2024 and 2.1% in 2025. So, the Fed acknowledged that inflation pressure will persist longer than in previous forecasts. At least this aligns better with their “higher-for-longer” stance as it relates to the funds rate.

- Also, in June the Fed had forecast that the rate-hiking campaign would have a somewhat muted impact on the labor market. We thought the new FOMC unemployment forecast was also interesting. For 2024, the median projection is 4.4%, which is half a point higher than the previous forecast and 0.7% higher than the current unemployment rate. There has never been a situation where the unemployment rate rose more than about 0.5% without the economy entering recession. We think the FOMC forecast is an implicit admission that a recession is likely, unless something extraordinary happens.

- Despite the more aggressive rate-hiking projections, and the projected increase in the unemployment rate, the Fed sees the economy narrowly skirting a recession. For this year, they see GDP growth at just 0.2%, significantly down from the 1.7% they saw in June. For 2023, they have GDP at 1.2%, followed by 1.7% in 2024 and 1.8% in 2025. That’s quite a bit weaker than the June projections but still projecting a non-recessionary soft landing.

To Conclude

The Fed delivered a more hawkish announcement than the market expected. Yes, we got the 75bps hike but the year-end rate of 4.25% – 4.50% and terminal rate of 4.5% -4.75% were higher than markets expected. The somewhat rosy set of economic projections in June have been replaced by a slightly more sober outlook, yet they still err on the side of a best-case scenario. The bottom line is that with price pressures still stubbornly elevated, Fed officials have reiterated their resolve to taming inflation and reinstating price stability…regardless of the costs to the labor market and broader economy.

The next Fed meeting isn’t until November 2nd, right before the midterms. We’ll also have to wait and see if the economic projections are adjusted downward yet again come the end of the year (December 14th). Until then we will get several major data points: 3 jobs reports, 2 inflation reports (PPI & CPI are December 9th and 13th, respectively), multiple speeches by FOMC members, as well as another round of earnings and corporate guidance.

In the shorter term, we’ve got a few data points on our radar. We have the PCE inflation report on September 30, the employment report on October 7, and the CPI inflation report on October 13. The stronger these data points, the higher the odds of more aggressive Fed tightening by year end.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The Personal Consumption Expenditures Price Index is a measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The change in the PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior. The PCE Price Index is produced by the Bureau of Economic Analysis (BEA), which revises previously published PCE data to reflect updated information or new methodology, providing consistency across decades of data that’s valuable for researchers. The PCE price index is used primarily for macroeconomic analysis and forecasting.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-20.