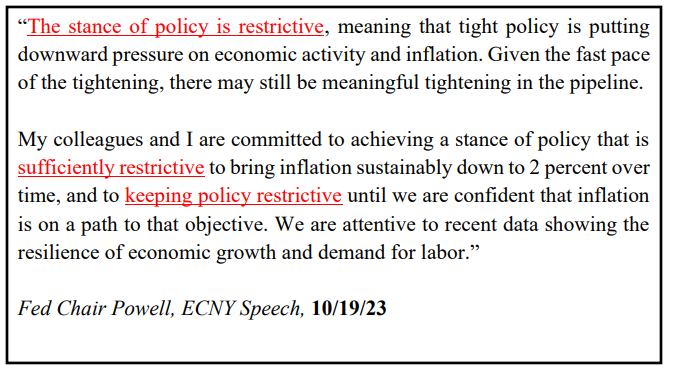

Probable Fed Pause in November

Fed Chair Powell’s commentary last week pointed to the relentless rise in longer-dated Treasury yields that was creating an environment of tighter financial conditions. This should help do some of the Fed’s work and allow them to pause their hiking campaign.

Source: Fed as of 10.19.2023

Source: Fed as of 10.19.2023

If the Fed does believe time is on their side and a year from now, we are still sitting at 3-4% inflation, they will likely be disappointed and risk further tightening.

Remember, when monetary policy is too easy, price surges (i.e., oil) can pass through into sustained inflation. This is where both prices and wages rise together. On the other hand, when policy is tight, overall demand is restrained & price shocks can become disinflationary. Essentially eating up a share of the consumers wallet. The question remains as to whether the Fed has done enough to extinguish inflation without causing pain in the economy.

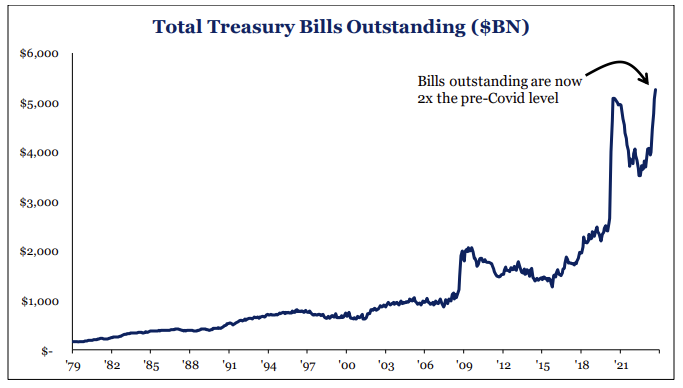

Who’s Going to Finance Our Deficits?

Back in July, net interest costs hit 14 percent of tax revenue and currently sit at 14.8% through September. Over 14% has been a historical inflection point which stresses the Treasury market and ultimately forces austerity on policymakers.

Source: Strategas as of 10.25.2023

Source: Strategas as of 10.25.2023

Shortly after the 14% threshold was breached, the Treasury’s Borrowing Advisory Committee (TBAC) announced that the Treasury was $250bn short of borrowing for the current quarter and longer-term bond issuance would increase for the first time in more than three years. Fitch downgraded the US Credit Rating the same day. Since then, the 10-year yield jumped from 3.9 percent to 4.8 percent in roughly 60 days.

With that backdrop in mind, the question has become…how will the Treasury issue the debt? We believe they will continue to lean on bill issuance at a level above the Treasury’s self-imposed 20-80% mix of bills to coupons at more like a 40-60% mix. While this temporarily can provide relief to market liquidity and long-term rates, it is effectively turning more of the US debt into “floating rate” debt.

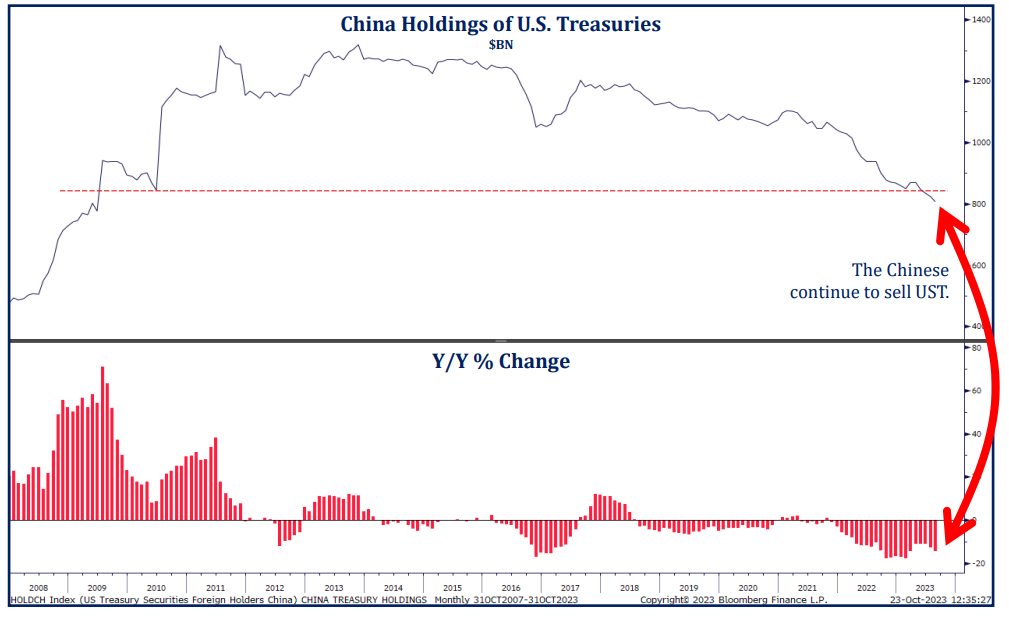

China is Dumping Treasuries

China’s holdings of US Treasuries continue to decline. While the motives are unclear, there are three possible answers:

(1) China is on a buyer’s strike,

(2) China is facing less exports (i.e., less USDs coming in), or being the most probable

(3) China is defending their currency (i.e., sell Treasuries to get USDs to purchase Yuan).

Source: Strategas as of 10.25.2023

Source: Strategas as of 10.25.2023

While the technical backdrop can get complicated, the ultimate question is with our largest UST buyers (central banks) out of the mix, what yield will private market buyers require in order to buy longer duration bonds?

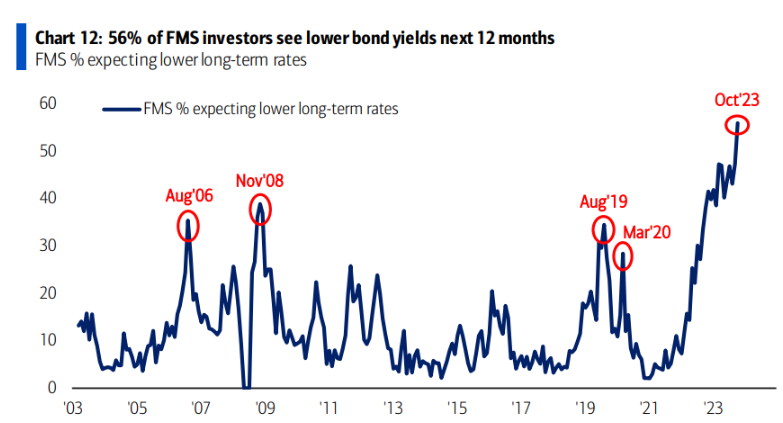

Investors Can’t Get Enough Bonds

Investor psychology and mean reversion are tough to crack. According to a recent Bank of America Investor Survey, 56% of investors polled expect the next 100 basis point yield move to be lower. While 56% doesn’t sound too extreme, it is the highest point in the 20-year history of this survey.

Source: BAML as of 10.24.2023

Source: BAML as of 10.24.2023

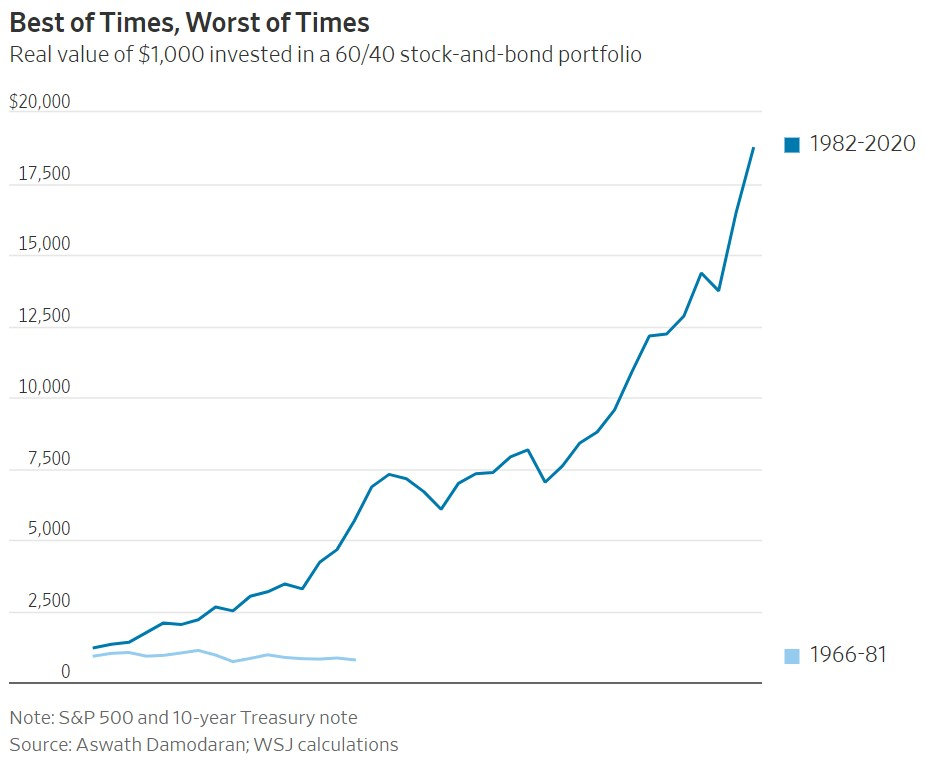

We saw a recent Financial Times post highlighting how spectacular the return and risk profile was from 1982-2020 for a 60/40 portfolio. If an investor put $1,000 into a 60/40 portfolio at the end of 1981, even after adjusting for inflation, they had $18,728 by the end of 2020.

The portfolio would have lost money in only five of those years. However, adjusting the timeframe to start in the mid-1960s (end of 1965) completely changes that narrative. This period where stock valuations were high and inflation was frothy, the same $1,000 investment in a 60/40 portfolio ends up with $785 in real terms by January 1982.

Source: Financial Times as of 10.25.2023

Source: Financial Times as of 10.25.2023

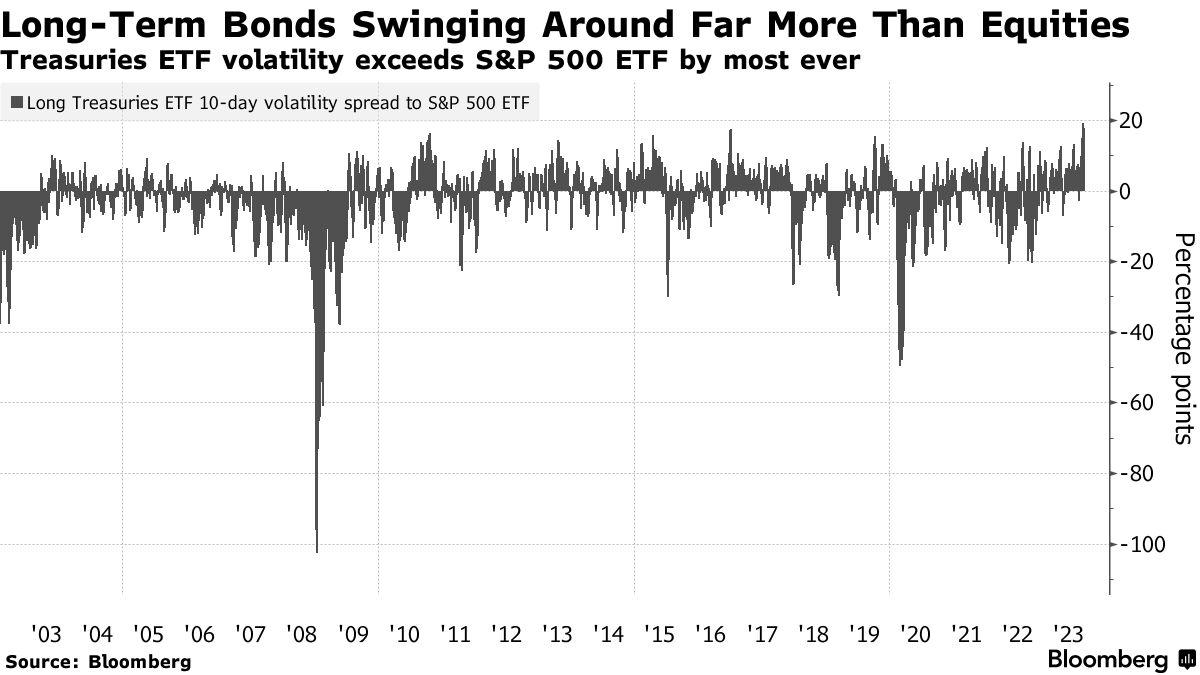

High Bond Volatility Supports Higher Yields

The violent swings in the “world’s safest asset” are driving global market volatility. The ten-day volatility for an iShares exchange-traded fund tracking longer-dated bonds is more than 15% above that of the S&P 500. That has flipped their traditional relationship on its head since the volatility on the bond fund has averaged 2 points lower than its equity peer over the past 20 years.

Ultimately, if bonds don’t serve as a useful hedge against risk asset volatility, market participants will naturally require a higher rate of return to compensate for the added risk.

Source: Bloomberg as of 10.23.2023

Source: Bloomberg as of 10.23.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2310-22.