Brian wrote a post last week that’s relevant to this month’s writeup. It’s worth a few minutes of your time as it provides perspective around how you should think about investing your hard earned money: The Lost Century in Bonds.

Volatility is not risk, and the appearance of stability does not define safety. True risk is far more sinister as it uses the comfort of stability today to rob your future purchasing power.

This realization is what matters most, as an awareness of this impacts how you think about the almighty investment decision – asset allocation.

Your risk-free asset has far more risk than you’d care to know. That’s what we want people to understand.

“I’m being safe…I have an investment with guaranteed payments, or a CD, or a Treasury bond, etc”.

You’re not being safe. You’re being robbed.

Nominal vs Real

I can’t make up the timing of this email; it was just received as I started typing this section:

“Kindly find enclosed invoice…

Unfortunately, inflation also hits our business. To make the impact as minimal as possible to you, we decided to pass on only 6.5% for the 2023 fees. We do hope for your understanding of the slight price increase.”

We will use this real-world price increase to drive home this point.

Let’s assume the note above is from a local lunch spot where we grab lunch for the office for $100 cash. There are two items in this transaction…the cash and the food. $100 is sufficient to feed the office for a day.

That was yesterday, but today the restaurant raises prices by 6.5%. My cash didn’t move – it’s still $100, but the real stuff I buy moved higher. The same amount of money from yesterday buys me less food today. In other words, my $100 ain’t what it used to be.

My nominal return was 0%. My real return was -6.5%.

Most people think of the difference between nominal and real to be the official Consumer Price Index (CPI) provided by our government. We question the CPI as an accurate reading of price levels, but let’s go with it.

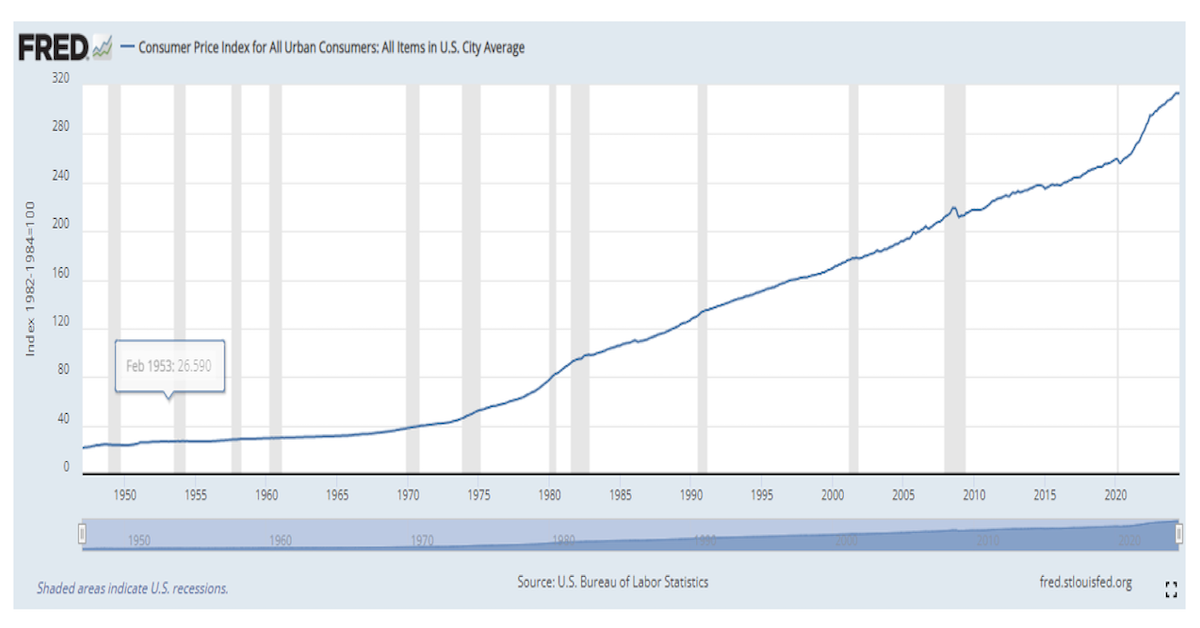

The chart below shows how price levels are always increasing. In other words, the real value of your dollar is constantly dropping.

We’ve all heard that 2% is the target for inflation. Why? Why is deflation (price declines) from productivity viewed as a bad thing and 2% inflation a good thing? Wouldn’t deflation be a natural free market response to productivity? Shouldn’t it allow our money to buy more stuff and not less?

I have so many questions.

What’s the Hurdle?

With invested assets, we seek real returns, which require a nominal return over and above some measure of price levels. While CPI is the default hurdle rate for generating real returns, we’d point out a couple of things.

Our government’s deficit spending (currently between 6-8%) is a better target for achieving real returns.

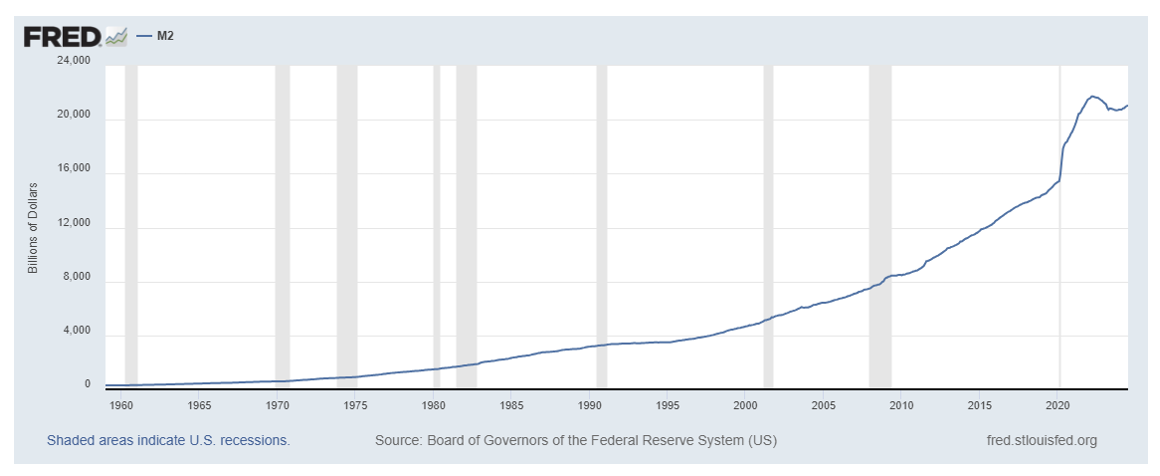

An even better hurdle rate, in our opinion, is the growth in supply of dollars. Since 1960, our money supply has increased by ~7.4% annually. This M2 chart is a decent approximation, looks like that CPI chart only has a much higher (and more realistic) rate of debasement:

If you remember our post from June, debt creates more money in the system. As debt grows so does money supply. I’d argue that the historic 7.4% figure will be higher given the current backdrop, one that most likely creates the need for more debt…a lot more debt.

The point is, to achieve real returns—the kind that matters—you must own growth assets. I define growth assets simply: stocks. More stocks, less bonds.

Centrally-planned and controlled monetary systems create the necessity to absorb near-term volatility, and recognize that’s not the risk you should lay awake at night worried about…we will come back to this point.

Bonds: Not Good

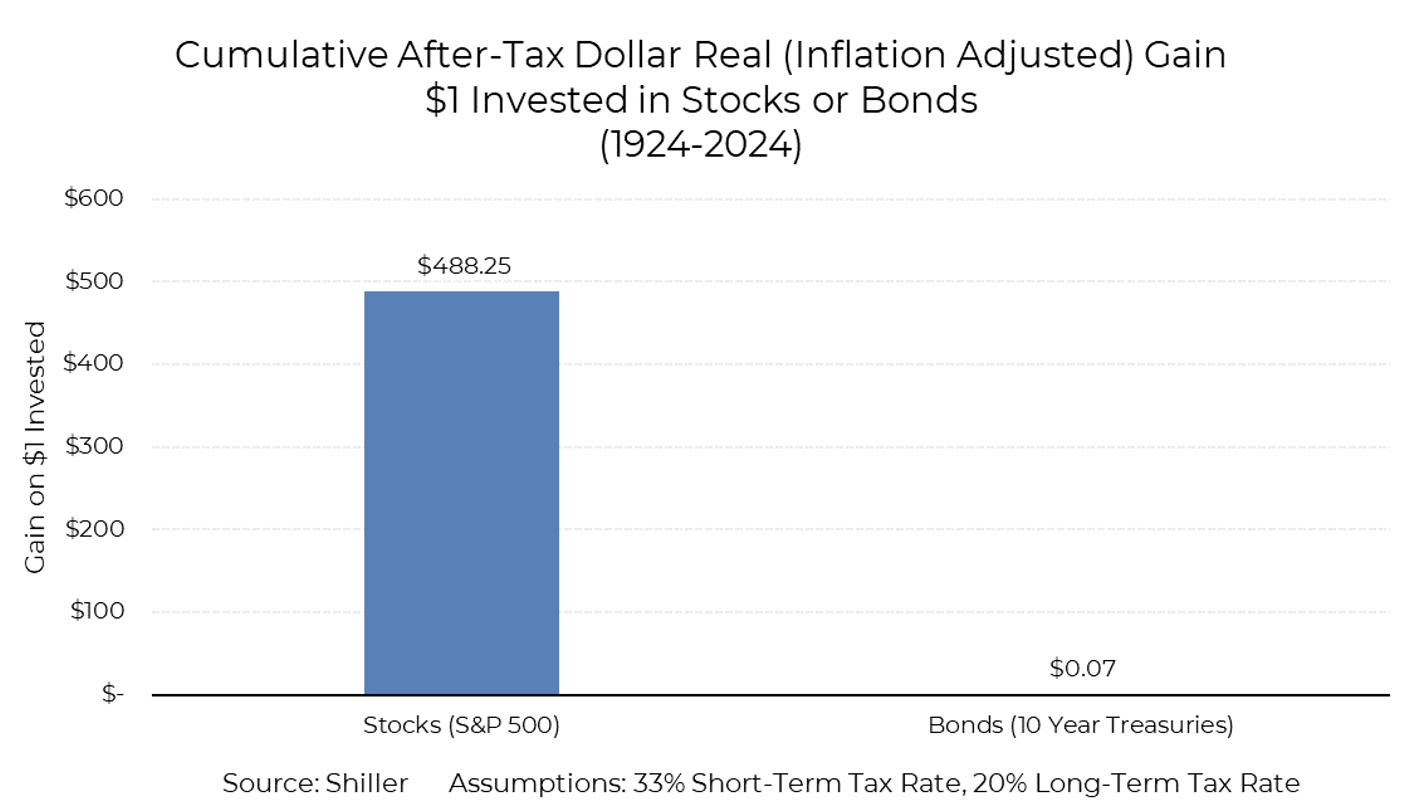

Brian’s post emphasizes the devastating effect taxes and inflation have on the real returns of bonds. The post ends with this chart below. It illustrates the difference between real returns in stocks vs 10-year treasuries. Again, how do you define safe?

Source: Aptus, Shiller as of 06.30.2024

Take 3 minutes and read that post!

But Don’t Stocks Have Drawdown Risk?

Yes, and big drawdowns at that.

They are painful behaviorally and create a volatility tax in the compounding of capital. Those are friction points we want to avoid.

This is the heart of our business. To message around our convictions in the need to alter allocation towards growth assets, and to create strategies that facilitate this shift while keeping risk in check.

We advocate the combination of more stocks + hedges that carry a known correlation and protective convexity. The correlation is negative, meaning hedges go up when stocks go down. Convexity means the payoff can be multiples of the premium paid to own the hedges.

We don’t own hedges to reduce risk. We own hedges so we can take on more risk. Their presence allows us to confidently absorb risk knowing that the risk so many investors worry about (large drawdowns) is the exact event that triggers convex payoffs from the hedges lying in wait.

Closing

In investing, the most important decision is asset allocation. My convictions grow by the day that for investors to preserve and improve wealth, they need to truly understand what is safe and what isn’t.

More stocks, less bonds.

There’s a place for bonds. Don’t get me wrong. They can provide income and some clarity on future outcomes. But safe? I would agree with you that bonds are safe, but then we’d both be wrong.

Thanks for reading. I could spend hours talking about this stuff, the need for a true store of value, the issues of centrally planned anything, etc. If you want to discuss, just hit me up. As always, thank you for your trust.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-4.