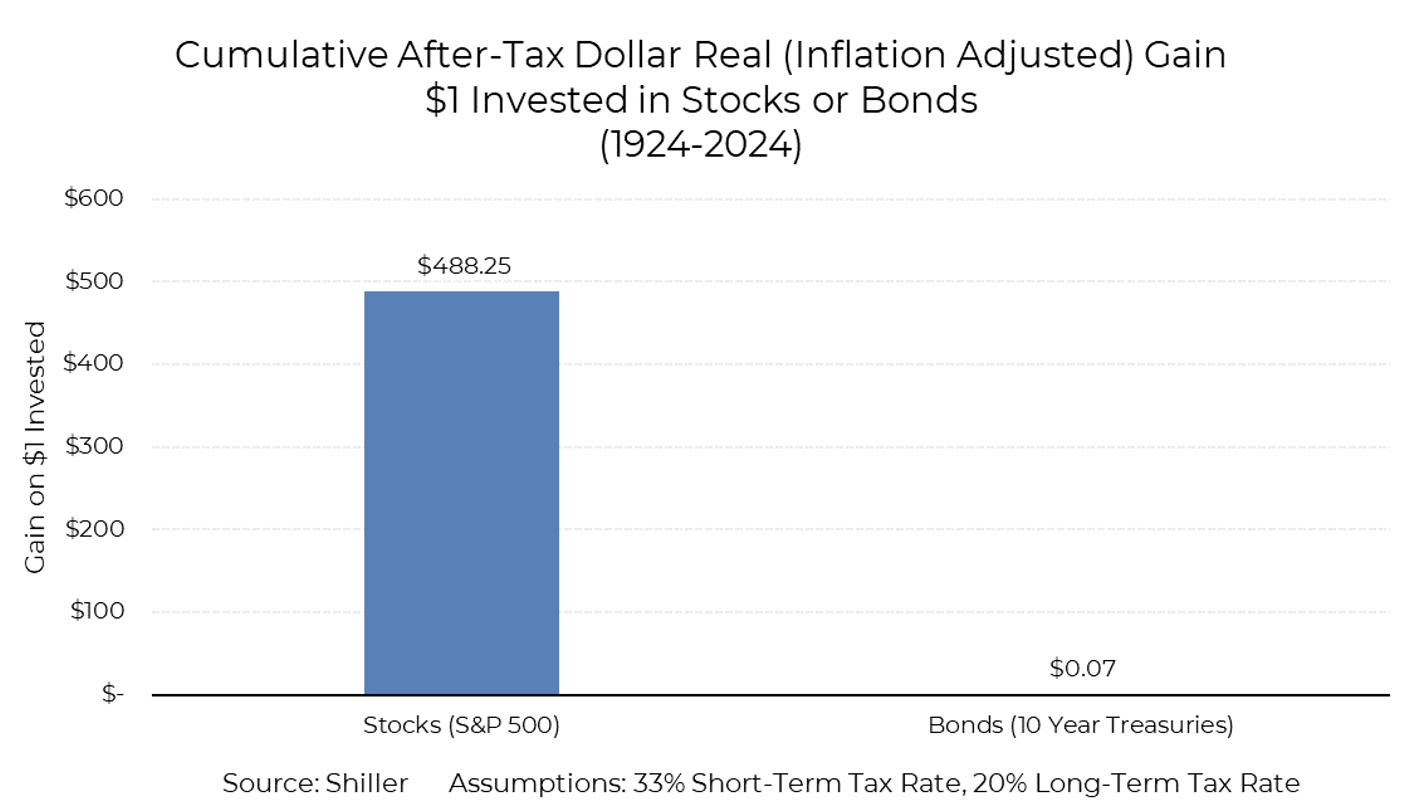

While Treasury bonds appear to offer safety, their real return tells a different story. Despite their nominal stability, investors in Treasury bonds have experienced essentially zero real after-tax returns over the past century. This highlights the critical importance of considering inflation and taxes in long-term investment strategies, as well as exploring alternative asset classes that are more likely to increase the purchasing power investors will need in the future.

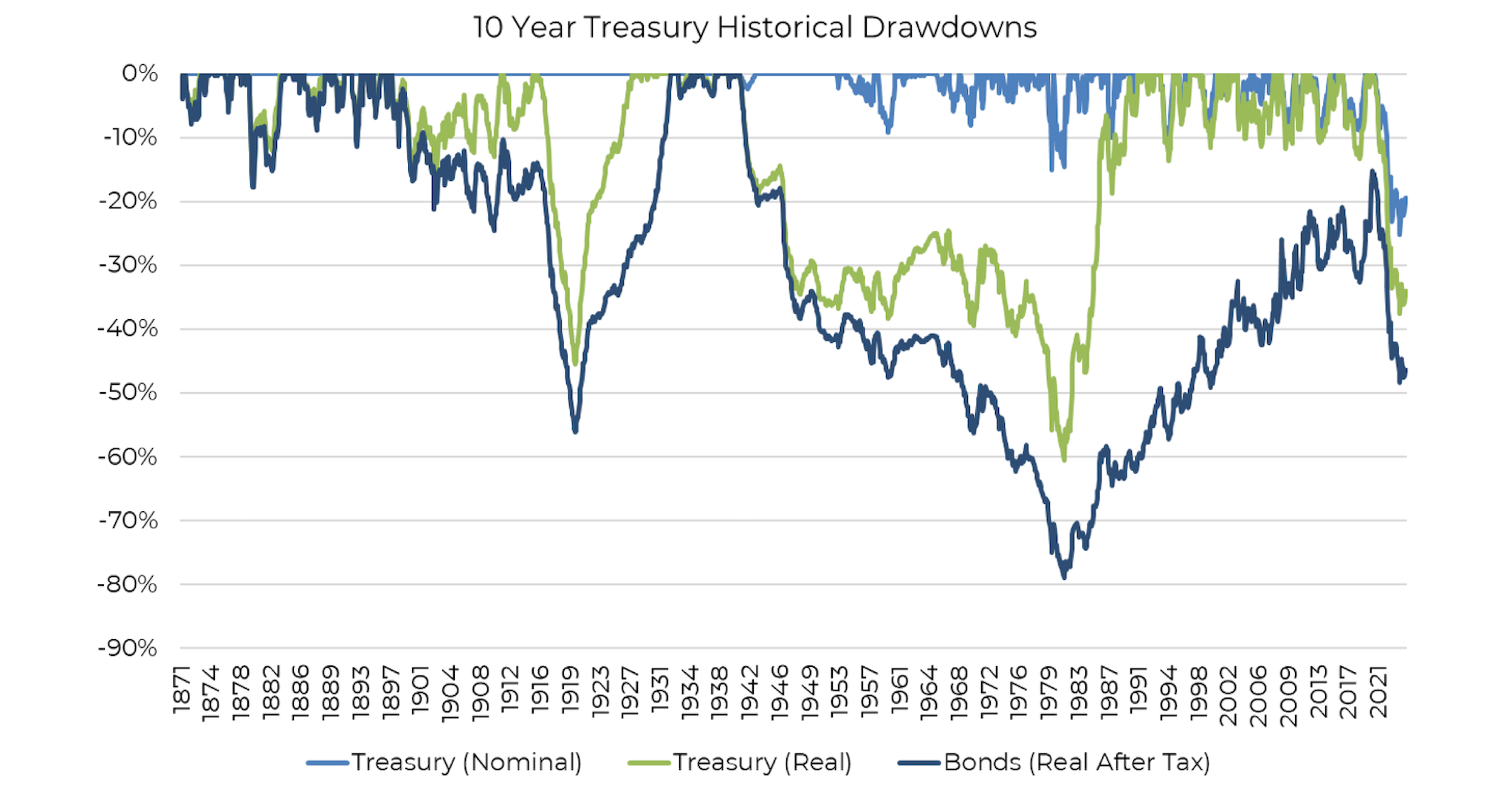

While historical returns reveal that the drawdowns—defined as the most an investment has lost from its peak—tend to be small in nominal terms, when considering real returns (after inflation) and the impact of taxes, the picture changes dramatically.

Source: Aptus, Shiller as of 06.30.2024

Source: Aptus, Shiller as of 06.30.2024

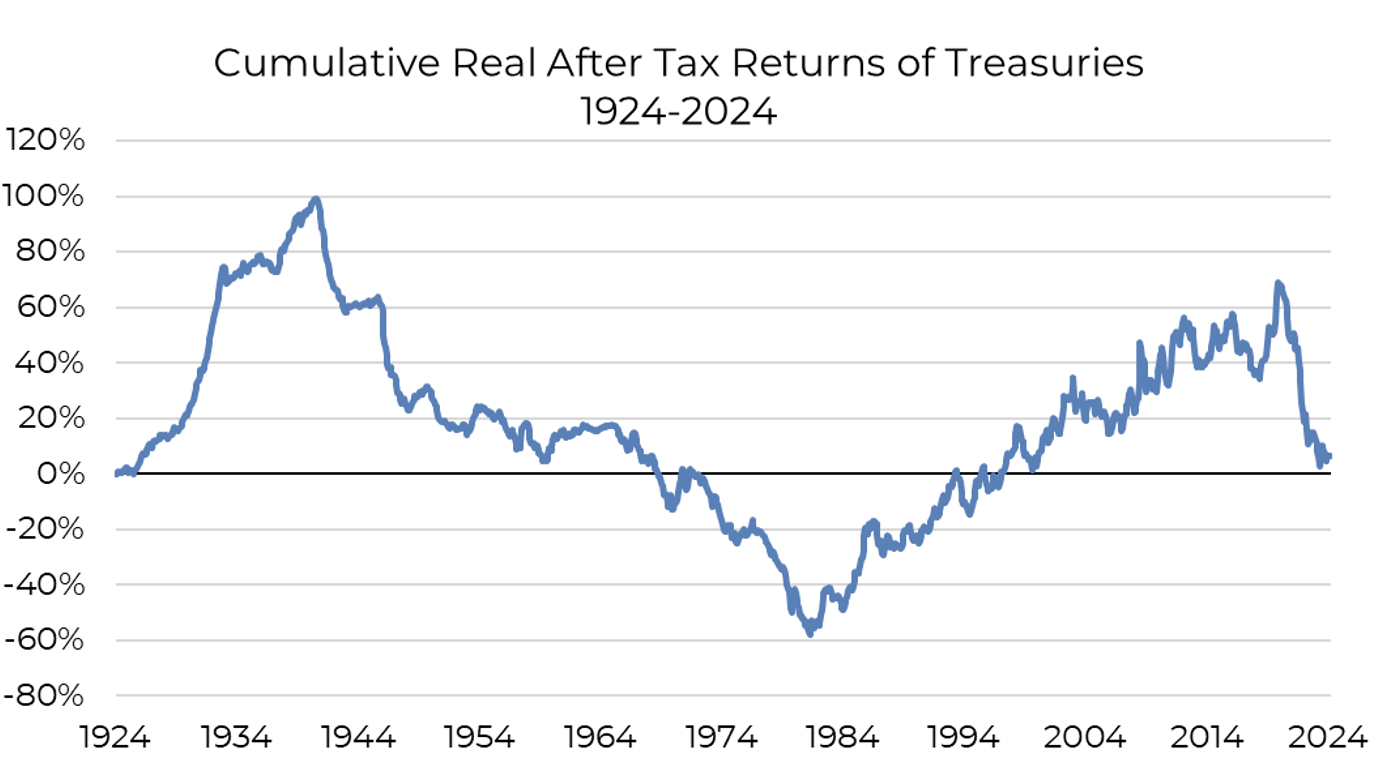

The result of this eight-decade period is striking: Treasury bonds have essentially earned nothing in real, after-tax terms over the last century.

Source: Aptus, Shiller as of 06.30.2024

Source: Aptus, Shiller as of 06.30.2024

The culprit? Inflation and taxes.

While Treasury bonds have provided relatively consistent nominal gains (setting aside the recent 20% drawdown as rates moved higher from record lows), these gains have been steadily eroded by inflation, which has reduced the purchasing power of the returns. Additionally, the nominal income from these bonds is taxed at short-term rates (assumed to be 33% in this analysis), further diminishing the actual returns investors receive.

In contrast, an investment in equities during this same period would have grown $1 to nearly $500 after accounting for inflation and taxes, thanks to their 1) higher returns and 2) more favorable tax treatment, including lower long-term capital gains tax rates and the ability to defer most taxes until the equity position is sold (see post Snowballing Returns: The Hidden Magic of ETFs).

Source: Aptus, Shiller as of 06.30.2024

Source: Aptus, Shiller as of 06.30.2024

This reality challenges the notion of Treasury bonds as a low-risk asset and highlights the importance of a more nuanced approach to asset allocation that accounts for the long-term effects of inflation and taxes.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. This information should not be construed as investment, legal, and/or tax advice. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-26.