Inflation has been a major headline the last 18 months as market participants digested the unprecedented government response to the pandemic (i.e., monetary and fiscal policy). Since early 2021, the Fed has championed that inflation would be “transitory” although following the higher-than-expected October CPI print, the narrative has begun to shift. Chairman Powell amended his definition of “transitory” and changed his tune to say that inflation is “probably transitory”. Thus far inflation has proven not to be transitory and elevated (and further rising) prices have quickly become a big problem for politicians and the Fed.

While inflation can be scary and the media is running rampant with stories on how prices are increasing, it’s important to take a step back and remember the steps we’ve taken to weather storms, specifically when it comes to inflation. If you skip out on reading the inflation details throughout the post, I’d highly recommend reading the last paragraph.

Jackson Hole Inflation Benchmarks

Back in August, Chairman Powell pointed to (5) inflation benchmarks during his Jackson Hole speech. He emphasized these (5) points as being the Fed’s key thesis on why inflation would ultimately be transitory. Let’s revisit those benchmarks. Buckle up.

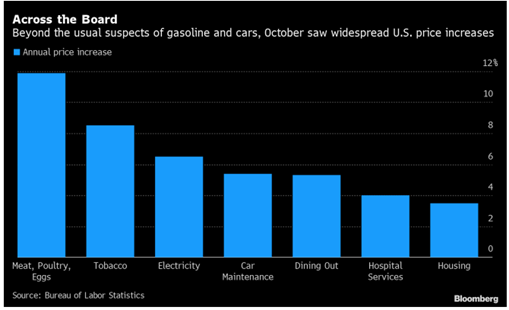

- Are Inflation Pressures Broad-Based? Back in August, Chairman Powell pointed out that many of the factors pulling inflation up were pandemic related and over time would normalize (i.e., the transitory components). Currently we are seeing broad based cost pressures across many of the components of CPI, which indicate more sticky inflation.

Source: Bloomberg LP. As of 11/17/21.

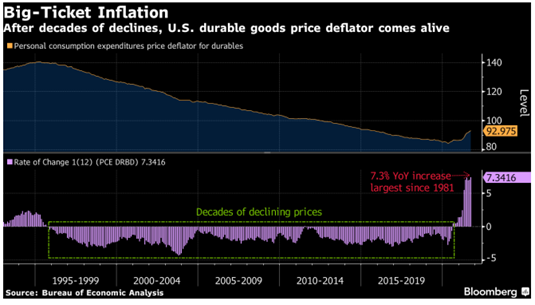

- Are Prices on Goods that Were Running Rampant (transitory/reopening related) Slowing Down? The United States has relied on importing cheap goods from China since they joined the WTO twenty plus years ago. As you can see in the chart below, we’ve experienced decades of declining prices on the goods front. As both input and logistic pricing have increased globally, companies are passing through higher costs to consumers. Companies have communicated in their earnings reports their ability to pass price increases onto end consumers. The chairman indicated that we’d start to see these upward-sloping, short term price divergences reverse… so far this hasn’t been the case.

Source: Bloomberg LP. As of 11/17/21.

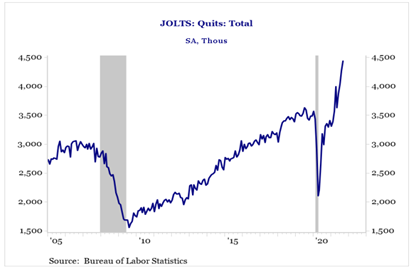

- Wage Pressures and Employee Negotiating Power are Becoming Powerful. If you are looking for a job, there are a plethora of job openings. The most recent JOLT job openings survey indicated that 10.43 million jobs were available. We are seeing a record number of employees quit their jobs (likely switching to higher paying jobs). In response to that, companies are paying higher wages which was evident in the most recent wage growth report (ECI) which showed wages growing at a 4.9% clip YoY. As the job market continues to tighten, we see wage pressures continuing to pressure inflation into ’22. Back in August, Chairman Powell indicated the likelihood of wage growth remaining muted as more workers came back into the work force alleviating pressure to hire. As we’ve seen a decent chunk of the labor force permanently remove themselves (early retirement, high asset valuations, crypto, etc.), this thesis seems less and less likely.

Source: Strategas. As of 11/06/21.

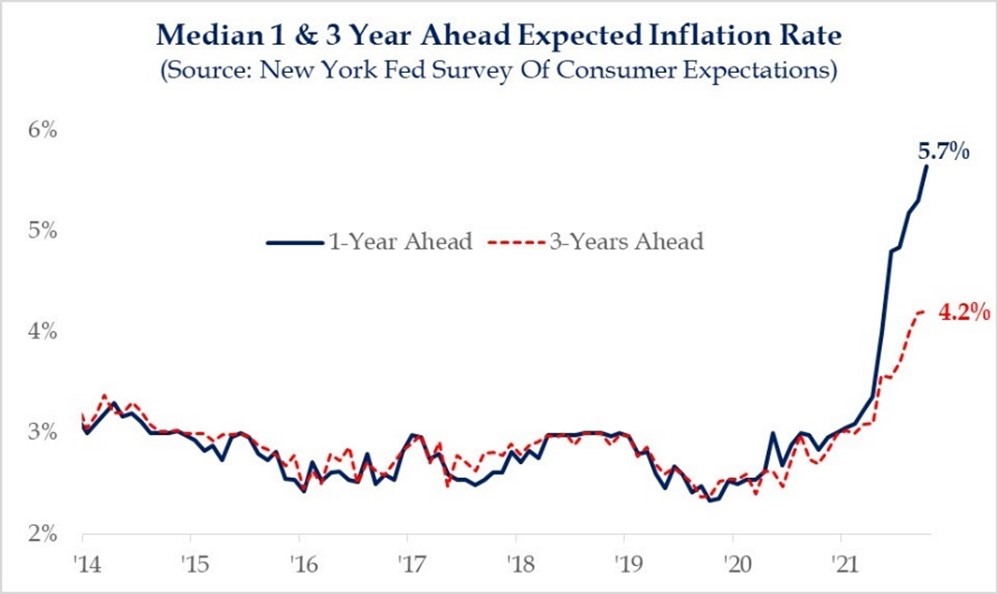

- Are Longer-Term inflation Expectations Rising? We’ve seen a sharp increase in higher expectations for inflation by consumers. Both short- and long-term inflation expectations have notably moved higher the last 6 months. While the expected 3yr inflation number is 150bps lower than the expected 1yr number, it’s still at a level (4.2%) well above the Fed’s 2% target level. Inflation at these levels doesn’t jive with a 0% Fed Funds rate. Expectations and in turn consumer sentiment are becoming a thorn in the side for the Fed as these measures continue to drift upward, the thesis of long-term inflation expectations being “well anchored” is getting harder to believe.

Source: NY Fed. As of 11/06/21.

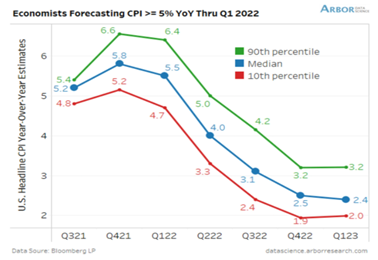

In addition, more and more economist (as polled by Bloomberg) expect headline inflation to remain above 5% well into Q1 ’22 and remain greater than the Fed’s 2% target through Q1 of ’23. More persistent inflation goes against the “transitory” rhetoric.

Source: Bianco Research. As of 11/17/21.

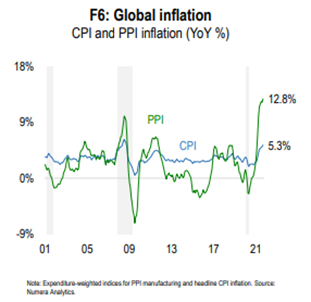

- Do DGT (Demographics, Globalization & Technological) forces continue to inject disinflationary pressures into the economy? With supply chain pressures causing massive goods disruption across the globe, we are dealing with a problem that is neither easily fixed nor solved by hiking interest rates. While demographics and technology are undeniably deflationary inputs to the long-term outlook on inflation, we don’t see these supply chain pressures quickly abating. Due to the U.S. being a major import economy, as global production costs increase (PPI), we’d expect CPI numbers to correlate (higher) as companies are forced to pass through costs to customers (and to consumers) to maintain profit margins. With persistent supply chain issues, the slack in supply chains continues to prove to be worse than expected.

Source: Numera. As of 11/16/21.

In Conclusion

We’ve gotten to the point where we think inflation has become problematic. The benchmarks that Chairman Powell indicated back in August are, at least temporarily, backfiring. We are facing a supply/demand imbalance magnified by governments filling consumers’ pockets with “free” money while extensive global lockdowns hamstrung supply chains. Ultimately, consumption is exceeding production and we are seeing prices reset higher to get back towards an equilibrium. The Fed has remained (overly) accommodative with QE and Monetary Policy since the pandemic begun and this has extenuated the inflation dilemma.

Where do we go from here? The Fed will have to walk a fine line to navigate the current backdrop as it’s unlikely a faster QE taper or rates hikes can solve supply related problems. While the global economy doesn’t equal the stock market, we see the market pricing in 3 rate hikes in ’22 as aggressive. Higher interest rates in the face of a slowing economy is a situation that could backfire. The Fed desperately needs to see inflationary pressures shift lower to keep the market from forcing a (over)reaction with rate hikes on a still fragile economy.

Let’s End on a Positive Note

The inflation topic is hard to ignore at this point. It’s in the news, paper, social media, radio, etc. While it can be scary to think back to periods of history where inflation ran rampant, we can use those periods to learn how to position accordingly. The biggest certainty we think we can make at this point is that fixed income (specifically long duration) is the worst asset class to own in an inflationary environment. We believe bonds significantly underperform the next several years, especially considering the real returns. While most portfolio managers realize bonds are currently a suboptimal asset class, most still hold them… we do NOT!

We believe the key beauty of owning an Aptus based allocation is the ability to mitigate the risks of inflation eroding client’s capital due to holding a “dead” asset class in the name of stability. Quite to the contrary, we’ve intentionally built our portfolios to be anti- fixed income, long stocks, and long volatility. By exposing client’s portfolios to more stocks that can grow and pass-through higher input cost to consumers as well as “cash-bang for buck” asymmetric volatility exposure, we truly believe we are in one of the best positions in the industry to steward clients capital through these uncharted waters.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2111-8.