Rate Cut Expectations

All eyes are on Jay Powell this week in Jackson Hole as he lays out the FOMC plan for the upcoming rate cut cycle. As of now, the market is pricing in ~1.25 cuts (roughly 31bps), basically a 25bps cut. Over the past weeks, we’ve bounced back and forth from zero cuts to >2.

Source: Bloomberg as of 08.22.2024

Source: Bloomberg as of 08.22.2024

We’d be surprised if the Fed did more than 1 cut (25bps) in September, especially given the recent rally back near all-time highs in risk assets. The economic backdrop and level of real interest rates currently warrant a slow and methodical cutting cycle. One other observation is that the market is pricing in about 9.3 rate cuts over the next 18 months, bringing the Fed Funds rate down to 3%.

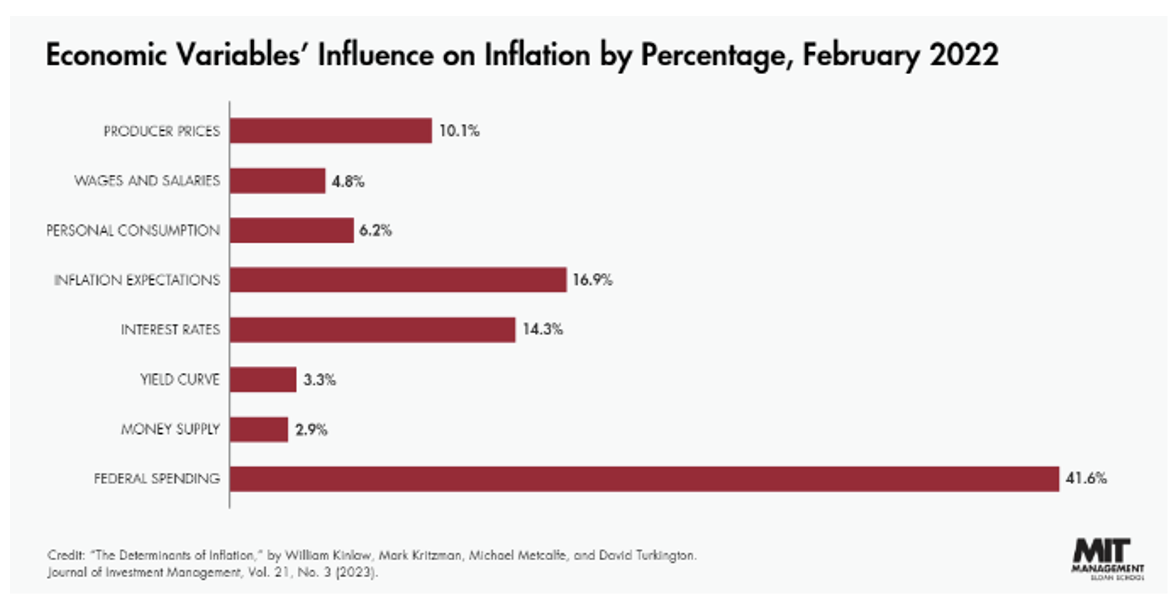

Federal Spending Aided the Post-COVID Recovery, But Inflation Was the Side Effect

MIT Sloan School of Management and analysts from State Street performed a study that found the overwhelming driver of the 2022 inflation burst was federal spending and not the supply chain. Their analysis found that federal spending was 2-3x more important than other factors in causing inflation after COVID. Excess liquidity was added to the economy through a combination of the CARES Act, the American Rescue Plan, and the Fed’s QE.

Source: MIT Sloan as of 08.21.2024. https://mitsloan.mit.edu/ideas-made-to-matter/federal-spending-was-responsible-2022-spike-inflation-research-shows

Source: MIT Sloan as of 08.21.2024. https://mitsloan.mit.edu/ideas-made-to-matter/federal-spending-was-responsible-2022-spike-inflation-research-shows

The results put a damper on the common (political) talking point that the spike in inflation was solely due to supply chain disruptions. The [insane] high levels of fiscal stimulus create a difficult environment for the Fed, given that their rate policy is being diluted by the Treasuries’ fiscal impulses.

This dynamic likely has considerable influence on both the magnitude and duration of the Fed’s high-for-longer rate policy. With loose fiscal policy seemingly here to stay, the level of interest rates could require the Fed to hold policy rates higher than the market expects. This doesn’t mean no cuts, but we could make a case for much fewer cuts than the market is currently pricing in.

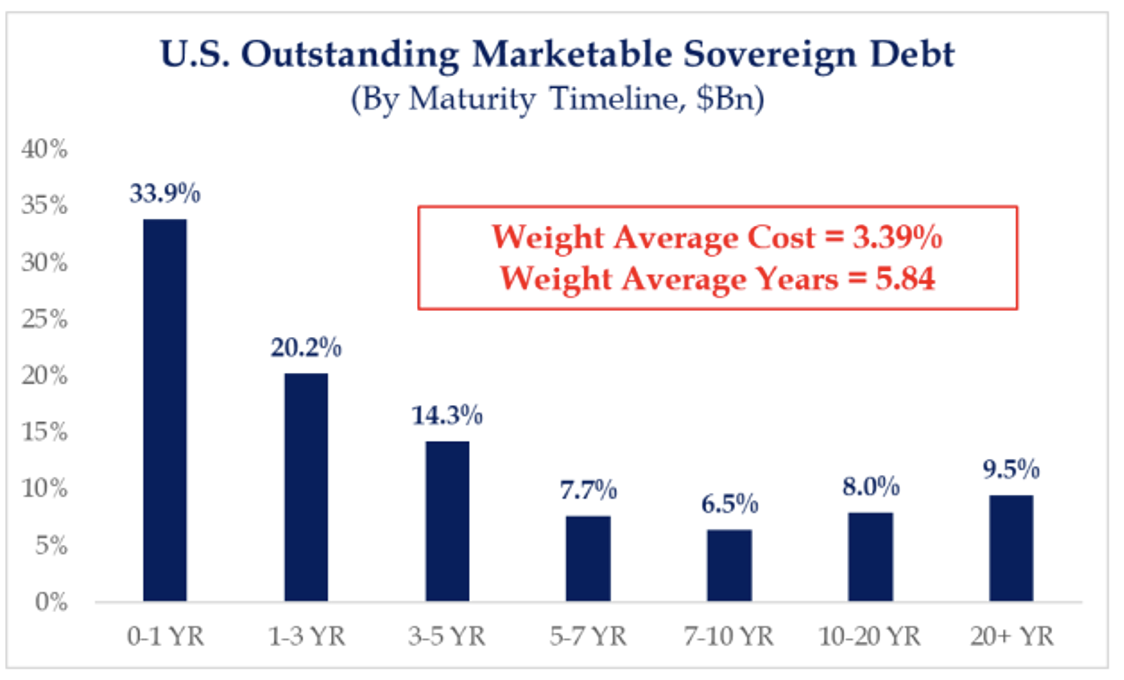

U.S. Treasury is Banking on Rates Moving Lower

A whopping 34% of America’s outstanding debt matures in the next year, more than 54% in the next three years. This is, again, a short-term strategy designed to hide the longer-term economic consequences of running serial budget deficits equivalent to 7% of GDP and puts the American taxpayer at great risk in the long term.

Source: Strategas as of 08.16.2024

Source: Strategas as of 08.16.2024

As we mentioned last week regarding Activist Treasury Issuance (ATI), Treasury Secretary Janet Yellen has manipulated Treasury issuance to keep long-term interest rates low by decreasing the supply of longer-dated Treasury notes and bonds in favor of issuing a frenzy of short-term Treasury bills.

By funding our rising debt load on the front end of the curve, interest expenses have skyrocketed as the Treasury Department must issue new debt (on the most expensive part of the curve). Currently, interest expenses on America’s debt now exceed our defense budget. By next year, interest expenses will exceed Medicare as well. Can you hear the Quantitative Engines (QE) revving? We can!

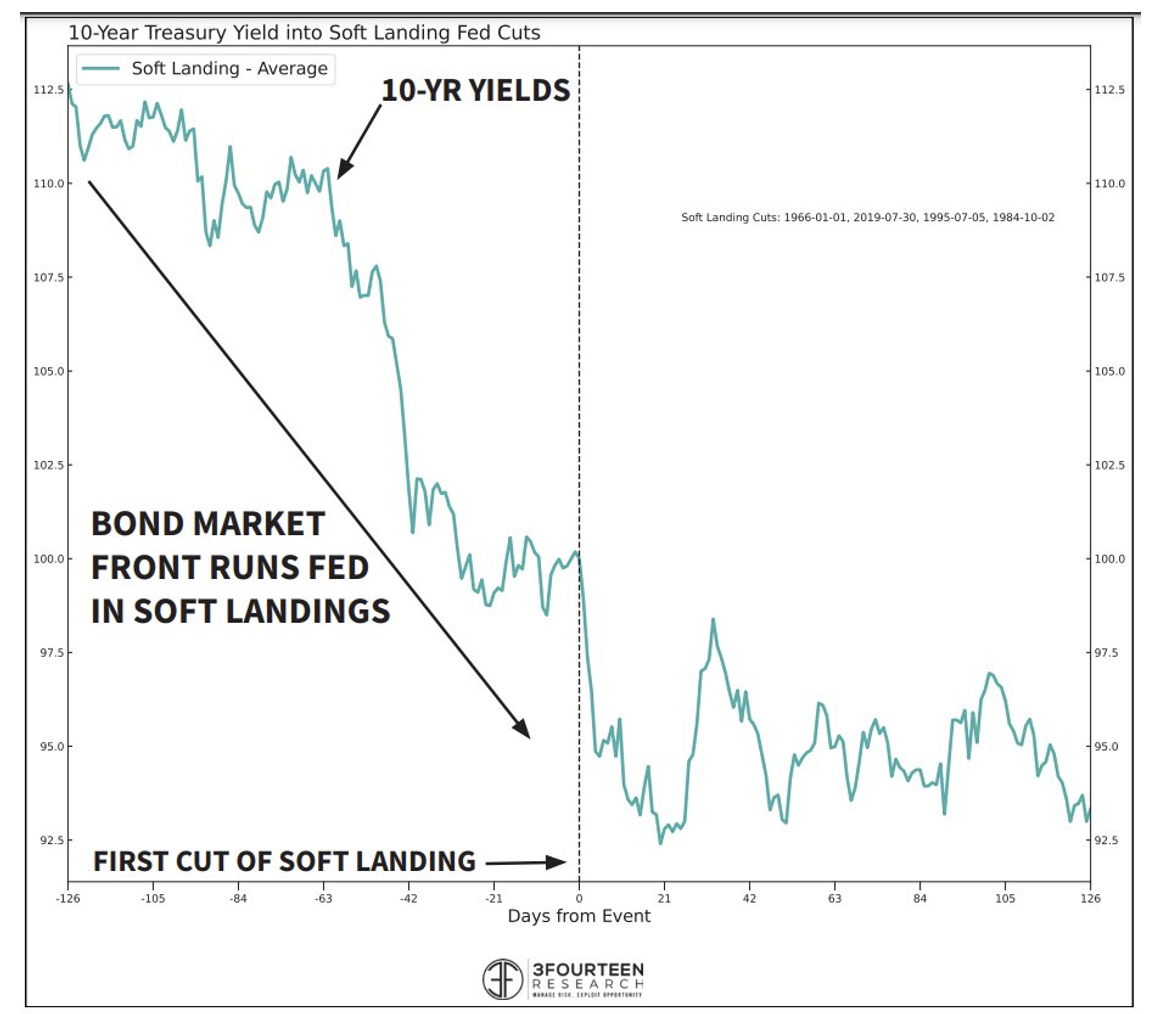

Run in Long Bonds Already Happen?

We all know markets are forward-looking. Due to this fact, taking a market position that is contrary to what the market is currently pricing offers potential for reward. This brings up the question as to whether the current yield environment on longer-dated bonds is correctly pricing the eventual outcome.

10-year yields have fallen from around 5% down to below 4% in anticipation of the Fed’s upcoming cutting cycle.

Source: 3Fourteen Research as of 08.16.2024

Source: 3Fourteen Research as of 08.16.2024

The problem with the race to buy bonds now is that history has shown us that, in a soft landing, markets front-run yields before the first cut and yields then tend to level out. A bond investor must consider the after-inflation and after-tax return…when you pair that with the potential for higher correlations to risk assets, we’d be careful.

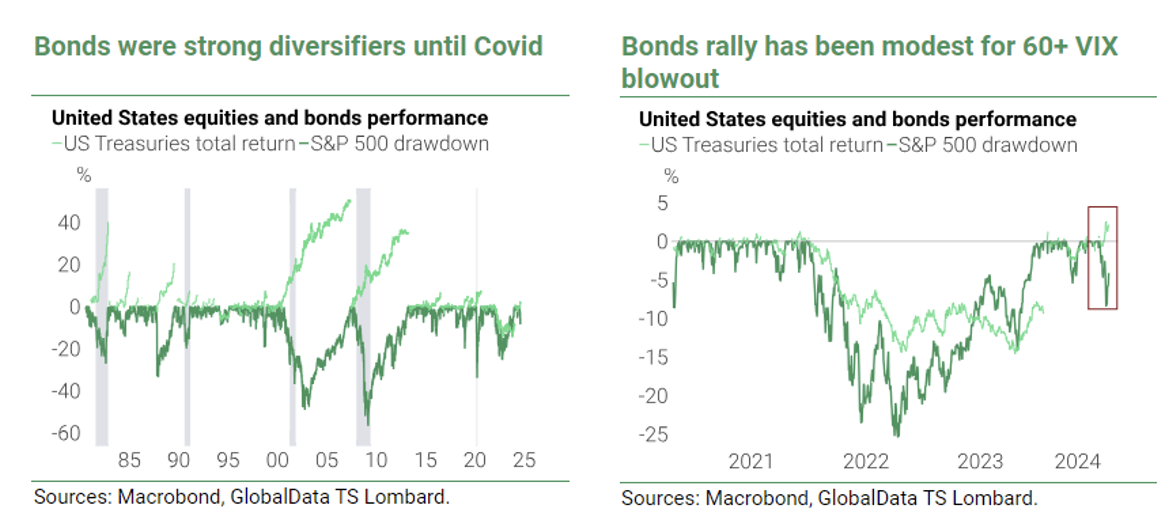

Bonds Offering Less Cushion

The case for bonds as diversifiers is weaker than it was in the 2010s. Weak growth and deflation were major concerns for policymakers in the 2010s, and that is why they responded forcefully to softer macro data and were quicker to lower rates.

The situation in the 2020s looks different, and the prospect of a more volatile inflation climate could weaken central banks’ resolve to cut rates decisively during market selloffs, i.e. a less reliable Fed put. Given that a significant portion of the yield curve remains inverted or extremely flat, we see limited price returns available to bond investors.

Source: TS Lombard as of 08.18.2024

Source: TS Lombard as of 08.18.2024

Of note, bonds did rally during the early August vol shock, however, the drop in yields was relatively modest and it remains unclear how well non-recessionary risk asset selloffs will be cushioned by bonds going forward.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2408-24.