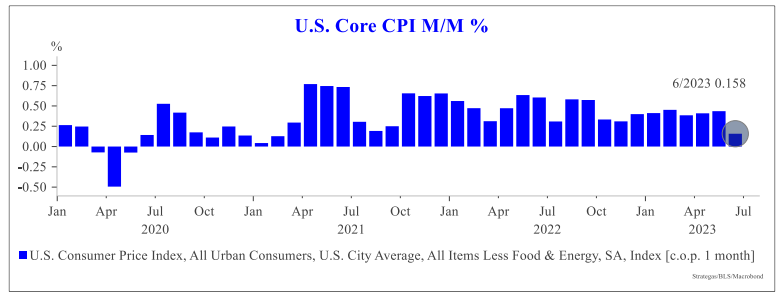

More Progress in June Inflation Numbers:

→ Headline CPI +0.2% M/M (vs +0.3% expected, +0.1% prior)

→ Core CPI +0.2% M/M (vs +0.3% expected, +0.4% prior)

It was exactly one year ago that headline CPI topped 9.0% (July 13th, 2022) with 10-year yields closing at 3.07% that day. A year later, yields are hovering around 4.00%, down only modestly from October’s 4.25% high… roughly 600 basis points of headline CPI relief and yields haven’t budged.

Source: Strategas as of June 2023

Source: Strategas as of June 2023

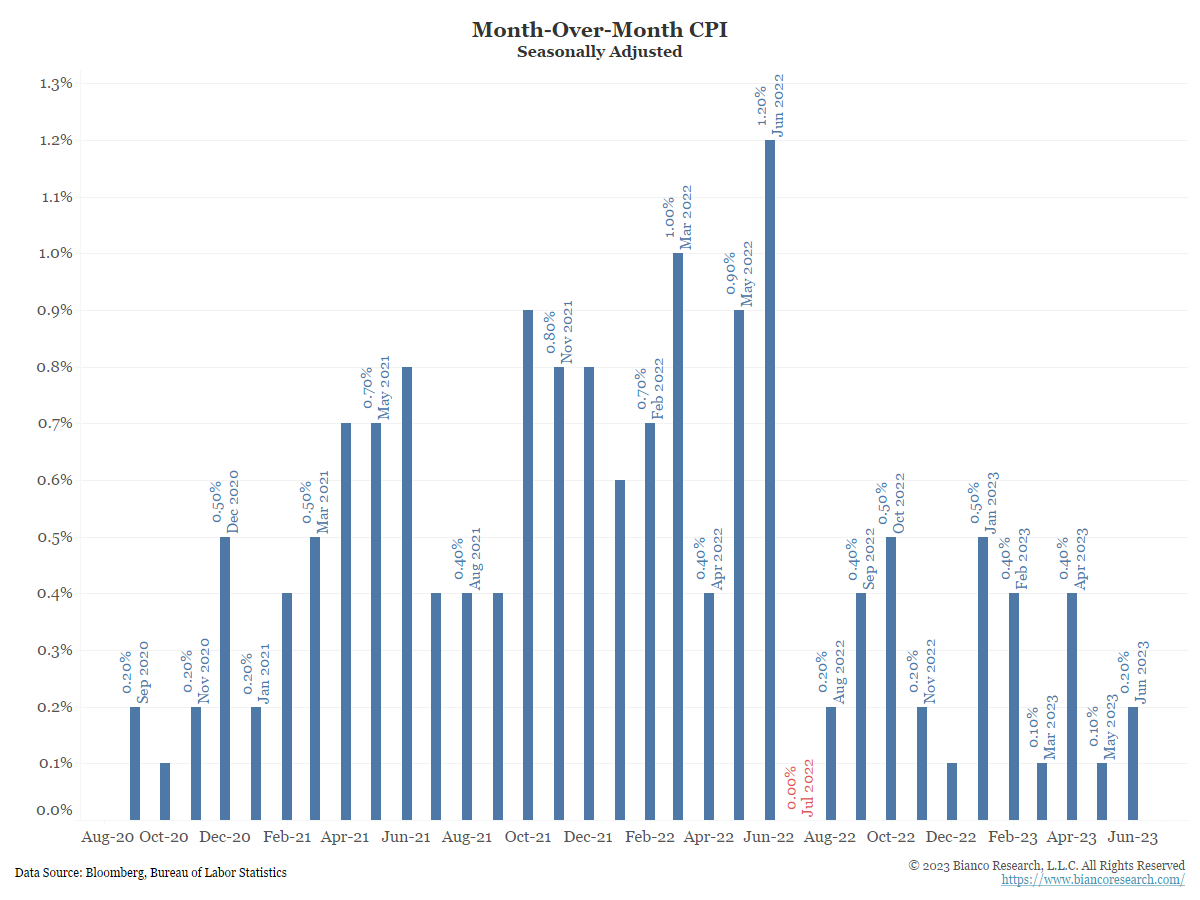

Core Inflation Breakdown

Headline and core came in this morning at +0.2% MoM. Shelter continues to do a lot of heavy lifting. Rents continue to point lower but are lagging and remain too sticky for comfort. In addition, services remain a worry as the Core 3 month annualized is still at 4.1%. Progress indeed yet still more work to be done.

Source: Citadel as of 07.12.2023

Source: Citadel as of 07.12.2023

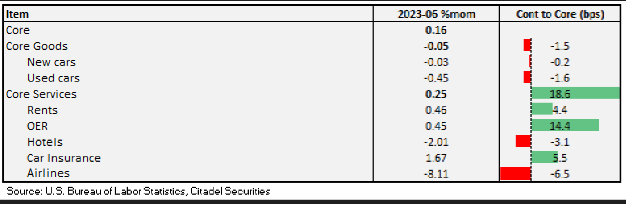

Year Over Year (YoY) Numbers Declined Significantly

Back in June 2022, the month-over-month change in CPI was much higher than in the 2020 period. This created a large tailwind for lower year-over-year inflation where headline CPI dropped to 3.0% YoY and Headline Inflation dropped to 4.8% YoY. At the surface, these numbers are drawing significant attention.

Source: Bianco as of 07.12.2023

Source: Bianco as of 07.12.2023

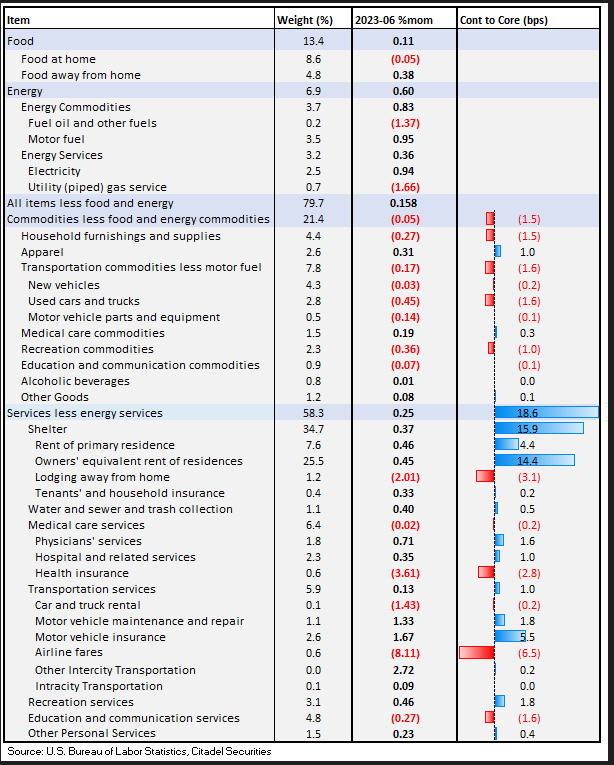

Core Inflation Details

- OER continues slowing, falling to 0.45%

- Used cars down -0.45%. According to the Manheim Index there is more to come over the next few months.

- Big decline in airfares at -8%, lowering the core print by 7bp.

- Hotel lodging declined by -2%

Source: Citadel as of 07.12.2023

Source: Citadel as of 07.12.2023

Shelter Remains Problematic

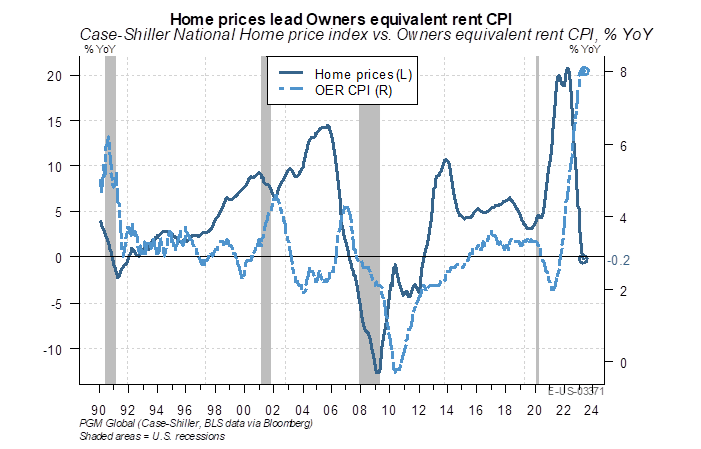

The battle with housing inflation will likely be one of the Fed’s longer-lasting inflation challenges. Home prices tend to lead owners’ equivalent rent (OER) by 18-24 months. Due to high mortgage rates in the U.S., we are seeing fewer existing home sales, which would have otherwise brought home prices and (eventually) rents lower.

Instead, housing shortages will likely keep home prices higher with more elevated OER inflation ahead. While many analysts point to inflation ex Housing as being at the Fed target, we think that analysis is misleading given the prominence of housing within our economy.

Source: Pavilion as of 07.05.2023

Source: Pavilion as of 07.05.2023

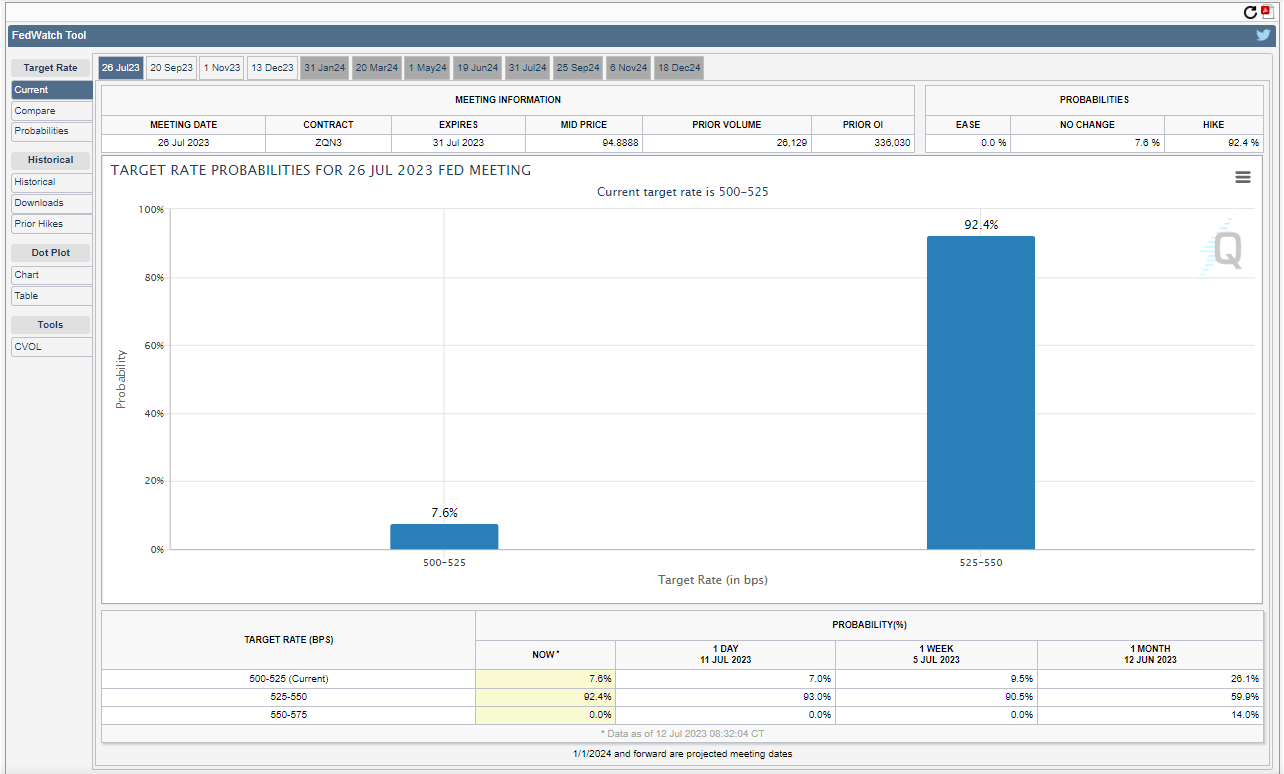

Market Pricing 25bps Hike July 26th

Despite the lower-than-expected inflation print, another 25bps hike on July 26th looks near certain although the probability for additional hikes post July did fall.

Source: CME as of 07.12.2023

Source: CME as of 07.12.2023

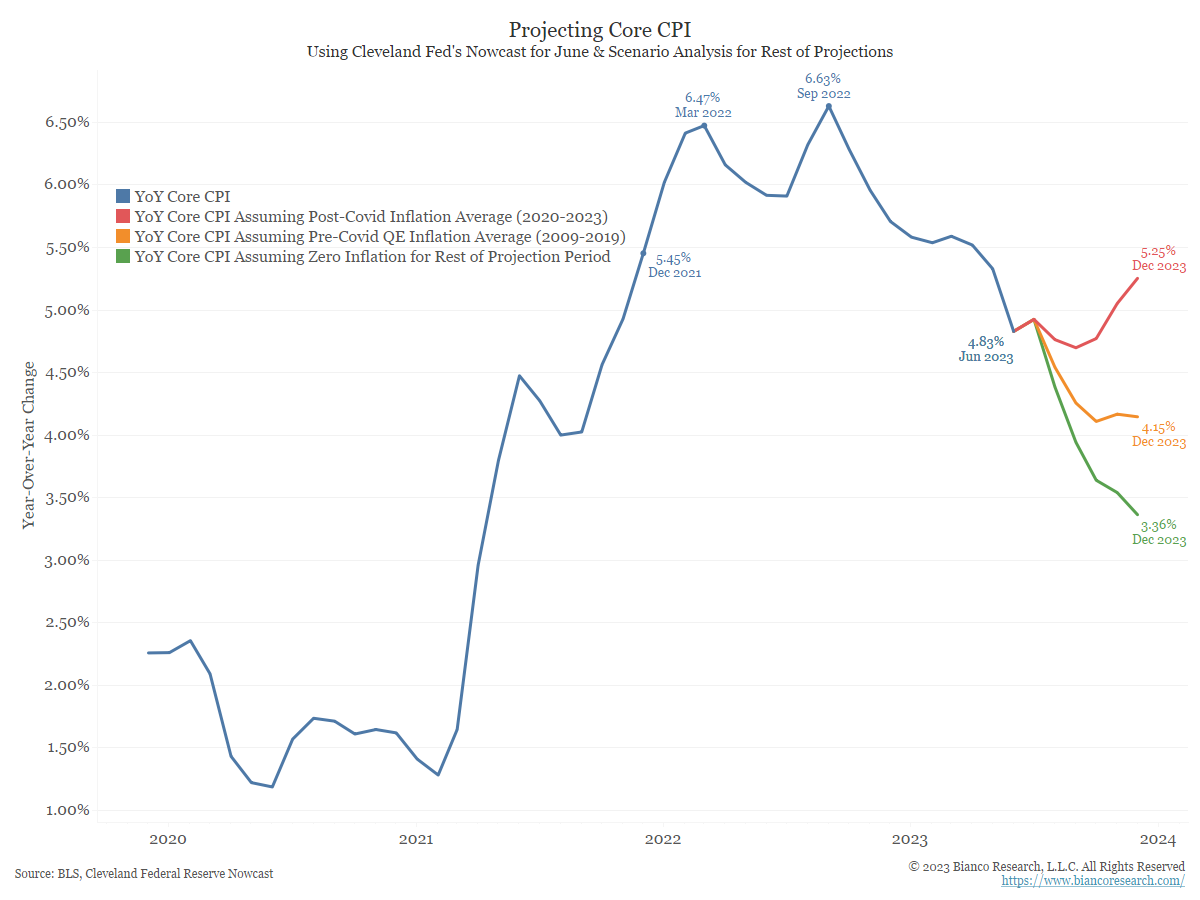

Was June a Local Low for Inflation?

Bianco Research has put out a helpful scenario analysis to evaluate where inflation is headed. In the analysis he assumes the Cleveland Fed’s CPI Nowcast of 0.40% month-over-month inflation for June will be correct and uses a combination of the pre and post Covid inflation data to project the future.

The red line shows Core CPI will hit 5.25% by December if inflation continues its post-Covid average. The orange line shows CPI would be 4.15% at the end of the year if the month-over-month releases equal pre-pandemic QE-era inflation. Finally, the green line shows CPI would be 3.36% by the end of 2023 if the month-over-month releases show 0% inflation between now and then.

Based on the impact of the base effect, this scenario analysis shows inflation could begin to creep higher again while falling quite short of the Fed’s 2% target.

Source: Bianco as of 07.12.2023

Source: Bianco as of 07.12.2023

To Sum it Up

Yields dropped and equities rose in response to the 3% Headline Inflation (and Core <5% for the first time since 2021) print as the market continues to see signs of immaculate disinflation (inflation down but growth okay/stable). Following the (likely) upcoming July hike, we believe the Fed will really look to the data as to whether they decide to continue hiking or simply hold rates at elevated levels for longer.

As shown above in the analysis from Bianco Research (and BAML), it is likely the June inflation print could be the local low in the inflation fight. While the Fed’s tightening of monetary policy has unarguably brought inflation lower the last 18 months, we must remember the “last mile” of the inflation anchoring marathon is typically the hardest. We believe the gusto of the Fed’s 2% target will likely be tested over the back half of 2023 and be a significant driver regarding what happens to risk assets.

While lower inflation is good for the Fed in terms of anchoring inflation (and ending their hiking cycle), declining inflation will be bad for companies as they lose pricing power. This isn’t an overnight phenomenon and will take time to work its way through the economy… for the next clues we will look towards earnings season.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-17.