The Fed raised rates for the 11th time in 16 months, bumping rates +25bp to 5.25%-5.5% at today’s FOMC meeting. This matched the market consensus and puts short-term rates at a 22-year high (last seen January 2001).

The Fed kept the statement the same in regard to additional policy moves:

“In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

That message is virtually unchanged from the June statement. The decision was unanimous.

A Few Notable Powell Comments:

“We’ve covered a lot of ground and the full effects of our tightening have yet to be felt.”

“We have been seeing the effects of our policy tightening on demand in the most interest rate sensitive sectors of the economy, particularly housing and investment. It will take time however for the full effects of our ongoing monetary restraint to be realized. Especially on inflation.”

“The Fed staff economists are no longer forecasting a recession given the resilience of the economy recently but are still anticipating a noticeable slowdown in growth starting later this year.”

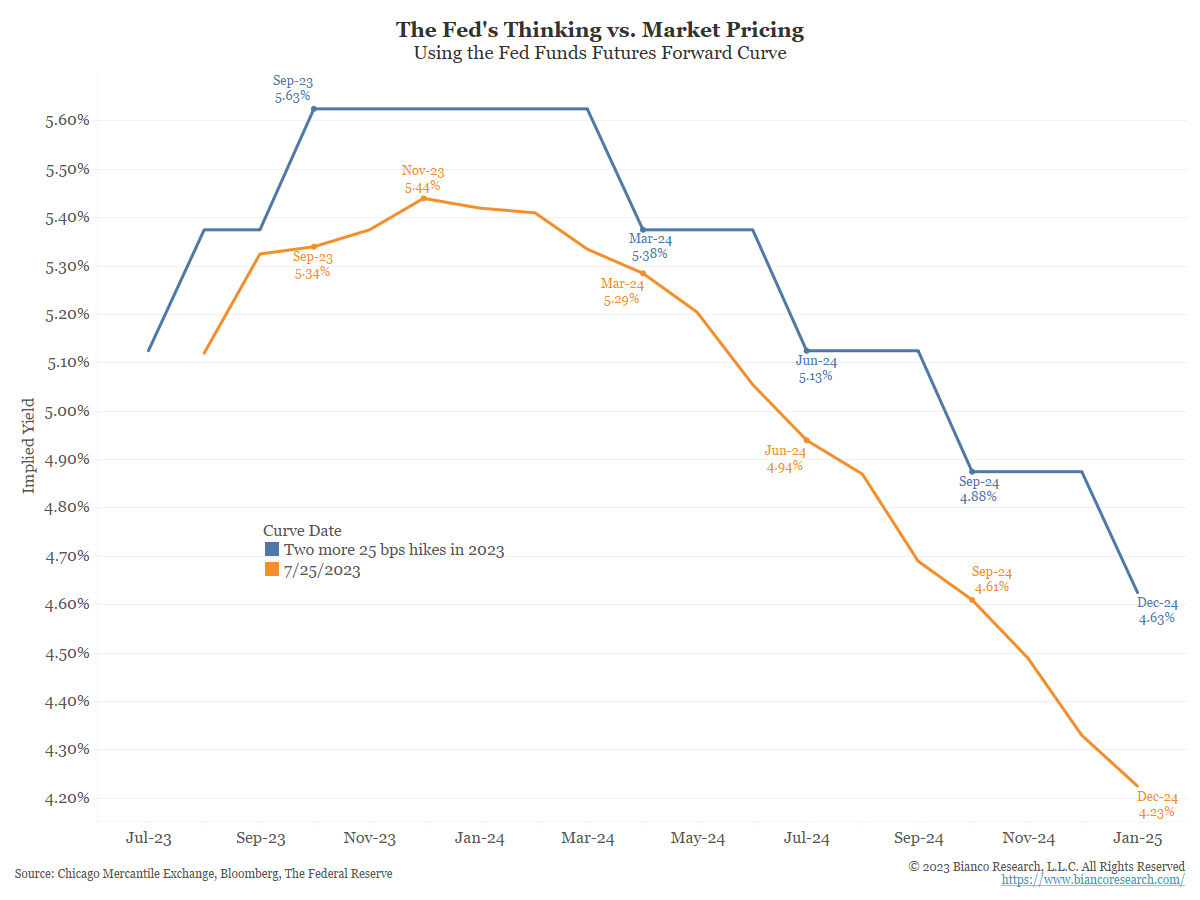

Market Still Expects Faster Cuts vs the Fed DOTs

Futures pricing prior to the announcement had the median terminal rate of 5.45% with 125bps of rate cuts by year-end 2024. Those futures levels continue to hold after the meeting.

Source: Bianco as of 07.25.2023

Source: Bianco as of 07.25.2023

In the Fed’s June forecast, they had one more rate hike this year with 100bps in rate cuts beginning in 2024 with the median rate at 4.625% by the end of 2024. There is, however, a wide range within the committee where 2024 ends with a high of 5.875% and a low of 3.625%.

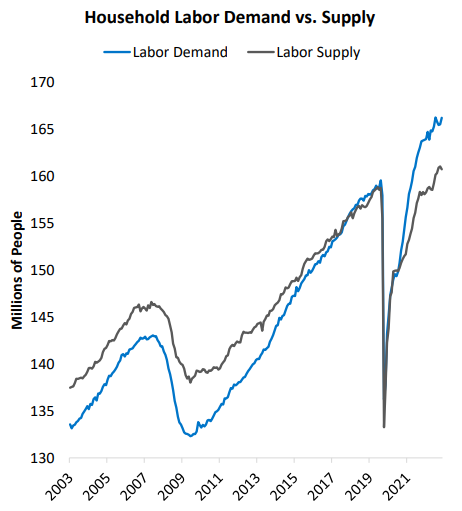

Softer Labor Market is a Key to Lower Inflation

Labor demand still exceeds labor supply although some progress is being made. Powell continues guarding against backing off too soon (i.e., the risk of Stop and Go from the 70s is high).

If the inflation readings continue to improve the Fed may shift more emphasis on the tight labor market and the above average wage gains as an excuse to hike again come September. The average hourly earnings (AHE) is running over 4% vs. the 3% long-run average.

Source: DoubleLine as of 07.15.2023

Source: DoubleLine as of 07.15.2023

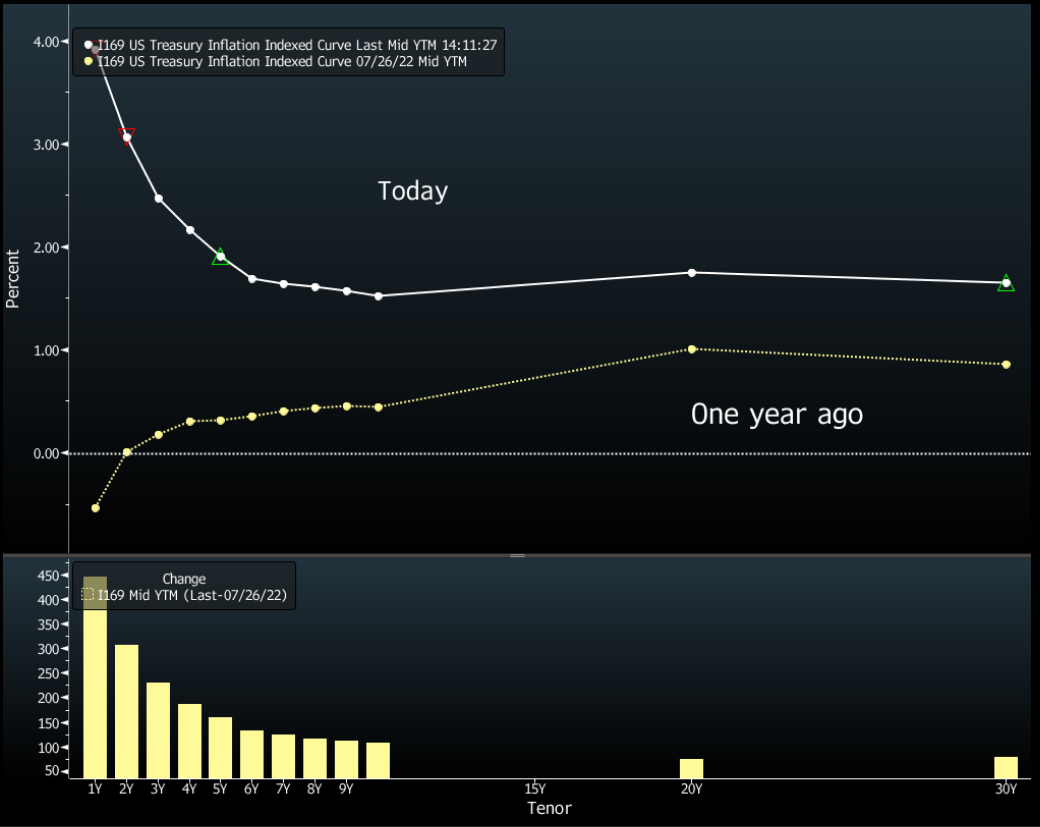

Real Rates Now vs 1 Year Ago

The real policy rate (measured using core CPI) is now at 0.7% and as inflation continues to trend lower, it should continue to push real rates higher. Historically we’ve needed to see the FFR get higher than inflation in order to conquer inflation.

Compared to 1 year ago, the entire Real Rates curve is now positive, typically an indication of restrictive policy. While this is important, it’s also prudent to remember we have just gotten to “restrictive territory” and will likely need to stay here for substantial time to squash inflation.

Source: Bloomberg as of 07.26.2023

Source: Bloomberg as of 07.26.2023

Conclusion

In summary, the Fed delivered the expected 25bps hike and signaled that future hikes will be data dependent, no real surprise. With two additional inflation and employment reports due before the September 20th FOMC meeting, the Fed will get data on whether to justify a hike or no hike decision.

While the market is pricing more rate cuts in 2024 than the Fed is projecting, the Fed didn’t see the need to push back this meeting. If the updated September dot plot, however, shows a discrepancy vs. the futures market for 2024 we expect the push back to reignite as that will likely mean the progress on inflation has stalled.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-29.