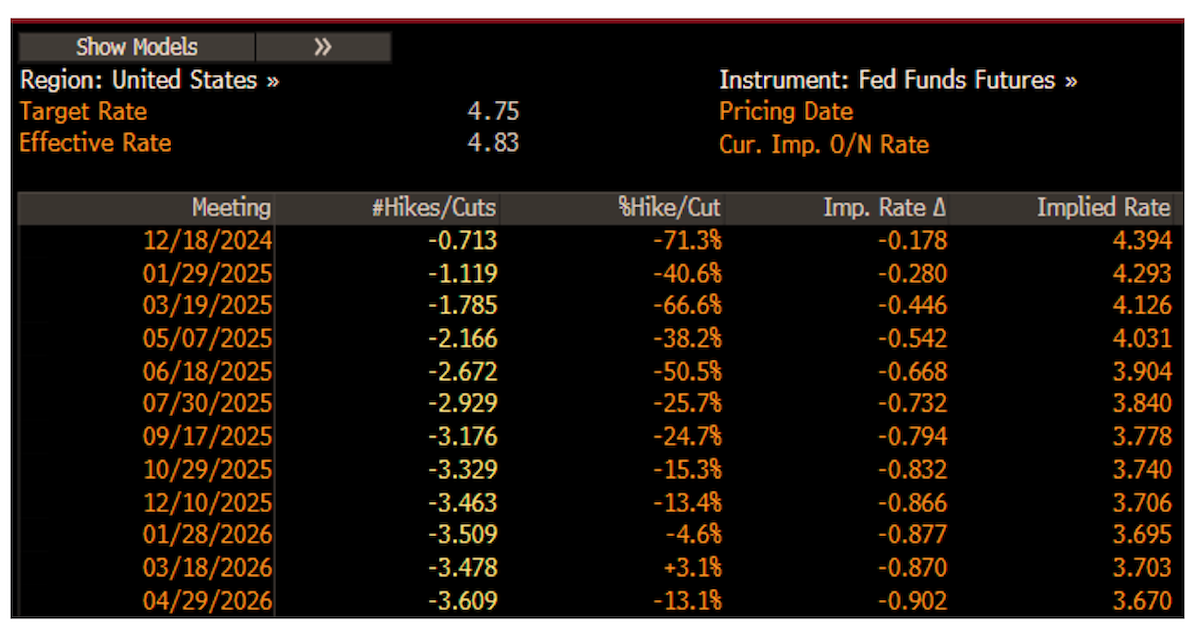

As expected, the Fed opted to cut rates by 25bps in November, taking the Federal Funds rate to a range of 4.50% to 4.75%. Marking now the second consecutive reduction in rates, this month’s cut is a notably smaller reduction following the 50bps cut to initiate the cutting cycle back in September. The decision was unanimous, with all 12 members voting in favor of a 25bp cut. There were no changes (for now) to their balance sheet policy.

On the inflation front, the Fed removed language regarding “greater confidence” that inflation is moving sustainably toward 2%. However, the statement noted inflation has “made progress” toward the central bank’s target pace. In other words, inflation continues to improve, further abating from a recent peak in Q2 2022. Although it remained above 2%, Fed officials recognized that there was still more ground to cover before declaring that the mission had been accomplished.

When asked about the impact on the economy and inflation from President-elect Trump’s policies (taxes, tariffs, etc.) Chair Powell said they would be assessed in the context of the economy’s performance at the time when these policies are put in place, not when they are proposed. As for what policies may be enacted and to what extent, Powell was clear – “We do not speculate, we do not guess, we do not assume”.

Source: Bloomberg as of 11.07.2024

Source: Bloomberg as of 11.07.2024

Powell was asked about the rise in term premiums and he said the FOMC is watching not reacting. He hinted that growth expectations rather than inflation were the predominant driver. The simple math of turning a forward-priced 3% funds rate into a 4% rate raises the 10Y as much as it has (markets pricing in a higher terminal).

Bottom Line: U.S. monetary policy is still likely restrictive and Powell repeatedly emphasized that the policy decision at the next meeting in December will depend on incoming data (i.e., a December cut is far from a lock). The Fed remains in a rate-cutting cycle, and skipping a meeting in December is possible if upcoming data suggest a stronger labor market and/or higher inflation.

This would buy additional time to see what fiscal policies might be coming and could prove prudent (especially given the high likelihood of a unified U.S. government). Skipping a meeting would also slow down the current cadence of policy rate cuts which makes sense as you get closer to a neutral stopping point (which appears to be closer to 4% than 3% based on the recent data and market pricing).

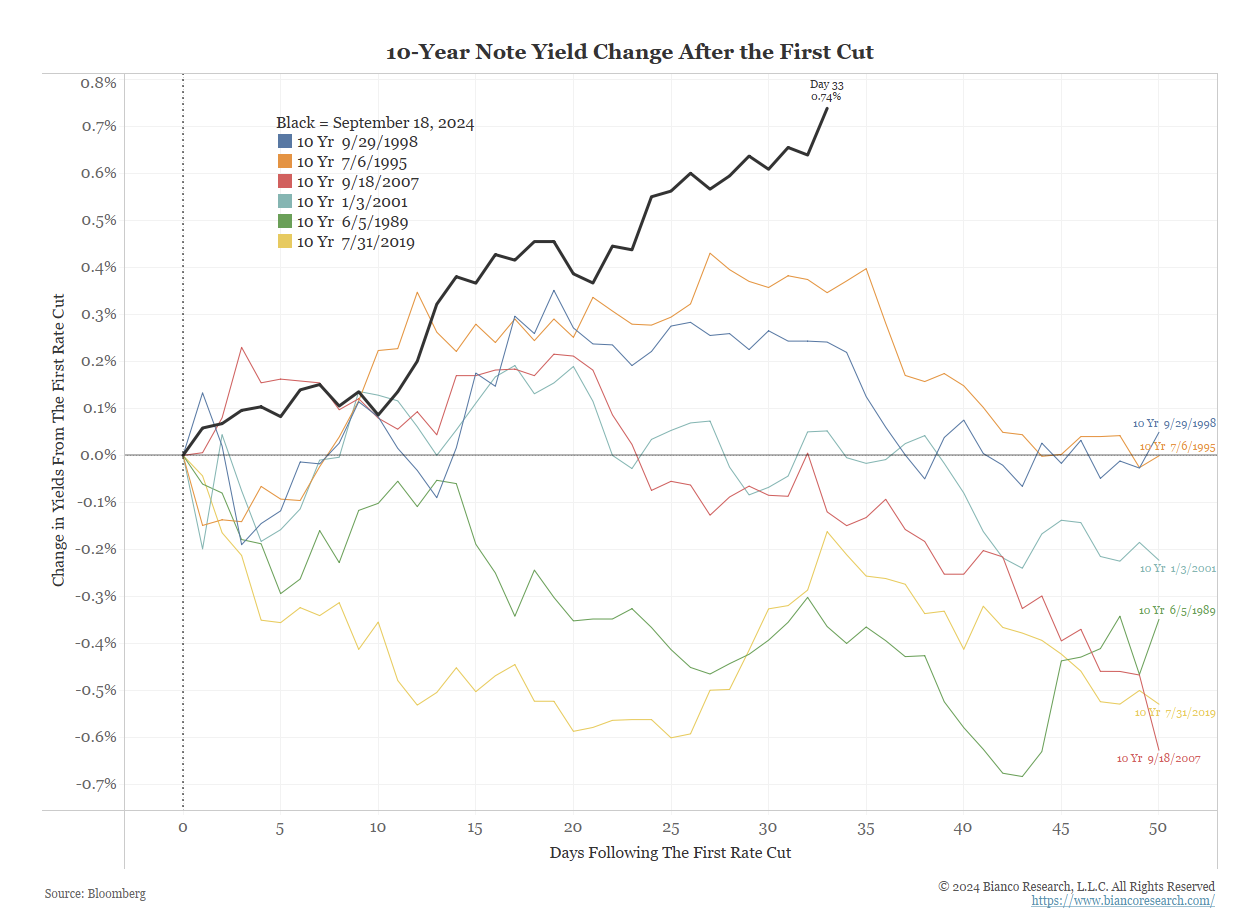

Rates Soar Higher After September Rate Cut

Source: Bianco as of 11.03.2024

Source: Bianco as of 11.03.2024

We’ve gotten numerous questions as to why 10-year yields have risen drastically given recent rate cuts. Remember the historical yield curve spreads showed the market was already fully priced in a slew of rate cuts over the next 12 months. Now that some of that dovishness is being questioned, yields are rising. Putting into context, with a neutral rate of ~3.5%, historical relationships say the 10yr Treasury could be in the 4.5%-5% range.

To Summarize: A higher nominal growth rate signals stronger economic activity and higher inflation, both of which tend to push bond yields up as investors seek compensation for inflation and risk associated with higher growth. With nominal GDP running at 5.7% and money supply growing at 5-7%, the appeal of bonds yielding mid-4%’s seems unattractive.

Taking it a step further, a 4.30% 10yr Treasury yield after tax and inflation is still likely a negative real return. Considering a 40% tax rate, 1.72% (of the 4.30%) goes to Uncle Sam, leaving 2.58%. Then after factoring in the long-term average inflation of 3%, you are left with a real return of -0.42%. Ouch!

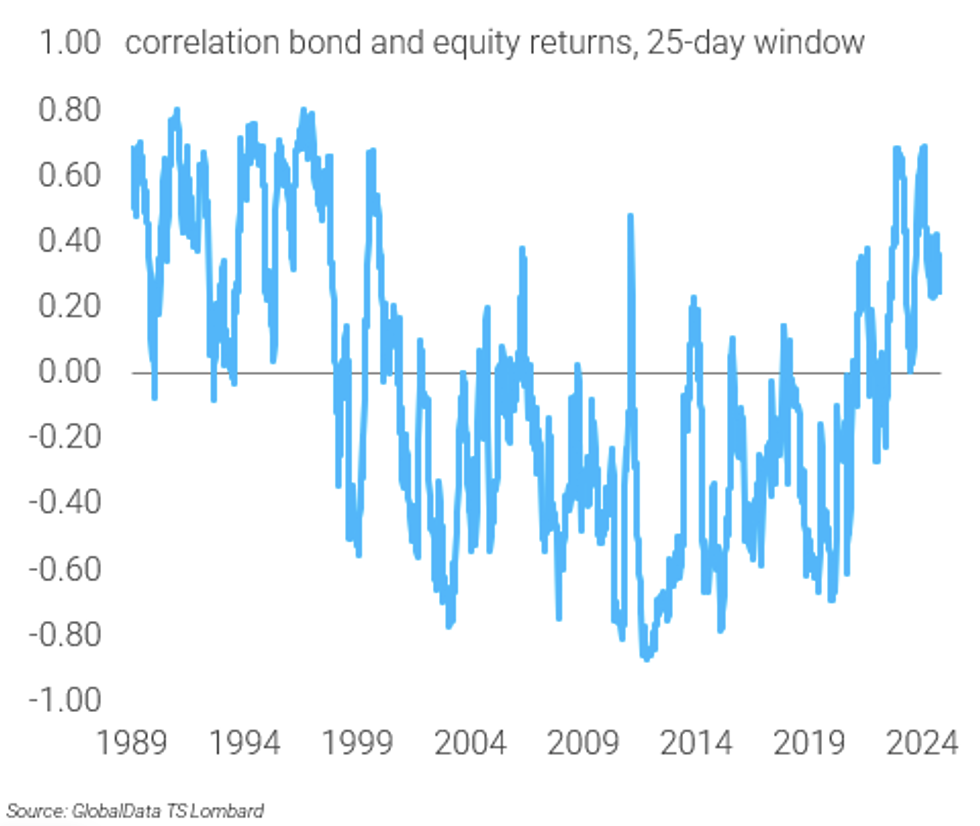

Positive Stock/Bond Correlation Pushes Yields Higher

The term premium is the extra compensation investors demand to hold long duration bonds rather than rolling over a sequence of shorter-dated securities. Historically the term premium has depended on the correlation between bonds and equities, not solely on UST issuance or fiscal policy.

Data as of 11.02.2024

Data as of 11.02.2024

When the bond-equity correlation is negative, bonds have natural hedging properties, and investors are willing to pay an insurance fee to have them in their portfolios (making for a low or even negative term premium). When bonds and equities are positively correlated, those insurance properties disappear, and the term premium widens.

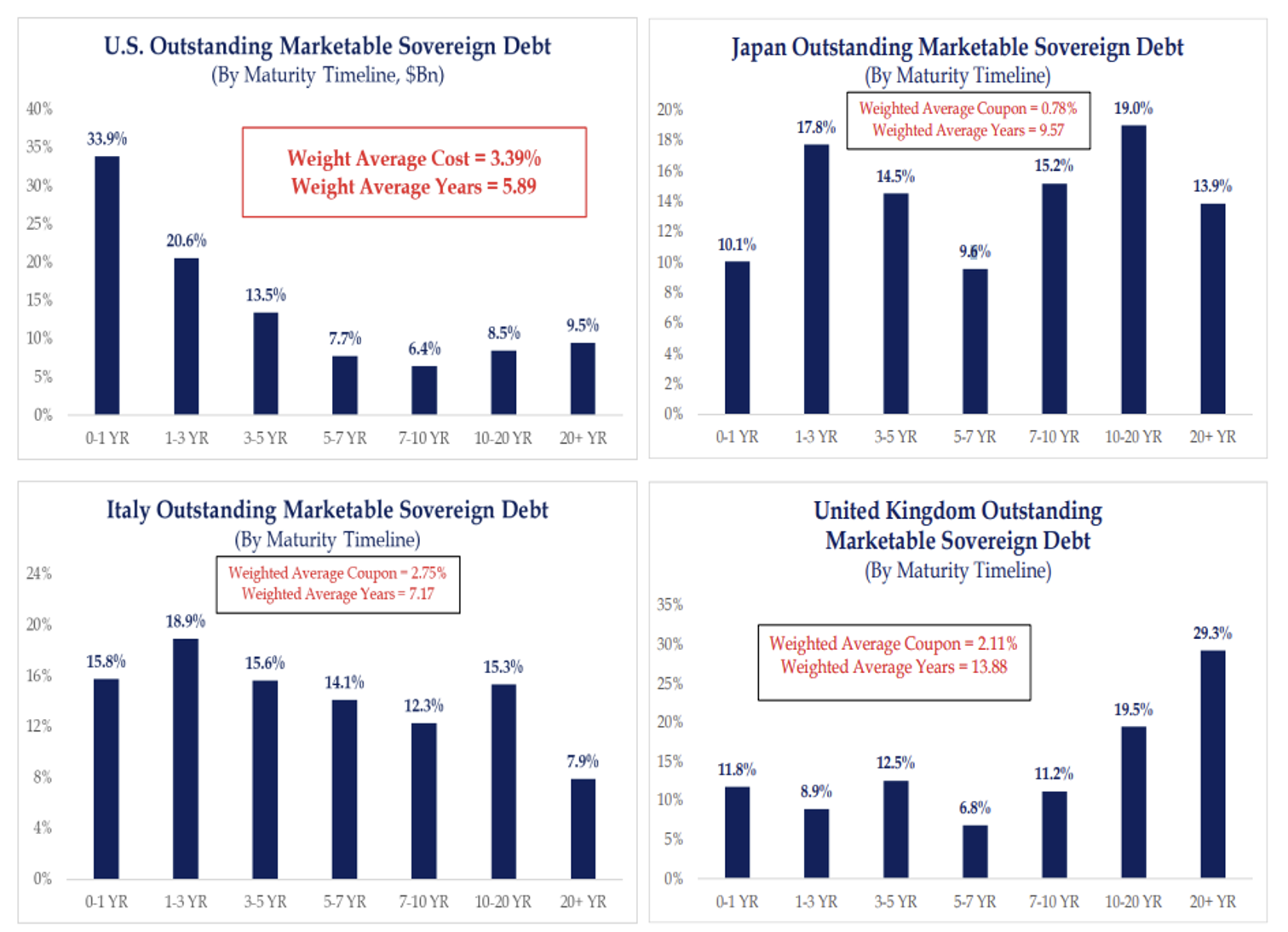

US Debt Maturity Wall Looms

More than 54% of America’s debt matures in the next three years. The weighted average cost of our debt is 3.39%, or a level lower than every part of the current yield curve.

Source: Strategas as of 11.02.2024

Source: Strategas as of 11.02.2024

Without a meaningful decline in interest rates and inflation – or another round of QE – America’s interest expense, already higher than its defense budget, will continue to grow. There are only four ways in the modern world to deal with this potentially vicious circle:

-

- Higher taxes,

-

- Spending cuts,

-

- Higher productivity, or

-

- Accepting a higher rate of inflation as a natural consequence of our spending habits

Surprising to most, the US debt maturity wall is more concerning than many other highly indebted countries like Japan, Italy, and the UK.

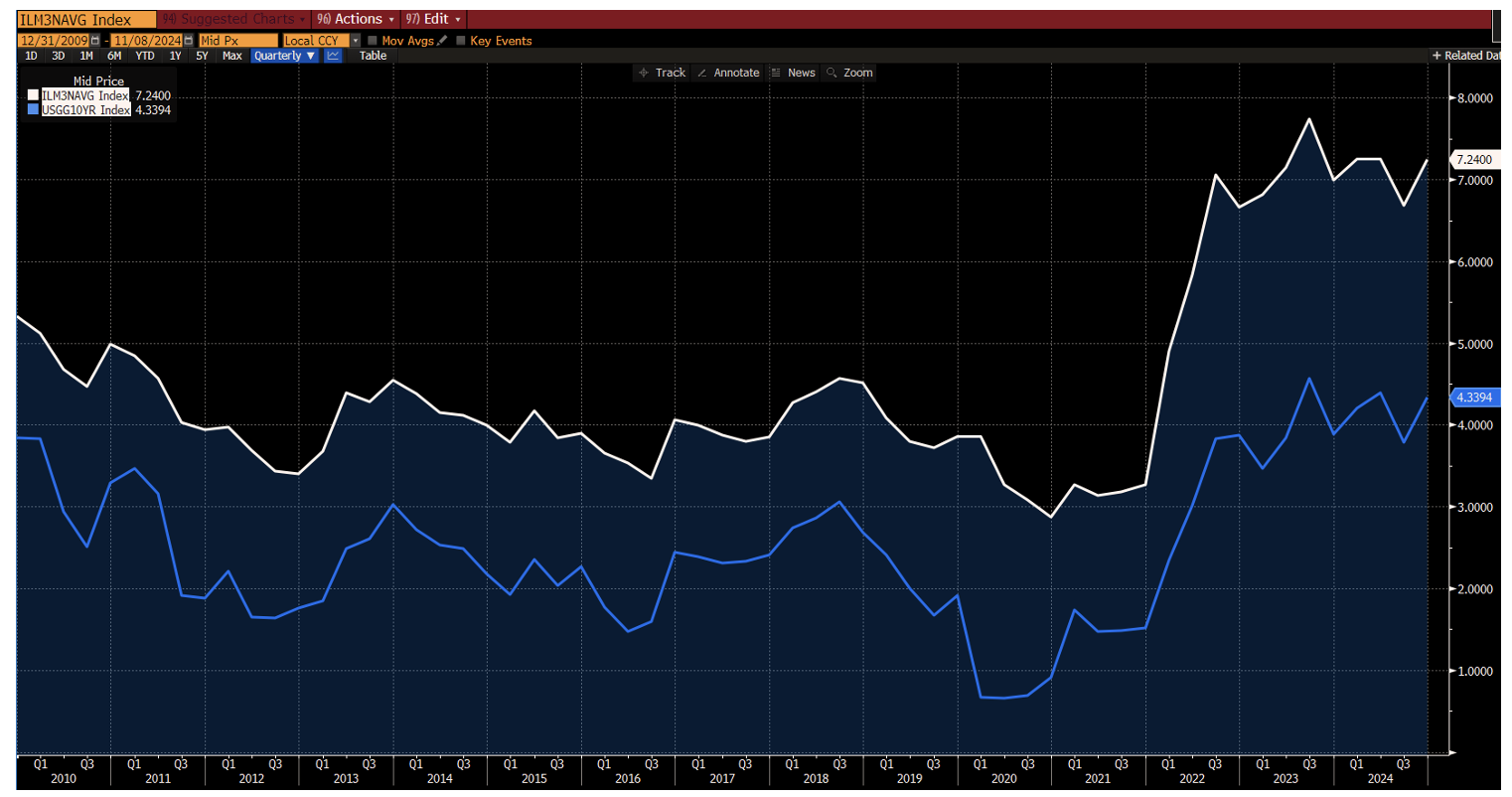

Mortgage Rates Remain Elevated… but There is a Silver Lining

The typical spread between the 30-year mortgage rate and the 10-year Treasury yield is generally around 1.5% to 2% (150 to 200 basis points). Currently, the spread is ~290bps.

Source: Bloomberg as of 11.03.2024

Source: Bloomberg as of 11.03.2024

We believe there are several reasons that spreads are wider, but probably the biggest is the lack of central bank purchases. In addition to central banks selling bonds instead of buying, interest rate volatility has also spiked.

Higher mortgage rates are undoubtedly hurting housing market activity. However, the pain appears most acute in existing home sales, as people with mortgages have a “golden handcuff” to their homes. In contrast, new home sales have been strong, hitting two-year highs given that most homebuilders offer buyers discounted mortgage rate incentives.

We think the boom in new home sales will provide some comfort that residential construction employment should remain firm. Construction employment leads to overall employment and the business cycle, and thus, will determine the type of landing the U.S. economy achieves. A slowdown in housing starts usually foreshadows construction job losses.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-13.