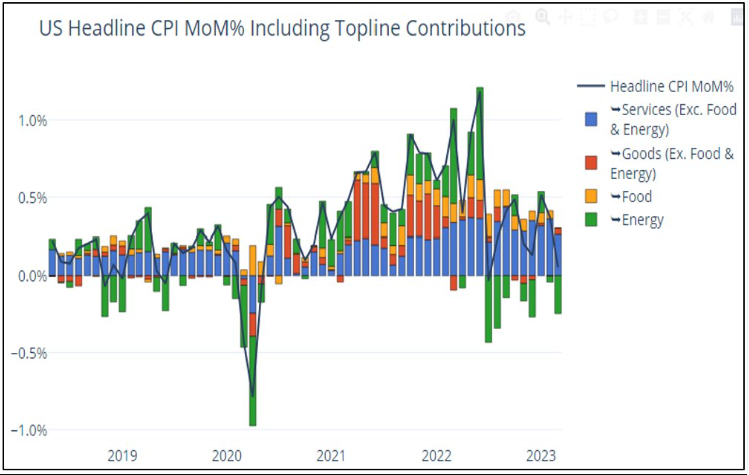

Core CPI was in line with a softer shelter print (shelter/OER came in at 0.45%), but the headline was a little soft as energy declined, food was flat. The big question is how will the Fed view this number?

Source: Macro84. As of 4/12/23.

Source: Macro84. As of 4/12/23.

Core still at 0.4% MoM… that isn’t a low number. Inflation volatility remains high. Considering the print, we’d assume we see another 25bps in May. It’s more progress but enough to stop hiking, we think not.

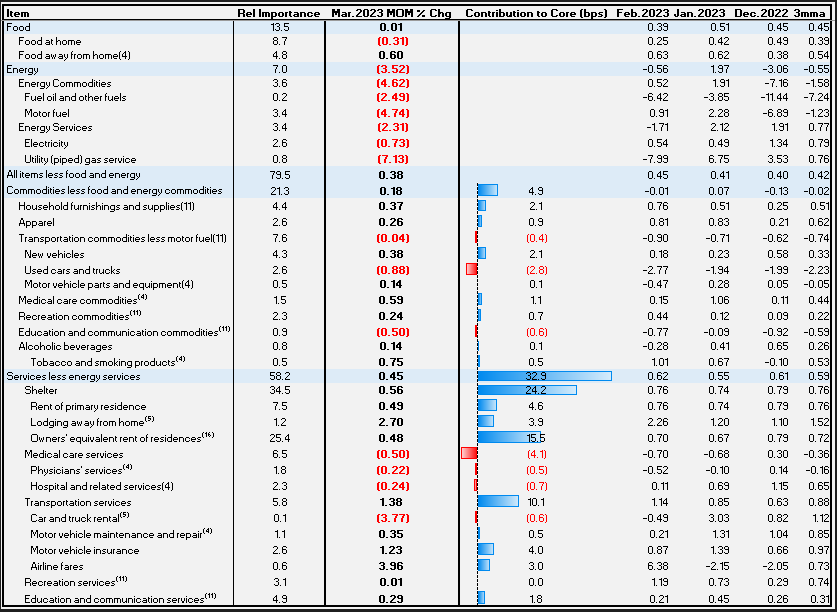

Source: Citadel. As of 4/12/23.

Source: Citadel. As of 4/12/23.

A few important considerations:

- Remember the YoY numbers rolled off a large comp if you recall this time last year marked the start of the Ukraine/ Russia conflict. This helped to bring headline CPI down by a full 1% YoY from last month (6% to 5% YoY).

- Also, energy prices have risen recently which will likely flow into the next couple reports.

- Lastly, used car prices continue to deviate from the Manheim price index (which has remained firm) and is a bit of a head scratcher.

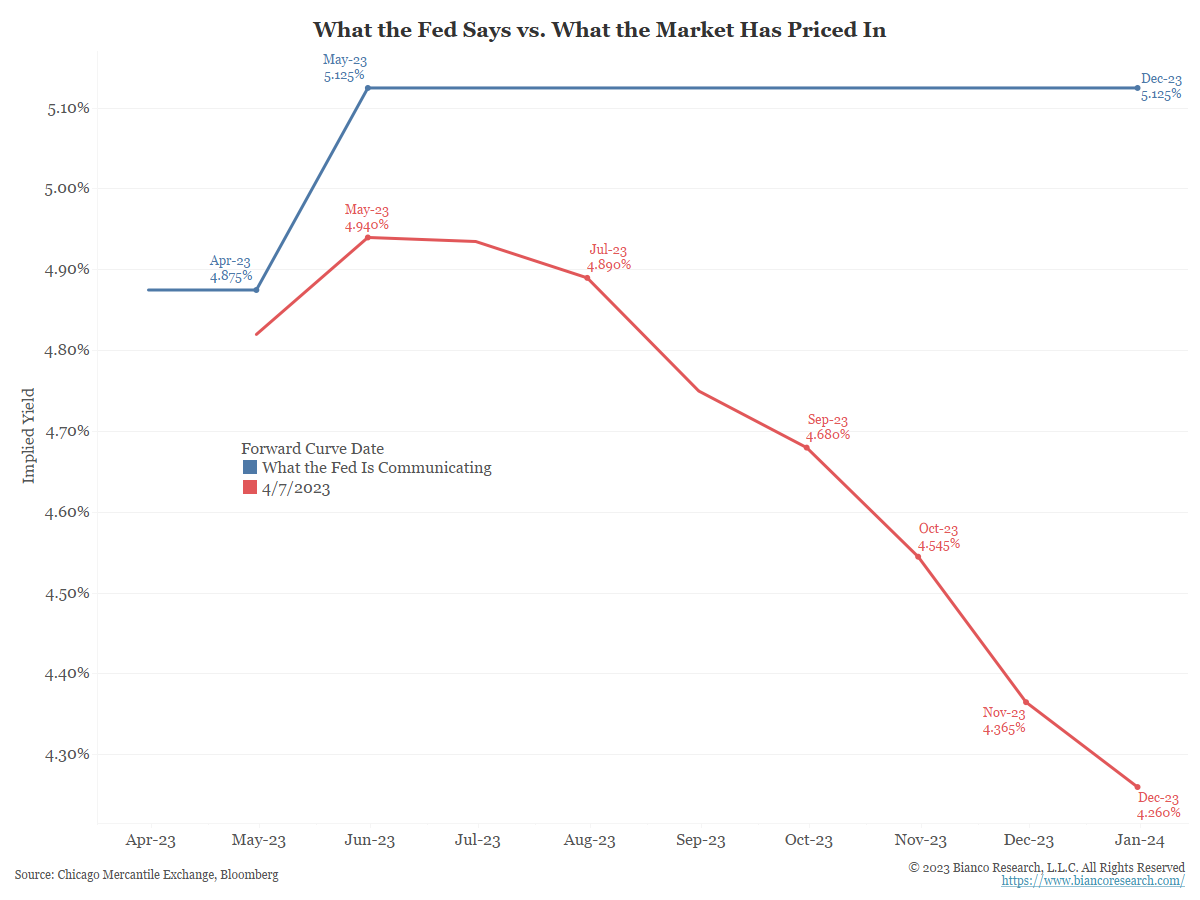

Fed Says Hike and Hold

Market continues to predict several rate cuts this year, when the FOMC says it isn’t even thinking about it. Is it immaculate disinflation or is something breaking to cause these cuts? The tug of war between what the Fed says and what the market perceives will continue. To make matters worse, today’s inflation data didn’t help alleviate the pressure.

Source: Bianco. As of 4/12/23.

Source: Bianco. As of 4/12/23.

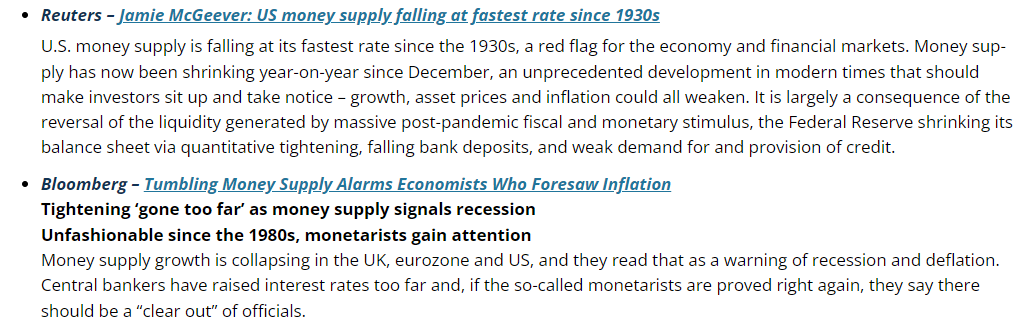

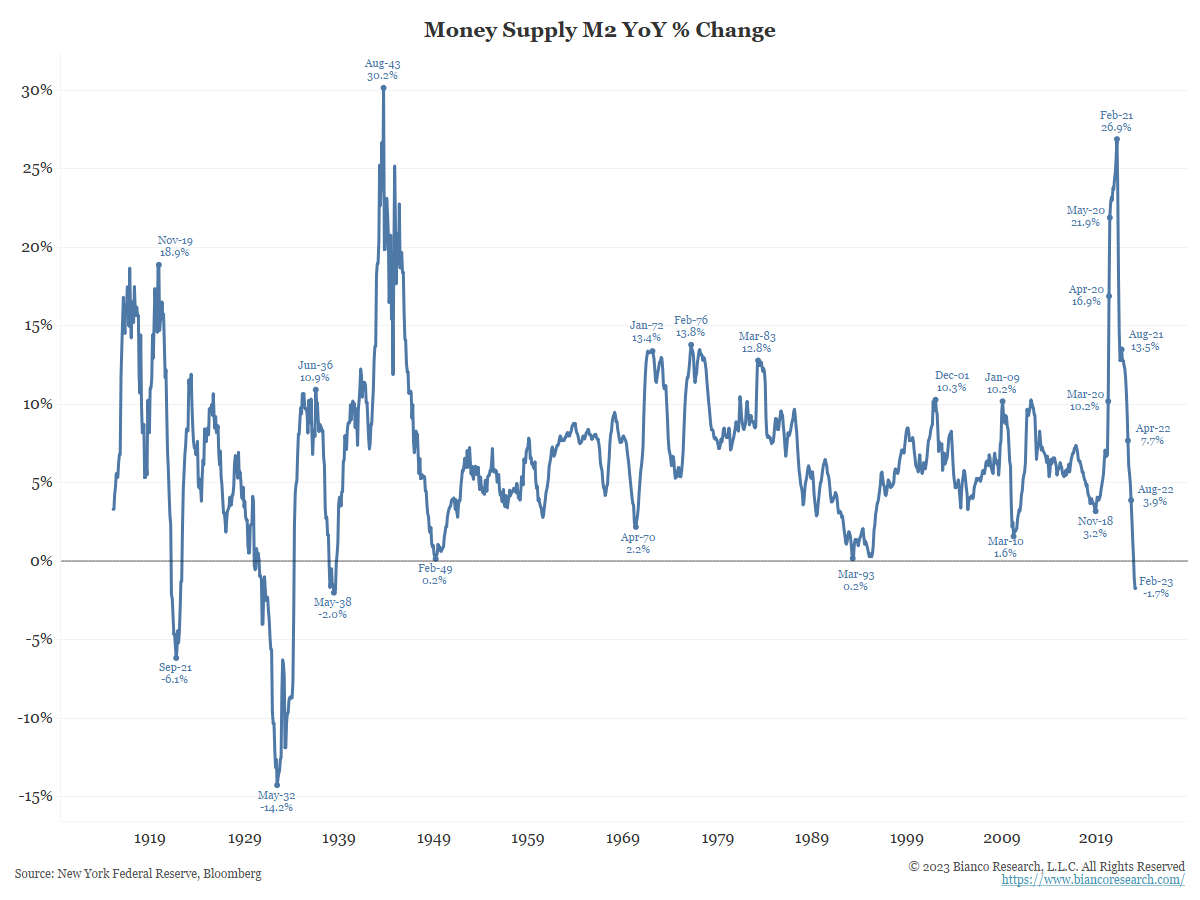

M2 (Money Supply) is Cratering. But is it Really that Scary?

Source: Bloomberg & Reuters as of April 2023

Source: Bloomberg & Reuters as of April 2023

Articles similar to what you see above are at the top of the current news cycle. Money is leaving banks for other higher yielding alternatives. So, the more important question in our mind is: if these components are collectively contracting, where is all the money going?

Source: Bianco. As of 4/12/23.

Source: Bianco. As of 4/12/23.

Four major categories that are not part of M2 which are expanding rapidly:

- Reverse repo (RRP) with the Federal Reserve

- Large time deposits, or CDs of $100k (aka jumbo CDs)

- Institutional money market mutual funds

- Ultra-short fixed-income ETFs

Money is shifting around, but it’s simply investors moving their money into higher yielding vehicles given the shift in rates. This doesn’t necessarily create panic at the banking level as seen with SIVB and other failed banks, but it will likely continue to tighten lending standards as banks focus on resiliency and capital versus loan growth. Ultimately, this should continue to push inflation lower.

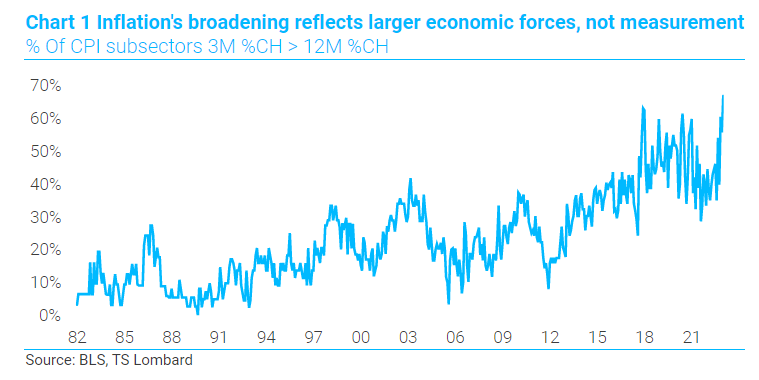

Broad Based Inflation Remains Problematic

Broad-based inflation reflects broader economic factors, not just problems measuring rent. The percentage of CPI sub-sectors where the three-month percent change is greater than the 12-month rate-of-change remains extraordinarily high relative to recent history.

Source: TS Lombard. As of 4/10/2023.

Source: TS Lombard. As of 4/10/2023.

The Fed must tame & anchor inflation (even if it’s in the 2’s vs. exactly 2%). For an economy to thrive, inflation must settle at a level that is low enough where it doesn’t overly influence business decisions and remains anchored so that returning to a neutral policy stance (say a 0.5% real rate) does not cause an immediate reacceleration.

We continue to monitor long-run inflation expectations (market-based measures, NY Fed survey, University of Michigan survey, etc) which we think will be telling on the market sentiment of future inflation.

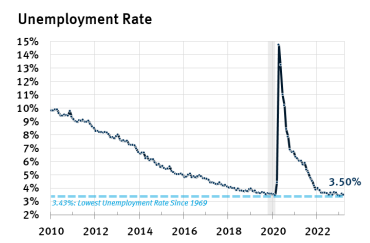

The Unemployment Rate Drops Again!

U.S. payroll employment rose a solid +236,000 MoM in March although there were downward revisions to the prior months numbers. Temporary help employment (a leading indicator) declined -11,000 MoM. The workweek fell to 34.4 hours. The U.S. unemployment rate fell to 3.5%, but that was with labor supply showing up as the participation rate rose to 62.6%.

Source: Stifel. As of 4/10/2023.

Source: Stifel. As of 4/10/2023.

Job openings also declined notably in February (JOLTs). This is helping to close the gap between labor supply & demand which should help alleviate wage pressures. U.S. average hourly earnings were +0.3% MoM and moderated to 4.2% YoY in March.

Bond Volatility Remains Paramount

Daily fluctuations in two-year Treasury yields erupted last month into the widest swings in 40 years. The ICE BofA MOVE Index, which tracks expected swings in Treasuries as measured by one-month options, climbed in mid-March to its highest level since 2008.

Source: Bloomberg. As of 04/10/2023.

Source: Bloomberg. As of 04/10/2023.

We’re also experiencing the largest gap between stock and bond volatility in 15 years as well (i.e., the VIX Index remains muted). Even after things calmed a bit, the MOVE Index remains more than double its average over the past decade.

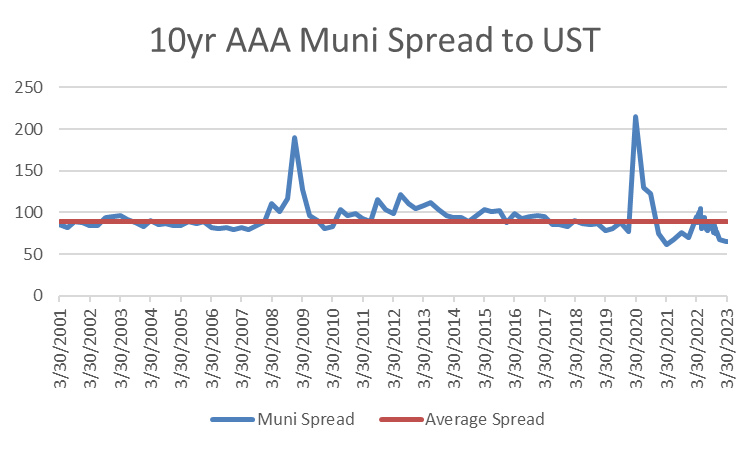

Municipal Bond Spreads are TIGHT!

We gauge the value of municipal bonds based on their spread to a similar duration Treasury bond. When spreads are wide, they are “cheap” and when they are tight, they are “rich”. Following the pandemic and fall of 2020 as yields have risen, the spreads on municipal bonds tightened in as retail and institutional investors looked for high quality tax free income.

Source: Aptus/Bloomberg. As of 4/10/2023.

Source: Aptus/Bloomberg. As of 4/10/2023.

The lack of supply due to pandemic related stimulus and heightened tax receipts from rising asset prices (namely real estate) sucked new issuance supply out of the market. This supply shortage environment continues to be present and in turn spreads remain historically tight on municipal securities. While we don’t see a degradation of municipal credit, we do see the drop in asset values and tax receipts. We believe this will lead to the need for more issuance and ultimately should pressure spreads wider.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2304-18.