The FOMC voted unanimously to leave their benchmark rate unchanged in the target range of 5.25%-5.5%.

Source: Bloomberg as of 03.20.2024

Source: Bloomberg as of 03.20.2024

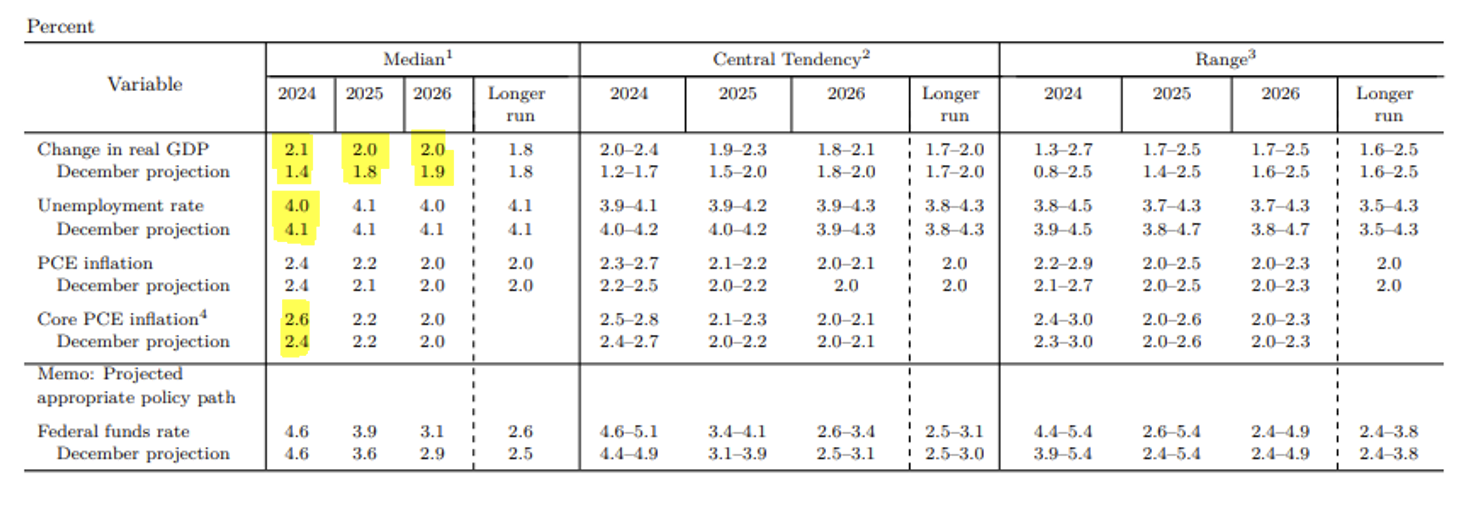

The big surprise was the willingness of the Fed to maintain their projection for 3 rate cuts in 2024 even on the back of improved economic data. The Fed increased their expectation for higher growth, and higher core Inflation in 2024 along with lower unemployment.

The Data:

Source: Fed as of 03.20.2024

Source: Fed as of 03.20.2024

- 2024 GDP forecast to increase to 2.1% from 1.4% in December. Their estimate of the long-run growth remained at 1.8%.

- The median 2024 Core PCE Inflation estimate was revised up 0.2% to 2.6% vs. 2.4% in December.

- 2024 Unemployment rate forecast cut to 4.0% from 4.1% in December.

It does appear that the Fed’s tolerance for accepting higher inflation for a longer period has increased. Chair Powell reiterated multiple times during the presser that the Fed would get “inflation down to 2% in time”. The question of “for how long” remains key!

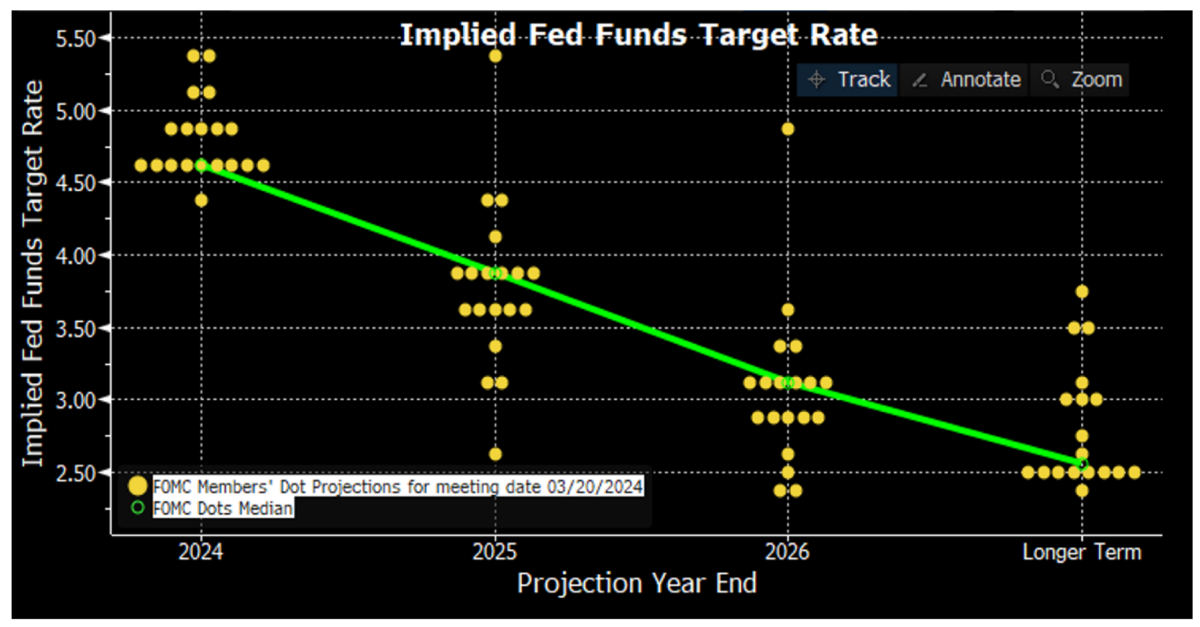

Interpreting the Dots

- FOMC Median Forecast Shows 75 Bps of Rate Cuts in 2024 to 4.6%

- FOMC Median Rate Forecast for 2025 Rises to 3.9% From 3.6%, a decrease of 1 cut versus previous projections.

The median dot for the long-run Fed Funds rate moved up 10bps from 2.5% to 2.6%. We’d chalk this up to improvements in supply-side factors as well as productivity improvements and increased immigration.

Following the meeting, the rates market sees about a 70% chance of a rate cut by June, and three cuts in total for the year. It does appear the threshold for cuts remains elevated, while the thought of another hike isn’t even in the cards at this point.

Balance Sheet

Chairman Powell recognized the $1.5 trillion reduction in the Fed’s balance sheet as a large accomplishment. He did emphasize that they were “fairly close” to slowing the pace of reduction although they had made not any decisions at this point.

Conclusion

The Fed wants to see more inflation data like we saw in 2H of 2023, and less data like we’ve seen to start 2024. Chair Powell reiterated the need to have confidence that inflation is sustainably coming down to 2% before cutting (specifically making the point they wouldn’t wait for inflation to be at 2% before cutting). While long-term inflation measures remain within comfortable levels, the shorter run we’ve seen nearer-dated measures rise as financial conditions loosen with markets at all-time highs.

Overall, a pretty dovish tone from Powell to not adjust rate cut expectations lower in 2024. Markets responded favorably, with stocks higher and front-end rates slightly lower while the yield curve steepened. As we’ve continued to say, it’s unlikely we see bad enough data quickly to see the Fed drastically change its path.

Ultimately, I think in this meeting we saw a shift in priority of the Fed’s mandate. They are choosing to focus on the 3rd (unstated) mandate of financial stability instead of inflicting pain by bringing inflation all the way back down to 2%. After a few iffy Treasury auctions the last couple of weeks, the Fed sees the need to ensure the government has the ability to offload Treasuries onto the market and fund the gov’t without destabilizing markets as a higher priority than aggressively smashing inflation. It’s a bold move, Powell.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-27.