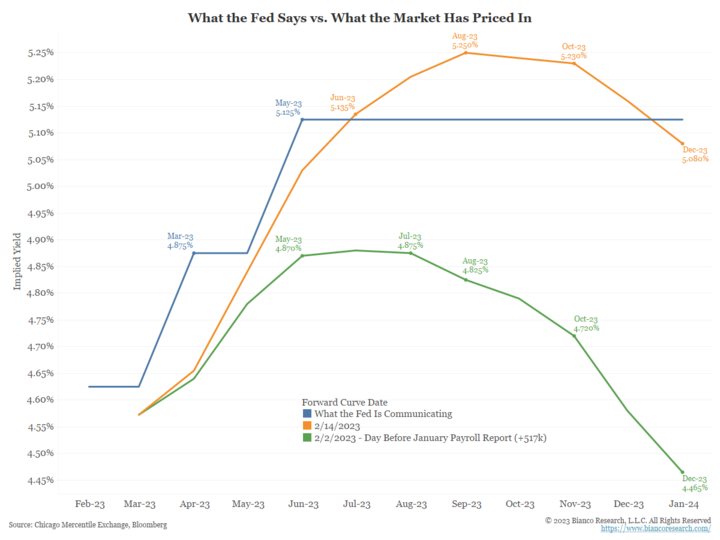

The blue line below is what the Fed is communicating per their DOT plot, on the terminal rate going to a range of 5.00% to 5.25%. The orange line is yesterday’s Fed Funds curve (following CPI). The market expectations for the Fed Funds rate is finally rising to the level of Fed communications (and actually slightly above it). The green line is the Fed Funds curve the day before the payroll report, less than two weeks ago.

Source: Bianco, as of 02.15.2023

This is a massive change in Fed expectations in just 12 days. We believe for the first time this entire hiking cycle, the market is pricing relatively close to what the Fed is suggesting. No more “pivots,” “pauses,” or “step downs.” The market is pricing a 100% probability the Fed will hike 25 basis points on March 22, to 4.75% to 5.00%.

Assuming the March 25 basis point hike, the market is pricing an 83% probability of another 25 basis point hike 5.00% to 5.25% on May 3 which would bring the rate to the Fed’s current communication target.

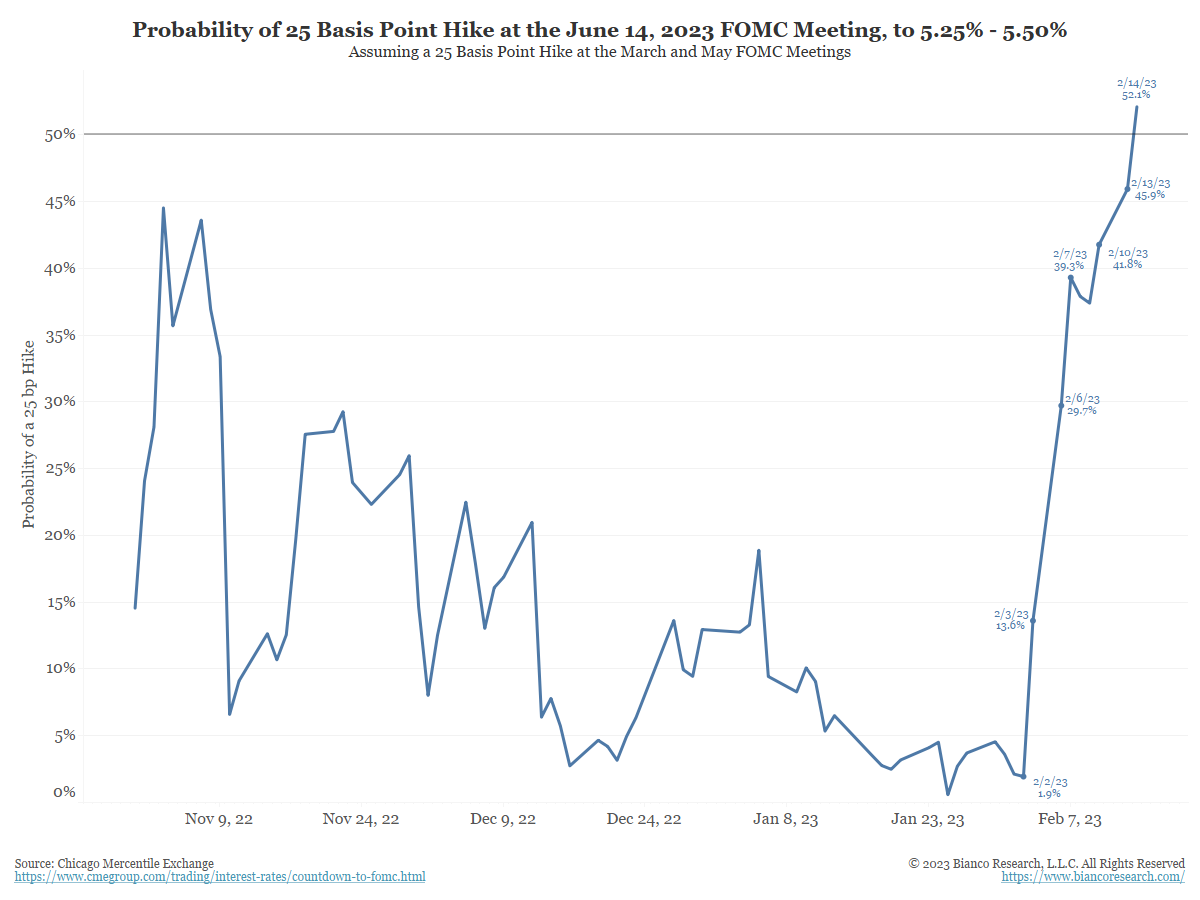

The Market Expecting the Dot Plot to Update… HIGHER?

The market is also pricing in a higher probability of another 25 basis point hike on June 14th. Yesterday, (post-CPI) the probability crossed above 50%. This is above the current Fed’s communicated target.

Source: Bianco, as of 02.15.2023

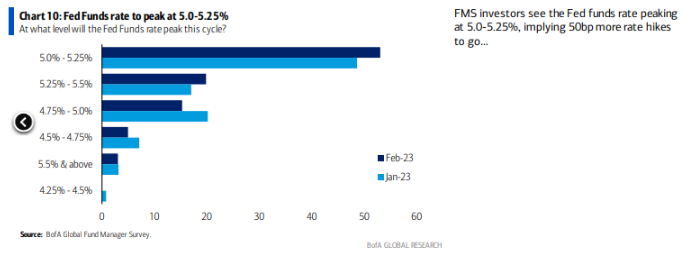

This goes contrary to the recent February BofA Global Fund Manager’s survey released yesterday morning, showing only 23% think the Fed will go above 5.00% to 5.25%. So, the market pricing detailed above has the terminal rate higher than 75% of the fund managers in this survey, covering 273 managers with over $750 billion of AUM and was conducted from February 2 to February 9.

Source: BAML, as of 02.14.2023

Higher Terminal Might be the Right Call

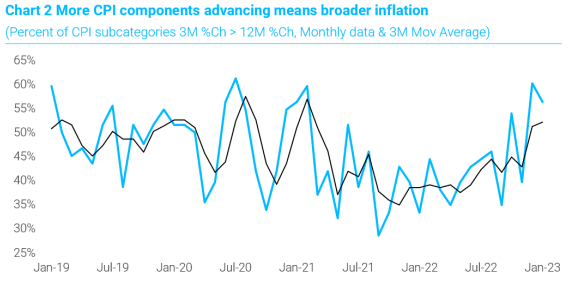

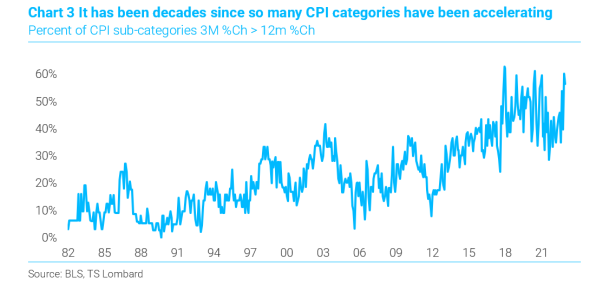

TS Lombard runs a diffusion index showing the January CPI data (percent of CPI sub-categories with 3M rates of change greater than their 12M % Change) that remains elevated and has been climbing since summer.

Source: TS Lombard, as of 02.14.2023

To underscore just how broad of an inflation problem the Fed is dealing with, here is the same chart covering the diffusion index since 1982:

Source: TS Lombard, as of 02.14.2023

Sticky Inflation Remains the Talk of the Times

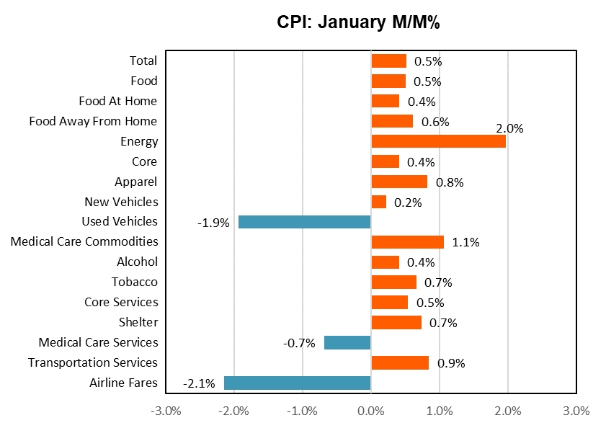

The 3-month annualized core CPI ticked up to 4.6%, moving away from the Fed’s 2% target. And the Fed’s preferred gauge – core PCE inflation – will be slower to fall, given its smaller weight for still-sticky shelter, and different methodology for health care. This could confirm higher for longer.

Source: Piper, as of 02.14.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-20.