The Fed delivered a 25bps hike as was broadly expected by markets. They made a modification in their statement omitting the wording regarding the necessity of further rate hikes. To us, this indicates a sort of “hawkish” pause in policy here at the 5-5.25% FFR level where they lean towards a weak bias of future hikes not cuts.

The Fed will want to see the implications on the economy from the elevated level of interest rates (and the lag of hiking). The Fed does expect the large increase in interest rates over the past 14 months to lead to slower economic growth and tighter credit conditions for households. In addition, the banking pressures will help the Fed in further tightening credit and financial conditions on households.

Inflation remains elevated and unemployment remains low. While the economy is showing some signs of slowing, it is still expanding, and inflation is above target. The Fed remains committed to bringing inflation back down to 2%.

There were no dissents and no change to the current QT policy.

Former Chairman Bernanke once made the comparison that monetary policy is the nail, and the Fed is the hammer. Even if they (the Fed) don’t “hit the nail” they want the market to know they have their hand on the hammer.

To us, the message was clear, they will be data dependent on further hikes (although the bar is high for further tightening) but the main takeaway is they aren’t cutting rates anytime soon.

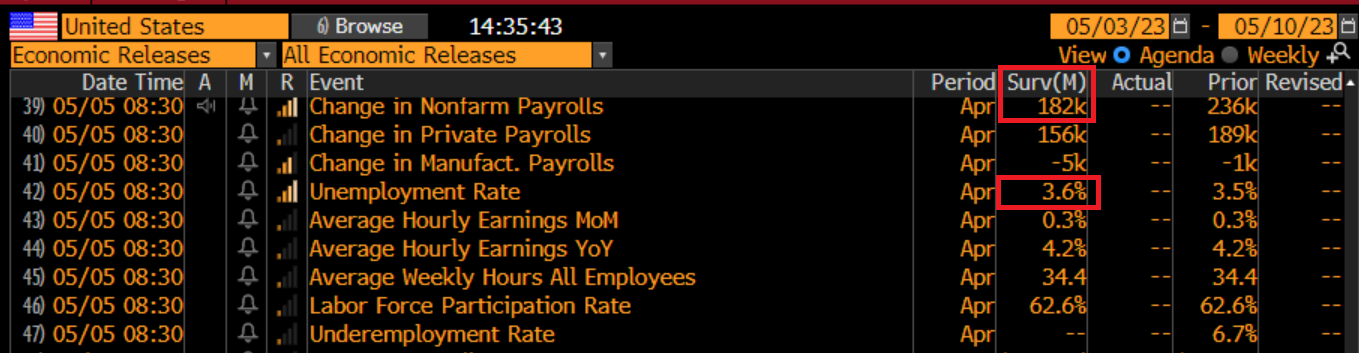

Source: Bloomberg. As of 5/3/23.

Source: Bloomberg. As of 5/3/23.

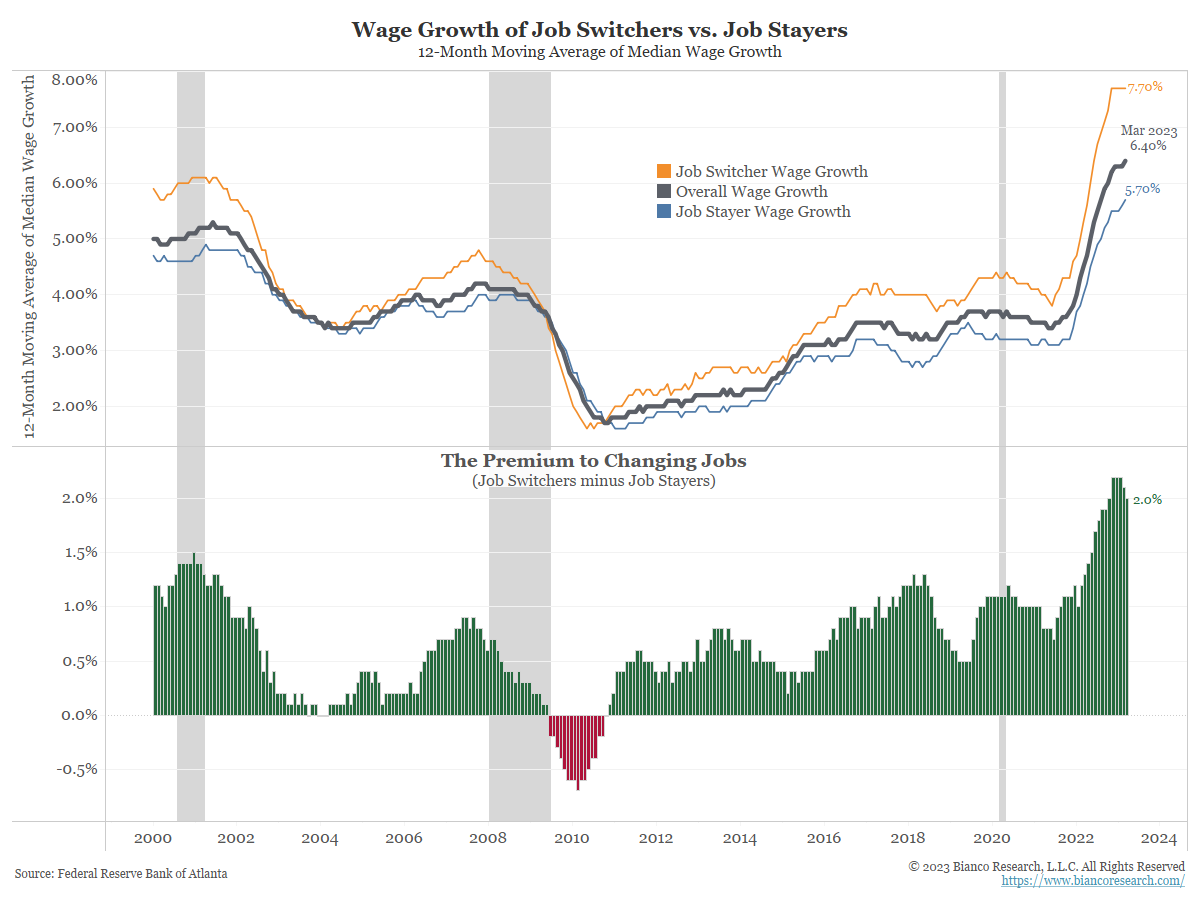

Source: Bianco. As of 4/1/23.

Source: Bianco. As of 4/1/23.

Coming Soon

The NFP jobs number comes on Friday and is likely to continue to show a relatively tight jobs market and low unemployment number (jobs add of 182k and 3.6% unemployment). Elevated jobs prints will continue to reiterate the need for “higher for longer” as wage inflation is still worrisome (currently at 6.4% as measured by the ATL Fed).

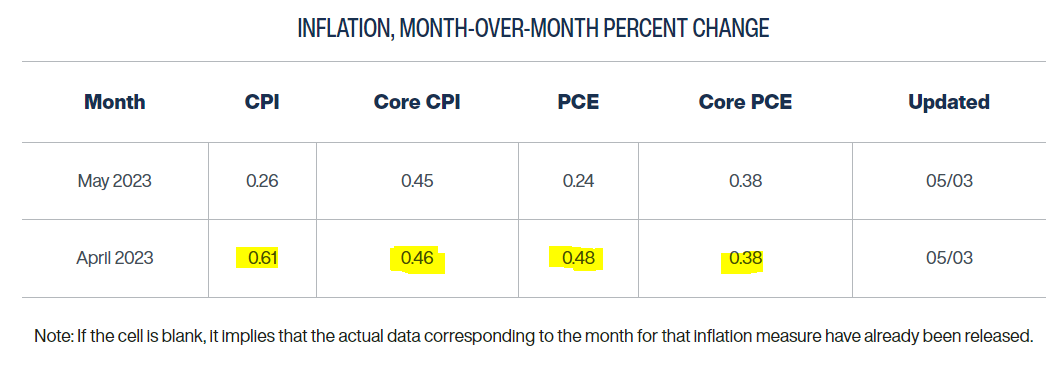

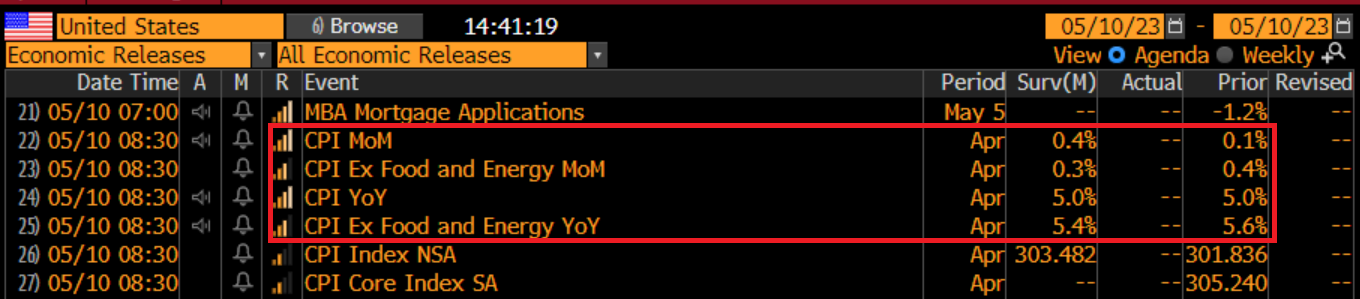

In addition, the next CPI data comes on 5/10. Highlighted in the Cleveland Fed Graphic #1, their estimate on the monthly print for both Headline and Core Inflation data are notably higher than Bloomberg estimates shown in Graphic #2. This will be interesting as the Headline data will account for the large oil spike following the surprise OPEC production cut last month.

Graphic #1

Source: Cleveland Fed. As of 5/3/23.

Source: Cleveland Fed. As of 5/3/23.

Graphic #2

Source: Bloomberg. As of 5/3/23.

Source: Bloomberg. As of 5/3/23.

Remember, the YoY Headline CPI prints have moved down drastically due to large comps from last year. As we get to the end of the summer, the comps fall drastically as we’ve pointed out many times before (ask if you want to see the graphic). This means it is likely that inflation rates will stay high on a YoY basis…overall this is a concerning development and will be the moment of truth for the Fed.

Lastly, with money markets and T-bills getting another boost, we continue to see a flood of checking account cash at low rates flow into high yielding cash alternatives, providing significant value for clients. Please allow us to help you present these types of opportunities to your clients!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-7.