Peak Inflation… Think Again!

Source: Bianco Research. As of 6/10/22

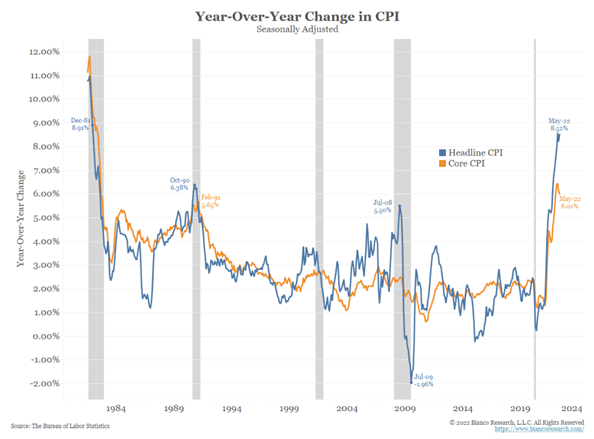

CPI rose 1.0% MoM and 8.6% YoY (a new high) in May. The core CPI again surged 0.6% MoM and 6.0%

YoY. Inflation looks to be broadening…

The Bones of the Report

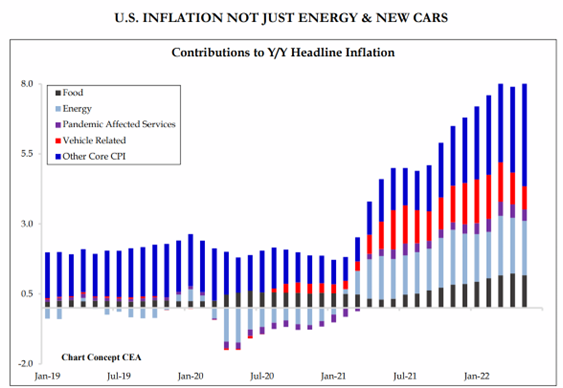

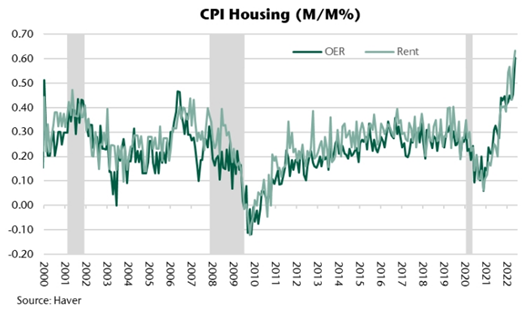

May’s report saw Rents and OER both increase by 0.6% month over month (MoM). This was the largest monthly increase for OER since 1990. In addition, Food inflation accelerated by 1.2% MoM which is the largest increase since April 2020 (lockdown frenzy). Energy services posted its largest MoM increase of this cycle at +3.0%. The more volatile components of the CPI exacerbated the upward pressure in May. Energy goods rose 4.5% MoM, used car prices rose 1.8%, new car prices rose 1.0%. Airfares also posted another red-hot increase of 12.8% MoM (that’s on top of a 30% increase in the prior two months).

Source: Strategas. As of 6/10/22

The problem is the broad-based pressures extend far beyond food and energy. Within core, there’s been a clear handoff from goods to services, which could crush hopes that an easing supply chain pressures will “fix” the inflation problem.

Core goods inflation is in fact slowing on YoY basis as it has decelerated from 12.3% in Feb to 8.5% in May. However, at the same time, service inflation, which has a much higher weight in the CPI basket and is stickier, has accelerated from 4.4% to 5.2%.

Were there Any Positives?… Meh…

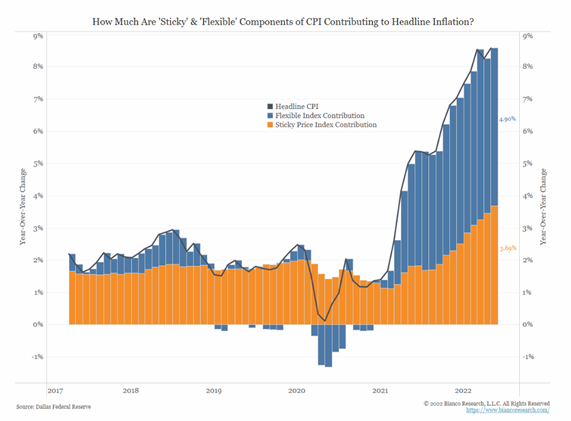

We did see a notable slowdown in furniture and appliances, which were up just 0.1% MoM, the smallest increase since last summer. This is a function of the inventory buildup, but it’s clearly not enough to offset pressures elsewhere. The swings in gas prices or used car prices could be explained away as transitory, but the jump higher in shelter costs will grab the Fed’s attention. While one month’s number can be overlooked, sticky costs such as housing continue to head in the wrong direction and remain very problematic for the Fed. Of the 8.6% year-over-year increase in CPI, 3.69% came from the more stable components of the index.

Source: Bianco Research. As of 6/10/22

Source: Jefferies/Haver. As of 6/10/22

Can Inflation Go Down on its Own… Doubtful!

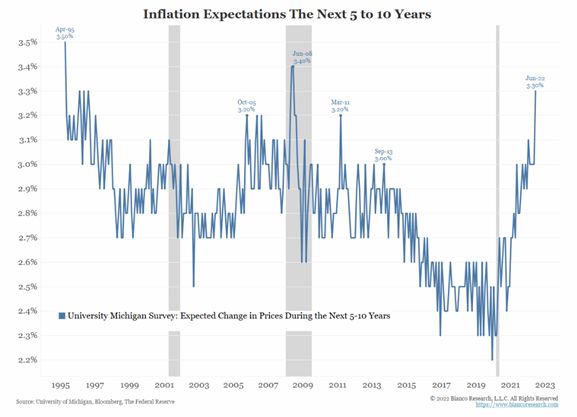

The University of Michigan’s Consumer Sentiment Survey showed just how badly the consumer is hurting right now. The June 2022 print, released on Friday, fell to its lowest level ever over its 70-year history. Maybe more importantly, the survey also shows the inflation expectations over the next 5 to 10 years broke out to the highest level since June 2008 and its second highest reading in 28 years.

Source: Bianco Research. As of 6/10/22

Inflation’s Impact on the Consumer

- In the short run (weeks/a month), household savings can offset a surge in commodity prices.

- Credit can also be used to offset a short-term spike. Revolving consumer debt has been trending up.

- If a surge in commodity prices lasts several quarters or more, pressure builds.

- The stress on income then acts with a lag of up to a year, as contagion filters thru the economy.

- Firms respond with job cuts as input costs rise, and personal income is cut further.

- Leveraged players can be at particular risk as income is cut.

- We’re still watching the U.S. yield curve & credit spreads for clues on financial contagion / recession.

- Today, the surge in inflation is making bonds less able to hedge stocks, as they did previously.

Cost of Living Marches Higher… Evident in Food Prices

We’ve seen a recurring theme of companies communicating the burden of higher prices to their operations. Food makers like Mondelez International Inc., maker of Oreos and other snacks, spoke recently about the cost of transporting raw materials from farms and factories to distributors and retailers. In our opinion, this is a recipe for higher grocery bills for consumers. Their CFO said its overall input costs will be up about 10% to 13% this year, with energy prices adding to the cost of transportation, ingredients, and packaging. “It is predominantly related to energy costs and the ripple effect that energy costs have throughout our commodity basket”. Mondelez doesn’t expect prices to decrease going into 2023, he said.

Source: Bianco Research. As of 6/10/22

To Sum it Up

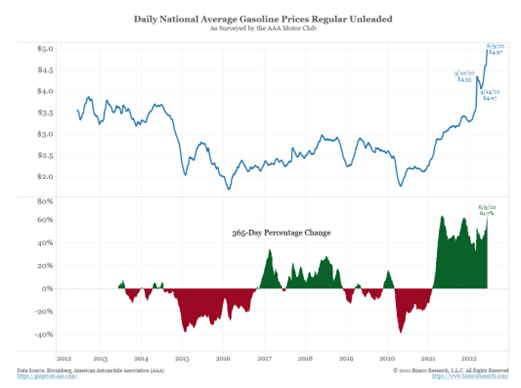

NYMEX gasoline futures are implying that energy goods prices will increase by 11.7% MoM next month, which will add 0.6% to the June CPI. That likely means another 1.0% headline print, which would push YoY inflation to 8.7%. The persistence of headline inflation raises the risk that it will feed through to longer term inflation expectations (even more than it already has). The reacceleration in MoM core CPI increases is very concerning for the Fed.

With the pressure clearly rotating from core goods to core services, the thesis that easing supply chain pressures will “fix” inflation is looking increasingly questionable. At some point, the Fed will have to acknowledge that inflation is sticky, that it’s unlikely to go away on its own, and will require a more aggressive response. We believe, over the last 2 trading days, the bond and stock market has begun to price in a VERY aggressive Fed over the near term.

The Fed Has to Respond

We have been a broken record on this, but the Fed will have no choice but to continue hiking until inflation begins to recede. The Fed put is dead (for now). The markets understand this, which is why stocks are taking a beating the last two trading days (S&P 500 down -6.67% & the Barclays Aggregate are down -2.4% since Friday 6/10).

Source: Bloomberg LP. As of 6/13/22

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities.

The Michigan Consumer Sentiment Index (MCSI) is a monthly survey of consumer confidence levels in the United States conducted by the University of Michigan. The survey is based on telephone interviews that gather information on consumer expectations for the economy.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-14.