→ FED SAYS UNCERTAINTY ABOUT OUTLOOK HAS ‘INCREASED FURTHER’

→ FED: RISKS OF HIGHER UNEMPLOYMENT, HIGHER INFLATION HAVE RISEN

→ FED HOLDS BENCHMARK RATE IN 4.25%-4.5% TARGET RANGE

Source: Bloomberg as of 05.7.2025

Source: Bloomberg as of 05.7.2025

The Fed has cut the fed funds target rate 100bp since September 2024 but held rates steady for a 3rd straight meeting, and emphasized they see a growing risk of both higher inflation and rising unemployment. The word of the day was “wait” where Powell said some variation of the word 22 times in his press conference, in reference to waiting for more data.

Policy uncertainty surrounding tariffs, tax cuts, inflation, and immigration has sidelined the Fed until the effects become clearer. The labor market and economic activity cooled in the first quarter of 2025, particularly due to tariff uncertainty. Inflation is still cooling, but short run price increases from tariffs put further progress in question.

The Fed downplayed recent weakness in the Q1 real GDP data, stating net export swings as an excuse (we agree), and described U.S. economic activity as “solid” (also agree). The Fed does not want to move pre-emptively given how fluid the U.S. economic situation appears. Pausing a while longer buys time to see the effects of the recent tariff shock.

Ultimately, the Fed offered minimal guidance on what comes next for monetary policy (however, markets are pricing slightly over 3 cuts for 2025). If inflation picks up over the course of summer, the next opportunity to cut rates could be pushed out longer than markets are currently pricing.

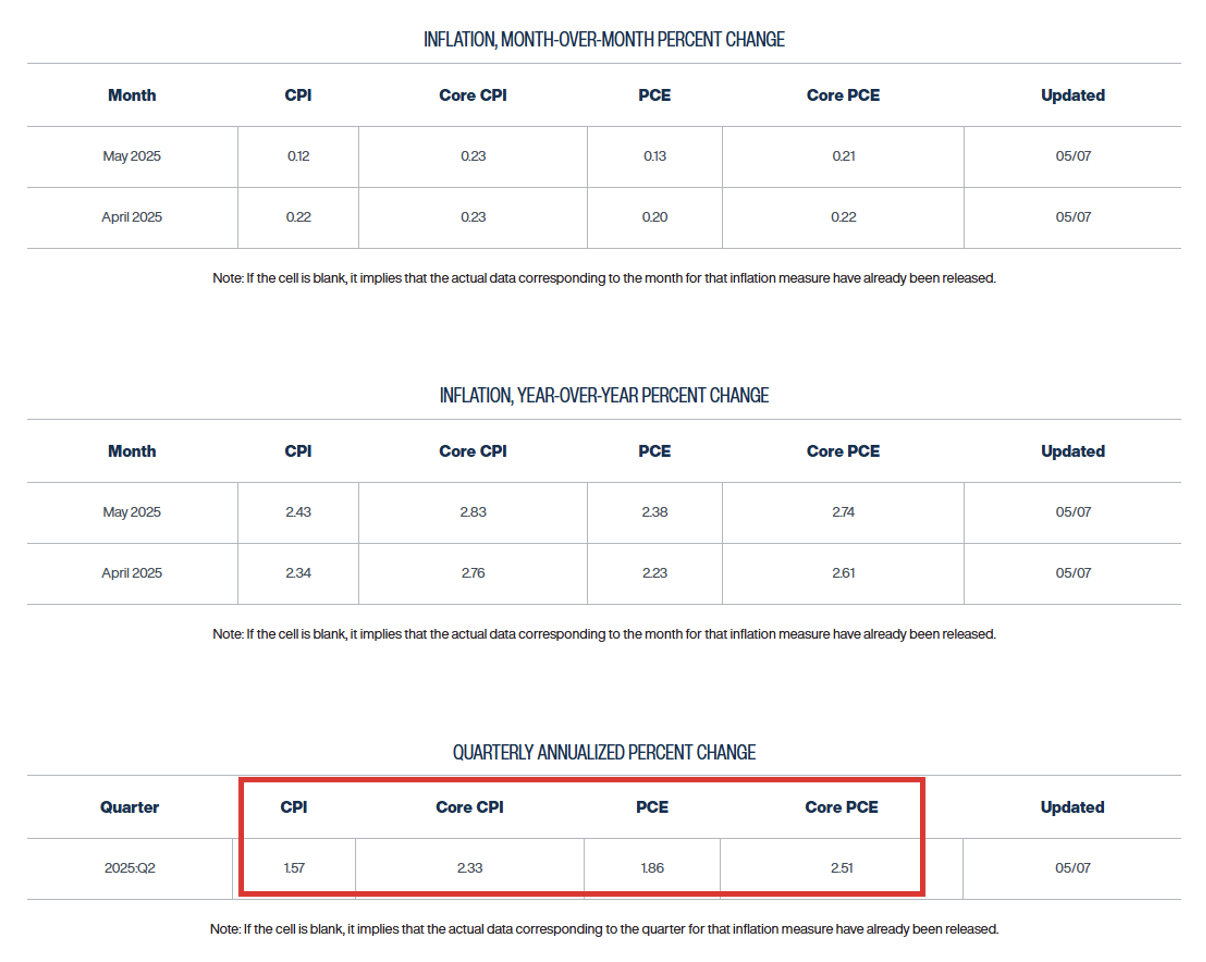

Cleveland Fed Inflation Forecast

I constantly monitor the Cleveland Fed’s Inflation Nowcast for the direction of inflation in real time. With the next inflation report coming up next week (5/13), another jobs report in early June, and the next Fed meeting on June 18th, there is a brief window for soft enough data to get the Fed to consider a June cut.

Markets are only pricing a ~30% chance of a cut, but these odds have moved drastically over the past month given market vol. Looking at the Cleveland Fed’s forecast, the shorter term (quarterly annualized) gives a good idea of the short-term trend.

Source: Cleveland Fed as of 05.07.2025

Source: Cleveland Fed as of 05.07.2025

As you can see in the red box, headline numbers are comfortably below the 2% objective (weak energy prices helping tame prices), but the Core numbers continue to hold above target (unfortunately, these are the ones that matter to the Fed).

With the Fed basically committing to not being proactive with cuts (hence the “waiting” message), it really begs the question of whether the Fed will wait for the Core numbers to post below 2% squarely or do they just need to see a report or two (remember March report was weakest since 2022) to change their tune?

Shelter Inflation: CPI Data Continues to Lag “Real Time” Data

Real-time inflation data continues to point to lower prices, specifically regarding the shelter category. As the data SLOWLY works its way through to the official CPI shelter calculations, it should continue to help pull inflation readings lower. This has been in the cards for multiple years now, but fortunately could finally come to the Fed’s aid in getting inflation back to target.

Source: Doubleline as of 04.30.2025

Source: Doubleline as of 04.30.2025

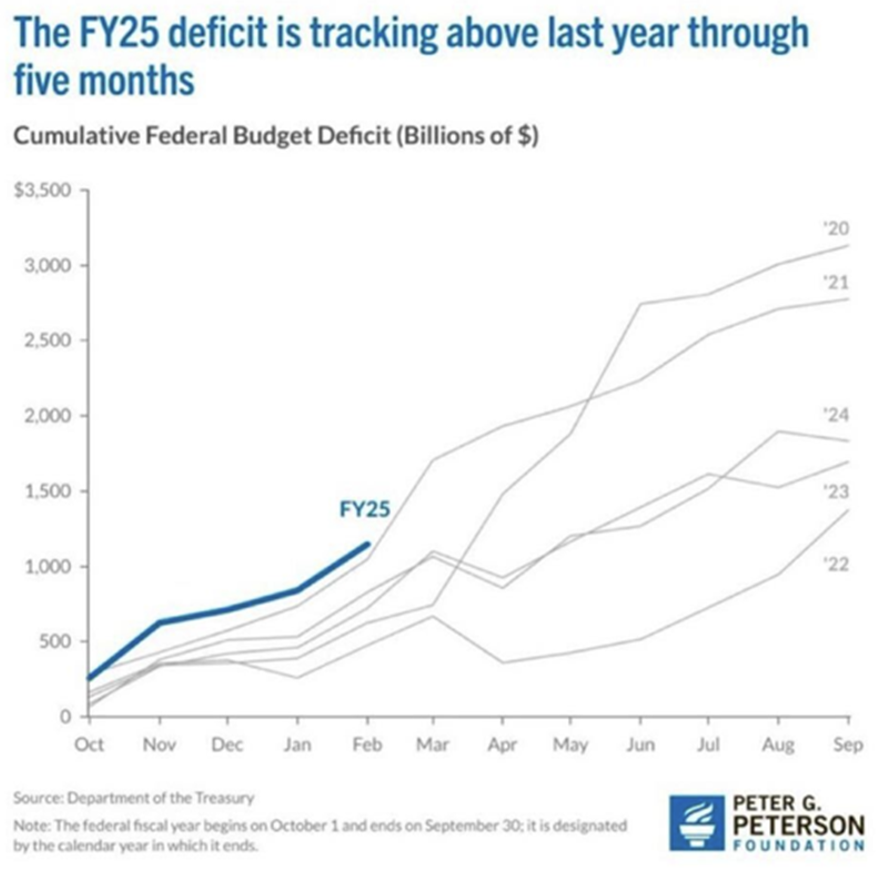

2025 Deficit Tracking Higher Than the Last 5 Years

The deficit story has been massive since COVID. The U.S. Government has run hefty fiscal deficits for the last several years, well above historic averages.

Source: Peterson Foundation as of 04.20.2025

Source: Peterson Foundation as of 04.20.2025

Fiscal policy is a tool more and more governments have leaned into, which went mostly unnoticed during the ZIRP (zero interest rate policy) environment, given that the cost to run high deficits wasn’t exactly penal. The last couple of years, as rates have risen, the buck has come due, and the deficits are causing our federal interest expense to get well above the 14% of tax receipts (currently ~18%) that have historically been associated with austerity measures.

When there is a cost to the debt, the compound effect of interest works in the opposite way of how you want it, snowballing the impact. Moving forward, we expect the fiscal side to work its way lower, and it’s likely a matter of how… by choice (cost control), or by force (bond vigilantes).

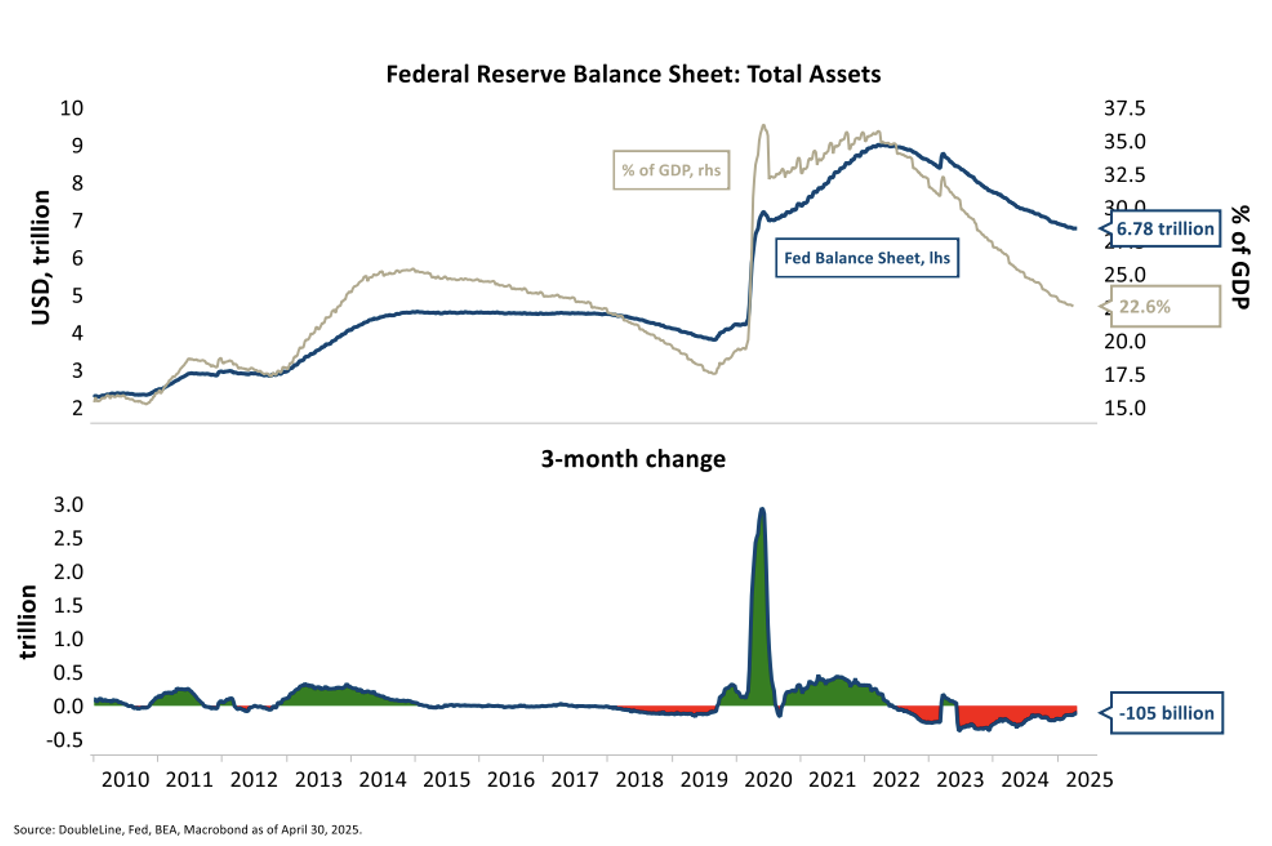

Fed Balance Sheet Update

The Fed continues normalizing its balance sheet after massive Quantitative Easing in 2020 and 2021. At its March 2025 meeting, the FOMC announced the Fed would slow the pace of balance sheet normalization further, with many in the markets expecting an end to the normalization later in 2025.

One interesting point is that the Fed has not (on net) sold any 10yr+ USTs since 2010, despite the US having gone through the longest yield curve inversion on record. This begs the question: if there was demand for long-duration bonds, why didn’t the Fed sell (and lower overall duration)?

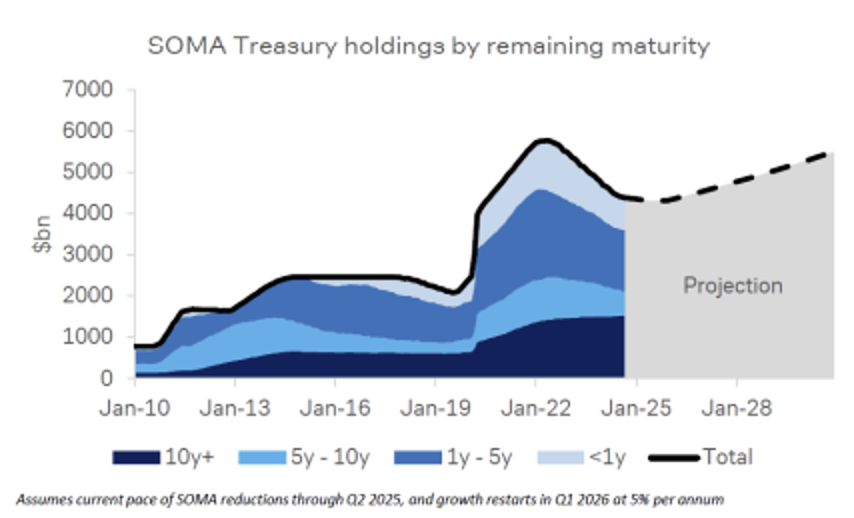

In addition, per the System Open Market Account (SOMA) forecast, a 5% growth rate in the Fed’s balance sheet is projected moving forward.

Source: SOMA as of 04.30.2025

Source: SOMA as of 04.30.2025

Simple math tells us that the balance sheet will double every 14 years, without anything bad happening to the economy. I guess that answers the question of who will buy the bonds… the Fed. Long-duration Treasury buyers beware!

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-9.