Last Friday, Moody’s rating agency lowered the US credit rating from Aaa to Aa1 (their version of AA+). Technically, this doesn’t change the US’s overall credit rating because it was already split-rated AA+. This follows downgrades by S&P in 2011 and Fitch in 2023.

Source: Strategas as of 05.19.2025

Source: Strategas as of 05.19.2025

When S&P downgraded the US credit back in 2011, many derivative contracts, loan agreements, investment directives, and similar documents prohibited using non-AAA securities for collateral. The fear was that a downgrade below AAA meant Treasuries would no longer be eligible under these rules and would create forced selling.

Cooler heads soon prevailed as the 2011 downgrade left the US split-rated AAA (Moody’s Aaa, Fitch AAA, S&P AA+). So, the US was still AAA and not in violation of these contracts. In the years after 2011, those contracts were rewritten from “AAA securities” to “government securities,” thereby excluding the credit rating qualification.

Back in August 2023, when Fitch downgraded the US to AA+, and the US became a split-rated AA+ country (S&P and Fitch AA+, Moody’s Aaa), officially losing its AAA status, it had almost no effect on the bond market. No one was forced to do anything.

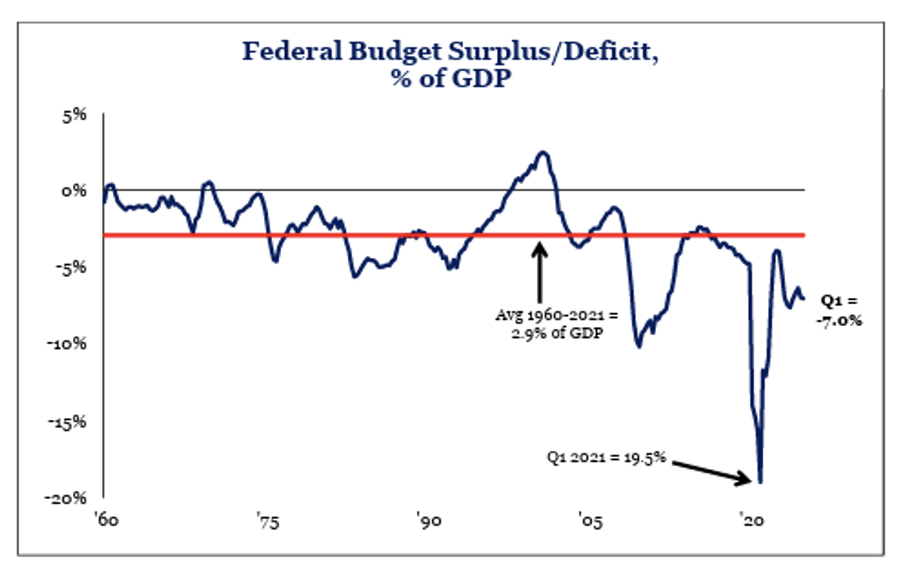

The Moody’s downgrade isn’t really telling investors anything they didn’t already know. S&P and Fitch were earlier movers on the downgrade citing similar concerns. We’ve seen the fiscal picture steadily worsen over the past 15+ years, it’s just recently become more noticeable given higher interest rates and the associated interest cost burden associated.

Time for Austerity?

The biggest thing is that improvements to the deficit have not been addressed. Historically when interest costs exceed 14% of tax revenues, fiscal hawks (or bond vigilantes) force change with some type of austerity measures.

Source: Strategas as of 05.19.2025

Source: Strategas as of 05.19.2025

Another wild stat is that deficits are this elevated even with tax revenues at an all-time high in April, after a great year for equity markets in 2024.

Unaddressed Deficits

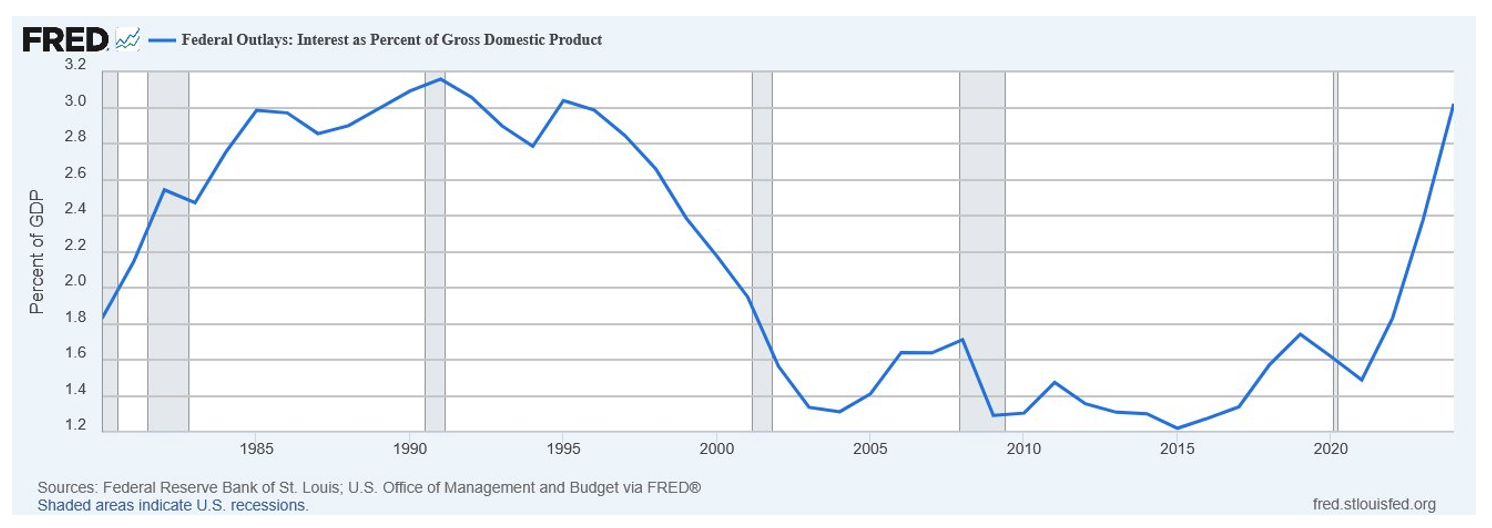

Interest costs have surged in nominal dollars, but when compared to the % of GDP, are only back to levels from the mid-90s.

Source: Strategas as of 05.19.2025

Source: Strategas as of 05.19.2025

Source: FRED as of 05.19.2025

Source: FRED as of 05.19.2025

The US fiscal situation has become untenable. But did we need Moody’s to tell us this? It was hardly a secret. That said, the act of downgrading the US will not force anyone to do anything. No one will have a forced liquidation like the worry when a company/country loses its investment grade rating. Besides, the US was already split-rated AA+ due to the previous S&P (2011) and Fitch (2023) downgrades. So, Moody’s downgrade changed nothing; they just aligned with S&P and Fitch.

Impact on Stocks

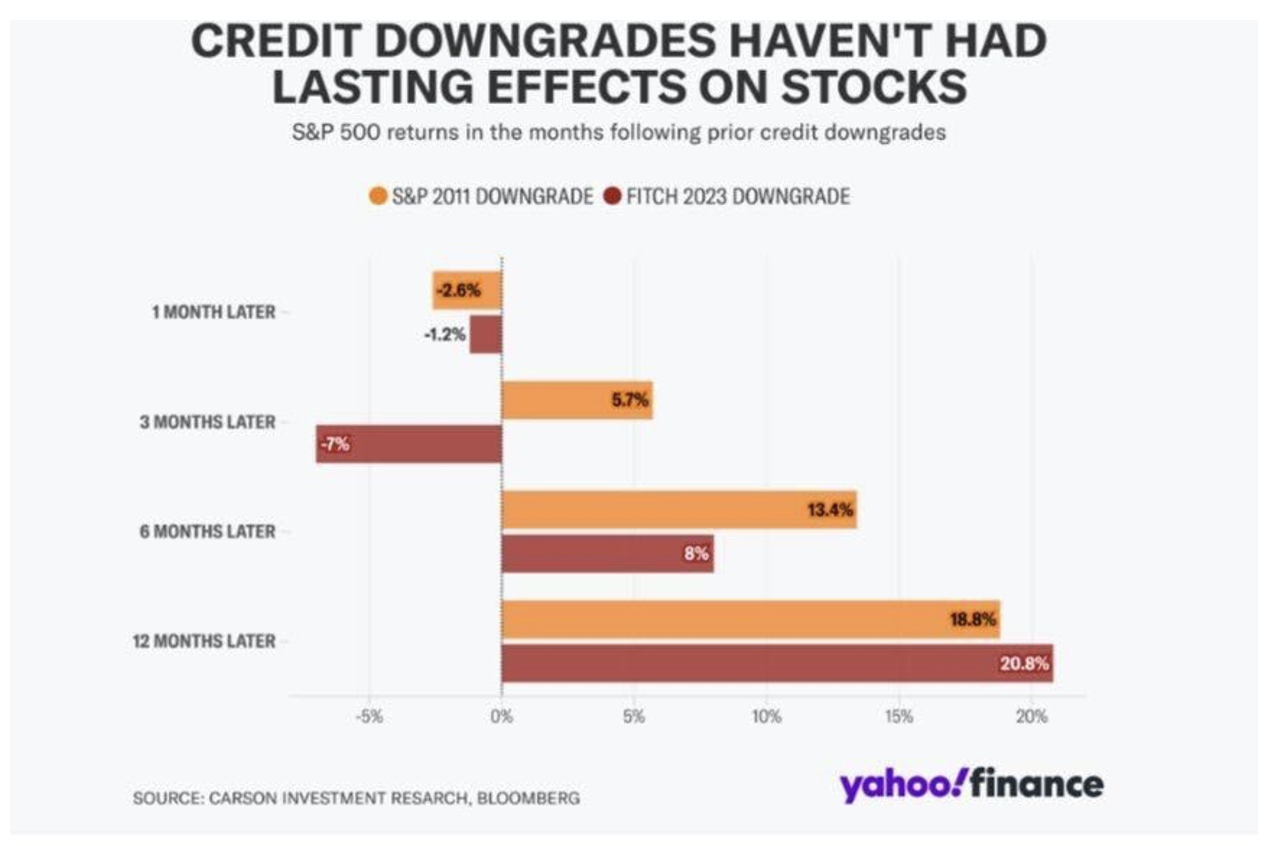

From a risk asset stance, looking past the initial blip in markets from past downgrades, markets were higher 6 and 12 months later in both scenarios (S&P in 2011 and Fitch in 2023). While past performance is of course no indication of future performance, to say the downgrade will be devastating to stock markets has historically proven untrue.

Source: Yahoo Finance as of 05.19.2025

Source: Yahoo Finance as of 05.19.2025

Bottom line, we all know it’s not sustainable to run budget deficits of 7% of GDP with this level of employment. The US needs to get federal spending in check to see meaningful deficit reductions. Time will tell on how/ when that happens but we think with the move higher in yields (and ensuing media coverage) could pressure congressional attention sooner rather than later.

Disclosures

Past performance is not indicative of future results. This material is not financial or tax advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed and all calculations may change due to changes in facts and circumstances.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2505-19.