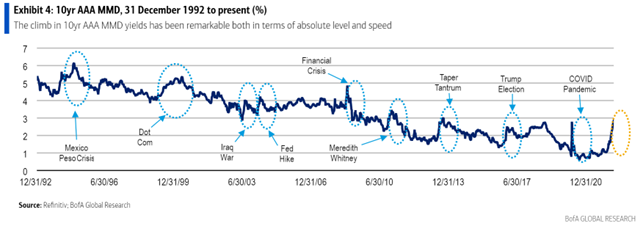

Municipal bonds have been thrown out with the bathwater since the beginning of the year as the Fed gets serious about taming inflation and in turn the market pushing interest rates higher. The decline in price (and increase in yield) could make the current landscape an attractive entry point. As the Fed gains back credibility that they will indeed slay the inflation dragon, state and local bonds may look relatively attractive.

Quick Recap:

The Bloomberg Municipal Bond Index experienced one of its worst quarters ever, delivering a total return of -6.23% in Q1 as yields spiked across domestic fixed income markets. The selloff in yields has continued into April and May, as the index has extended its losses further to -8.70% (as of 5/25/22).

Source: Bank of America. As of 5/25/22.

Historically, drawdowns in municipals have been followed by impressive snapback periods of outperformance. Given the underlying quality of what is backing the bonds (a quasi-sovereign issuer backed by tax receipts and public outrage) we believe the sentiment for municipal credits could become more sought after given a more risk off sentiment in equities and other risk assets.

Tax Receipts are HIGHER:

The improvement in Municipal budget finances has been historic. Surging tax collections and a torrent of COVID-19 support funding from the Federal Government have state house coffers across the country. In addition, property tax collections are rising given the meteoric rise in housing prices.

Source: Pavilion. As of 5/23/22.

Back in January, states reported a 17% year-over-year revenue growth. The strength is not just limited to the states and is evidenced by the very low default rates occurring in the high yield municipal space the last 18 months.

Source: Pavilion. As of 5/23/22.

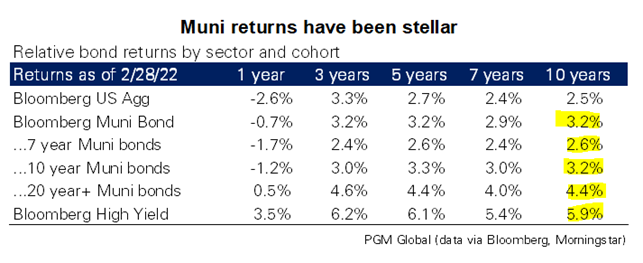

Over the past decade, municipals have provided portfolios with a strong return profile. These numbers are even more attractive when paired with high current income investors that incur the tax benefit.

Bottom Line

We think the poor market timing of muni inflows and outflows underscores a change in market composition that exacerbates both positive and negative performance. Mutual fund assets (of muni bonds) have doubled over the last 7 years and now account for ~25% of the market. The mutual fund structure brings about an inherent liquidity mismatch between the daily liquidity offered by the fund and the semi-illiquid assets (municipal bonds) that it owns.

As we saw in March 2020 and again in March 2022, large outflows contributed to forced selling and put pressure on prices and strains market liquidity, which in turn leads to further price pressure and the cycle repeats. High current income/ net worth buyers that reap the benefit of tax-free income could have a good opportunity to put cash to work in municipal bonds.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2205-21.