FOMC Update

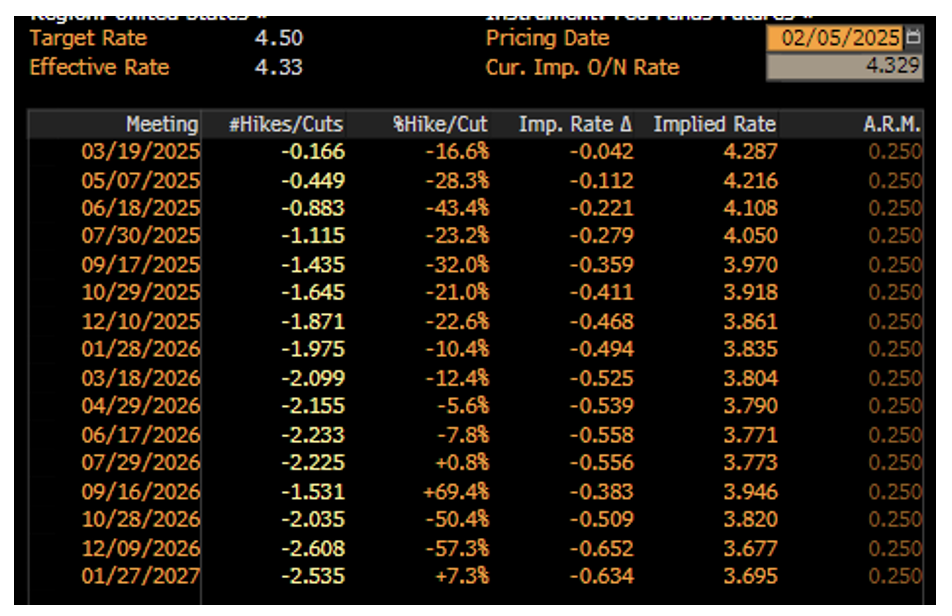

The January FOMC meeting went as expected (no rate cut). Chairman Powell offered limited forward guidance, stating that “we’re meaningfully above” the neutral rate for fed funds but countered that by noting the Fed is in no hurry to cut rates.

Source: Bloomberg as of 02.05.2025

Source: Bloomberg as of 02.05.2025

Upcoming monetary policy decisions will be based both on data dependency but also on the market impact of Trump’s policies (such as tariffs, deregulation, and immigration). It will be difficult for the Fed to preemptively lower rates given the amount of policy uncertainty, at least in the short term. Gauging the recent dialogue of Fed speak, it seems that most of the Fed members agree.

The bar appears elevated for a March rate cut unless we see significant downside surprises in upcoming data. Markets aren’t fully pricing the next rate cut until July, with less than 2 cuts for the entire year.

Trump & Bessent: Goal is to Bring Down 10Yr UST Yields

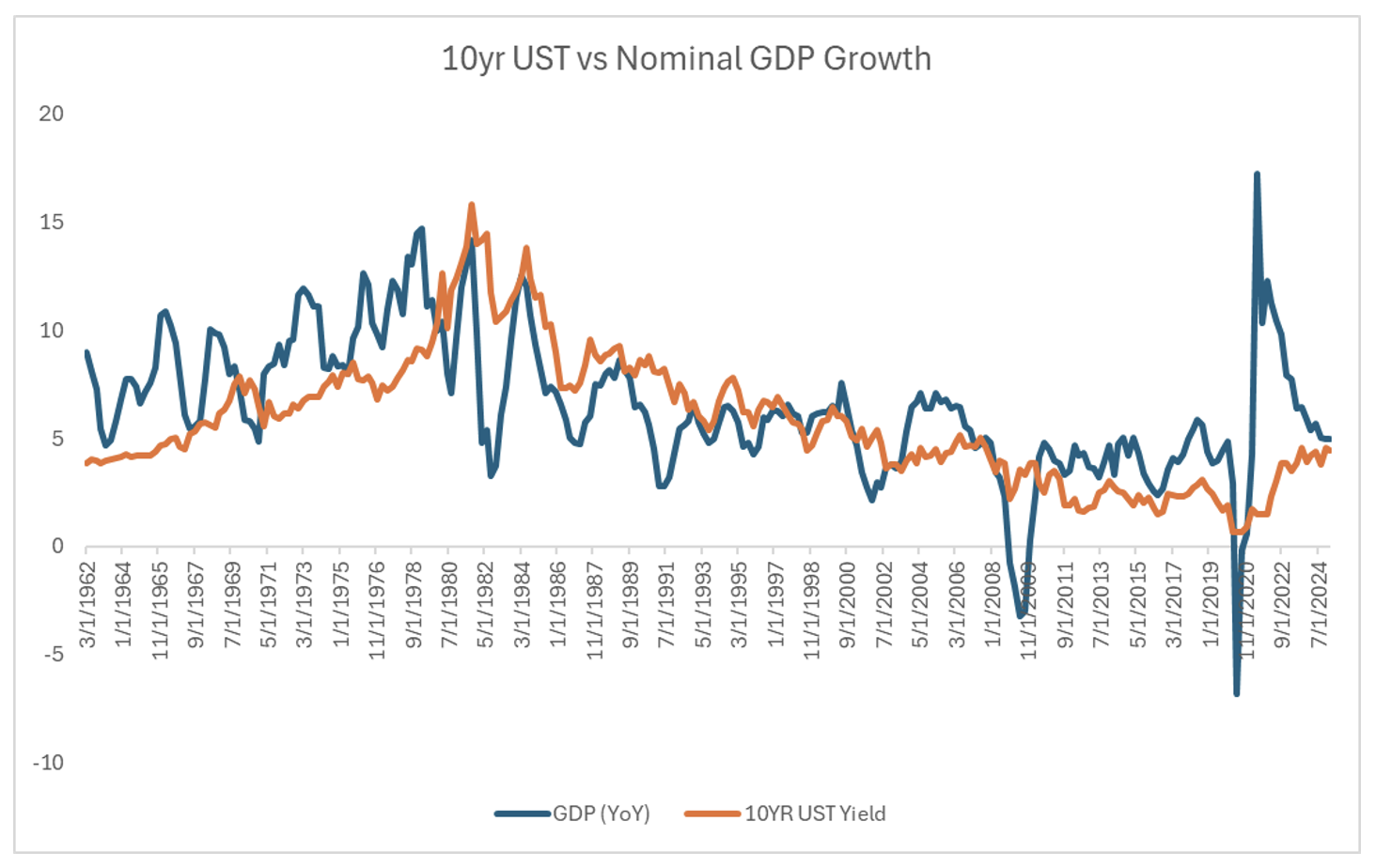

In a recent interview with Fox Business, Treasury Secretary Scott Bessent said the Trump administration’s focus with regard to bringing down borrowing costs is 10-year Treasury yields, rather than the Federal Reserve’s benchmark short-term interest rate.

The 10-year Treasury yield and the rate of nominal GDP growth have historically exhibited a strong correlation. Over longer periods, the 10-year yield tends to track nominal GDP growth given that it reflects expectations for future inflation and real economic growth.

Source: Bloomberg as of 02.05.2025

Source: Bloomberg as of 02.05.2025

Over history, the best way to reduce yields has been to bring down economic growth. The question is whether Trump 2.0 policies will be able to achieve strong growth, stable inflation, and lower yields.

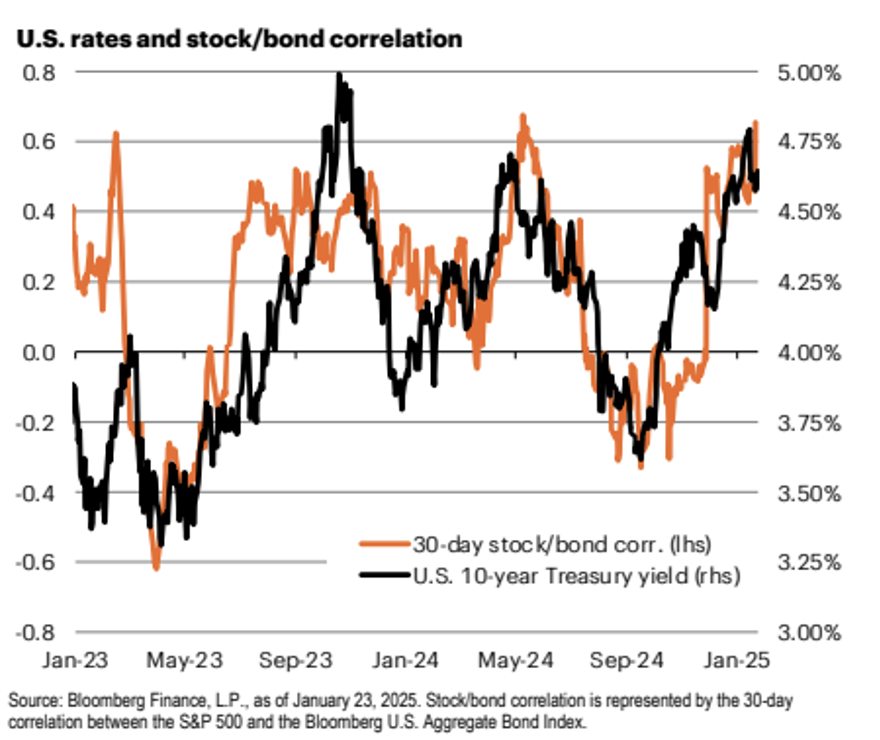

Positive Stock-Bond Correlation Continues

The new interest rate regime marks a significant shift from the era of “secular stagnation” of the 2010s, presenting an opportunity for investors to embrace equity-driven portfolios while strategically managing risk. The past three years have demonstrated that the U.S. economy is resilient to higher interest rates, and we expect this trend to persist. With labor market data improving, inflation remaining above target, and policy set to favor growth, the investment landscape is primed for equity exposure over traditional fixed-income allocations.

Markets have already adjusted to this reality, pricing in only 1.5 rate cuts this year, while the futures market projects short-term rates staying above 4% indefinitely. This shift has profound implications for portfolio construction, signaling a need to emphasize asset classes that can thrive in such an environment. Rather than relying on fixed income for risk mitigation, investors should explore hedging techniques that allow for greater equity participation while managing downside risk effectively.

Source: FS Investments as of 02.05.2025

Source: FS Investments as of 02.05.2025

A prolonged period of higher rates presents two primary challenges. First, companies and assets will need to navigate an environment of persistently higher borrowing costs. While this does not jeopardize economic expansion, it does require a focus on quality assets and strong business fundamentals, reinforcing the case for active stock selection. Second, higher rates redefine policy dynamics, with the Federal Reserve balancing both sides of its mandate more actively than in recent years. Historically, such conditions have coincided with positive stock-bond correlations, underscoring the need for a portfolio strategy that prioritizes equities while employing active risk-mitigating strategies instead of traditional fixed-income buffers.

In this evolving market, the optimal approach is to tilt allocations toward equities, leveraging dynamic risk management tools rather than relying on bonds to provide diversification. Investors who adapt to this new paradigm by emphasizing high-quality equities and innovative risk mitigation strategies stand to benefit from the structural changes shaping the financial landscape.

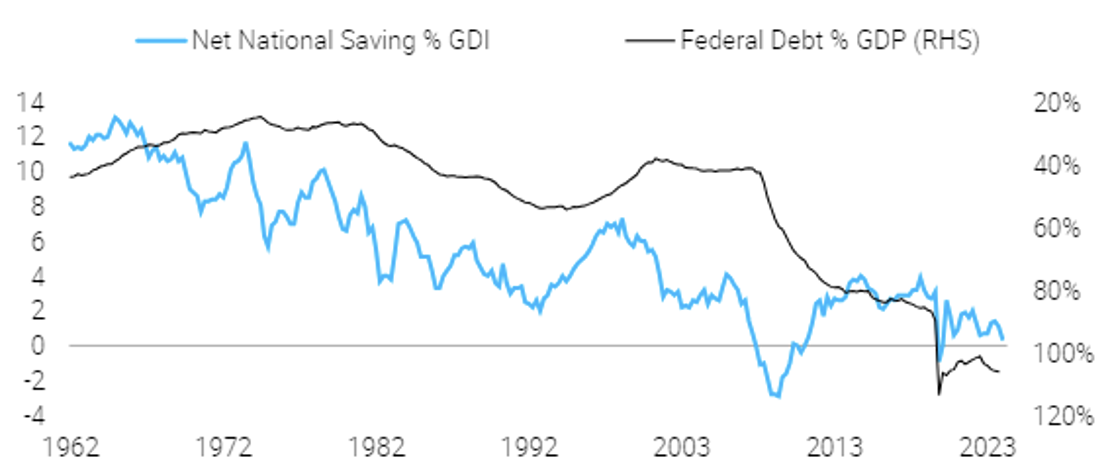

Budget Deficits and Trade Wars Could Stress Foreign Lenders

We believe there will be a constraint on Trump’s use of tariffs to break global trade flows (i.e., reshoring). The US is a net debtor nation running a budget deficit that is 6.5% of GDP during an expansion. Roughly 30% of outstanding UST debt is held by non-US investors and some 20% is held by the Fed.

Source: TS Lombard as of 02.05.2025

Source: TS Lombard as of 02.05.2025

The current stable system of global capital flows that runs alongside goods flows may be challenged if Trump’s tariffs break the ordered flow of goods (i.e., tick off too many of our trading partners). The Fed may yet find itself faced with the task of shoring up the needed inflow of capital to fund the government at the expense of domestic economic growth – if it is allowed to make that choice. This is how 1960s inflation turned into the 1970s, and could be a foreshadowing of what is to come.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2502-8.