Fed chair Powell (and many other FOMC members) have made it clear that as of today, the Fed intends to:

- Slow down the pace of hikes

- Reach a higher peak rate than it thought in September

- Stay at peak for longer than normal

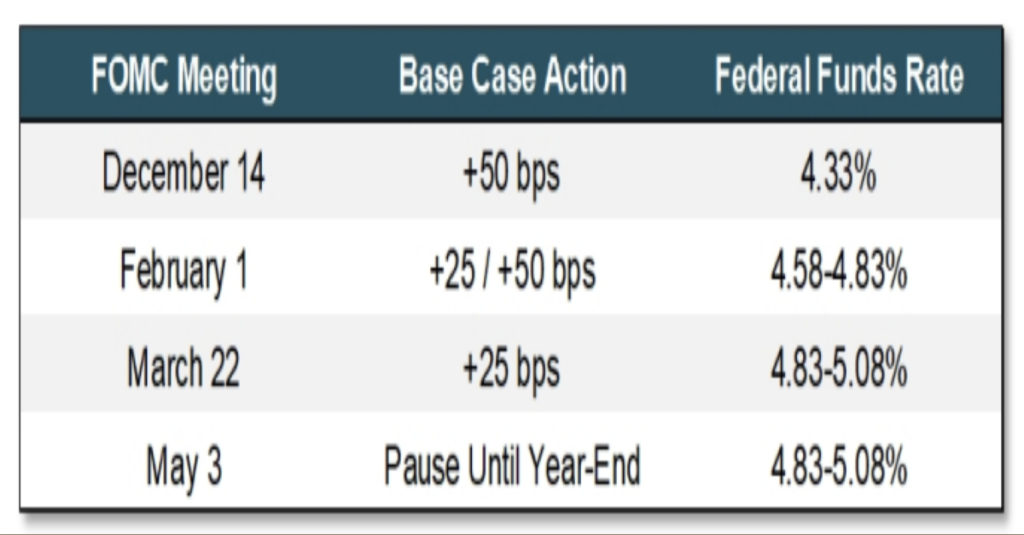

How long will policy remain restrictive? This is probably the most important question in determining an outlook. Our belief is that the Fed will reach a peak rate at around 5% (depending on the next couple of months’ inflation data) by March and stay at that peak rate for the rest of the year.

The market agrees on the peak but expects a couple of cuts in the second half of 2023. The discrepancy between the scenario above, vs. those expectations, leads us to the conclusion that the yield curve could continue to invert more between now and the spring (currently at ~80bps but could invert in excess of -100 bps at the two- to ten-year level).

The language used by Powell in his Brookings speech last week is that “restoring price stability will require holding policy at a restrictive level for some time.” The “some time” phrase is intentionally vague, but it is aimed at communicating that the stay at the peak rate is likely to be longer than the few months average of the past several decades. We can infer that the Fed, given what it knows today, does not intend to cut rates in 2023.

Source: Piper. As of 12/7/22.

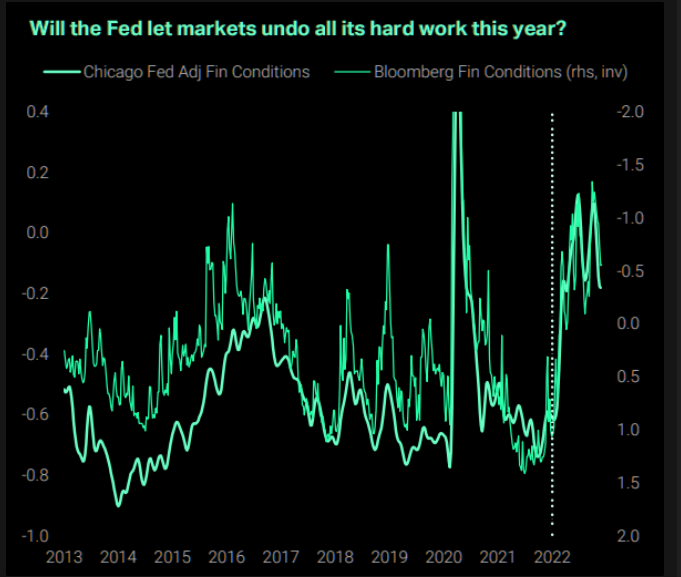

Financial Conditions … EASING?!

Source: TS Lombard. As of 12/06/22.

Source: TS Lombard. As of 12/06/22.

Even though the Fed isn’t done hiking rates and certainly not done with QT, the market has already “eased” significantly. Surprisingly, financial conditions are easier now than they were in June, when Fed Funds were at 1.50-1.75%.

If the Fed does slow the pace of rate increases, it is important they signal that this is not the end of the tightening cycle and there is still more work to do. If they fail to communicate that a slowdown is not a pivot, we fear the Fed risks undoing all the hard work it has done this year tightening policy. The Fed can’t have both tightening of policy and loosening of financial conditions — something’s gotta give!

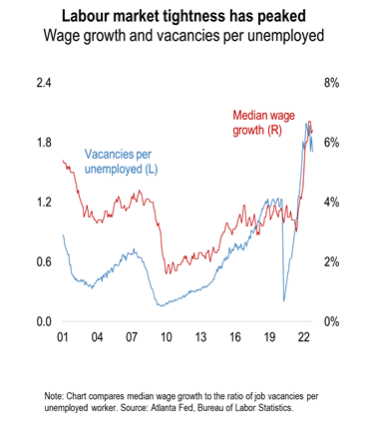

We Said this before, We’ll Say it Again …. The Job Market is Key

Source: Numera. As of 12/06/22.

Source: Numera. As of 12/06/22.

While both the inverted curve and the manufacturing data are signaling a slowing economy, the constrained labor supply and strong wage growth will likely limit layoffs. And also prevent the unemployment rate from rising as much as we’ve experienced in previous recessions.

Remember, there are 1.7 jobs open for every person looking for a job. With that being said, we believe higher wage inflation over the coming year will pressure the Fed to maintain its policy rate higher than markets expect in the near/ medium term (i.e., no rate cuts in ’23).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2212-12.