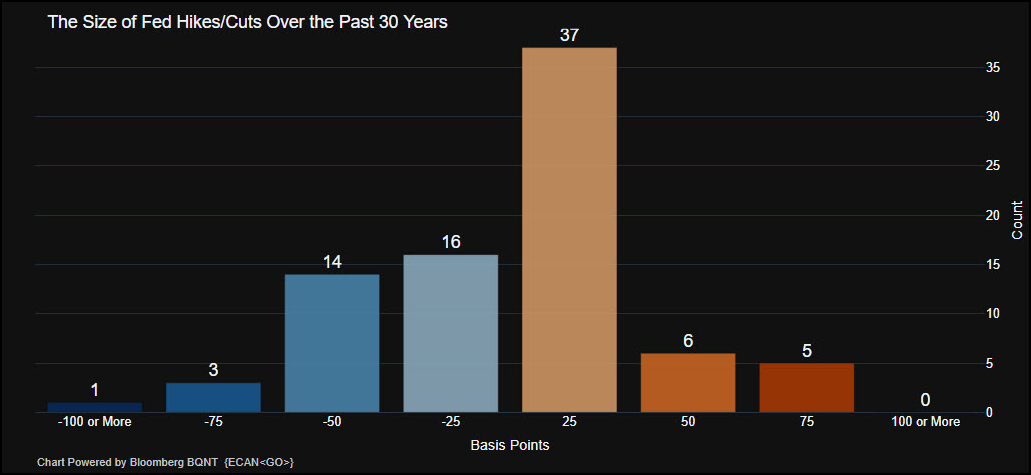

As expected, the Fed hiked 25bps to the 4.5%-4.75% range, the eighth hike in a year.

The markets experienced a pretty large rally following the FOMC meeting & presser. Stocks moved higher and yields lower as Powell continued to believe a soft landing was very possible given the recent softening in inflation data and resilient labor market.

Source: Bloomberg. As of 2/1/23.

Source: Bloomberg. As of 2/1/23.

There continues to be a large discrepancy between the price of the terminal rate (shown via Fed Funds futures) and the Fed’s Dot Plot. While Powell acknowledged that inflation has come off peak levels, monetary policy makers remain committed to a further rise in rates to reinstate price stability. Powell spoke of the need for ongoing increases (plural). Ultimately, from a hawk’s perspective, this verbiage was big in its emphasis on the need for more hikes and higher for long. This was a slowdown, not a pivot.

The market reaction seemed contrary but in its defense, Powell didn’t defend the December plots aggressively or the easing of financial conditions, taking a “play it by ear” mentality (i.e., let’s see how fast inflation comes down and based on that we’ll be data dependent).

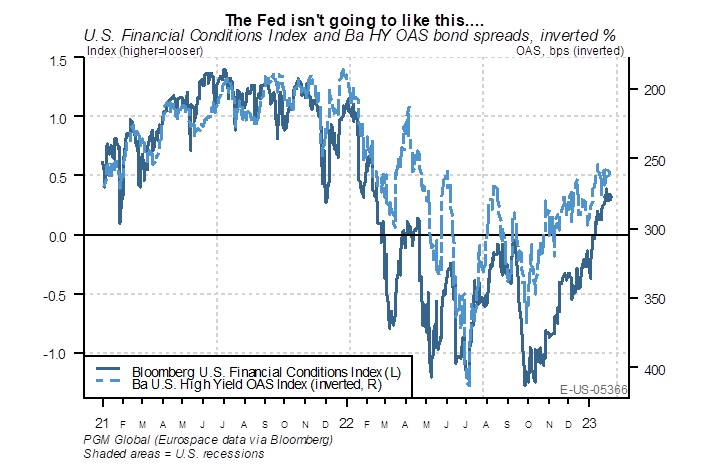

Financial Conditions Continue to Ease

One comment from the press conference that stuck out to us was Powell’s lack of concern for the easing of financial conditions. We’ve seen a rather larger shift in risk appetite throughout the first of the year. Powell said they (at the Fed) focus on long term financial conditions and not short-term conditions. Powell pointed to believing that financial conditions have tightened due to all the hikes/ QT over the last 12 months. While the rate environment has tightened since last spring, we’d argue that financial conditions have indeed eased drastically since December.

Source: Pavilion. As of 1/31/23.

Source: Pavilion. As of 1/31/23.

For example: Equity multiples have expanded – the S&P 500 is back to 18x 2023 earnings. Lower long-dated interest rates – 10 year yield back to 3.5%. Tighter credit spreads/ high yield spreads, and lower mortgage rates also point to easier financial conditions in our opinion.

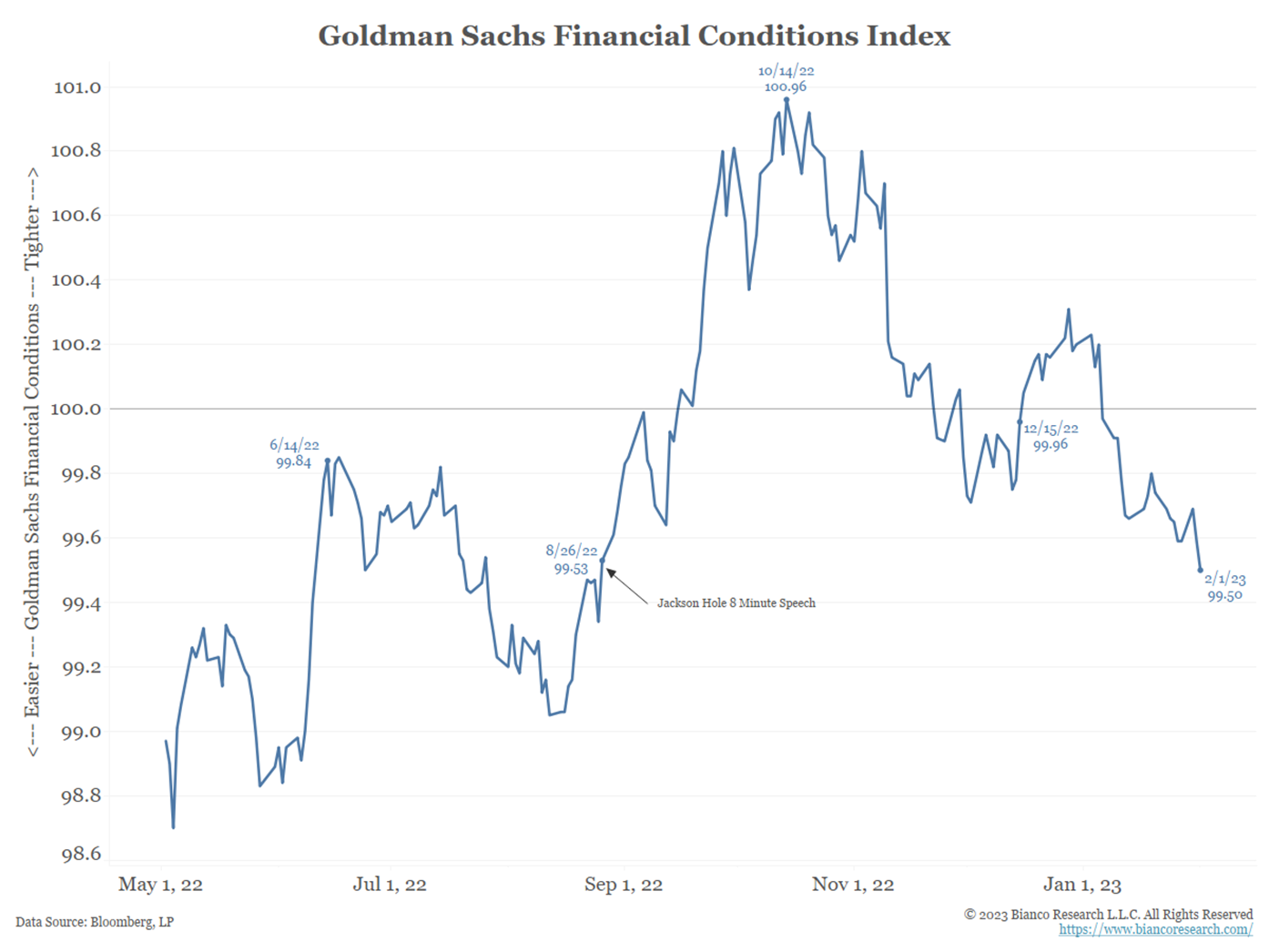

This contrasts with comments from Powell. As shown below, as measured by the Goldman Sachs Financial Conditions Index, financial conditions have eased drastically since December and are actually in-line with the pre Jackson Hole meeting from last August.

Source: Bianco. As of 2/1/23.

Source: Bianco. As of 2/1/23.

So, What Gives?

In terms of forward-looking inflation, Powell believes disinflation is just getting started. We are seeing evidence in goods, from opened supply chains / shift to service spending, which should continue to help bring down goods pricing. The service and housing piece of inflation isn’t showing disinflation yet, but he believes it will be coming soon. We’d agree those pressures will slow although we’d expect more of a grind than a huge drop lower.

In general, the market expects inflation to move down more quickly than the Fed, pricing in fewer hikes (lower terminal rate and faster cuts). Powell said unless inflation drastically comes down, it will not be appropriate for the Fed to cut policy rates this year. Higher for longer is the way…unless inflation screams lower quickly.

Bottom line, the job is not done, and we need more hikes and higher for longer, making 2023 cuts unlikely. On a positive note, inflation is slowing even with the jobs market remaining resilient. Powell thinks a soft landing is possible (i.e., jobs market weakens but doesn’t spike which brings down wage pressures). We can’t deny that a softer landing is looking more and more possible given the softer economic data. Definition of a soft landing: when inflation slows faster than growth.

To Summarize

The major difference between the Fed and market participants broadly is that the Fed thinks that inflation will be high enough to prevent them from cutting later in the year, while market participants think it will fall faster, leading to cuts in Q3/Q4 (>125bps of cuts priced in in 2H). In other words, markets have moved to team transitory while Powell & Co. isn’t so sure.

This is not the first-time markets have diverged from Fed guidance, but what was so different this time was that Powell didn’t push back. In the past he had been much more forceful in getting the market in line with his forecasts (think Jackson Hole). This time he seemed content to let it play out. In the next couple weeks, the big question will be whether he and other Fed members push back more forcefully or whether they really are content to let it play out and watch the data.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2302-1.