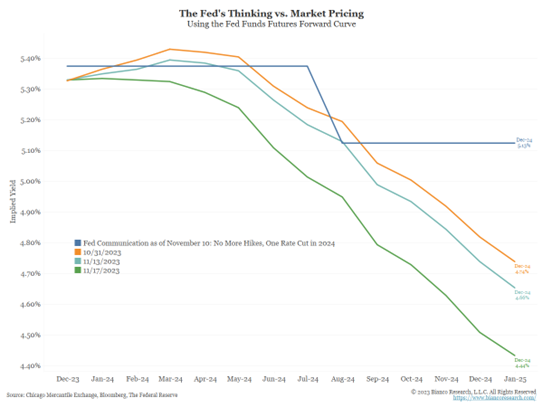

Last week, the CPI & PPI print both came in weaker than expected. The market responded favorably with stocks up and yields dropping. The bigger change in our minds was the drop in forward interest rate expectations where the market continues to price a lower interest rate level than what the Fed has broadcasted.

Update on Market Expectations for Rate Cuts

The markets are pricing the Fed Fund rate to be ~50 basis points lower by mid-2024. However, that was not necessarily the case before last week’s inflation report as investors began pricing in more aggressive rate cuts in 2024 post the CPI & PPI data.

Source: Bianco. As of 11/17/23.

Mimicking our commentary from a couple weeks ago, we’ve already seen this story play out ~7 times this hiking cycle. Markets have potentially once again got ahead of reality. Until the inflation cycle is conquered, we think it’s too soon to throw in the towel on the Fed maintaining restrictive policy higher, for longer.

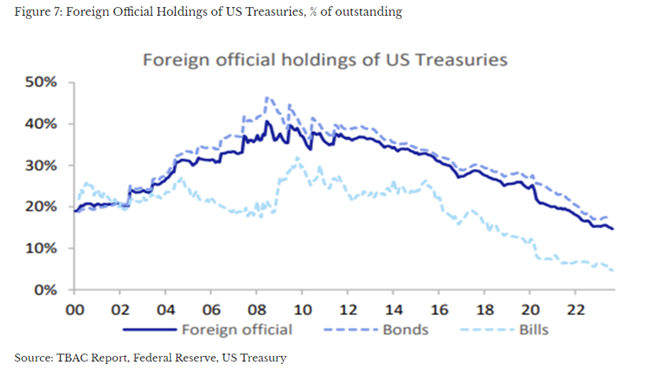

Foreign Holdings of Treasury Market Not Keeping up with Supply

The graphic taken from the TBAC presentation shows a clear picture of the declining share of ownership by foreign holders of US Treasuries.

Source: TBAC. As of 11/21/23.

We think investors should focus on the absolute level of Treasuries from foreign holders instead. The takeaway isn’t that foreigners have stopped buying US Treasuries but, rather, their purchases haven’t kept up with the pace of supply.

We saw commentary from Jason Furman, who served as a top economist in the Obama administration and is now an economics professor at Harvard, with an eye-opening comment. Jason said the current jump in the fiscal deficit is only surpassed by “major crises,” such as World War II, the 2008 financial meltdown, and the coronavirus pandemic.

Only during these national catastrophes did the United States see deficit numbers this large as a share of the economy or this substantial an increase in the deficit, Furman said. The U.S. economy is expected to grow at a steady 2.1 percent this year.

“To see this in an economy with low unemployment is truly stunning. There’s never been anything like it,” Furman said. “A good and strong economy, with no new emergency spending — and yet a deficit like this. The fact that it is so big in one year makes you think it must be some weird freakish thing going on.”

This brings us full circle to our friend David Dredge at Convex Strategies, whose million-dollar question remains “Who’s going to buy the 40?” Referring to the fixed income allocation typically associated with a traditional 60/40 portfolio.

With more debt supply, lower allocation from price-insensitive buyers, and the recent dip in yields, we’d pause before getting overly excited about fixed income. When considering what’s left after taxes and inflation, the net returns are paltry.

Financial Conditions are Easing Drastically

The Goldman Sachs Financial Condition Index just experienced a 15-day decline that ranks among the largest ever and that includes 3 crisis periods.

Source: Bloomberg. As of 11/21/23.

To review, the index is roughly 40% long term rates, 40% credit spreads, 5% USD, 5% short rate, 5% equity.

The undoing of the recent tightening highlights the ongoing cycle we have continued to see the last 18+ months of the tightening cycle. Conditions get tight, the Fed lets off gas, spirits lift, and risk markets reignite in hopes for a “best case” outcome. If the Fed is reliant on the tightening in financial conditions to finish the job for them, we wonder what they think now that those tight conditions have unwound.

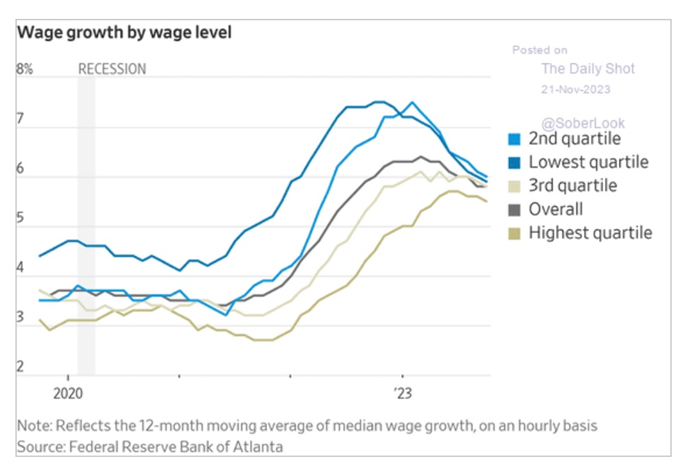

Wage Growth Showing Improvement But Still Too High

Wage growth has been elevated in the last few years but is showing some signs of stabilization. The problem is wage pressures are still running at elevated rates compared to what has been typically associated with 2% inflation.

Source: WSJ. As of 11/21/23.

The bottom line is current wage growth suggests that unless we see more loosening in labor markets, it appears income growth will remain too high for the Fed to meet its mandate.

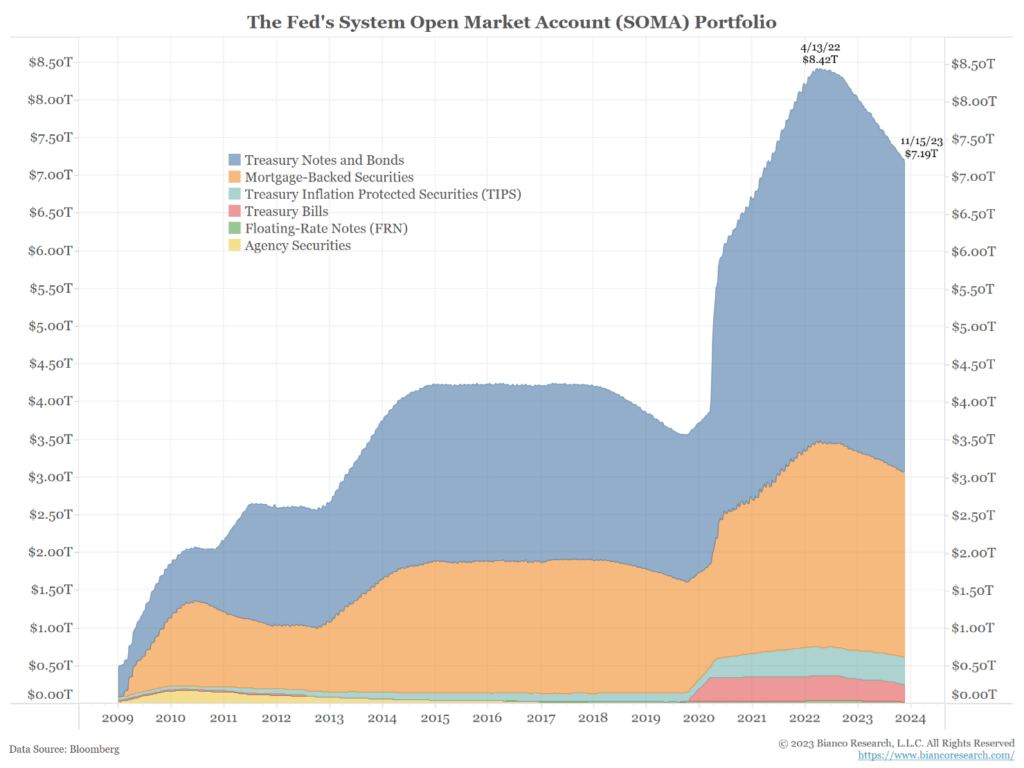

Quantitative Tightening… The Silent Sucking Noise Working in the Background

The Fed has been reducing its balance sheet by $95 billion a month since June 2022. The balance sheet has run off a little over a trillion dollars so far to $7.8 trillion.

Source: Bianco. As of 11/21/2023.

While the balance sheet has been decreasing, there’s still a long way to go to return to the pre-pandemic $4 trillion mark. Fed Chair Powell says the balance sheet reduction will continue but we have doubts internally that we get back to pre-2020 levels. And we’d imagine that the Fed will likely utilize their balance as the first line of defense against economic weakness before flipping to cutting interest rates.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-16.