Headline CPI rose 0.6% in August from the prior month, a faster pace than in July as gasoline prices jumped. Core CPI rose 0.3% (stripping food and energy costs), a hotter pace than the prior two months.

- Headline CPI: +0.6% (Consensus Expectations: +0.6%)

- Core CPI: +0.3% (Consensus Expectations: +0.2%)

- Headline CPI: +3.7% YoY

- Core CPI: +4.3% YoY

Details:

- Energy category rose 5.6%

- Energy commodities rose 10.5%

- Airline fares rose 4.9%

- Auto Insurance +2.4% and repair +1.1%

- Owners Equivalent Rent (OER) +0.38%, below consensus expectations

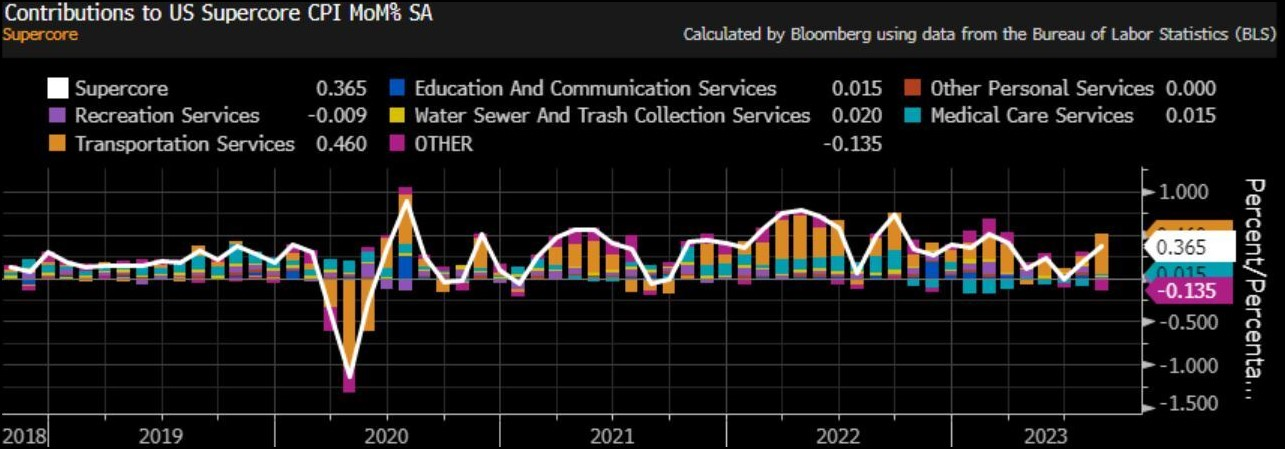

Super-Core Inflation Problematically High

Super-core Inflation looks at core services prices excluding housing. This metric became a focus for Fed policymakers, where the idea of stripping out housing was to account for lagged weakness coming down the pike. Super-core rose 0.37% in August. The most since March.

Source: Bloomberg as of 09.13.2023

Source: Bloomberg as of 09.13.2023

We wouldn’t be surprised if Powell drops his focus on this so-called “super-core.” Convenient, of course, now that the core rate is running lower than super-core. Something to watch.

Ultimately, the U.S. labor market does not appear to have rolled over enough to remove concerns about wage inflation yet (which matters for services inflation). While the report wasn’t overly great, it’s moving in the right direction. Today’s number likely assures a rate pause in September. There is ~50% chance of a hike at the following meeting in November.

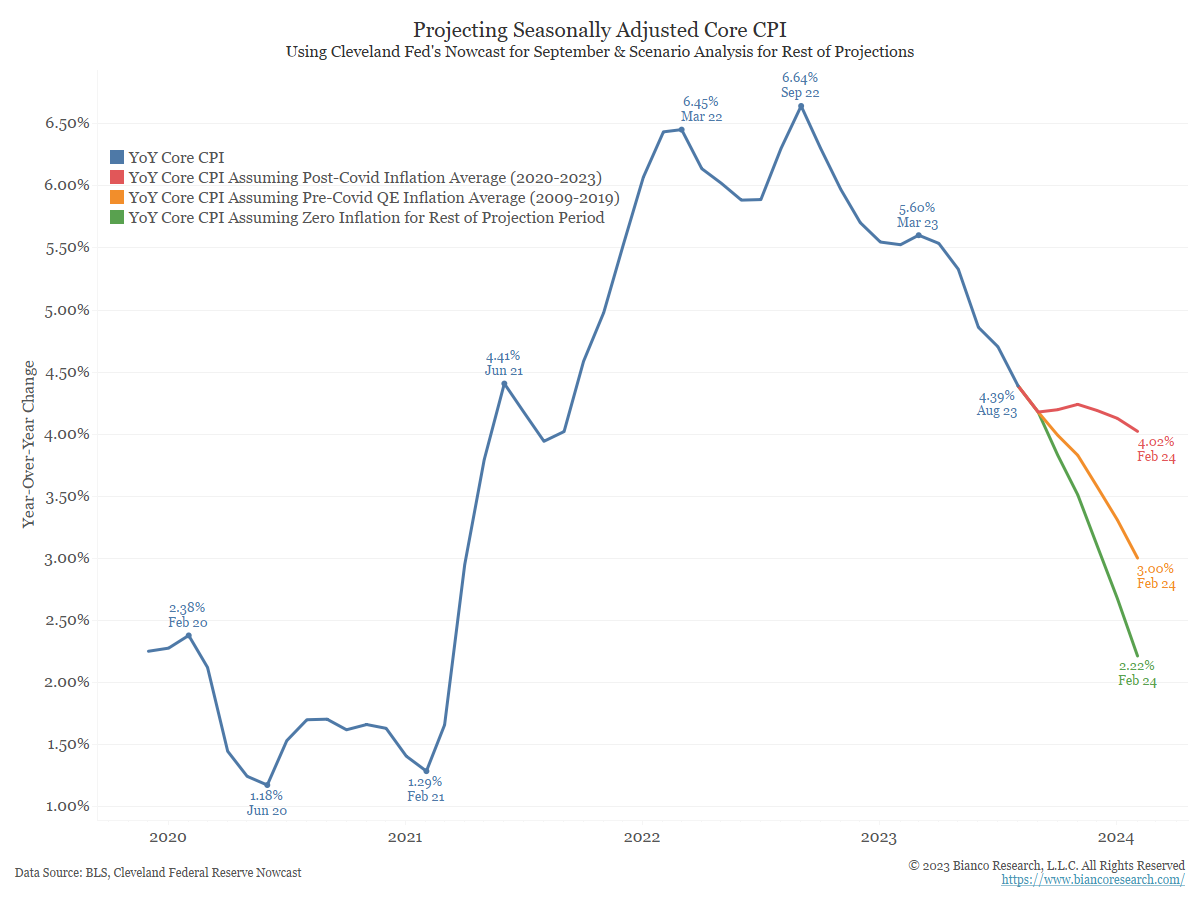

Where Will Core Inflation Settle Out?

The blue line in the chart shows year-over-year CPI, which rose by 4.3% in the twelve months through August 2023. For the scenarios below, it’s assumed the Cleveland Fed’s CPI Nowcast of 0.37% month-over-month inflation for September will be correct. The red line shows CPI would be roughly 4.02% by February if inflation continues its post-Covid average. The orange line shows CPI would be 3.00% at the end of February if the month-over-month releases equal pre-pandemic QE-era inflation. Finally, the green line shows CPI would be 2.22% by year-end if the month-over-month releases show 0% inflation between October and February (after using the Cleveland Fed’s Nowcast for September).

Source: Bianco Research as of 09.13.2023

Source: Bianco Research as of 09.13.2023

Fortunately, these numbers will likely continue declining through February under the two more benign scenarios. Would the Fed be happy enough with core inflation running around 3% in February? The market thinks so, pricing in rate cuts in 2024.

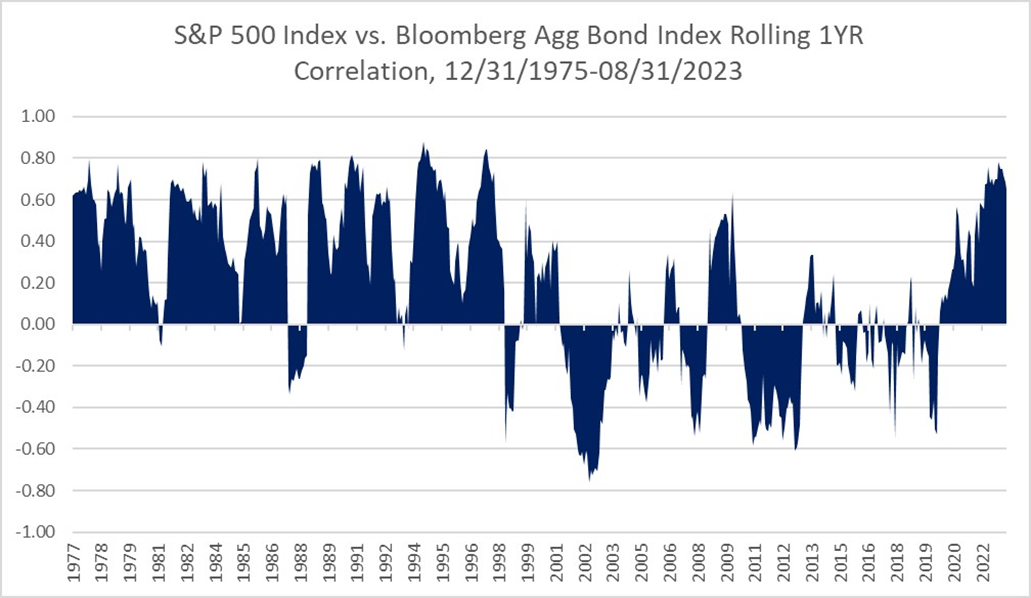

Will Bonds Hedge Stock Risks?

The surge in inflation and fear of future inflation has led bonds to be a poor hedge to risk assets (stocks). The ability for bonds to act as a form of hedge and insurance-like asset is one of the reasons bond yields were so low before the recent stretch of high inflation.

Source: Aptus Research as of 08.31.2023

Source: Aptus Research as of 08.31.2023

A rising correlation structure between stocks and bonds will likely cause investors to demand more compensation and higher yields to hold bonds.

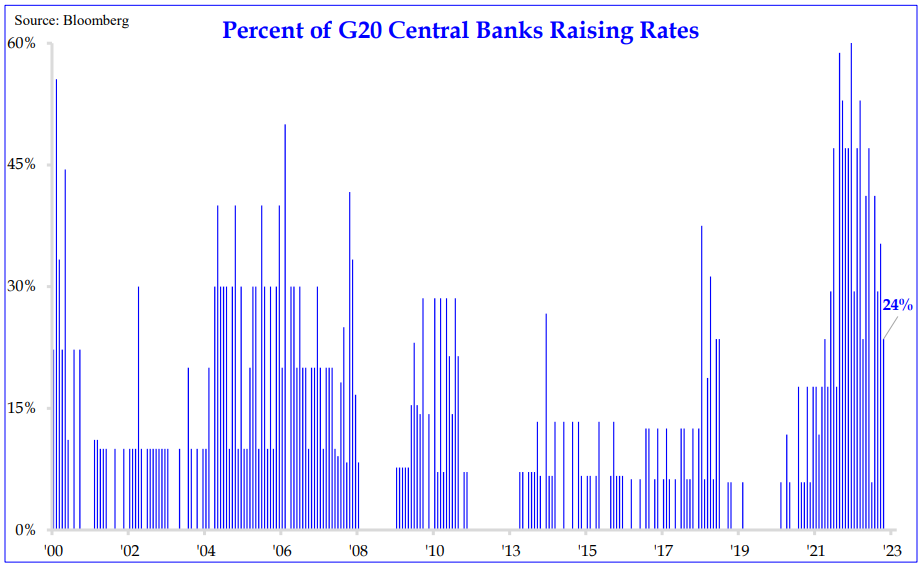

Appears Central Banks are Rounding Third Base this Hiking Cycle

Only 24% of central banks globally are raising interest rates, down from 60% this time last year. Across most developed markets, we’ve seen an improvement in the trajectory of inflation, showing effectiveness of rate hikes.

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

Before markets get overly giddy, we must remember inflation has historically come in waves. It’s too early to consider rate cuts at this stage and the most likely path is higher for longer.

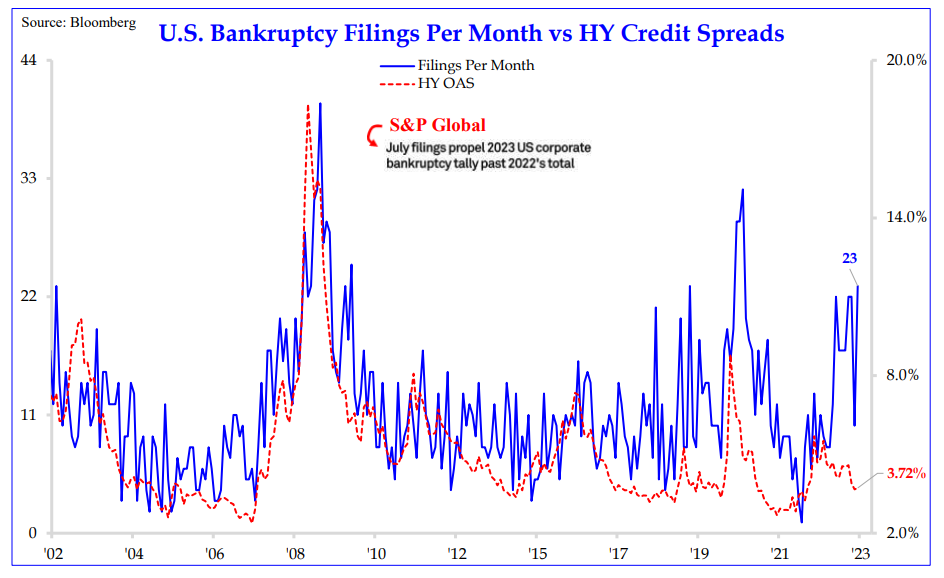

High Yield Spreads Tight Despite Bankruptcies Ticking Higher

High-yield spreads continue to price in a tranquil future as spreads remain historically low. We continue to monitor the space as a sentiment gauge on the fear level within the market.

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

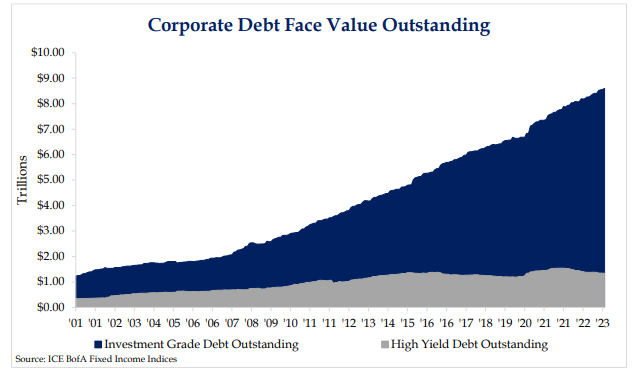

As shown in the graphic, the level of high-yield issuance hasn’t increased like we’ve seen in the Investment Grade space. It does appear that a lower supply could keep spreads tighter than they should be.

Corporate Bond Market Has Grown Massively Since GFC

As we’ve repeatedly mentioned over the past 6 months, corporates (similarly to households) took advantage of record-low interest rates and went on a borrowing spree over the last decade. For example, the average bond price inside the LQD ETF is $89.73 (with Par being $100). Remember interest rates up, bond prices down.

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

In hindsight, this was prudent financial engineering (to borrow low and long) and either repurchase stock or reinvest for the future. This debt load will be something to watch over time as it either must be paid off (using inflated dollars), or refinanced at higher interest rates. While not concerning now, if rates do stay elevated for longer, companies will have some serious thinking to do.

See past bi-weekly bond updates here.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-20.