The 10-year Treasury yield is up ~60 bps from the YTD lows seen just prior to the 50bp Fed cut on September 16. The widespread view is that the spike in rates is due to a combination of a) repricing the Fed’s rate cut path and b) the rising risk of a post-election inflation shock as Trump’s election odds have increased (Trump era tariffs + a reversal of immigration flows).

Although the rise in yields does correspond to Trump’s rise in the online betting markets, a good chunk of the move has been driven by a re-pricing of the Fed’s rate-cutting path, after a) the strong September NFP report and b) a steady rise in GDP tracking estimates for Q3.

In addition, headlines from the likes of Druckenmiller, Paul Tudor Jones, and T. Rowe Price have rattled the bond market over fears of spiraling deficits and an ensuing inflation panic. T. Rowe Price predicts a 5% 10-yr yield, triggered by big deficits and accompanying inflation.

Source: Bloomberg as of 10.24.2024

Source: Bloomberg as of 10.24.2024

Looking at the numbers, most of the move in rates have come from the real side, not inflation expectations. The TIPS market allows us to decompose the Treasury yield into a real rate and an inflation component (TIPS are indexed to the CPI). From the 9/16 low when the 10-year yield bottomed at 3.62%, real rates have risen ~40 bps while inflation expectations have risen ~25 bps.

This move has been associated with a 70 bps rise in terminal Fed policy rate expectations (current Fed Funds expectations shown above). The expected level of the Fed policy rate (neutral) two years down the road is now 3.50ish% instead of 2.87%. The market is now expecting a measly 1.5 cuts for the rest of the year; hard to forget the cries for two more 50bp cuts in 2024, in addition to September’s just a few weeks ago!

Does the recent rise in rates mean it’s time to buy bonds? Not so fast. We do expect pressure on longer-term rates to continue. Supply pressures, strong US growth (nominal growth is still a 5 handle, generally a good proxy for the 10-year yield), a return to positive term premiums (which should correlate to real growth), and a return to an upward sloping yield curve all point to 10-year yields in the 4-4.5%+ camp. The headlines can be scary but take a step back; we believe the US isn’t turning into Argentina and the truth probably lies somewhere much less extreme.

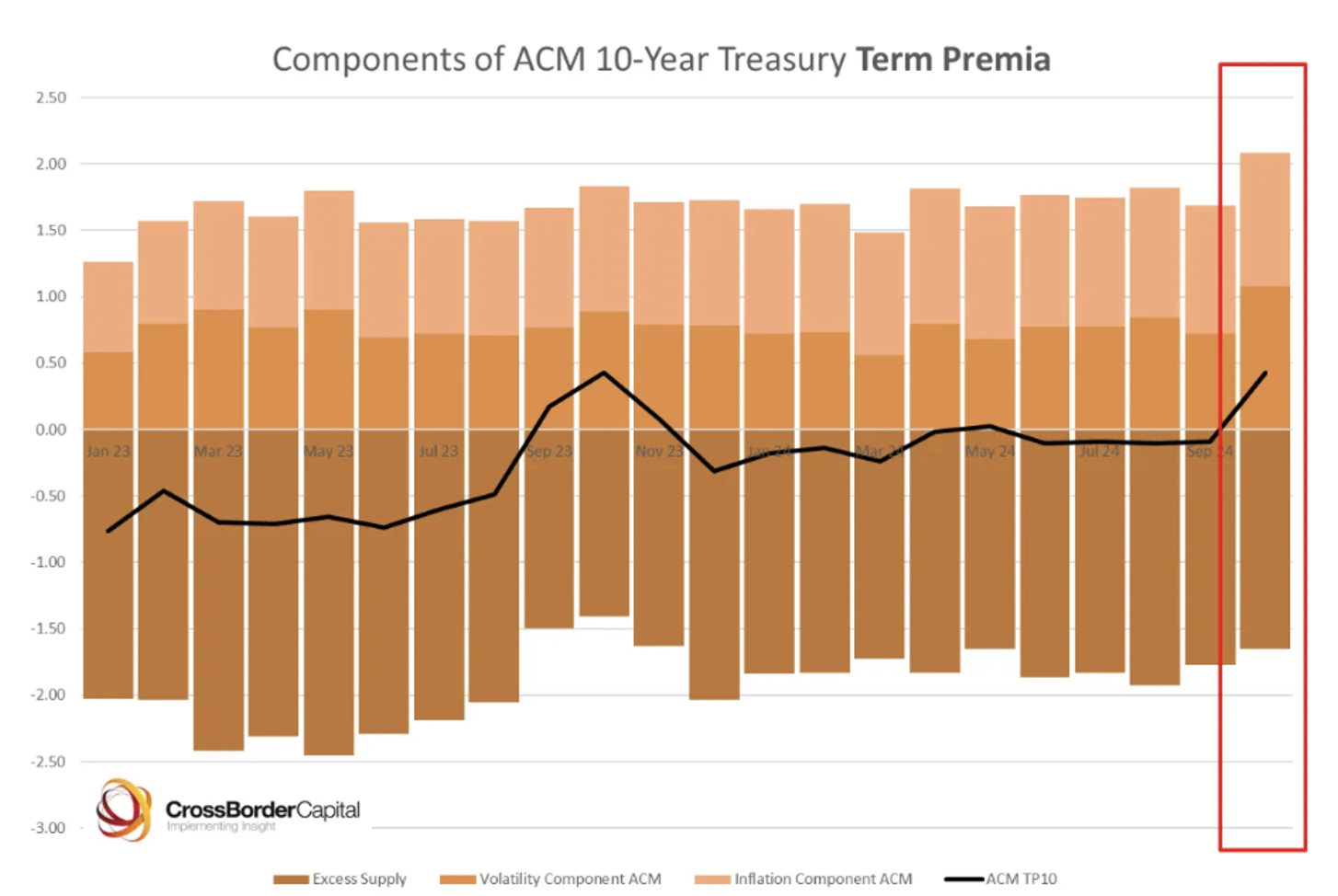

Term Premiums on the Rise

Term premium is the extra yield investors demand for owning long-dated debt versus rolling over short-term securities. Term premiums have risen to their highest level since last November after the Fed’s 50bp cut last month.

Source: CrossBorder Capital as of 10.24.2024

Source: CrossBorder Capital as of 10.24.2024

Term premium can be broken down into 3 main components:

-

- Supply (excess)

- Volatility risk

- Inflation risk

The recent rise in premium has mostly come from the volatility component (MOVE Index highlighted last note) which, in our opinion, can most likely be attributed to the rising odds of a 2nd Trump Presidency. Keep in mind that most of the time, markets “overfear” what they think they know and often underprice what it doesn’t.

Increasing Spending Promises/ Tax Cuts to Buy Votes

We’ll preface this comment with, we cannot wait for this election cycle to be over.

Both Harris and Trump have lots of tax and spending proposals that add up to a larger deficit beginning in fiscal year 2026 and the years following. Looking at a middle trajectory, as tabulated by the Committee for a Responsible Budget, the Harris budget mix would add $3.5 trillion to the deficit over the next 10 years, while Trump would add $7.5 trillion.

Digging into each side reveals what one would expect from each party in terms of taxes and spending. Truth is, neither is likely to get all that is wanted through Congress or even much of it at all. If Harris is elected with a Republican Senate, my thoughts are she’ll basically be a lame duck. If Trump wins, we’ll learn how much was simply part of his “tough” negotiation tactic.

One must keep in mind that these budget proposals are, first and foremost, political statements. They are not rational forward accounting of government balances and even though this is the “most important election of our lifetime” (just kidding), we should probably look at them as what they are – political statements.

FOMC Member Commentary: Data Dependent and Gradual

Several FOMC participants have spoken over the past week. We think it’s important to gauge their temperature in the future direction of rate policy. The gist of their comments supports gradual easing, but there was some variance in the level of commitment to cuts.

-

- Jeffrey Schmid, Kansas City Fed: “While I support dialing back the restrictiveness of policy, my preference would be to avoid outsized moves, especially given uncertainty over the eventual destination of policy and my desire to avoid contributing to financial market volatility.”

- Neel Kashkari, Minneapolis Fed: “Right now I am forecasting some more modest cuts over the next several quarters to get to something around neutral, but it’s going to depend on the data.”

- Lorie Logan, Dallas Fed: “If the economy evolves as I currently expect, a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve our goals. However, any number of shocks could influence what that path to normal will look like, how fast policy should move and where rates should settle.”

- Mary Daly, San Francisco Fed: “So far, I haven’t seen any information that would suggest we wouldn’t continue to reduce the interest rate. This is a very tight interest rate for an economy that already is on a path to 2% inflation, and I don’t want to see the labor market go further.”

If there is one underlying theme, it is that participants favor playing it by ear, tailoring the easing pace as appropriate, depending on data as it is released. The stronger-than-expected September employment and hotter-than-expected September inflation, for example, were clearly noticed.

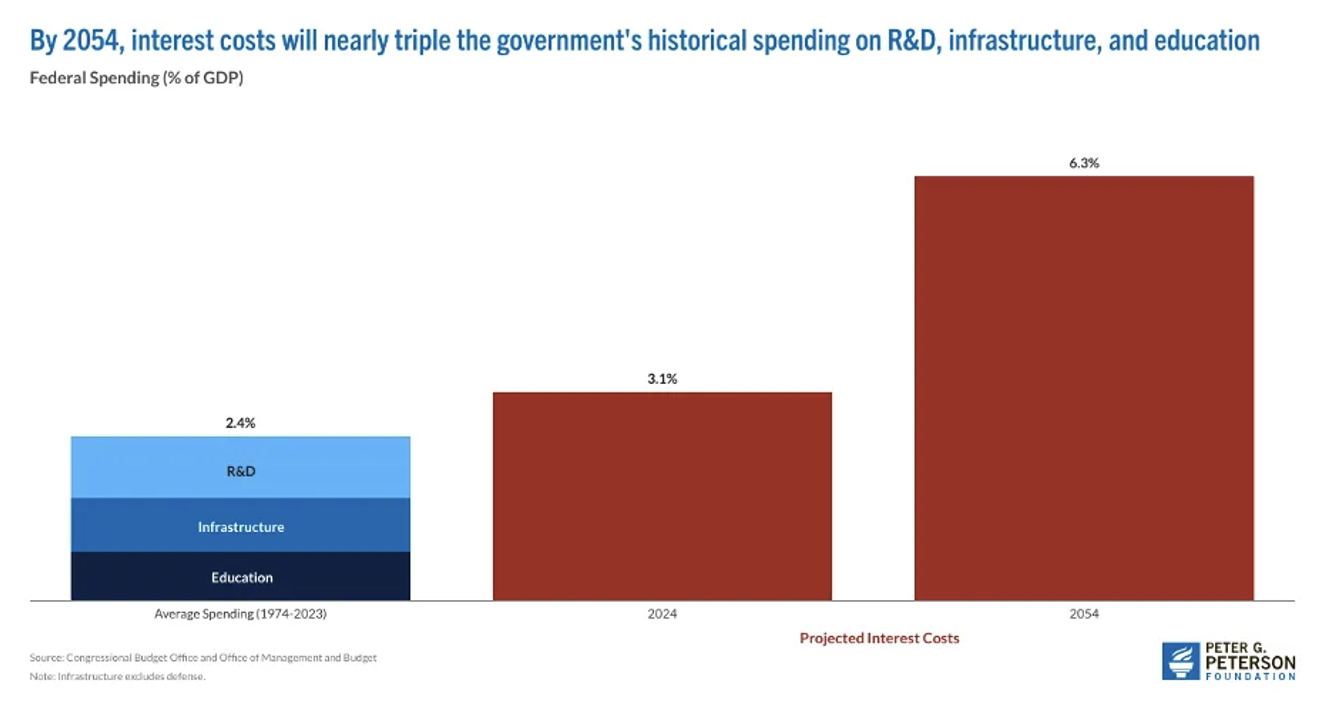

Interest Costs Expected to Continue Rocketing Higher

The Treasury released final deficit numbers for FY 2024 last Friday (over a week late but who’s counting). The deficit was $1.832 trillion, up from $1.695 trillion in 2023 despite $479 billion in revenue growth. Spending increased $617 billion. The biggest increases were in spending for natural resources (the green New Deal), up 24.0%; Social Security and veterans’ benefits, both up 7.9%; and interest on the debt, up 33.7%.

Source: Peterson Foundation as of 10.21.2024

Source: Peterson Foundation as of 10.21.2024

Part of the increase in interest expense reflects Janet Yellen’s decision to finance a huge chunk of the debt in short-term T-bills to prevent long-term rates from rising. The takeaway here is twofold. The deficit problem will worsen unless measures are taken to slow the bleed (neither presidential candidate is campaigning on this issue). The Fed can help (the Treasury) by pulling its lever to decrease short-term rates and help finance the deficit at a lower interest expense. We also expect QT to be another upcoming policy change where the Fed will likely halt the shrinkage of its balance sheet. Big deficits are probably inflationary…not a backdrop where you want to own a bunch of LT government debt. Got stocks?

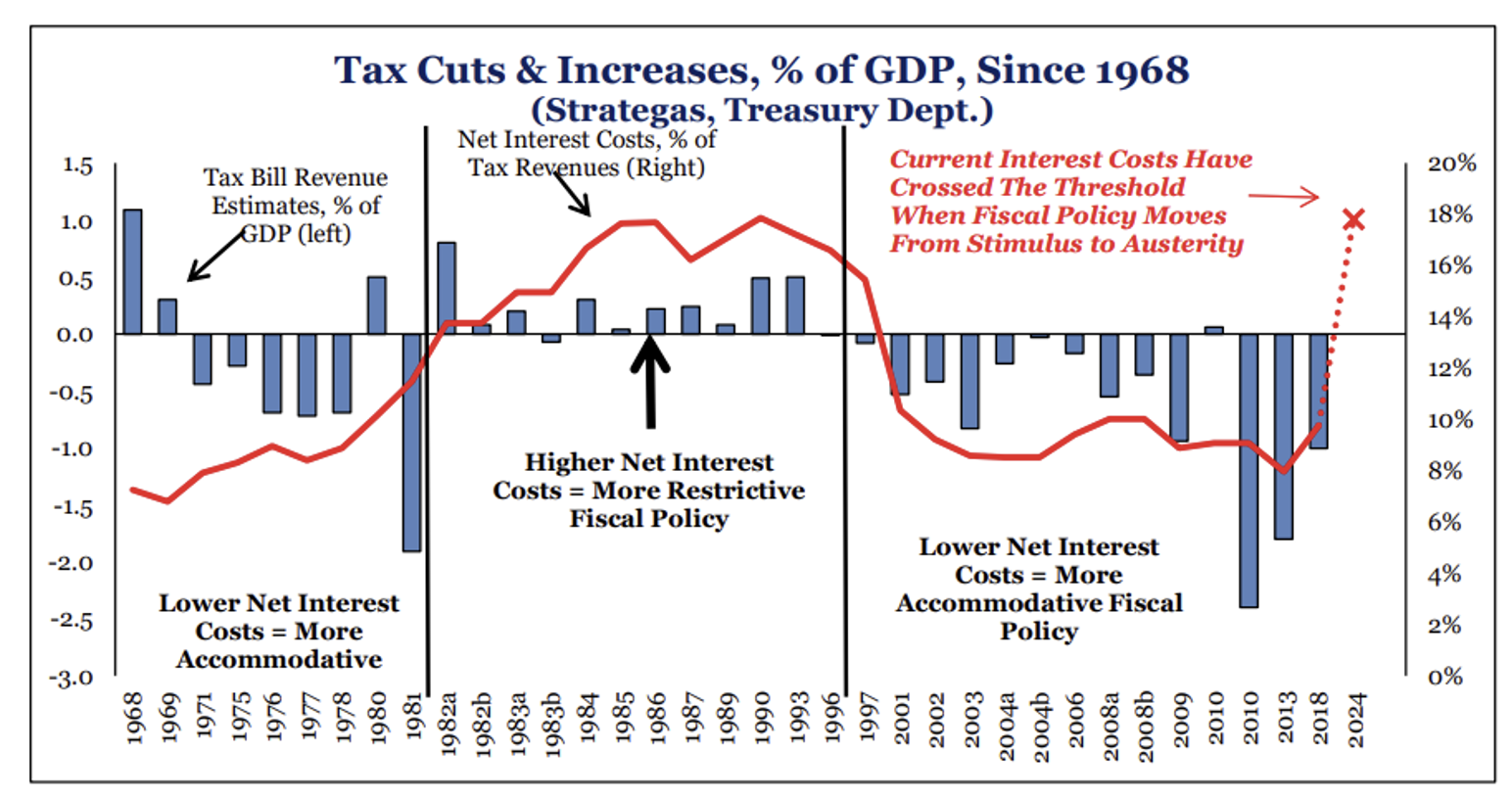

Interest Expense to GDP in Austerity Zone

Historically once interest costs hit 14% of tax revenue, austerity kicks in for Congress. The ability of Congress to increase discretionary spending fades when interest costs crowd out the rest of the budget. Debt servicing costs approached 18 percent of tax revenue in September and the next President will be restrained in his or her ability to increase the deficit moving forward.

Source: Strategas as of 10.23.2024

Source: Strategas as of 10.23.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-28.