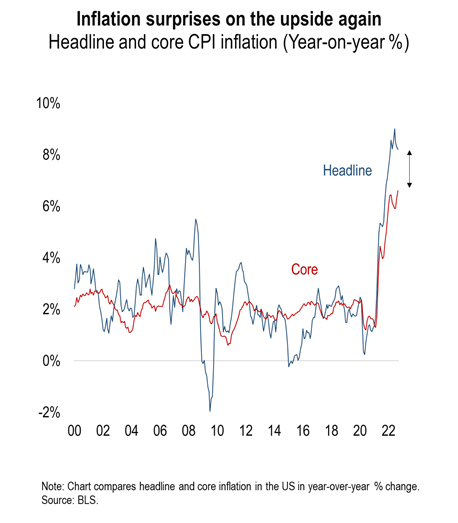

Another hot print with Core CPI hitting a new cycle high of 6.6% y/y, numbers summarized here:

CPI m/m: +0.4%

CPI y/y: +8.2% (vs +8.1% exp)

Core m/m: +0.6% (vs +0.4% exp)

Core y/y: +6.6% (vs +6.5% exp) (vs +0.2% exp)

On a positive note, even with the larger-than-expected gain in September, the annual pace of headline inflation did slow from 8.3% to 8.2%. The main differences between Core and “headline” CPI month over month were driven by Food +0.8% vs Energy -2.1%, the third consecutive month of cooling price pressures (we do note prices at the pump have been up in October).

Source: Numera, as of 10/13/22

Source: Numera, as of 10/13/22

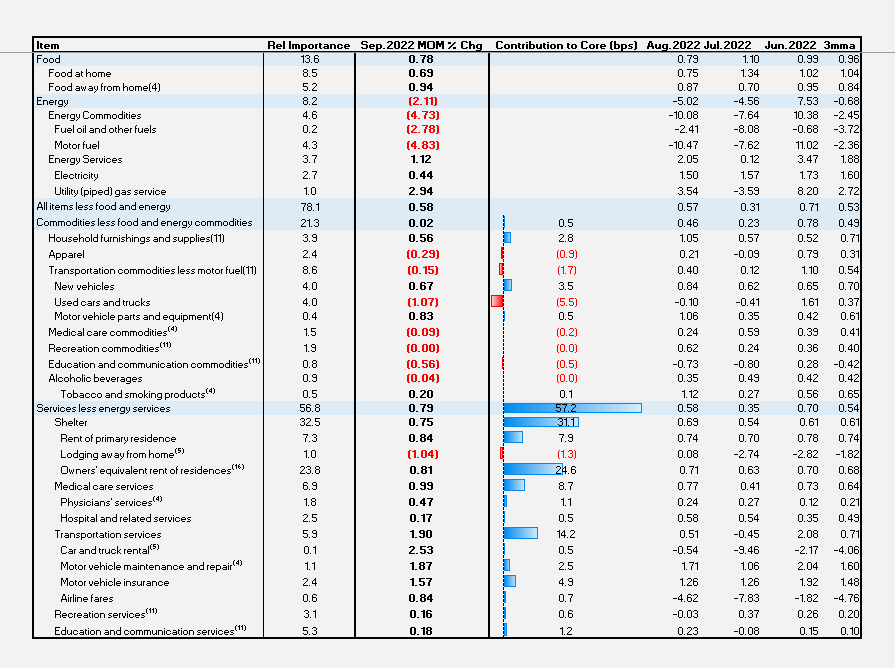

Within Core CPI

- Strongest subgroups m/m: Transport Services (+1.9%), Medical Services (+1.0%), Shelter (+0.7%).

- Weakest subgroups m/m: Used Vehicles (-1.1%), Apparel (-0.3%), Medical Goods (-0.1%)

- Car insurance came in very strong at (+1.6%)

In-focus subgroups:

Rent – Primary Resi m/m: +0.8% vs +0.7% prior

Owners Equiv Rent m/m: +0.8% vs +0.7% prior

New Vehicles m/m: +0.7% vs +0.8% prior

Used Vehicles m/m: -1.1% vs -0.1% prior

Quick Recap

Core goods are finally decreasing but core services are accelerating. OER and rent both accelerated by 10bp to new highs, which as we know, is one of the largest and most cyclical and persistent categories.

Source: Citadel, as of 10/13/22

Source: Citadel, as of 10/13/22

Where Do We Go From Here?

Despite 300bps of tightening (Fed Funds rate), price pressures – both on the consumer and producer side – remain elevated. This is putting extreme pressure on the Fed to use whatever tools necessary to cool inflation. Whether a result of supply-side factors outside of the Fed’s control, or a significant lag in changes to monetary policy, inflation has clearly confounded the Committee’s expectations…we’re not yet seeing a more precipitous decline back down towards the Fed’s 2% target range. On that point, we have a few thoughts on where we could be headed next… one positive and one negative.

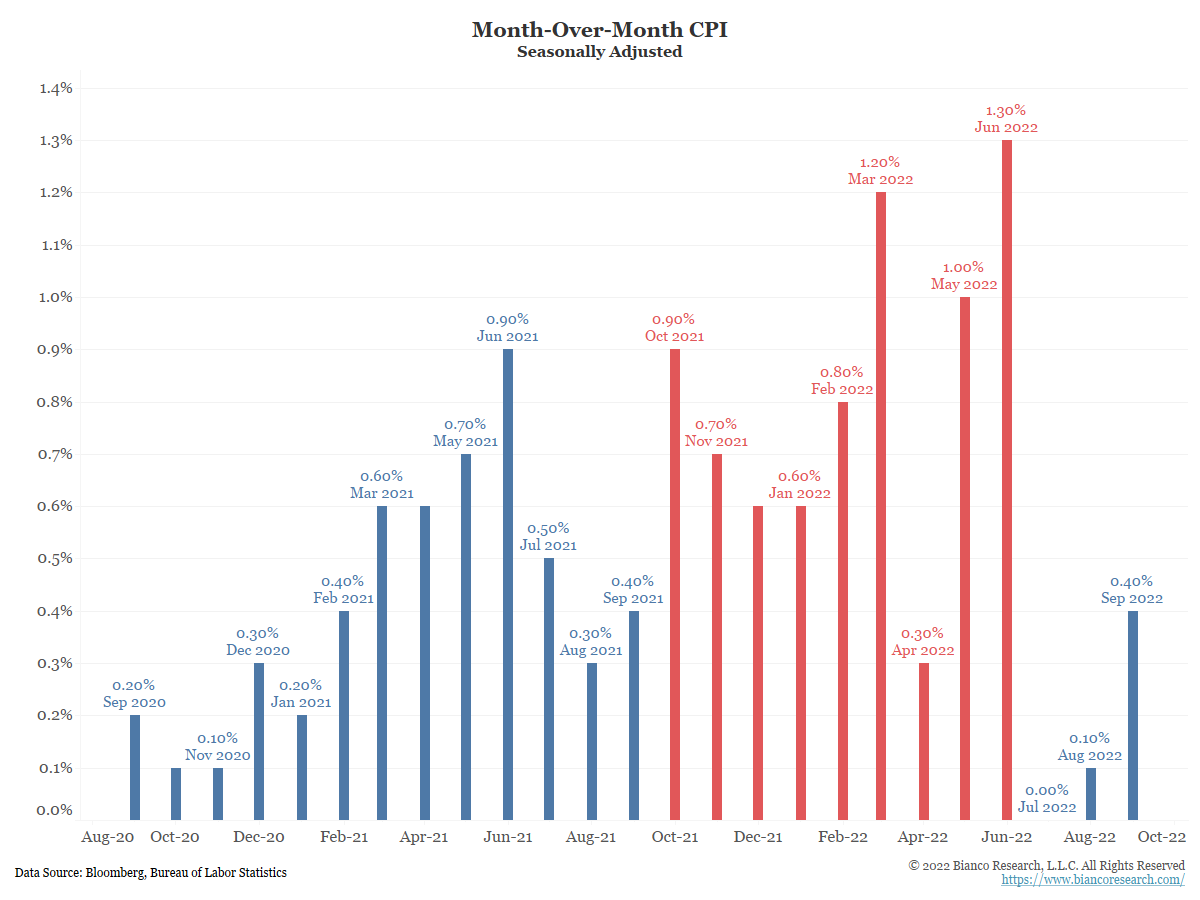

Comps Get Easier From Here

Source: Bianco, as of 10/13/22

Source: Bianco, as of 10/13/22

September’s CPI release is the last month in which the year-ago m/m number was unusually low (basically the end of easy comps). We can now circle October as the beginning of a period in which headline inflation numbers could provide some relief for Fed officials. Traders are aware of this and will be watching how fast the y/y number begins to fall.

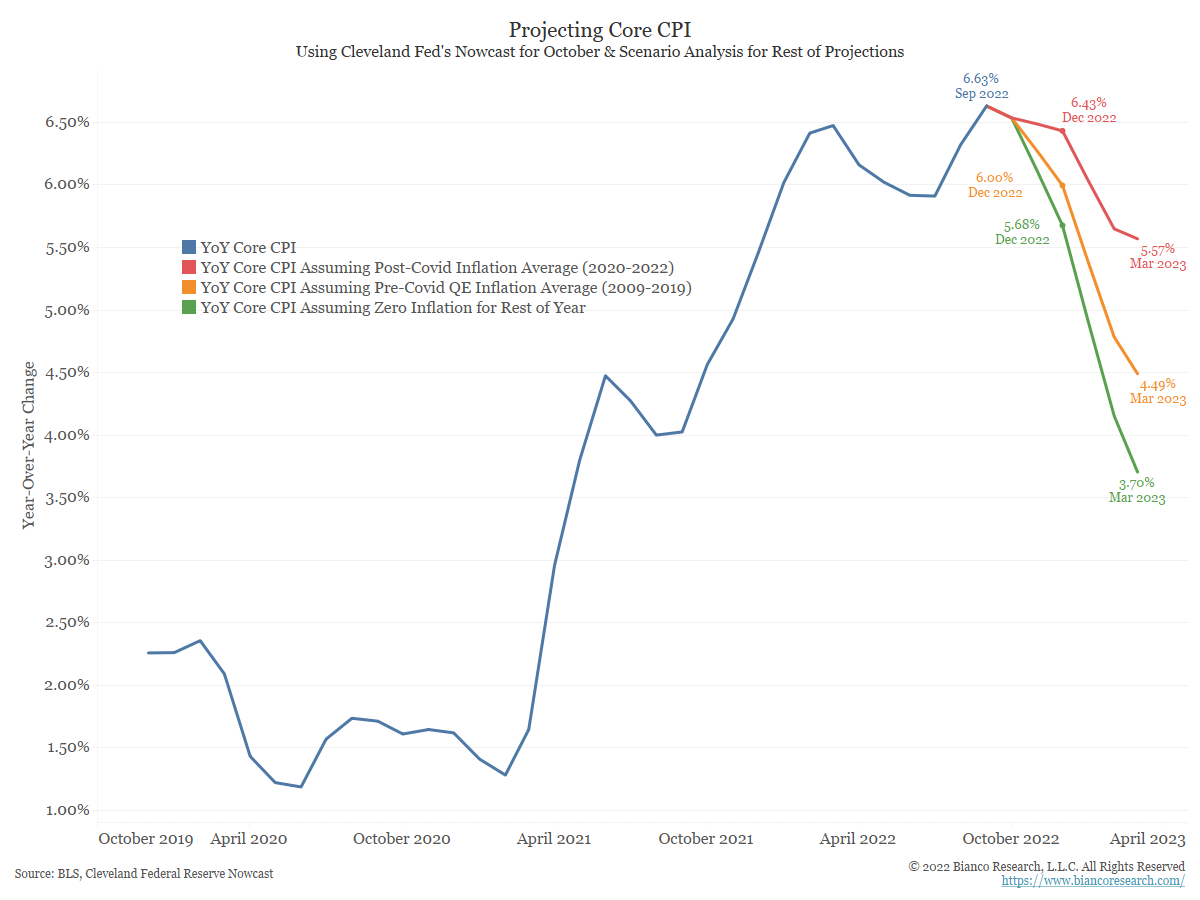

For the scenarios above (run by Bianco Research), they assume the Cleveland Fed’s CPI Nowcast of 0.72% m/m inflation for October will be correct. I’d note that Cleveland Fed has been more accurate than Wall Street but still undershoots actual inflation most months during this inflation cycle.

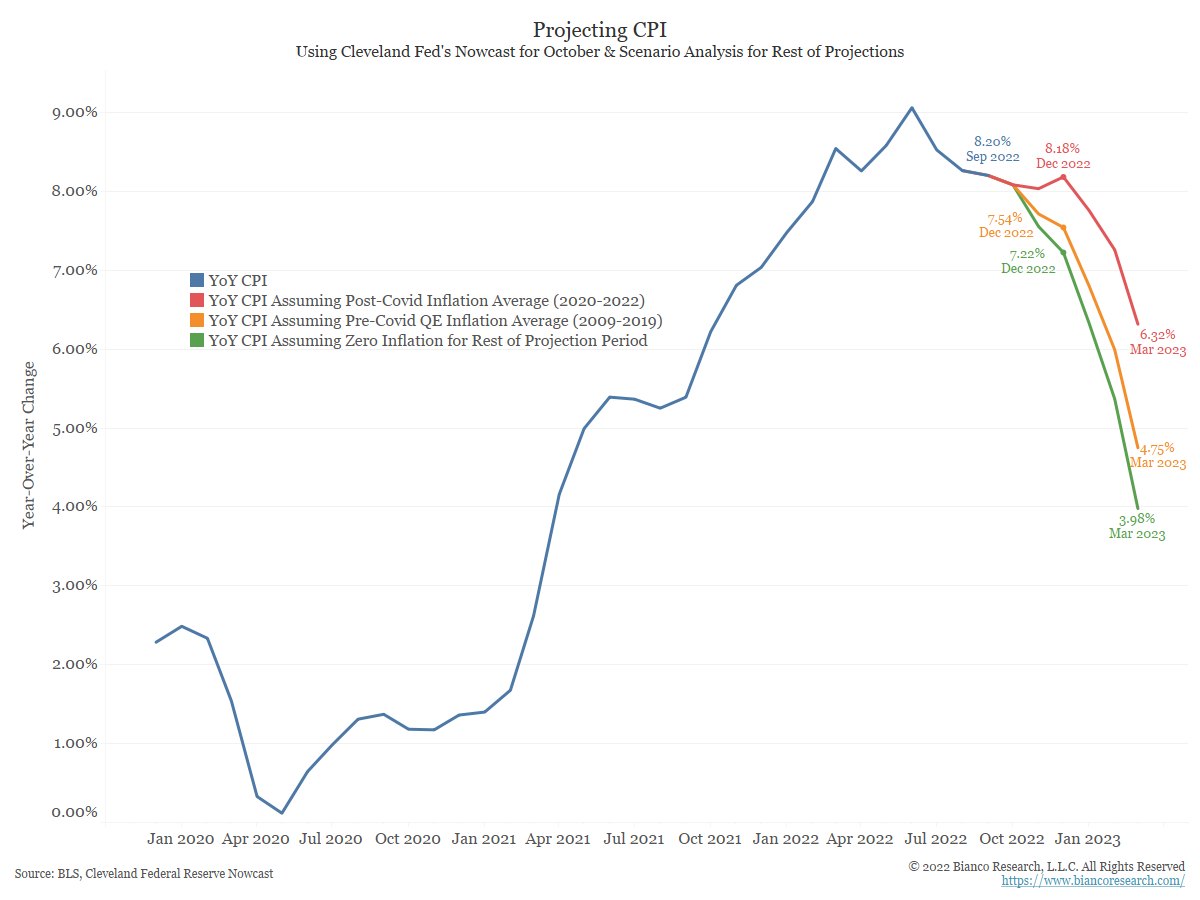

The red line shows CPI would end the year at 8.18% if the m/m releases equal the average seen since the pandemic began in 2020. The orange line shows CPI would end the year near 7.54% if the m/m releases equal pre-pandemic QE-era inflation. Finally, the green line shows CPI would end the year at 7.22% if the m/m releases show 0% inflation for the rest of the year (in my opinion, this seems unlikely).

These estimates are much higher than the consensus on Wall Street. Anyone calling for inflation to fall to somewhere near or below 7% by year-end is actually calling for deflation over the next three months.

For comparison, the chart below shows the same scenarios for Core CPI. The year-end projections for Core CPI have risen a bit based on the last few month’s releases.

Source: Bianco, as of 10/13/22

Source: Bianco, as of 10/13/22

If inflation follows the red lines in the projection charts above, we could still be staring at 6+% CPI six months from now. If energy and housing prices start to ease, the orange lines in the projections above might prove more accurate. In that case, Core CPI would be closer to 4.75% come March. A break in inflation would be well received by the market!

To Conclude

The markets responded to today’s CPI release by making a 75 basis point hike at the November meeting a virtual lock, and drastically increasing the chance for ANOTHER 75 bps hike come December. Timiraos officially blessed a 75 basis point move shortly after CPI’s release (WSJ article: Nick T Blesses 75 for December). A 75 bps hike in November will mark the fourth straight 75 basis point hike in a row. December (if it comes) would be the fifth.

Perhaps this highlights why Fed officials have been so direct in pushing back on hopes of a pivot. If inflation is still at 4.75% in March, rate cuts would seem highly inappropriate unless financial conditions absolutely force their hand. A longer pause (THIS IS NOT A PIVOT), which is what the Fed Funds market is currently pricing in, could make more sense if these projections play out as hoped (i.e., get to restrictive territory and hold steady).

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services, excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-18.