A Central Bank’s place in an economy is to be the behind-the-scenes moderator of financial conditions. Here in the US, they specifically have two jobs: price stability and full employment. Their job is to step into the mix when financial conditions overly fluctuate…and, arguably only then. The argument of if that has happened is for another day though.

When financials conditions get too easy and the economy and inflation are running hot, the Fed can increase interest rates to tighten credit to companies and incdividuals, which slows down lending (more of your money goes to interest). As rates rise, asset values fall due to discounting the assets against a higher interest rate.

In theory, this has a reverse wealth effect and tightens financial conditions (i.e., you feel poorer, so you spend less). On the contrary, during slowdowns, Central Banks make financial conditions easier by lowering interest rates and increasing credit to companies and individuals (via banks), to spur borrowing and increase business activity.

Also in modern times, the Fed has bought fixed income securities which has in turn buoyed asset prices, via “QE”. This liquidity has an increasing wealth effect.

In short: COVID brought extreme financial policy (monetary AND fiscal) accommodation, lifting virtually all asset prices higher. 2021 began a new regime of inflation (created from BOTH too much demand and supply issues) which was denounced originally by the Fed as transitory.

Now, 2022 brings a great moderation leading to a normalization of both monetary and fiscal policy. The economy can’t run at a high single digit rate without creating problems, especially when consumers’ pockets are loaded with cash and supply chains aren’t properly functioning (from Econ 101 that is called demand pull + cost push inflation).

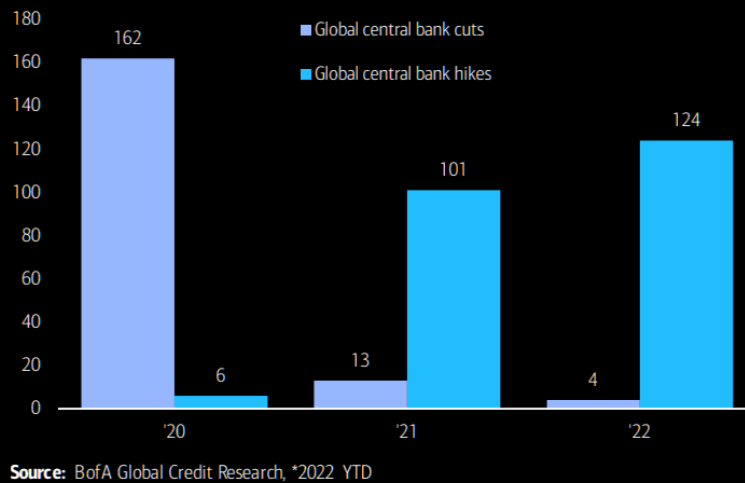

In Response: The Regime has Changed, Central Banks have gotten aggressive!

The Fed is NOW Scared of Inflation

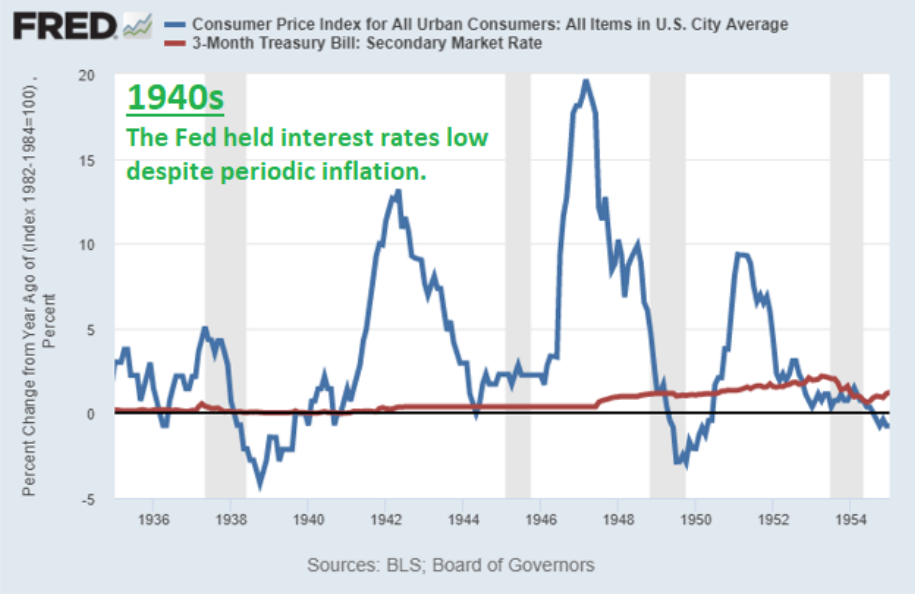

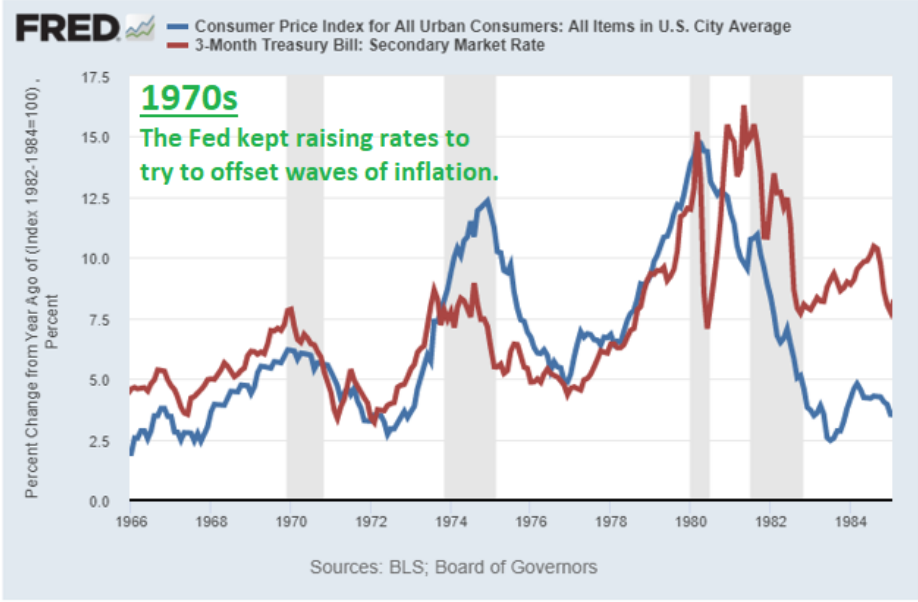

We’ve heard a number of media heads comparing today’s inflation to the 1970s. While many might have more of a living memory of the 1970s, the economic data looks to us more like the late 1940s (post WWII) where excess savings that accrued during the war came flooding into the economy to goods and services, creating substantial inflation (peaking at 20% year over year in early 1947) followed by deflation 2 years later, without any change in rates.

1940s

1970s

Source: BLS. Annotated by Lyn Alden.

Source: BLS. Annotated by Lyn Alden.

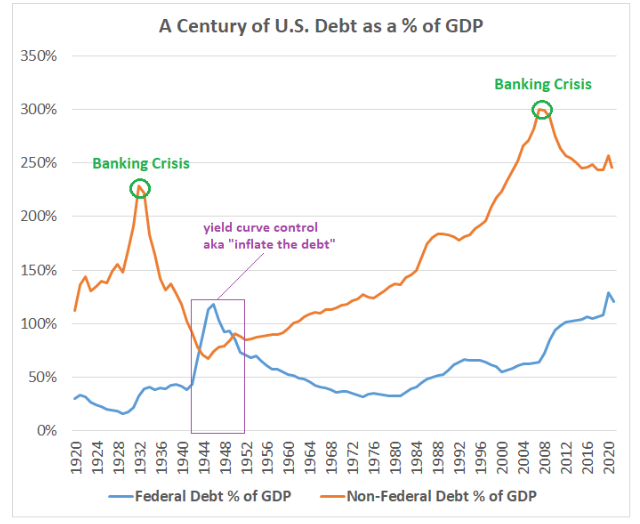

Source: Lyn Alden

Source: Lyn Alden

How Does This Compare to Today?

Back in the 40s, the Fed was not driven by the 24-hour news cycle, and likely was controlled by a US Treasury that had a top priority of paying down WWII debt (at lower rates), so the entire yield curve was fixed until 1951 (what we’d refer to as Yield Curve Control). In turn, debt/GDP decreased materially.

The bag holders of this operation were the bondholders who were forced a negative real return (similar to 2022, huh?!). Inflation was solved because inflation was driven by excess demand as consumers spent their pent-up savings from the war, but eventually the excess savings dried up and, after 2 years, demand slowed.

Two important things happened during this period: wages never accelerated meaningfully (meaning no wage spiral) and supply issues improved materially across the economy. Basically, capitalism worked.

This is not what happened in the 1970s because inflation was not primarily driven by excess demand, it was driven by long term supply issues that required meaningful structural changes to the economy before inflation was permanently lower.

Volcker did not kill inflation, he wounded it. Over the long term, inflation stayed down due to globalization, opening Alaska for oil drilling (and ultimately shale), deregulation of transportation industries, and lower marginal taxes, to name a few.

Today, the global economy has plenty of potential capacity, it just needs to be opened up more fully – China lockdowns, Oil/Gas drilling, Labor Force participation. If this supply side of the economy recovers in 2023, central banks globally could be whipsawed, as rapid inflation could transition to substantial disinflation along with a recession/slower economy.

The bottom line is that we believe slowdowns caused by a Fed tightening cycles are (a lot) worse (i.e., recession) compared to cyclical slowdowns that don’t involve a tightening cycle.

In General, We Don’t Think This is the 1970’s (yet)

→ Average annual hourly earnings are lower today than at any time between 1968-1982. In addition, they are decelerating. Tough to argue for a wage/price spiral when wages are decelerating.

→ Money supply growth has flattened (and is down in April & May) – The trend over the last few months is weaker than at any time from 1970-1985, and its likely getting weaker as consumers spend out excess savings. Inflation lags M2 growth by ~18 months. Funny that when M2 growth was 30% YoY, policy makers weren’t worried about inflation, and now that M2 is flattening, everyone is upset over inflation risk.

→ Personal Income Growth is an annualized 5% YTD, lower than at any time from 1970-1985, and its likely decelerating. Even when unemployment was 10%+ in the 1970s, income growth never dipped below 5.5%, and was usually much higher. Unemployment benefits were much more meaningful, and the unionized workforce largely didn’t feel the pain of long-term unemployment and maintained contracts with high wage growth.

→ Oil/Gas/Energy Crisis – yes they happened in the 1970s, but also existed in the late 1940s as excess demand put pressure on supply chains that were still recovering from WWII.

As a reference, here is a link to a New York Times article about Oil/Gas Shortages from 1947: Oil, ‘Gas’ Shortage is Seen for Winter

My Caveat

This could turn into 1970s type inflation, but it would require supply issues lasting years and a compounding of the current policy mistakes (unrealistic “Green” initiatives, ESG, villainization of legacy energy companies before a sustainable solution is upon us, etc.). While this is certainly possible, we believe the likely outcome remains supply chains recover, and the world will come to its senses on energy supply. This will be a KEY issue come midterms.

So Soft Landing vs Hard Landing?

For the Fed, we believe there are two possible paths forward 1) The Fed doesn’t hike enough and falls behind the curve to expansionary inflation for the foreseeable future, or 2) They overtighten and choke off growth sending the economy into a recession.

Thus far in the story, growth has been the fear, as Fed action (and their indication of future tightening) has drastically tightened financial conditions. This can be seen with the normalization of risk metrics (i.e., HY spreads wider & Equity P/E multiples lower).

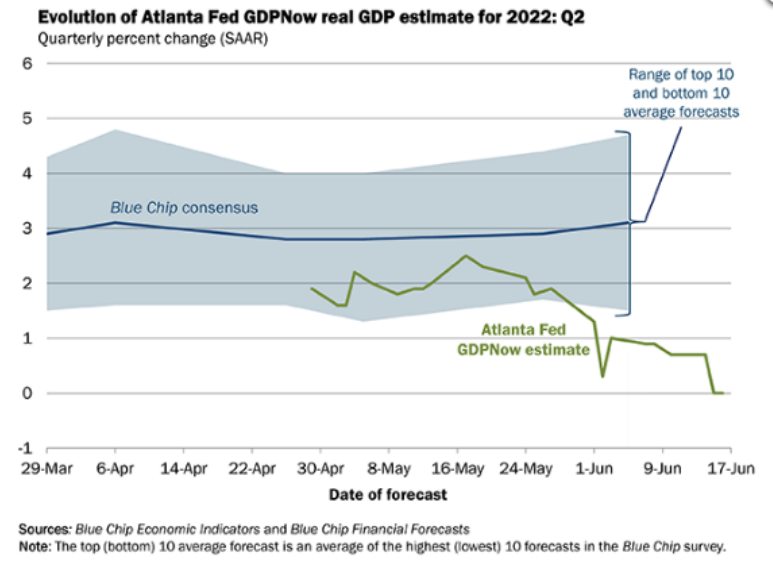

In addition, the surprise negative Q1 GDP print and decline in the Atlanta Fed’s real GDP estimate for Q2 (currently @ 0.0%). Remember, recessions typically begin when an economy exhibits two consecutive quarters of negative GDP Growth so a lot is riding on this Q2 number – a big reversal would do wonders given the recessionary fears present.

Source: Atlanta Fed. As of June 17th, 2022

Source: Atlanta Fed. As of June 17th, 2022

Hard vs. Soft

We’d define a hard landing as a recession caused by Fed tightening (Rates + QT) and a soft landing as a growth slowdown in expense for lower inflation but with the kicker of no recession… aka threading the needle! We can see a pathway for it, but the soft-landing story is getting trickier – even Chairman Powell said last week he thought it would be difficult given the persistence of inflation.

So how can we see a soft landing?

The markets (Fed) need the private sector to increase supply of markets. To start, lowering energy costs (increasing supply) would help lower food costs amongst many other costs. On top of that, we need a return to pre-pandemic job levels – which would help ease wage inflation. Simply put, we have 11.4 million job openings in the U.S. economy vs. “just” 6 million unemployed people and another positive is the massive cash cushion that’s still likely available for upper-income consumers.

To Conclude

The Fed’s 75bps hike has resuscitated its inflation-fighting credibility, for now. This has driven a change in the market narrative away from a parochial focus on inflation toward a growth slowdown. However, if there is a secondary inflation shock (like the 70s) in the pipeline, it will be driven by a shortage of diesel/refining products and will be problematic.

The Fed will have a choice: continue to hike into stagflation or backtrack to support growth or financial stability. The back up in real yields the last few days are suggesting the Fed will backtrack… time will tell. BUT, to the extent to which we believe that rents, wages, environmental policies, and a significant slowdown in the pace of globalization are likely to render inflation more structural than transitory, we believe that the Fed has just started its long journey to reach price stability.

Bringing inflation from its current level to something more in-line with the Fed’s target of 2-2.5% will take time.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2206-22.