“The most important job is to strike the appropriate balance between offense and defense” Howard Marks

We recently wrote a piece outlining sequence of returns risk and the impact it may have on a plan. Today, let’s talk more about the headwinds you have in managing that risk in today’s market and how you might think about addressing it. One note, there are two sides to planning for this risk: distribution planning and investment. In the spirit of avoiding a 10page article today we will stick to the investment portion.

![]()

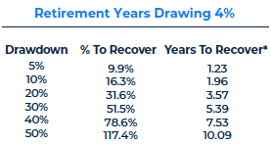

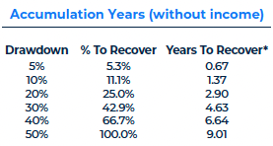

Source: Aptus Research

*Assumes Recovery = 8% Net CAGR

There are a number of ways to reduce volatility . The most common and we think important way to manage risk is through asset allocation. Harry Markowitz research on portfolio selection dating back to 1952 discusses how a portfolios risk is not simply the sum of each individual component. It depends on how each of those components correlate and interact with each other.

Stocks and bonds provide appealing correlation differences. Yet in today’s market is it enough to manage risk and obtain sufficient returns?

Current Market Conditions

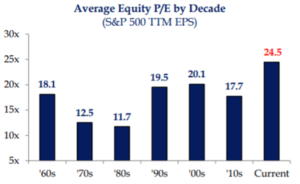

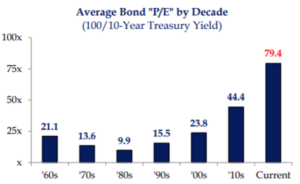

Source: Strategas Dec 2021

Price to earnings is typically only discussed in equity markets but can also be looked at from a bondholder’s perspective. By taking the bond’s par value, 100, and dividing it by the 10-year Treasury yield as of December 21’, you can gain some perspective on their elevated prices as well. We are now combining historically tight credit spreads, low interest rates, high valuations in both stocks and bonds, inflationary pressure with a less accommodative Fed. If the time this year in markets has taught us anything, I think it is safe to say conditions are much different than a year ago. Fixed income investors have continued to see similar income and return challenges since September 20th, 2020 which was the most recent low point in yields (10-year was 0.5%).

Stocks can provide capital appreciation and dividends into our portfolios while historically bonds have provided income and stability. Moving forward, we are faced with an environment of elevated multiples on stocks and abysmally low interest rates on bonds. The market environment we are walking into is potentially VERY different from what we experienced the last 30-40 years where interest rates went from 15% to 0%.

Considering Market Volatility an Opportunity

“Risk isn’t what you think is going to happen, it’s what hurts if it does happen.” David Dredge, Convex Strategies

In our eyes the lifeblood of financial services is the $500k to $3 million family nearing or in retirement that will need to tap assets at some point. They need two things:

- Sufficient growth

- A return stream they can stomach.

How can we construct portfolios which find adequate return while keeping risk in line?

The most powerful lever we can pull to drive each of the above in today’s market, in our opinion, is altering allocations away from bonds. This may seem counterintuitive to the conversation of how to manage a sequence of negative returns, so stick with me here… Allocating to assets with correlation benefits is important but having 60% of your life savings in an asset class with minimal income today, a limited buoy based on the current rate environment, and no ability to grow just doesn’t make sense to us. If you could allocate less than 5% to an asset which we would argue has better correlation benefits and gives you the freedom to own more equites, would you consider it?

The good news about adding volatility as an asset class is that the natural convexity does not require a significant allocation for it to pay dividends to your clients. In other words, even having 2-3% in ownership of volatility can significantly impact the risk profile of your total portfolio.

Expected returns in a rising market will be negative for a traditional hedge, so the manner in which you use hedges to manage risk matters. The big point here is the potential asymmetric payoff when volatility spikes. Giving you an additional asset class to mitigate sequence risk while giving your clients the freedom to own more stocks to address any growth goals.

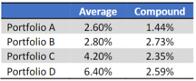

Boring Wins The Race

The gap between average and compounding return can be defined as the volatility tax. Our team looks to mitigate the volatility tax by owning volatility. That is an oxymoron, right? The more volatile a return stream is the greater that tax will be. This concept is extremely important for your clients planning for retirement.

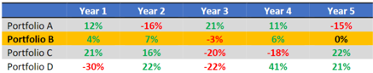

Which portfolio would your client pick as they approach/enter retirement?

Portfolio B is the surprising leader in the clubhouse:

Andrew Lo and Stephen Forester’s recent book In The Pursuit Of The Perfect Portfolio includes profiles on some of the most prominent financial minds including Harry Markowitz, Jack Bogle, Bob Shiller, Bill Sharpe, and the list goes on. The authors after talking to so many important financial leaders describe “the perfect portfolio” as one that will adapt to both individual changes in circumstances as well as market conditions. These comments could not be more accurate in my mind as you plan for sequence risk with your clients in today’s market.

The idea of being willing to adapt to the different market cycles is a huge tool in your tool belt to help with achieving adequate returns while not taking on risk your clients cannot handle. The good news is our industry has come a long way for advisors to access options exposure for their clients without the need to trade individual options at the account level.

Challenge the norm in this environment. Allocating 50% to an asset class that is battling hurricane force winds is not the adaptation to markets that I think these prominent minds in finance would envision as being the perfect portfolio.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2202-33.