We thought the current backdrop provided an opportunity to dive into the basics of inflation. The below analysis will attempt to isolate different types of inflation, and distill our input on where we stand on each in the current cycle.

This is a bit “economic” at its core, but we’ve tried to provide both a technical answer and an “Aptus Take” for each component. This is by no means comprehensive of everything (macro cycles are deep!) but we hope it can help clarify questions regarding issues our current economy and Federal Reserve are facing.

Inflation is a complex economic phenomenon. We like to narrow inflation down to several common factors which can contribute:

- Demand-Pull Inflation

- Cost-Push Inflation

- Wage-Price Spiral

- Monetary Policy

- Fiscal Policy

- Exchange Rates

- Consumer Expectations

- Supply Shocks

- Misaligned Incentive Structures/ Improper Capital Allocation/ Overly Burdensome Regulation

- Demographics/Labor Force

We will attempt to define each type of inflation, show a visual, and distill why it’s important to the current cycle. Within the “Aptus Take” we will provide a real-world explanation of how we’re seeing each component impact our economy today.

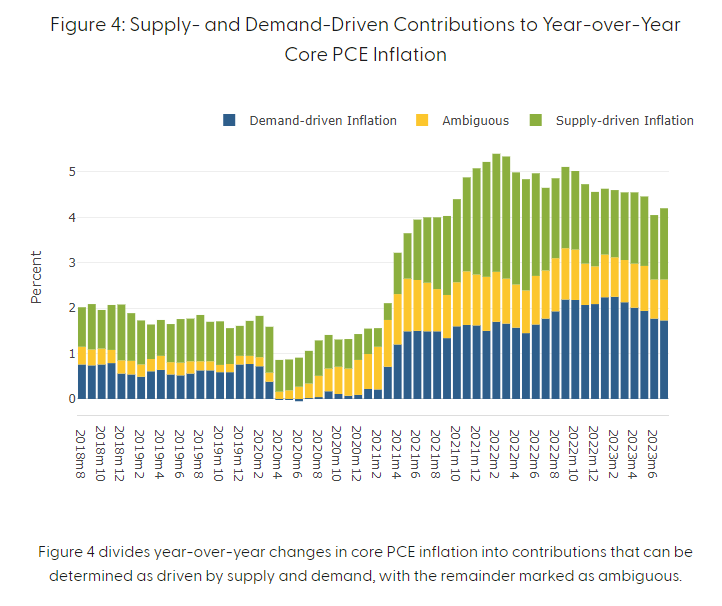

Demand-Pull Inflation

This occurs when the demand for goods and services in an economy exceeds the supply. When demand outpaces supply, businesses may raise their prices to take advantage of the increased demand, leading to rising overall price levels.

Source: San Francisco Fed as of 08.31.2023. Inflation Contributions.

Source: San Francisco Fed as of 08.31.2023. Inflation Contributions.

Aptus Take: Consumer demand for goods following the pandemic (which then turned to services) was overstimulated. This was likely magnified by supply constraints from resiliency issues in our supply chains, which muted the availability of supply as well as employment/ labor market constraints. As simple as it is, when you hand out money to the US Consumer, they will spend it. This influx of heightened demand overburdened our economic capability. The Fed SHOULD be able to slow demand with their interest rate policy.

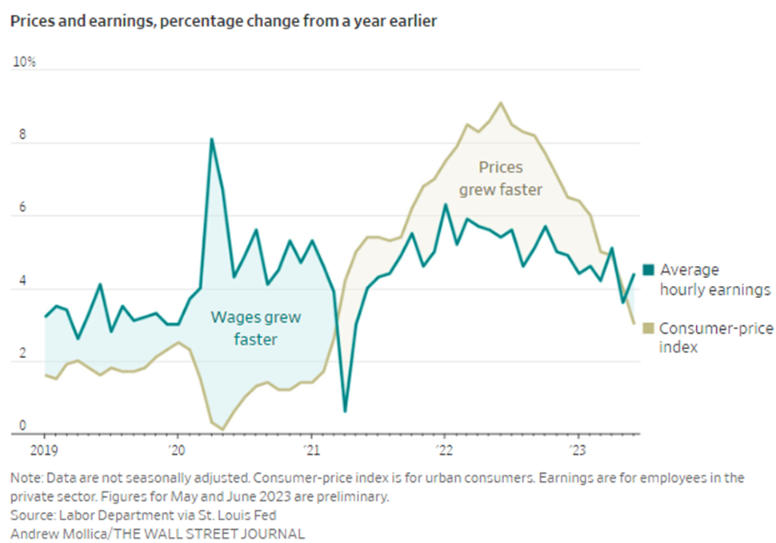

Cost-Push Inflation

This is driven by an increase in the production costs of goods and services. It can be caused by factors such as rising labor costs, increases in the prices of raw materials or energy, and supply chain disruptions. When businesses face higher production costs, they may pass those costs onto consumers in the form of higher prices.

Source: Wall Street Journal as of 07.31.2023

Source: Wall Street Journal as of 07.31.2023

Aptus Take: We all felt in some capacity the surge in commodity prices following both the pandemic and the Russia/Ukraine conflict. Many companies faced rising costs of production in their day-to-day business practices, making their cost of doing business rise.

One surprise of this cycle has been the ability for companies to raise prices, and the acceptance of higher prices by the consumer. As businesses faced higher costs, they passed them through to us. As those input prices fell and companies became more efficient, they maintained the higher prices which has led to larger margins.

While the Fed can’t necessarily decrease production costs for companies (little effect on commodity prices), they can use their policy to slow demand which should in turn dent labor market pricing pressures. Up to this point, there has been only a marginal impact on the labor market.

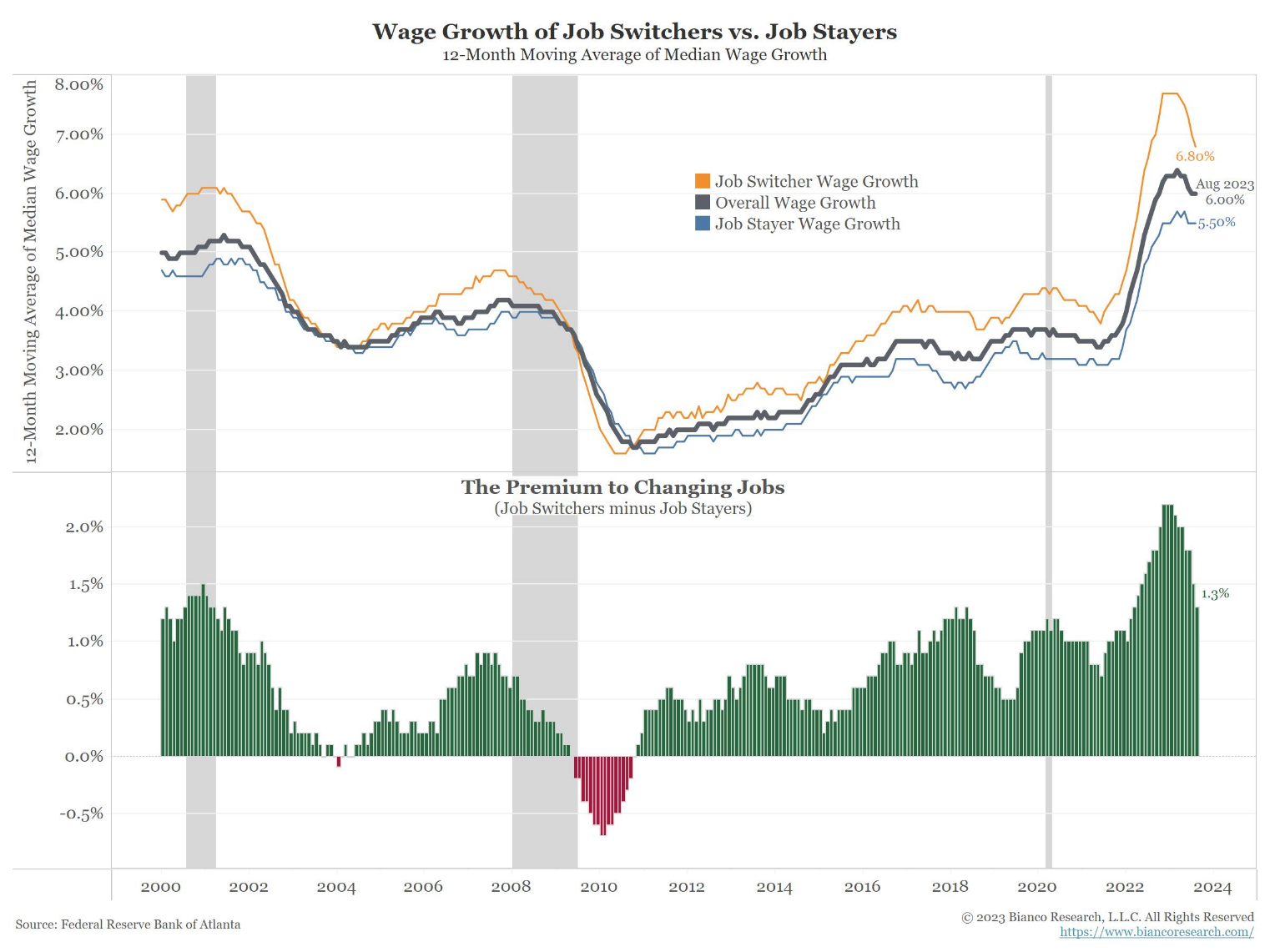

Wage-Price Spiral

This occurs when workers demand higher wages to keep up with rising prices, and businesses then raise prices to cover the increased labor costs. This cycle can continue, with wages and prices continually pushing each other upward. Currently, skilled workers continue to have leverage on employers. Employers are being forced to pay up to both attract and keep talent.

Source: Bianco as of 09.19.2023. Wage Pressure via ATL Fed Wage Growth Tracker.

Source: Bianco as of 09.19.2023. Wage Pressure via ATL Fed Wage Growth Tracker.

The unemployment rate was 3.8% in August (3.5% in July). This is one of the lowest readings in the last 70 years. JOLTs data recently showed 8.3 million open jobs existed in the United States in July. There are 5.8 million unemployed. That means we have 2.98 million more open jobs than unemployed workers, or 1.51 open jobs for every unemployed worker.

Aptus Take: We don’t have enough skillful workers to satisfy the demand of our economy. With that, wage pressures are running above levels historically consistent with 2% inflation.

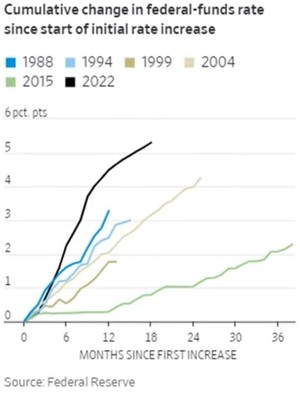

Monetary Policy

Central banks play a crucial role in controlling inflation through their monetary policy. If a central bank increases the money supply too rapidly or keeps interest rates too low for an extended period, it can stimulate demand and potentially lead to inflation. Conversely, tightening monetary policy by raising interest rates can help curb inflation by reducing borrowing and spending. This is the lag feature… but it works in both directions.

Source: WSJ as of 09.19.2023. Fed Fund Rate over time.

Source: WSJ as of 09.19.2023. Fed Fund Rate over time.

Aptus take: The Fed held interest rates FAR too low for too long and then threw accelerant on the fire with massive QE (balance sheet expansion) as well as helicopter money via stimulus checks.

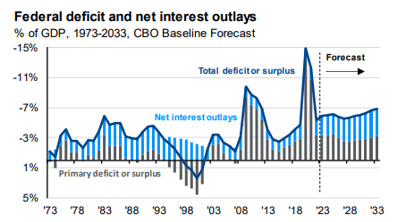

Fiscal Policy

Source: CBO as of 08.31.2023. Federal Deficit and Forecast.

Source: CBO as of 08.31.2023. Federal Deficit and Forecast.

Government fiscal policies, such as deficit spending, tax cuts, or increased government expenditures also influence inflation. Expansionary fiscal policies, when used during a strong economy, can boost demand and potentially contribute to inflation.

Aptus Take: This is a BIG DEAL. In our opinion, the government spending is in opposition to the Fed’s monetary policy. The spending dilutes the tightening of interest rates and continues to keep money flowing into the real economy. The US gov’t is running wartime-like deficits and according to the CBO’s projections, large deficits will continue to grow.

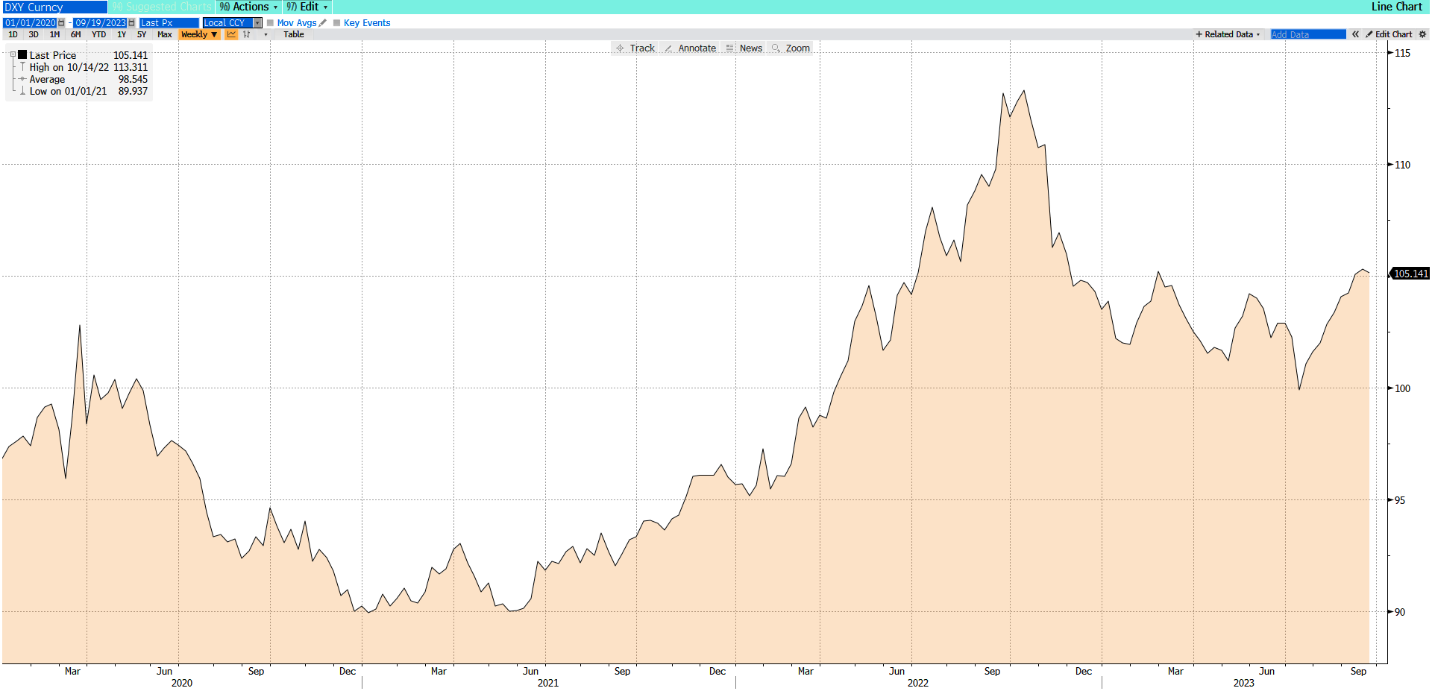

Exchange Rates

Exchange rate fluctuations can affect the prices of imported goods and services. A weaker domestic currency can make imported products more expensive, leading to inflation if consumers and businesses rely heavily on imported goods.

Source: Bloomberg as of 09.19.2023. DXY Index.

Source: Bloomberg as of 09.19.2023. DXY Index.

Aptus Take: Strong US dollar exports some of our domestic inflation. The reserve currency dictates the world making it an important economic indicator on what is to come.

Consumer Expectations

Inflation expectations can become self-fulfilling prophecies. If individuals and businesses expect prices to rise in the future, they may adjust their behavior, accordingly, demanding higher wages or raising prices, which can contribute to actual inflation.

Source: Bloomberg as of 09.19.2023. 5-year, 5-year Inflation Swap Rate.

Source: Bloomberg as of 09.19.2023. 5-year, 5-year Inflation Swap Rate.

Aptus Take: The market’s future inflation expectations are closely monitored by central banks. When inflation rides perpetually higher than target, participants begin to lose faith in central bankers’ ability to get inflation under control. Current 5y/5y inflation swaps are pricing inflation at ~2.70%.

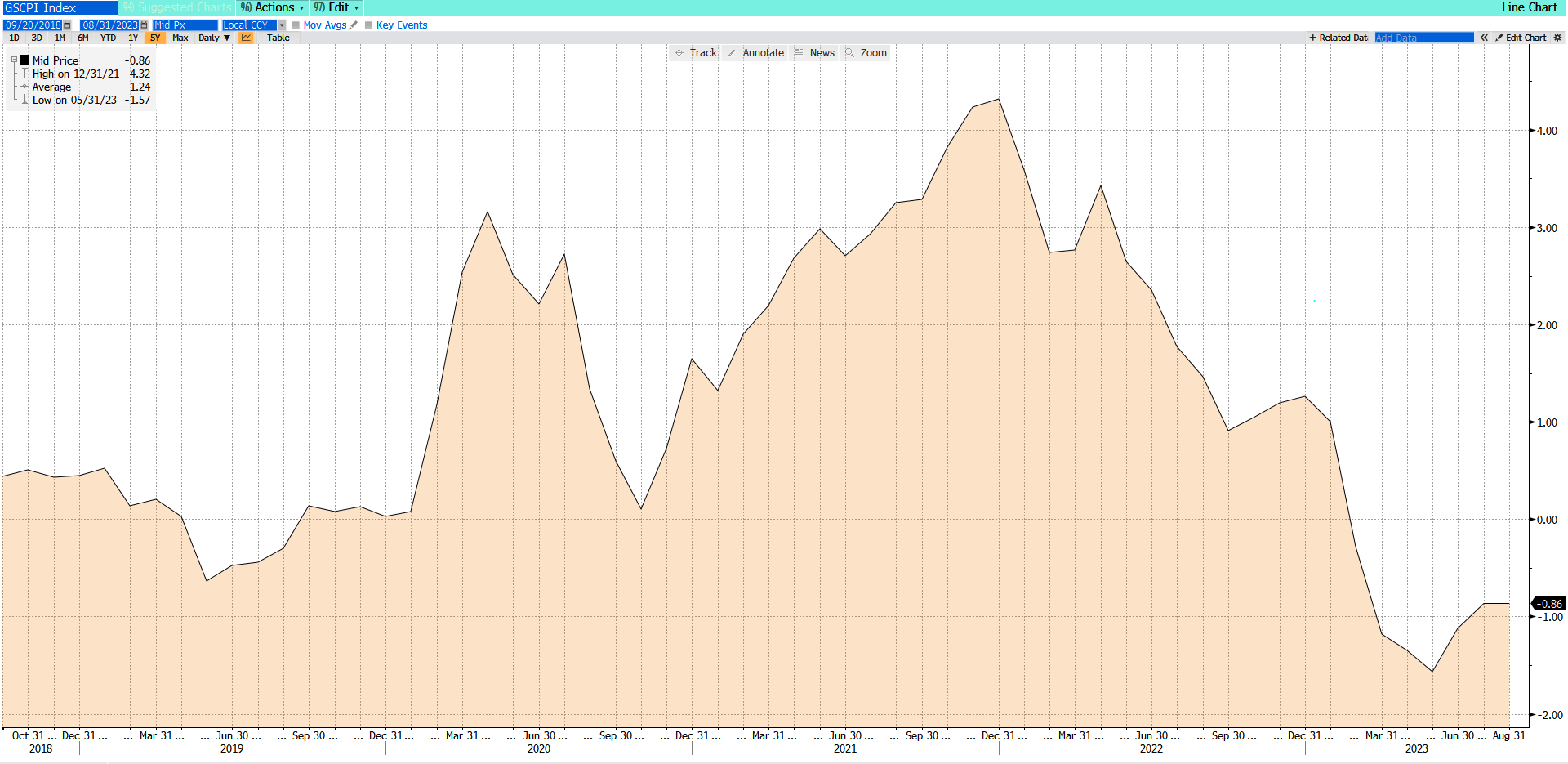

Supply Shocks

Sudden and unexpected events, such as natural disasters, geopolitical crises, or disruptions in the supply chain can lead to supply shortages and drive-up prices for certain goods and services.

Source: Bloomberg as of 09.19.2023. NY Fed Global Supply Chain Pressure Index.

Source: Bloomberg as of 09.19.2023. NY Fed Global Supply Chain Pressure Index.

Aptus Take: Supply chain pressures are inflationary pressures that typically go away as quickly as they come. Barring being fixable, these types of problems aren’t typically ones Central Banks will harshly respond to, and are more or less just the cost of doing business.

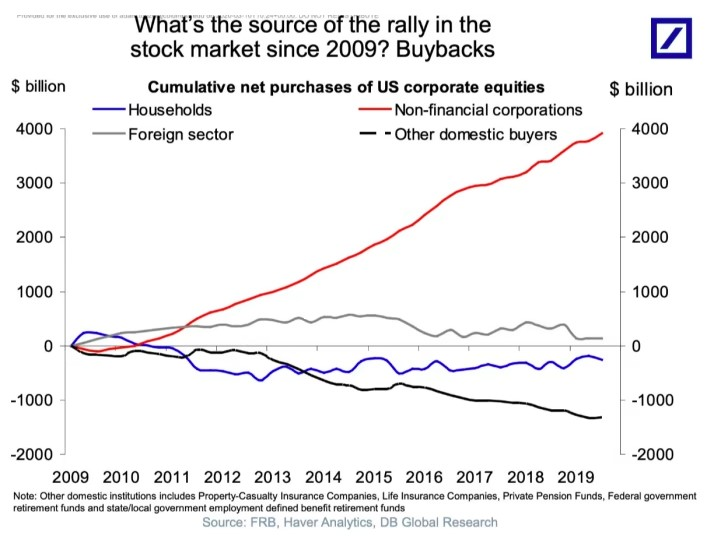

Misaligned Incentive Structures: Improper Capital Allocation/Overly Burdensome Regulation

Poor allocation of capital/ government regulation can lead to unnecessary inflationary pressures. The last ~13 years, governments have caused capital/ investment to shift away from hard assets to financial assets due to ZIRP rate policy.

Source: Deutsch Bank as of 09.19.2023. Net US Corporate Equity Purchases.

Source: Deutsch Bank as of 09.19.2023. Net US Corporate Equity Purchases.

In addition, we’ve rewarded policies like buybacks which have engineered earnings higher without the associated capex/ growth spend typically required. In addition, regulatory policies have chosen winners and losers due to gov’t incentives/ responses (think energy drilling regulation).

Aptus Take: We could show dozens of graphics here to illustrate the point but will limit it to one. The last decade, ZIRP policy has enabled corporations to issue cheap debt and buy back their stock, boosting earnings. While this can be a good financial decision for shareholders, the problem is it hollows out the underlying resilience of the economy (i.e., we export our labor force and manufacturing capability to SE Asia). Years of underinvestment lead to FOMO buying (thinking reshoring) when leaders realize they are behind the eight ball. The same could be said for energy policy domestically.

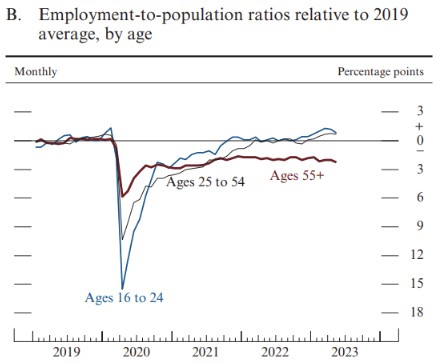

Demographics/Labor Force

The post-pandemic labor market is different from the pre-pandemic labor market. During and following the pandemic, we saw record exodus from the jobs market from the 55+ cohort.

Source: BLS as of 08.31.2023.

Source: BLS as of 08.31.2023.

While there are a multitude of reasons gauging from health to wealth, one can’t deny the benefit baby boomers have experienced the last several decades in terms of positive wealth effect (i.e., ability to retire). As the more experienced and productive workers leave the workforce to retire, they are being replaced with less skilled younger employees who are demanding high wages and benefits. In addition, we simply don’t have the labor force capacity to meet the labor market demands.

Aptus Take: Demographics aren’t something the Fed has much influence on. Government policy can control immigration (talking here about the good kind) which can help balance the supply and demand picture for labor. The last several years we’ve had minimal legal immigration to fill the needs of our economy. On top of that, many experienced workers have retired and left the workforce permanently. There are no easy fixes to this problem and it’s likely the more and more power will shift back into the laborers’ hands until either we get more workers OR more productivity to replace them with technology.

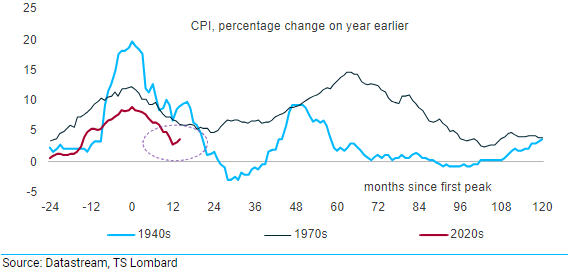

Conclusion

Inflation and its causes are complex subjects. There are often many root causes and effects from the different types of inflation. Each can work together and separately to create problems for economies and Central Bank policy. Some inflation pressures can be mitigated by interest rate policy (think demand) while others could be magnified by it (think supply/ capital investment).

Source: TS Lombard as of 09.19.2023

Source: TS Lombard as of 09.19.2023

We are at a crossroads where the Federal Reserve has acted aggressively to combat inflation and is beginning to see some progress. The question remains as to whether what they’ve done will be enough or whether more restrictive policy will be needed. We’d argue that the implications from underdoing it and creating another wave of inflation far outweighs the risk of overdoing it.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-24.