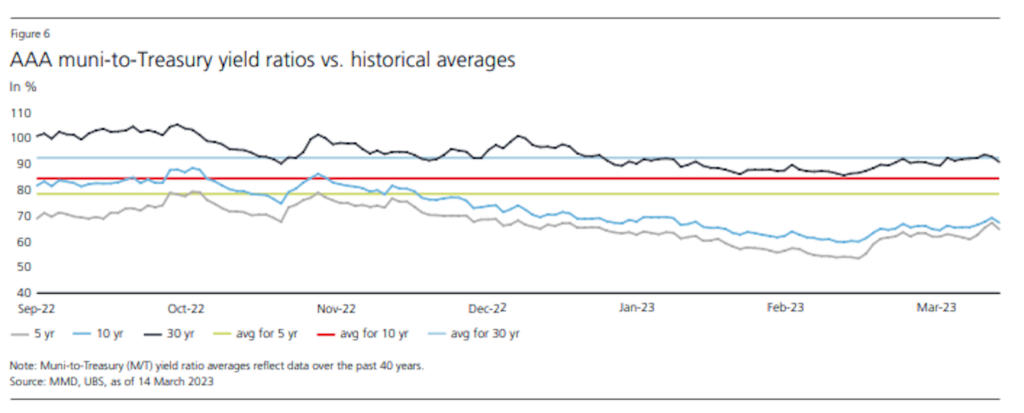

Municipal Spreads are Lacking Luster

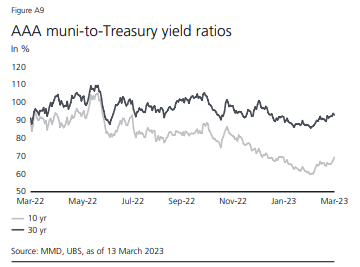

Spreads on short municipal paper (10yrs and in) are well inside their historic averages.

Source: UBS. As of March 17th, 2023.

Source: UBS. As of March 17th, 2023.

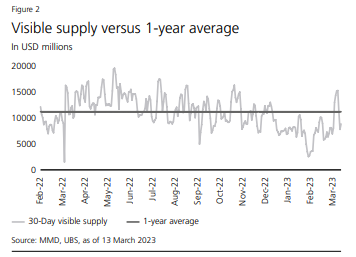

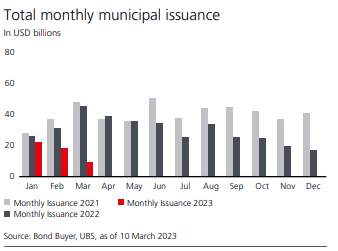

Municipal Supply Remains Tight

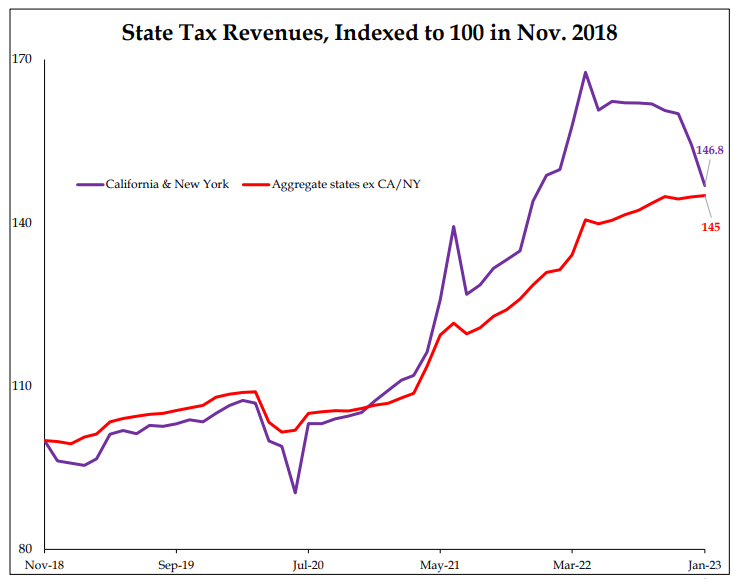

The expected muni supply coming to market is light. Municipalities saw record tax receipts in 2020 & 2021 from rising asset values and home prices. In addition, they received an unfathomable amount of fiscal support from the Federal Government which curtailed need for issuance.

Source: UBS. As of March 17th, 2023.

Source: UBS. As of March 17th, 2023.

Over the last 10 years, municipalities have had a historic opportunity to lock in record low interest rates and extend durations of their debt maturity profiles to yield starved investors. Most issuers jumped at this opportunity.

Source: UBS. As of March 17th, 2023.

Source: UBS. As of March 17th, 2023.

There have not been many deals year to date (especially in the southern states) which continues to curtail supply available in the secondary market and drive in spreads (as can be seen in the graphic below).

Source: UBS. As of March 17th, 2023.

Source: UBS. As of March 17th, 2023.

A Few Weak Links

A few states like California and New York are facing problems with high costs of living, high crime and weakening state income taxes which is beginning to weigh on tax receipts. In addition, budget problems are spilling over to their fiscal situation (i.e., a balanced budget ain’t in the cards) like rising unemployment and a likely drop in corporate taxes. We know both of these states are highly reliant on capital gains tax revenues which are harder to find given the decline in asset values the last 15 months.

Source: Strategas. As of March 17th, 2023.

Source: Strategas. As of March 17th, 2023.

In a positive light, most of the rest of the country is in better shape. We continue to believe that for states that did not overspend during the pandemic, have high immigration, and have lower crime rates, municipal stress will not likely be an issue in the coming years.

Municipals No, CDs Yes?

Bottom line, current spreads on municipal bonds are historically unattractive, when compared to similar duration Treasury bonds. Most offerings in our typical “buy zone” (1-10 year call / < 15 year final maturity) don’t excite us. While a savvy trader can occasionally find some opportunities, the current backdrop is much less attractive.

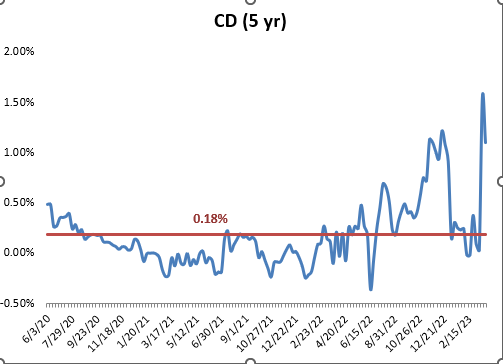

On the other hand, banks have increased deposit rates on brokered CDs to attract assets. In turn, we have seen the spread to Treasuries increase to historically attractive levels, as shown below:

Source: SouthState Bank. As of March 17th, 2023.

Source: SouthState Bank. As of March 17th, 2023.

Remember, CDs are FDIC insured up to $250k. The recent uptick in spreads could create an interesting opportunity to ladder out CDs for clients looking for defensive, insured interest income on their capital. Lastly, considering the lifeline thrown to banks with the new BTFP Liquidity facility in place, I don’t think this opportunity will last forever.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-21.