With many declaring the Fed’s work done, we thought it made sense to discuss the challenges that still remain in this hiking cycle. The headline inflation numbers have been hammered down, but underlying conditions still give them the backdrop to try putting the inflation genie all the way in the bottle.

High Yield Spreads Back On The Lows

High yield spreads have compressed back to the lows that were seen prior to March’s mini-banking crisis. At ~380 basis points they are also at the lowest levels in more than a year.

Source: Strategas as of 07.14.2023

Source: Strategas as of 07.14.2023

With the uncertainty that remains in the economy, it may be more challenging for them to compress further but for now they are not signaling any major issues. At the start of the previous recession, HY spreads were more than 100bps higher than where they are today.

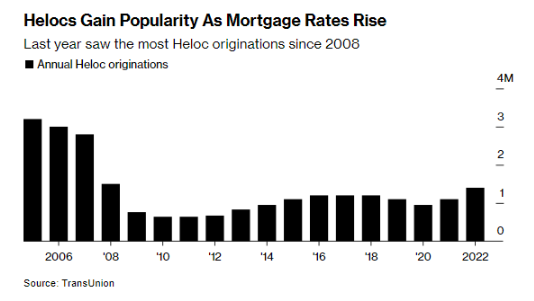

Consumers Still Have a Lot of Home Equity to Tap

While real estate prices have cooled from the roar seen in 2020-2022, most US homeowners have substantial appreciation in their property values, especially in the south/ southwest. According to Black Knight Inc., Americans collectively had $28.7 trillion worth of home equity at the end of the first quarter.

Source: Bloomberg as of 07.17.2023

Source: Bloomberg as of 07.17.2023

While the number is down from the record high in the second quarter of 2022, it’s still up ~$20 trillion from the beginning of 2020. Meanwhile, tappable home equity (the amount available to borrow against while keeping a 20% equity cushion) is at $9.3 trillion, which is up 56% over a three-year period. Home equity could serve as another buffer for the consumer.

Everyone Locked in Low Mortgage Rates

According to a recent study done by the Federal Housing Finance Agency, roughly 91% of mortgages outstanding have a mortgage rate below 5%. 26% of mortgages outstanding are less than 3%! In an environment where most Americans are locked into a long-term fixed rate mortgage at well below market levels, don’t expect a lot of housing supply to come to market.

Source: Morningstar as of 07.17.2023

Source: Morningstar as of 07.17.2023

This also makes another strong point that given the significant equity accumulation in housing the last several years, consumers have another source of liquidity, HELOCs! Even without tapping their home equity, monthly mortgage payments have felt the benefit of inflation…in real terms, most likely have more disposable monthly income to spend (thanks to a fixed mortgage payment and rising wages).

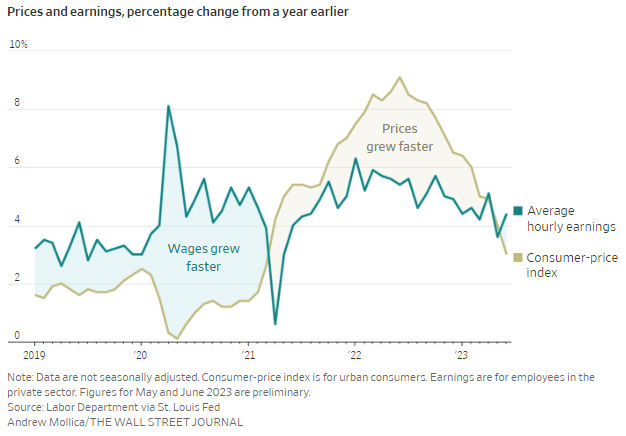

Real Wages Finally Getting a Boost

Federal Reserve Chair, Jerome Powell, signaled wage growth is too high for comfort in the Fed’s inflation-fighting campaign. While wage growth and an increase in pay for Americas workforce is generally a positive, the wage increases plus the steady decline in inflation (higher real incomes) continues to allow the consumer to purchase more expensive goods and services and in turn support the elevated inflation.

Source: Wall Street Journal as of 07.14.2023

Source: Wall Street Journal as of 07.14.2023

Prices do not typically decelerate into a strong labor market, adding to the economy’s resilience and ultimately challenging the Fed in conquering inflation.

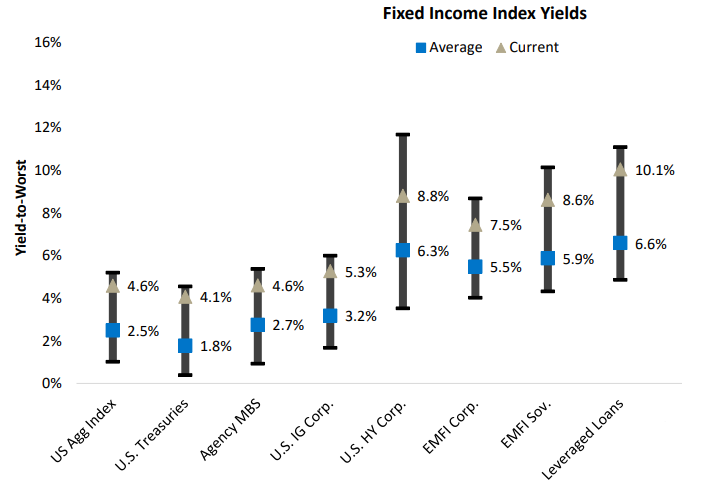

Are Bonds Attractive?

We’ve seen several bullish fixed income commentators show graphics like the one below, which compare current fixed income yields versus their 10-year ranges and tout their attractiveness.

Source: DoubleLine as of 07.01.2023

Source: DoubleLine as of 07.01.2023

We believe it’s important to keep in mind that comparing yields only to the last 10 years might not be the best comparison. We’ve experienced the lowest interest rate environment seen in all human civilization!

While yields are attractive on a nominal basis, compared to inflation they are still low. Regime changes come and go, and we believe that relying on the bond performance of the last 40 years to repeat could be dangerous.

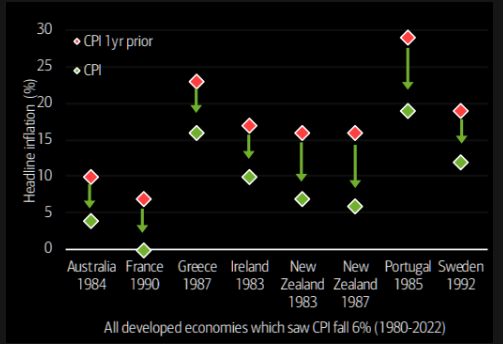

Credit Where Credit is Due… Kinda

The collapse in the US CPI over the past year is extreme, falling from 9.1% to 3%. BofA research found that since 1980, only in 8 cases has inflation fallen by more than 6% in a year, and only in France in 1990 from a starting point lower than 10%.

Source: BAML as of 07.18.2023

Source: BAML as of 07.18.2023

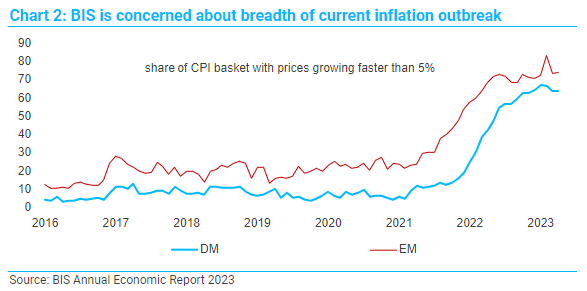

But the Last Mile Often Proves Most Difficult

Getting inflation down to 3-4% was easy. The next 100-200bps will be a very different game. Simply put, inflation is not going to miraculously disappear.

Source: TS Lombard as of 07.17.2023

Source: TS Lombard as of 07.17.2023

The easy disinflation progress will soon fade because the max 2022 deceleration from 2021 is rounding past the one-year mark. Getting from here to 2% requires a weaker labor market – likely a recession.

As we’ve continually said, we think one of the biggest questions facing the market is whether the 2% inflation target is flexible. While US inflation has dropped from 9% to 3% as unemployment has stayed at historic lows, we don’t think the final 1-2% drop will come so easily.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2307-23.