Why ETFs Deserve the Flow of New Money

-

- Mutual funds distribute gains that investors may not have realized themselves

-

- ETFs can defer or avoid those gains through in-kind redemptions

-

- Deferral enhances after-tax compounding, especially in taxable accounts

-

- New money should favor ETFs where possible, to keep more of the return investors earn

At the end of every year, mutual fund investors brace for an annual surprise they did not ask for…capital gain distributions. Morningstar’s latest review shows that many mutual funds are once again preparing to hand investors a tax bill, even in cases where the investor never sold a single share.

That is one of the great structural flaws with mutual funds. When the fund manager makes allocation changes or other shareholders sell, the manager may need to realize gains to meet redemptions or to reallocate, forcing all remaining holders to pay tax on those sales. It is a relic of a pre-ETF era when efficiency was not part of the design.

The ETF Advantage: Structure Matters

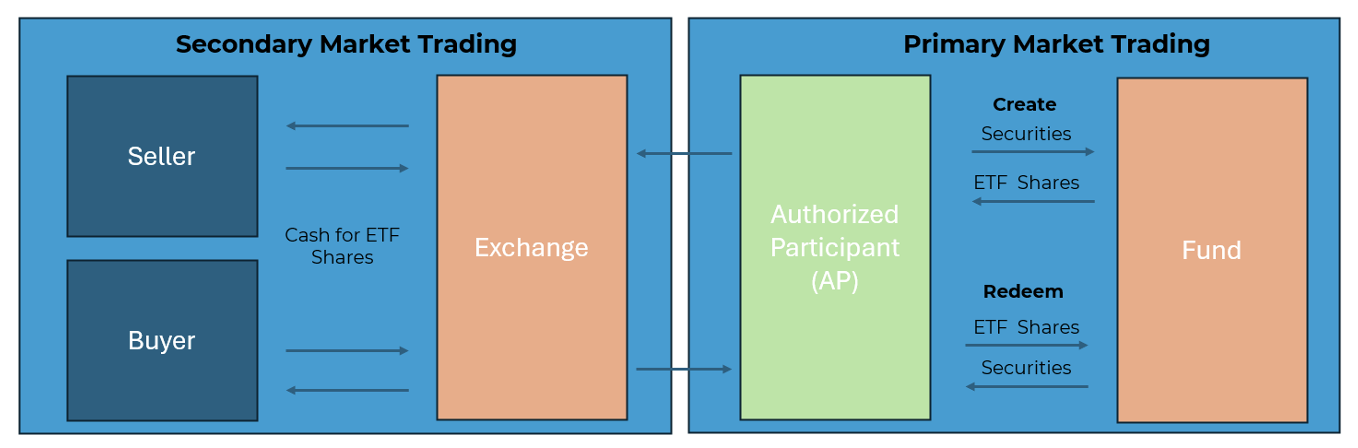

Exchange-traded funds were built differently. An ETF trades in two connected markets. In the secondary market, investors buy and sell ETF shares with each other on an exchange just like a stock. In the primary market, large institutions called Authorized Participants (APs) work directly with the ETF fund to create or redeem shares. When demand rises, APs deliver securities to the fund in exchange for new ETF shares; when demand falls, they return ETF shares for the underlying securities. Through the in-kind creation and redemption process, ETFs can swap securities for cashless baskets rather than sell them outright. That means far fewer realized gains and more control over when taxes are triggered.

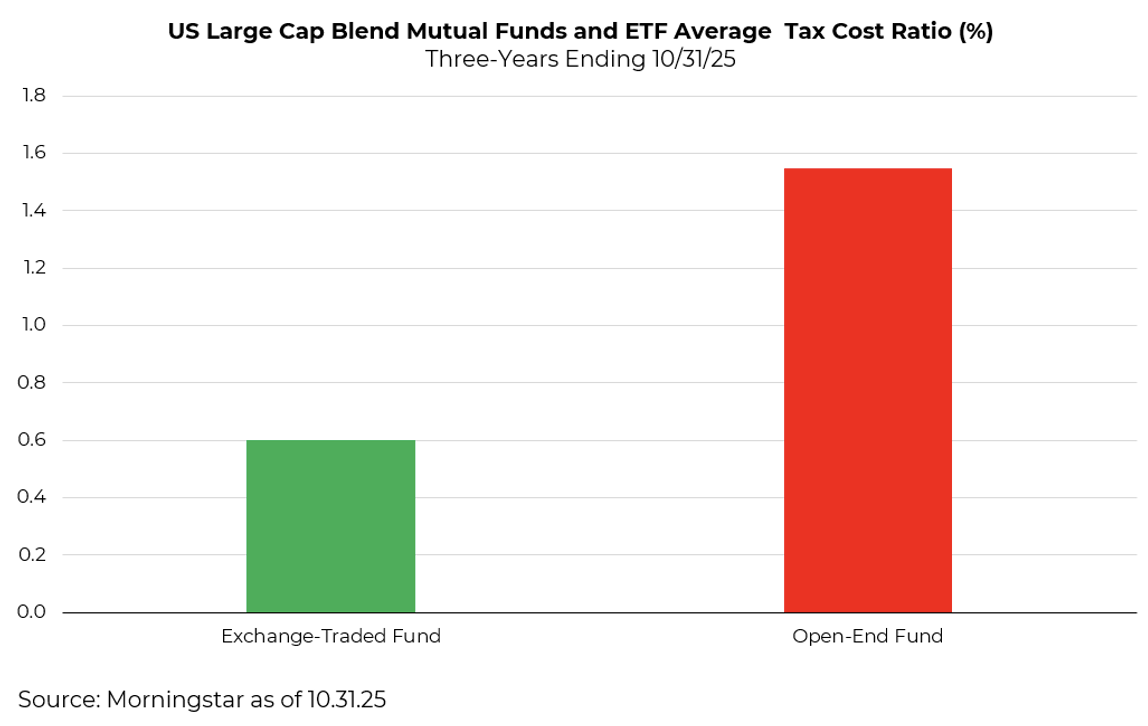

For investors in taxable accounts, that deferral is powerful. The difference between paying 20% every year versus compounding tax-deferred for a decade can lead to a material difference in after-tax wealth. ETFs do not eliminate taxes forever, though with thoughtful tax planning and a bit of timing, they often can. More importantly, they allow the investor to choose when to realize gains, typically when selling the investment. Over the last three years, the typical ETF has had tax costs less than half that of mutual funds.

Source: Morningstar, Aptus

Source: Morningstar, Aptus

Mutual Funds vs. ETFs: Same Exposure, Different Outcome

Morningstar’s analysis highlights that even high-quality mutual funds, many of which hold the same underlying securities as ETF peers, are preparing to distribute sizable gains this year. Those distributions often range from 5% to 15% of NAV (though they list 25 funds with 30%+ distributions), creating a phantom income event for investors who did nothing but hold.

Had those same dollars been in an ETF, it is probable that most of that tax drag could have been deferred or avoided entirely. The key takeaway is not about any one fund but about the wrapper itself. Structure determines the investor’s after-tax experience far more than style or security selection.

A Practical Reminder for Advisors and Clients

For investors with new money to allocate in taxable accounts, we think ETFs should be the default starting point. They combine professional management, broad diversification, and transparency with a structural advantage that compounds quietly over time.

We often remind advisors that managing risk and maximizing compounding go hand in hand, and taxes are one of the most consistent risks to compounding. Minimizing unnecessary distributions is one of the easiest wins available.

As year-end distribution season unfolds, it is a timely reminder that how you invest can be just as important as what you invest in.

Disclosures

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

*Conceptual Illustration: Information presented in the above charts are for illustrative purposes only and should not be interpreted as actual performance of any investor’s account. As these are not actual results and completely assumed, they should not be relied upon for investment decisions. Actual results of individual investors will differ due to many factors, including individual investments and fees, client restrictions, and the timing of investments and cash flows.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2511-9.