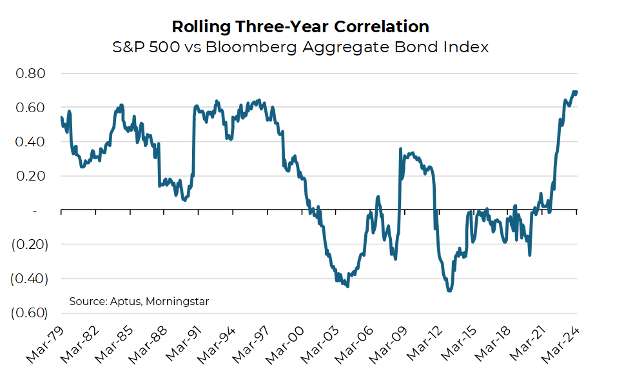

For decades, investors have treated bonds as a cornerstone of portfolio diversification, largely based on their performance during the late 20th century. From the early 2000s and through the 2010s, the often-negative correlation between stocks and bonds provided a compelling justification for including bonds in a diversified portfolio even with their low yields and poor tax treatment.

However, recent shifts in economic conditions and historical analysis suggest that the high correlation experienced through much of its history prior to the 2000s, and record high correlation exhibited over the past three years, means that view might need a reassessment.

Historical Correlation and Inflation Impact

A deep dive into the historical data reveals that the correlation between stocks and bonds has not always been negative. In fact, aside from the low-inflation era of the 2000s, this correlation has typically been positive.

Statistical Insights:

- Historical Norms: Since the inception of the Bloomberg Aggregate Bond Index in 1976, the correlation between stocks and bonds has been positive, consistently so during periods of elevated inflation.

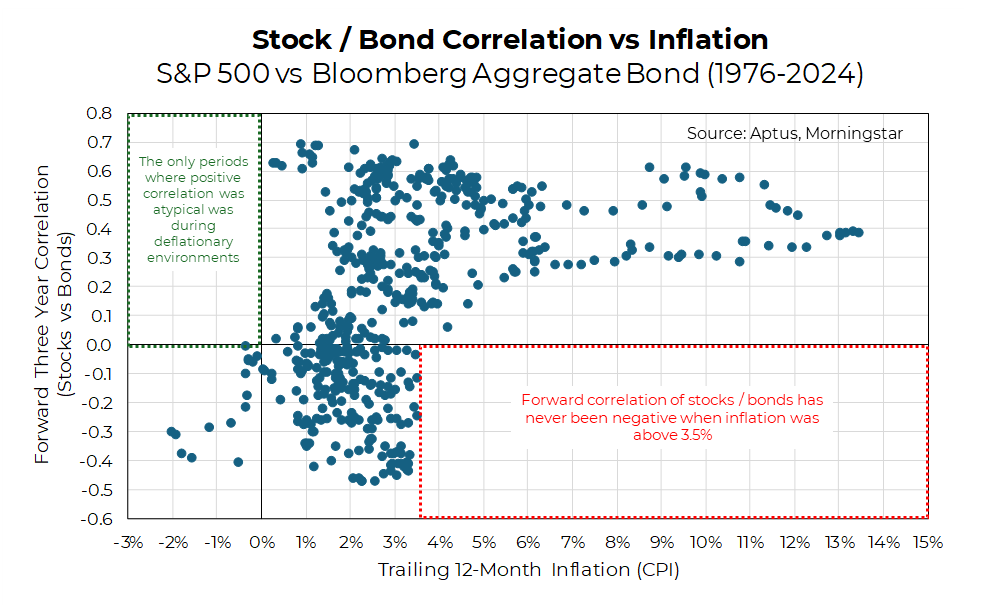

- Current Situation: Correlations have never been negative over any forward three-year period since the inception of the Bloomberg Aggregate Bond Index when starting inflation was 3.5% or higher, a headwind should inflation stick around.

- Negative Correlations and Inflation: The only period when correlation was consistently negative between stocks and bonds was when we experienced short periods of outright deflation.

It should be no surprise that given our current environment of higher inflation, there has been an uptick in the correlation between stocks and bonds to levels not seen in decades. This shift suggests that the negative correlation experienced during the early 21st century may have been an anomaly rather than a norm.

Additional Dynamics Favor an Alternative

The traditional justification for bonds in a portfolio may need re-evaluation:

- Low Expected Real Return: The real return on bonds, after adjusting for inflation, is minimal. This makes bonds less attractive as a long-term investment to meet retirement needs.

- Negative Carry vs. Owning T-Bills: With an inverted yield curve, longer-term bonds yield less than short-term Treasury bills, which diminishes the rationale for holding long-term debt as a means to derisk compared to simply holding Treasury bills.

- Tax Inefficiency: Bond yields are taxed as regular income, which can be at a higher rate compared to long-term capital gains on stocks, making them less tax-efficient.

Reconsidering Bond Investments

With the historical context and current economic indicators in mind, investors might need to adjust their expectations and strategies regarding bonds. The once-prized negative correlation with stocks during periods of market downturns may not hold in today’s economic climate, making bonds less effective as a diversification tool.

As a result, exploring alternative means of achieving portfolio-level diversification becomes crucial. Investors may consider strategies that allow for capturing more of the equity market’s upside while structurally protecting the downside, such as through hedging techniques or derivatives. These alternatives could potentially offer more dynamic responses to market volatility compared to traditional bonds.

Conclusion

The evolving economic landscape requires a fresh evaluation of traditional investment wisdom. Bonds, while still serving roles in risk management and income generation, may not offer the same benefits in terms of portfolio diversification as they once did.

Investors should consider this historical perspective and current market conditions when integrating bonds into their portfolios, especially against a backdrop of rising inflation and changing market dynamics. Moreover, we believe that alternative investment approaches that can adapt more flexibly to market changes will be more effective.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-25.